Glory Info About Goodwill Impairment Balance Sheet

(1) the proportionate goodwill arising is calculated by matching the consideration that the parent has given, with the interest that the parent acquires in the net assets of the.

Goodwill impairment balance sheet. But the subsequent hostile lobbying. It does not, however, amortize or depreciate the goodwill as it would for a normal asset. Impairment occurs when the market value of an asset drops below its previous cost, due to anything from declining cash flows to an economic depression.

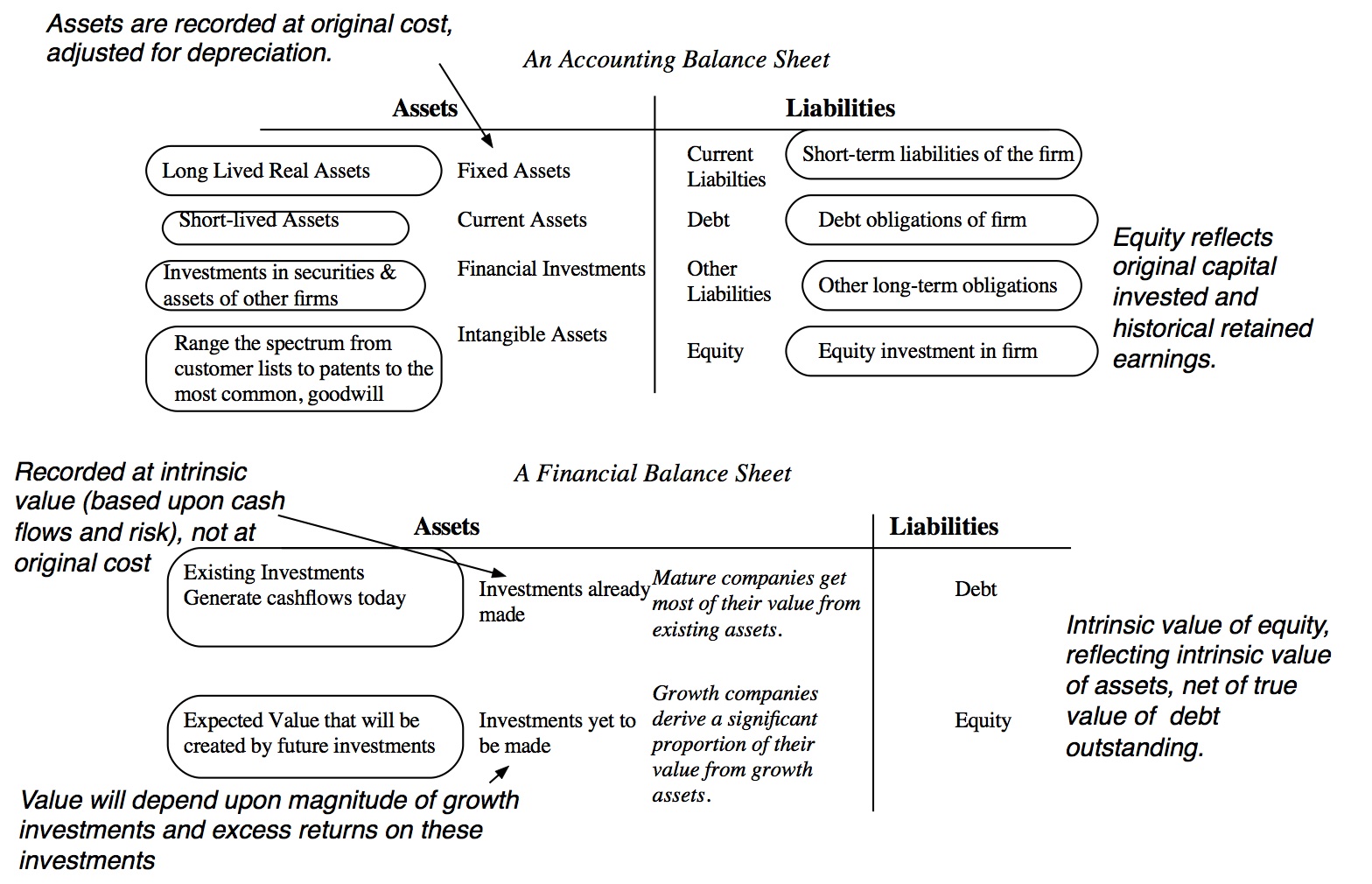

Goodwill represents the intangible value. Here is an example of goodwill impairment and its impact on the balance sheet, income statement, and cash flow statement. A company accounts for its goodwill on its balance sheet as an asset.

