Exemplary Info About Expenses By Nature And Function Example

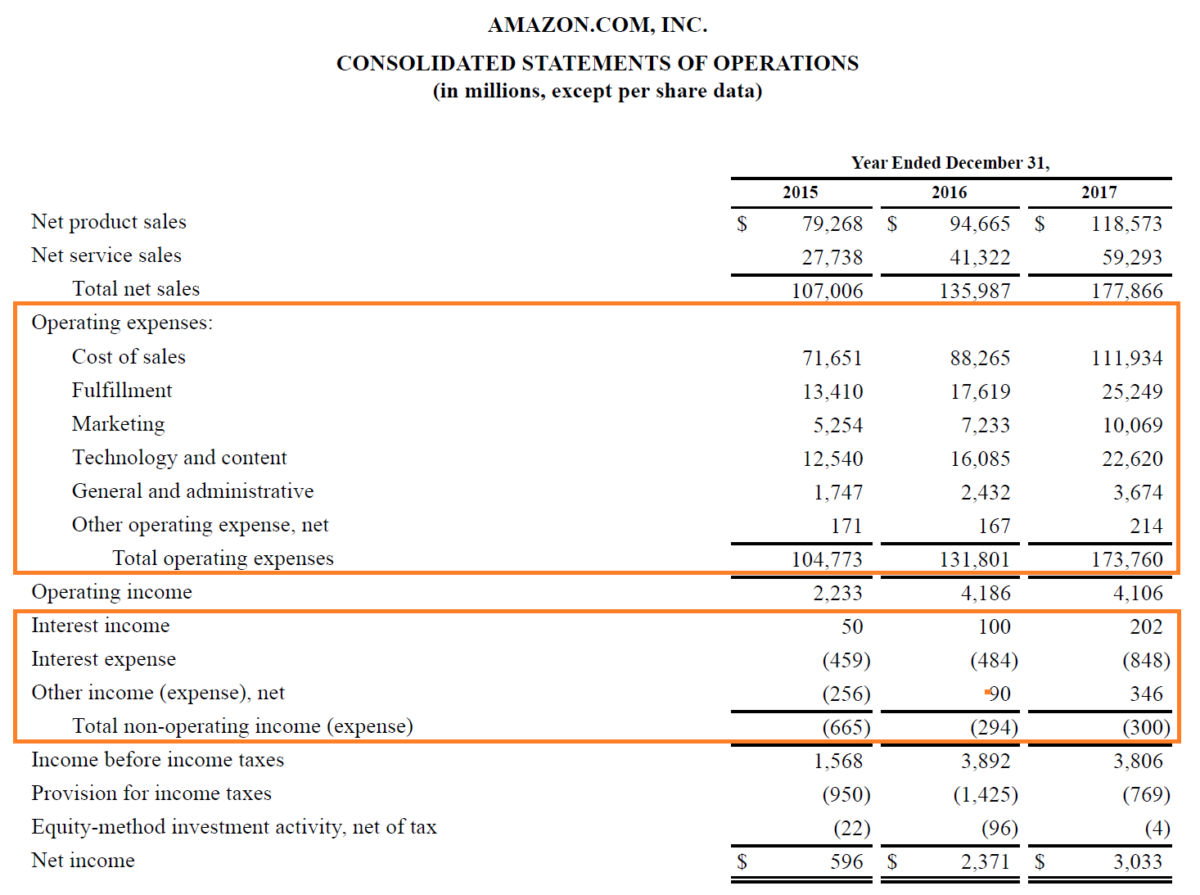

An alternative format is to report expenses by their nature.

