Fun Info About Comparing Financial Statements Of Two Companies

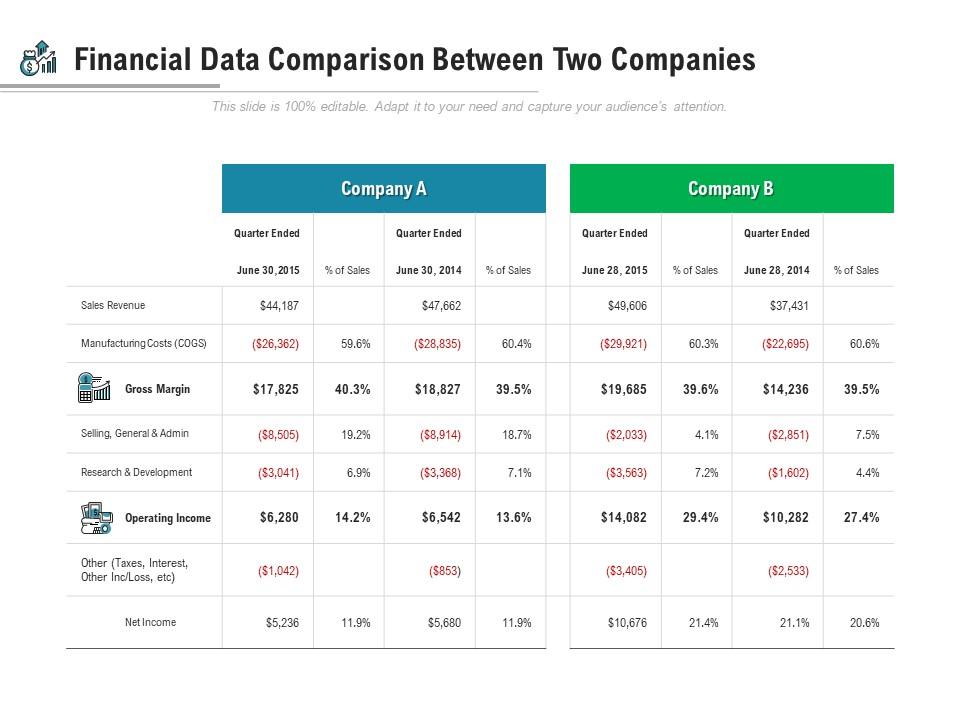

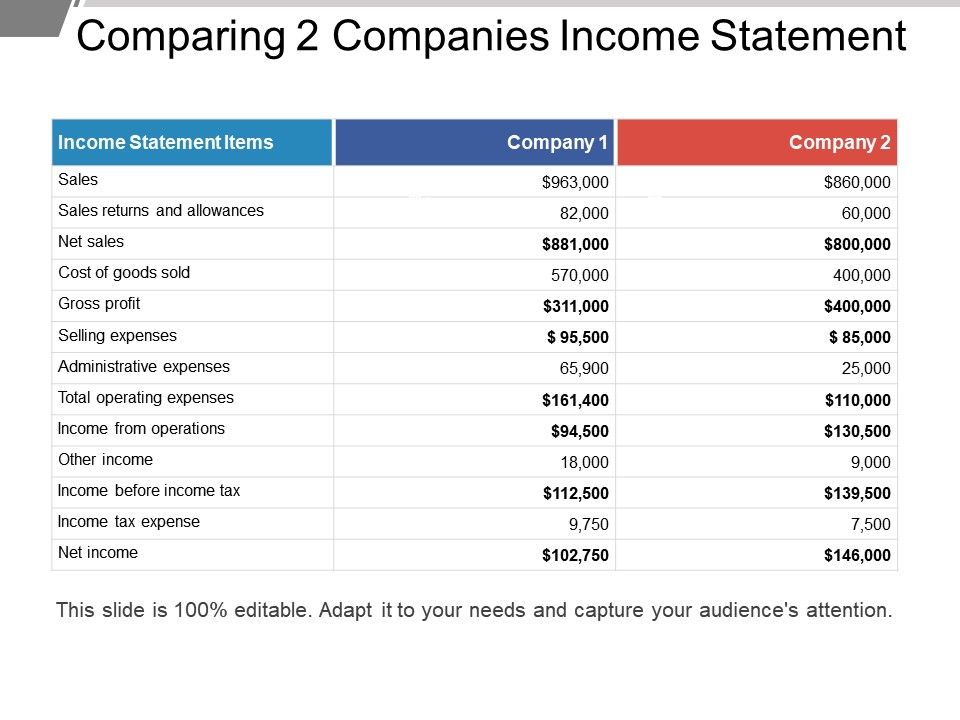

The topics discussed in these slides are sales revenue, manufacturing costs, gross margin, research and development, operating income, net income.