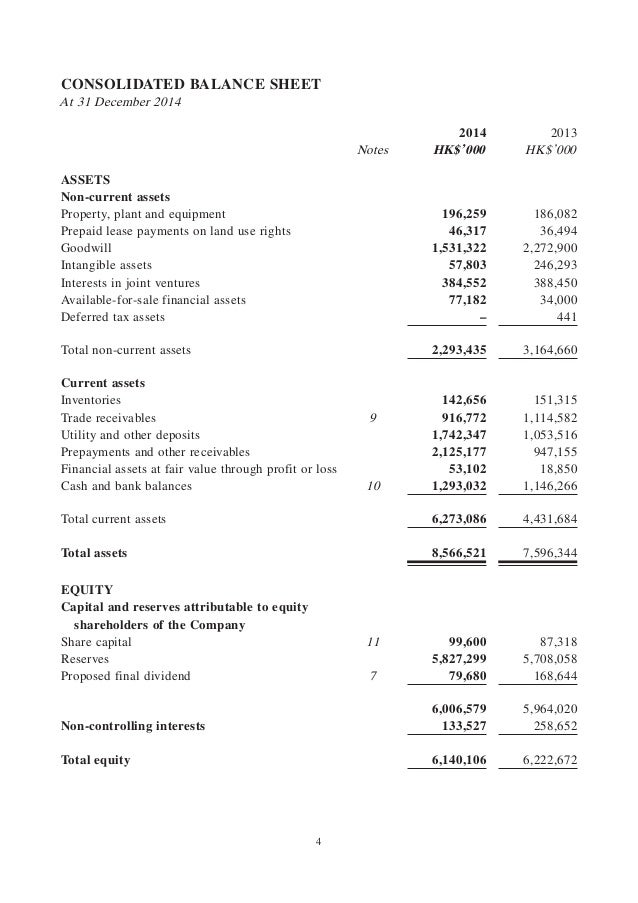

In other words, goodwill represents an acquisition amount over and above what the purchased firm's net assets are deemed to be valued on the balance sheet. Intangible assets are reported on the balance sheet. The gross amount and accumulated impairment losses at the beginning of the period;