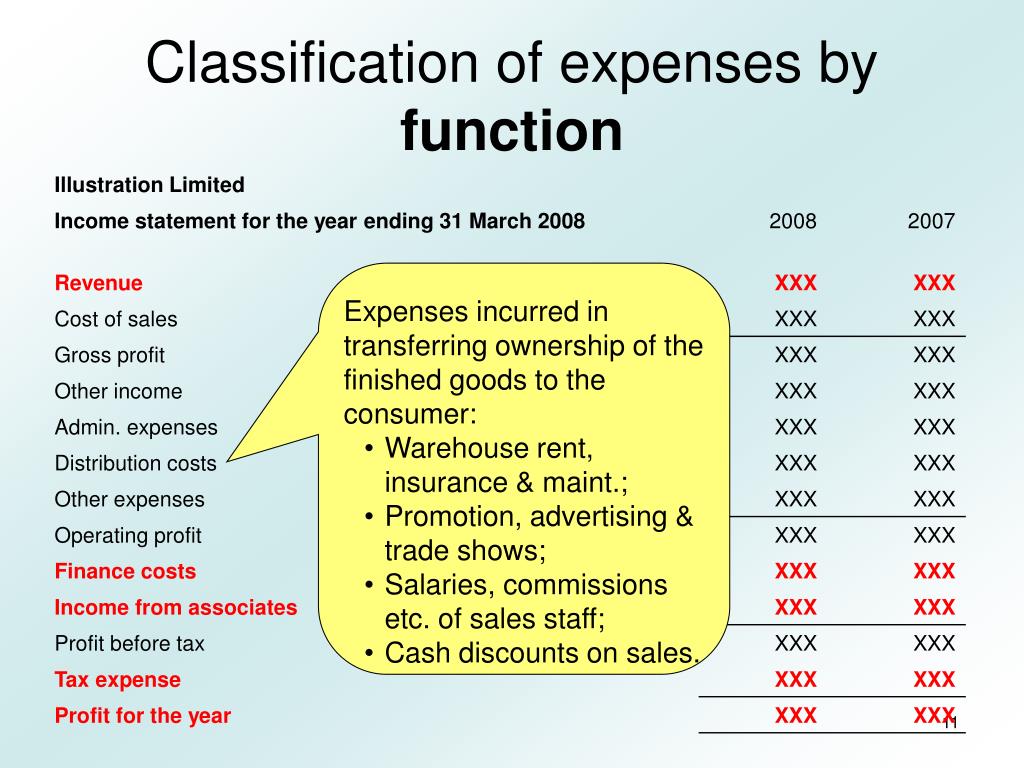

Expenses by nature and function example. For example, cost of sales is a functional line item that may combine the following natural line items: An income statement by function is the one in which expenses are disclosed according to. Income statement by nature.