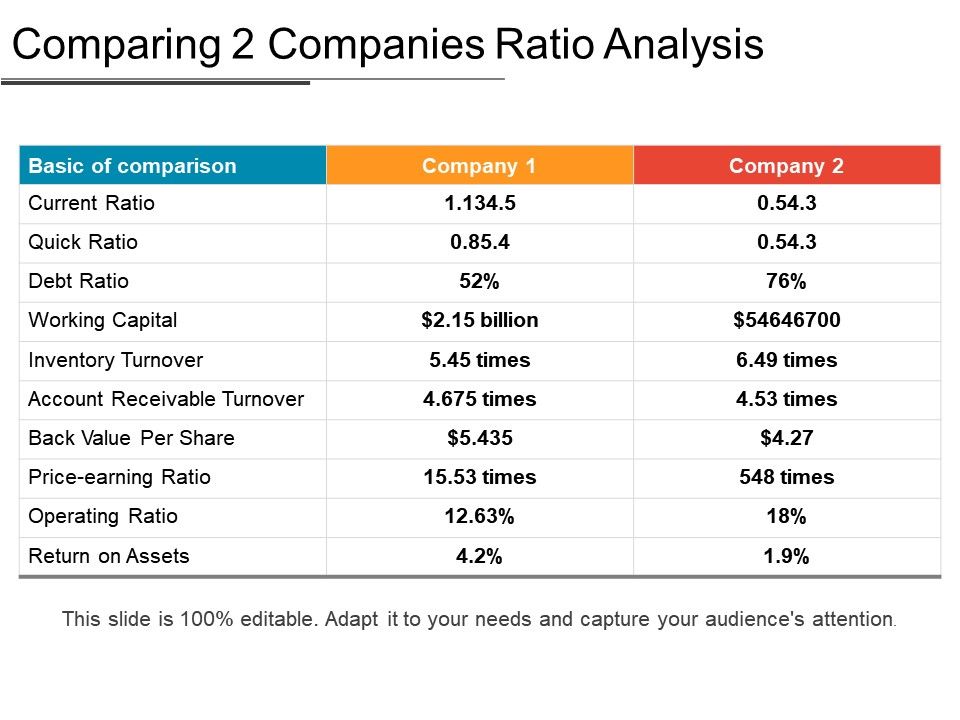

Comparing financial statements of two companies. Learn to calculate ratios and use an ratio scrutiny is ampere company to evaluate its financials. This is based on two companys financial position which is helpful for the companies and us to know the real situation. Shannon stapleton/getty images.