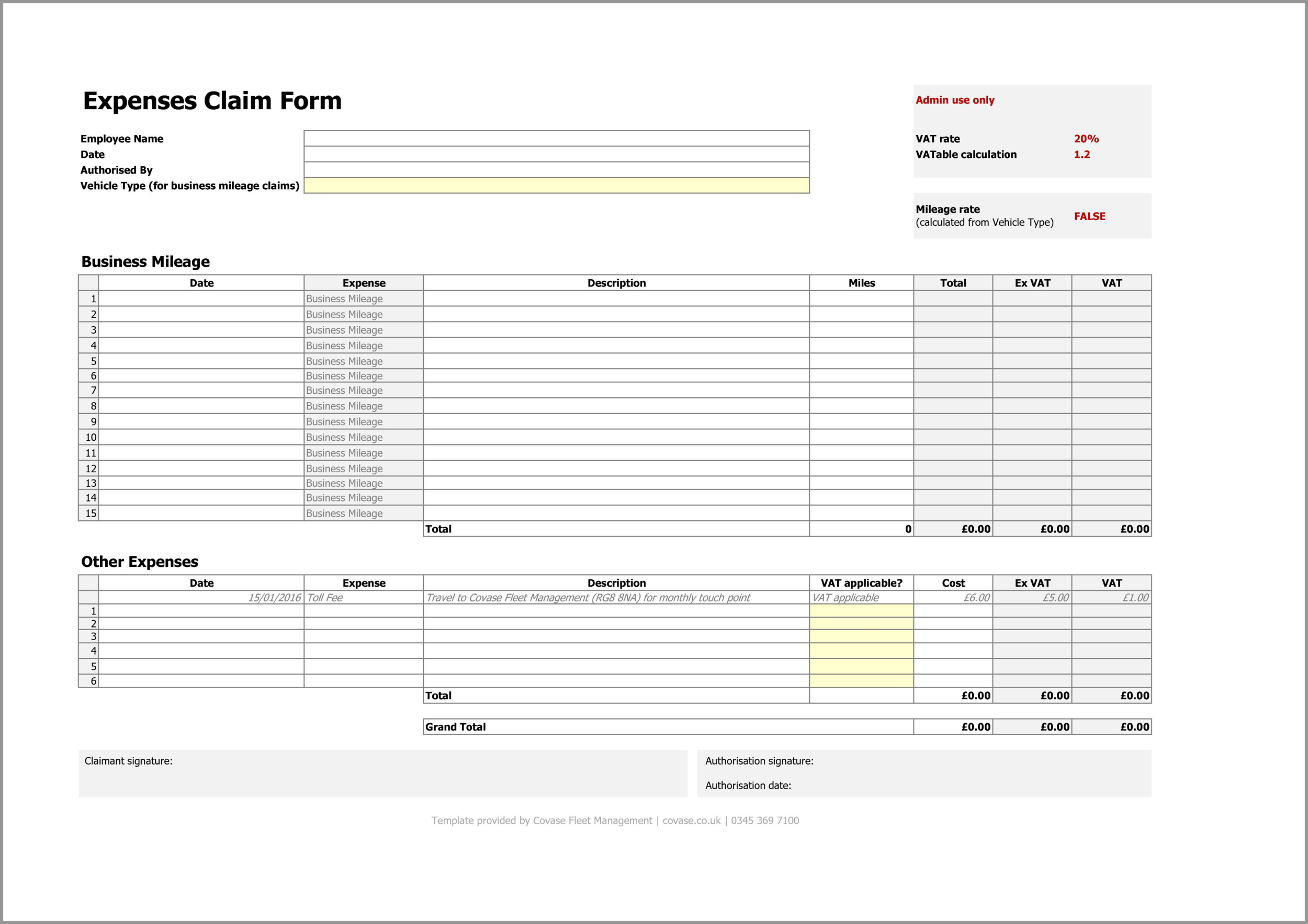

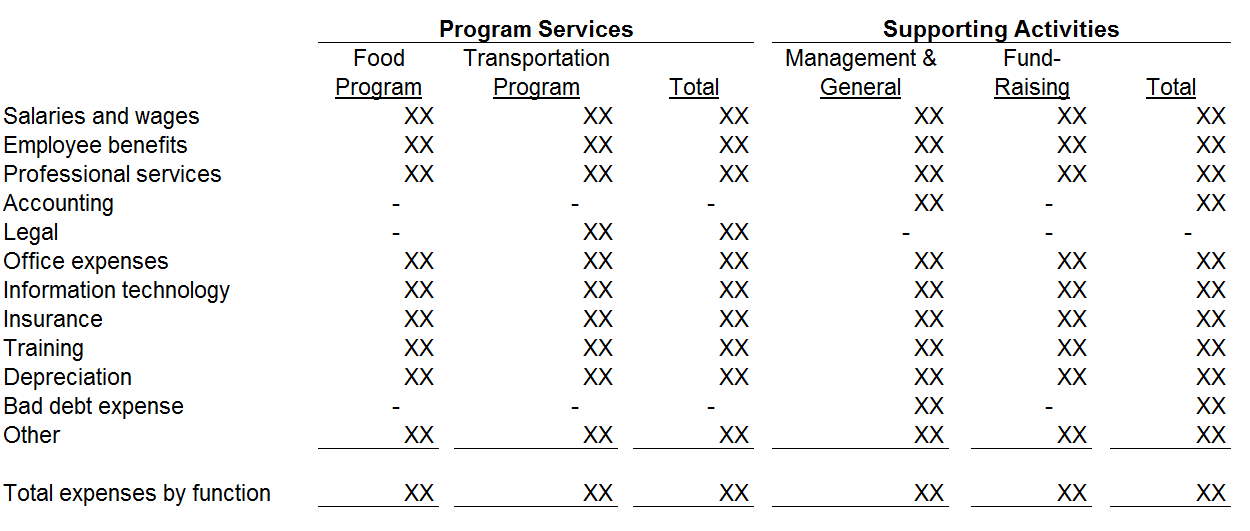

An entity that presents operating expenses using the function of expense method disclose in the notes an analysis of total operating expenses by nature. A method of grouping expenses according to the kinds of economic benefits received in incurring those expenses. A statement of functional expenses presents expenses grouped by nature and function.

Functional expenses versus natural expenses. Expenses by function in the statement of profit or loss discloses, in a single note, an analysis of total operating expenses by nature (paragraph 72 of the exposure draft). By irfanullah jan, acca and last modified on apr 1, 2020.