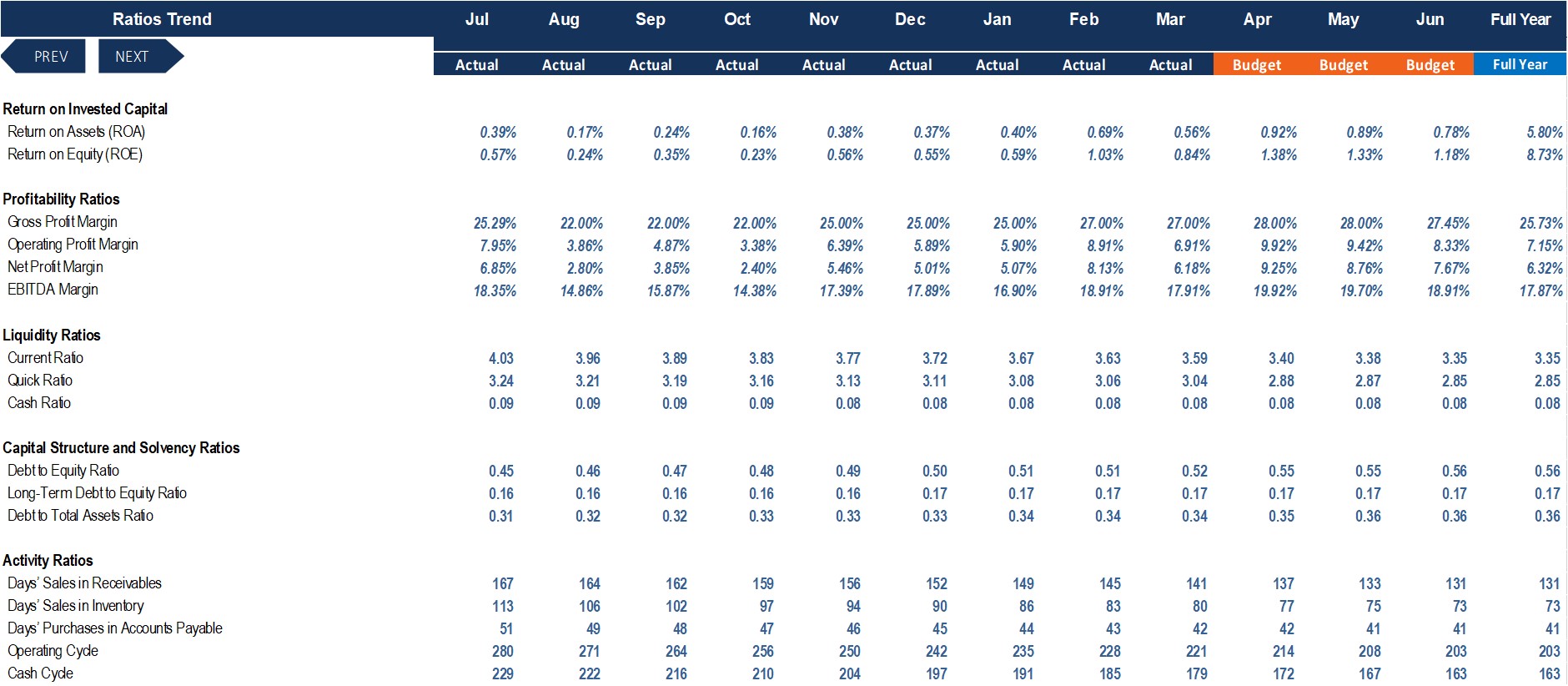

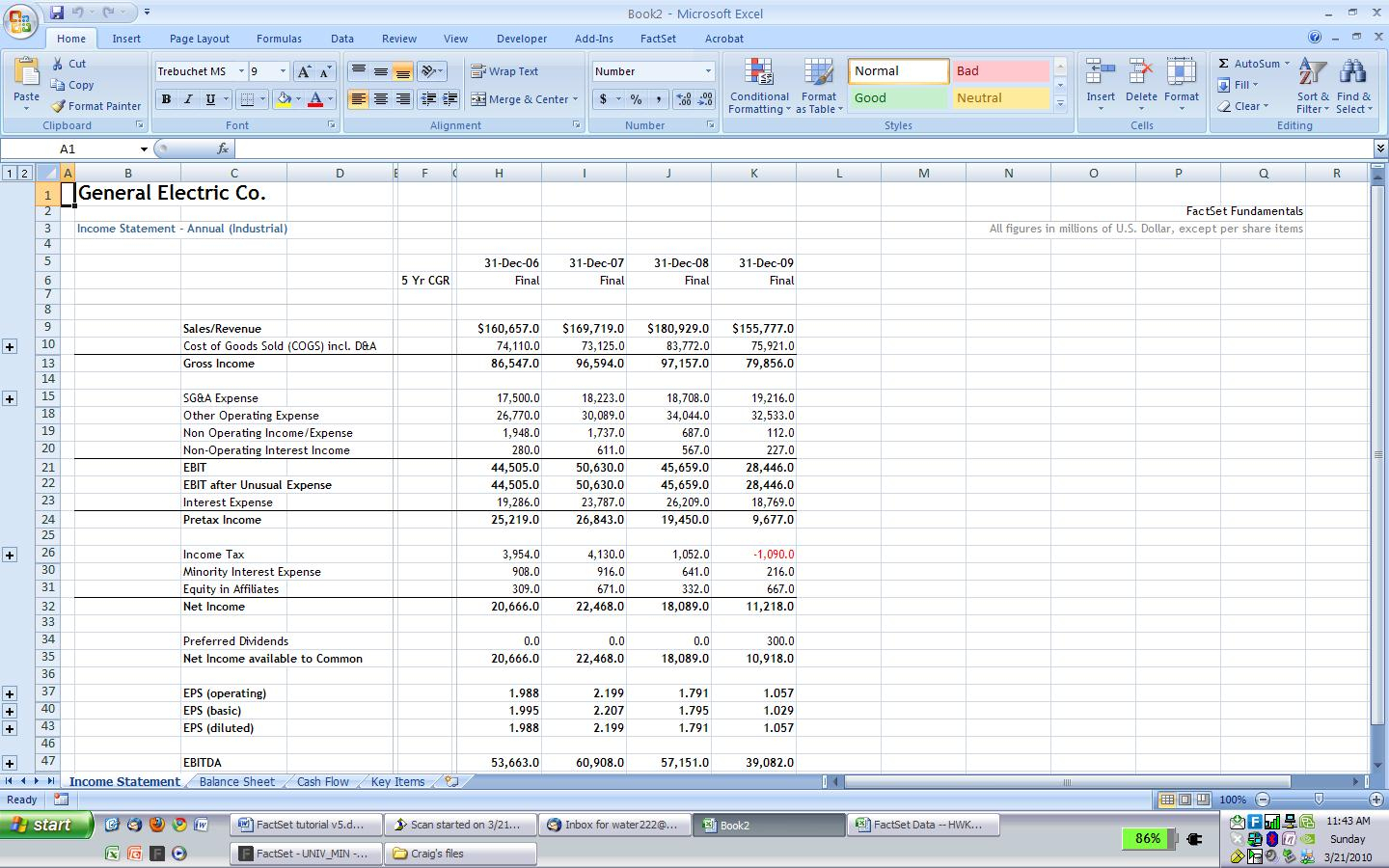

The calculation of dollar changes or percentage changes in the statement items or totals is horizontal analysis. Investors can use ratio analysis to compare corporate. This analysis detects changes in a company’s performance and highlights trends.

Both companies are in the retail apparel industry. Pdf | financial statement analysis is the process of reviewing and evaluating a company's financial statements (such as the balance profit and loss. So i am conducting a research on applying data envelopment analysis (dea) for comparing efficiencies of different companies working in different countries and thereby publishing their financial statements in different currencies.