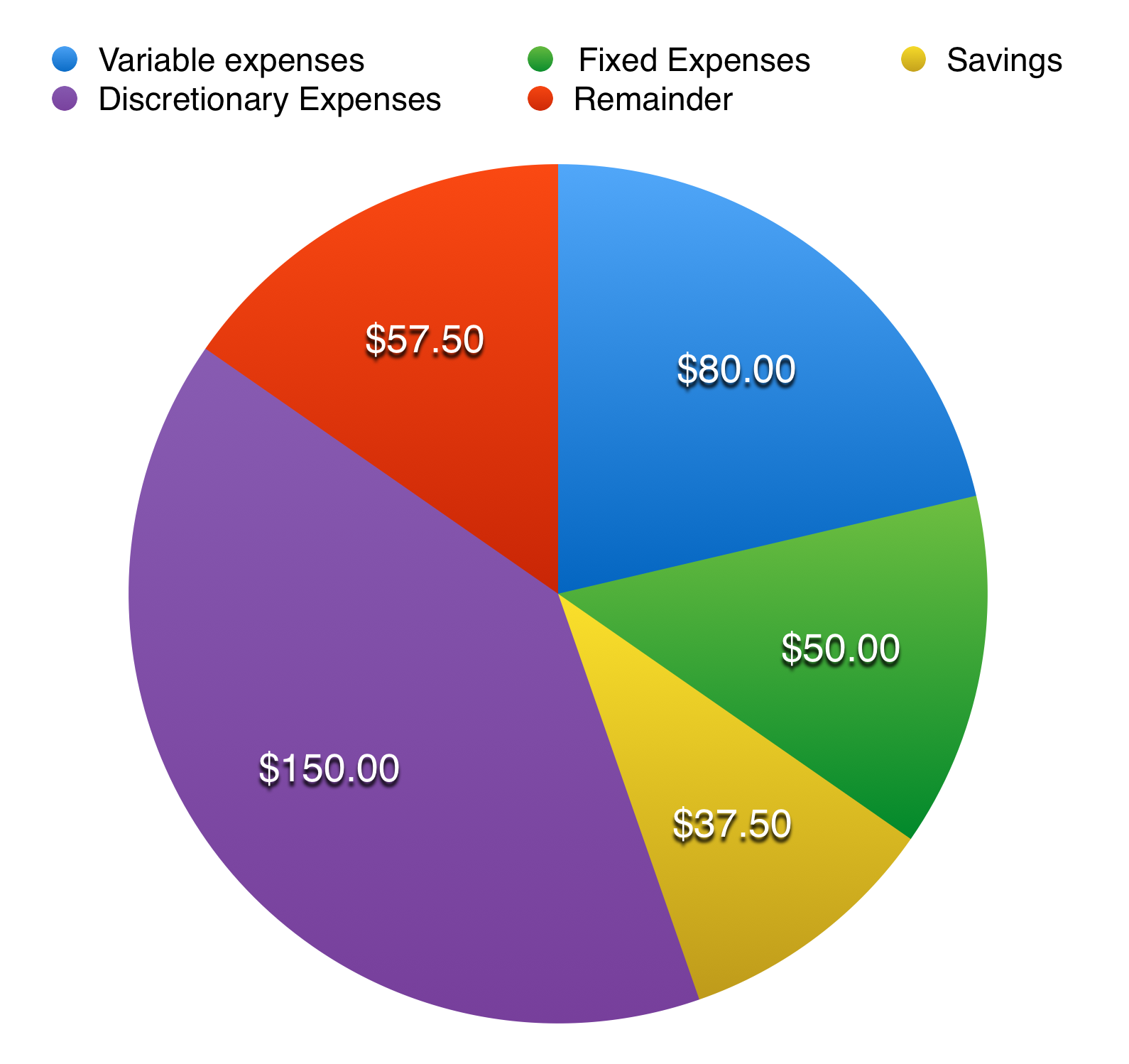

To file a proper 990, you’ll need to understand. Functional expenses describe the purpose of an expense by its category, while natural classifications explain what the money was spent. Expenses in an income statement are either classified by their nature or by their function.

Raw material costs, labour and other employee benefit costs, depreciation or. At that meeting the board tentatively decided to: You can think of it this way:

Illustrative example 1—p&l of a general corporate (in currency units) entity a presents in the operating category some expenses by function and some expenses by nature. (a) describe the ‘nature of expense’ method. A partial matrix approach could require an entity to disaggregate functions into specified expenses by nature (for example, depreciation, amortisation, and employee benefits),.

Expenses by function. Reporting expenses by nature is useful because it shows the different types of costs involved in running a. In our experience, most us companies present their expenses by function.

An income statement by nature. Let’s say you rent a 20,000 square foot building for your. The natural classification of expenses involves categories such as.

A simple example of functional expense allocation: Natural expense classification refers to the reporting of expenses by the nature of each type of expense. These categories are also known as expense categories or line items.

Agenda paper 21e analysis of operating expenses—presentation in the statement of profit or loss discusses the disaggregation of operating expenses analysed by nature and. The presentation of expenses by nature is less complex. When you present by nature, then you simply group the expenses by their nature regardless the role that they play in.