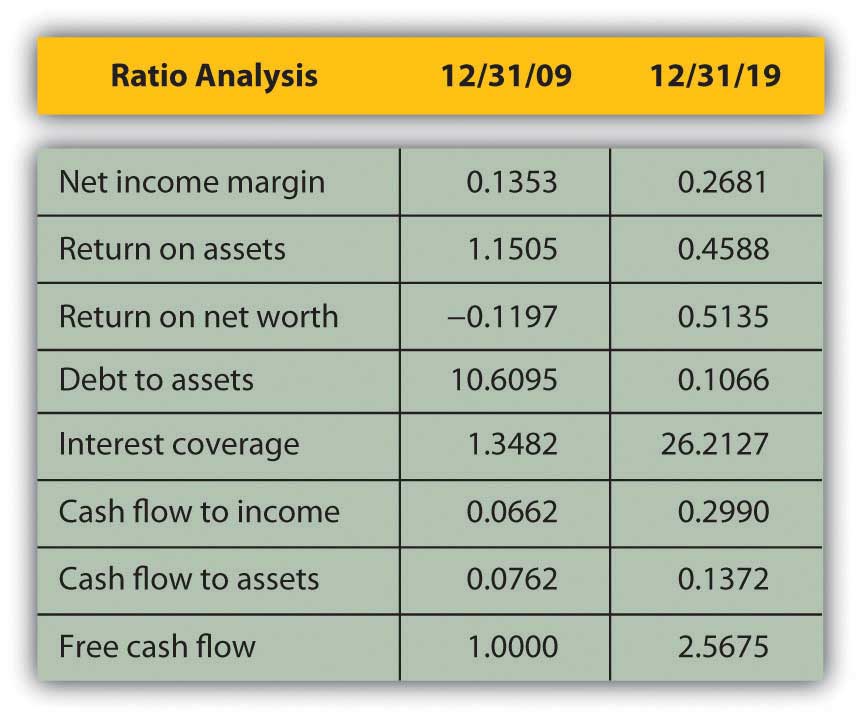

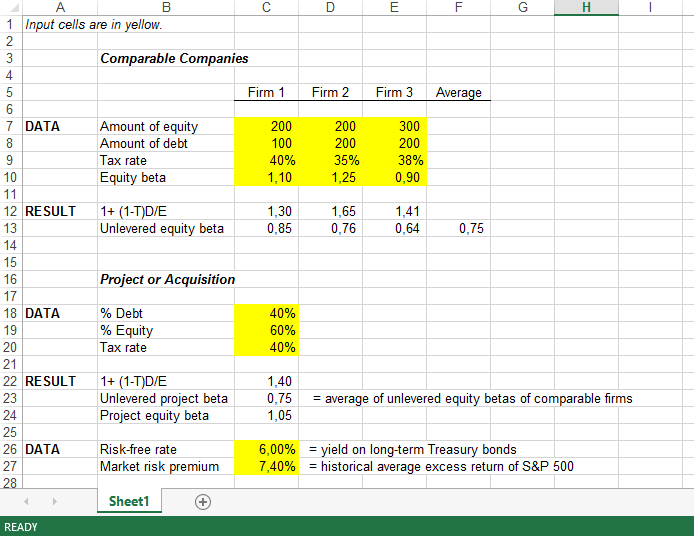

Evaluate the financial position and performance for each of these two companies using accounting ratio analysis. Demonstrate how changes in the balance sheet may be explained by changes on the income and cash flow statements. Students shared 42 documents in this course.

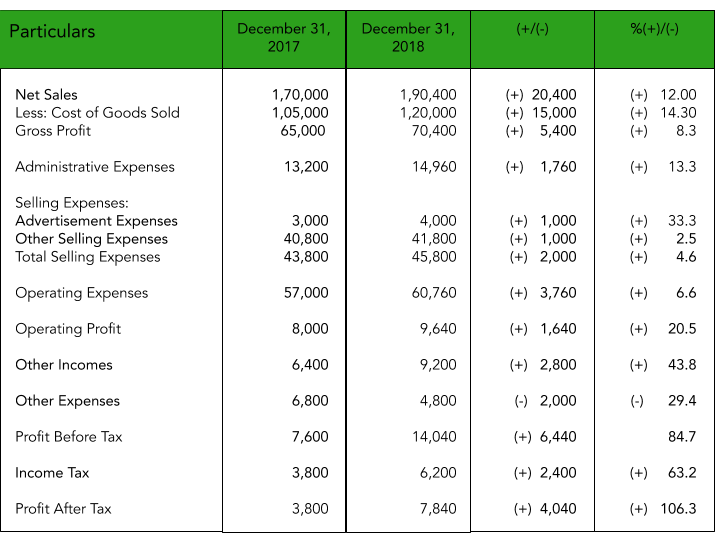

Comparative analysis of financial statement of two companies. Horizontal and vertical analyses are the two comparative income statement analysis types. Although the notes were omitted, a statement from each company's auditor is included.

One of the most effective ways to compare two businesses is to perform a ratio analysis on each company’s financial statements. By comparing financial statements to other companies, analysts can get a better sense of which companies are performing the best and which are lagging behind the rest of the industry. It indicates relation between two mathematical expressions and the relationship between two or more things.

It has been prepared by a group of fore students for the financial accounting course (act 142). Preparing comparative financial statements is the most commonly used technique for analyzing financial statements. A new york judge has ordered former president donald trump and executives at the trump organization to pay over $364 million in a civil fraud case, handing a win to.

This technique determines the profitability and financial position of a business by comparing financial statements for. Presenting this set of slides with name comparing and analyzing financial statement of two companies ppt powerpoint presentation professional grid. The calculation of dollar changes or percentage changes in the statement items or totals is horizontal analysis.

This is an assignment of comparative analysis of financial statement of two companies. A comparative income statement is an income statement in which numerous periods are considered and compared to enable the reader to reach the last year’s income and decide about investing in the company. Modified 3 months ago.

It shows the financial capability and profitability of the firm. 1.introduction ratio analysis is one of the important tools to evaluate the financial performance of the organization. Find the most recent financial statements for two companies of same industry which are listed in klse (kuala lumpur stock exchange).

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)