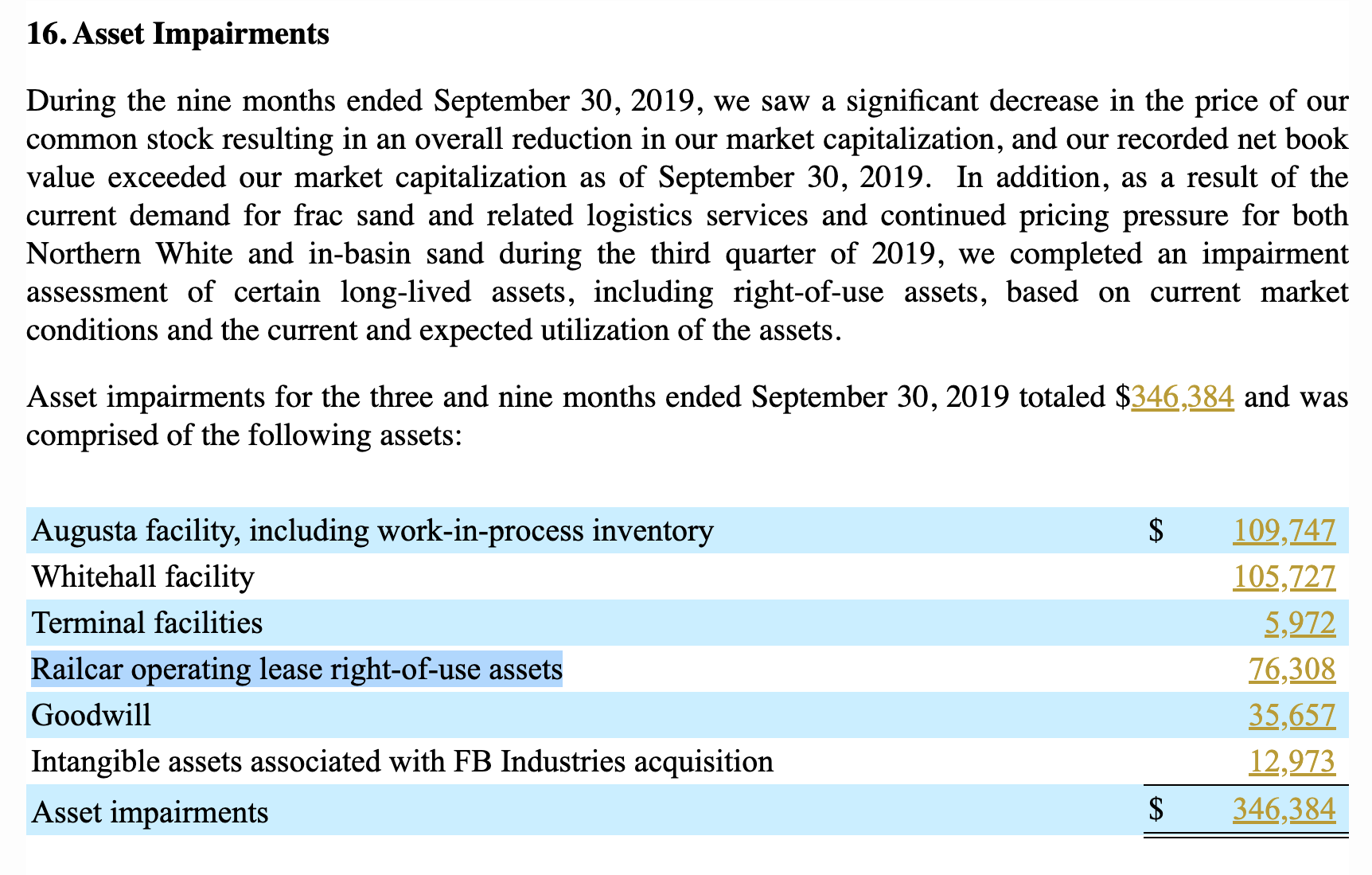

Goodwill impairment occurs when the recorded value of goodwill on a company’s balance sheet exceeds its fair market value. Goodwill goodwill is a miscellaneous category for intangible assets that are. In this journal entry, the goodwill which is an intangible asset on the balance sheet of the company abc will be reduced by $1,000,000 as a result of the impairment.

The british consumer appliance retailer may still be overestimating its goodwill, a balance sheet measure of the premium paid for assets over the fair value. After a year, company bb tests its assets for. Tangible asset it is recognized only through an acquisition;

Companies with high levels of goodwill. A goodwill impairment is an indication that the company purchased an asset in the past, and that asset is now worth less than its value on the company’s. The notes to the financial statements did not disclose the nature of the intangible assets, the valuation method or the method.

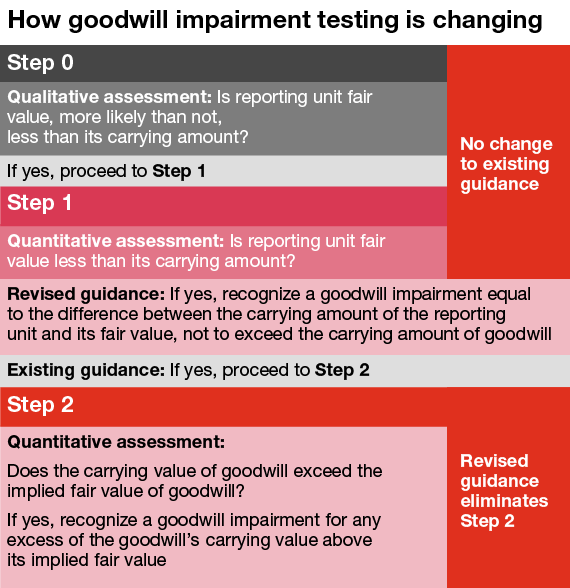

Accounting goodwill impairment test: Additional goodwill recognized during the period, except goodwill included in a disposal. Definition & examples facebook twitter linkedin want help with your bookkeeping?

Understand the basics by jason fernando updated july 31, 2021 reviewed by charlene rhinehart fact checked by. They proposed in 1999 that goodwill be routinely recognized in the balance sheet and amortized through the income statement. It is classified as an intangible asset on the balance sheet, since it can neither.

On a balance sheet goodwill and intangible assets are each separate line items. When testing goodwill for impairment, banks are required to assess the carrying value of a significant balance sheet asset by applying the discipline of fair value. Company bb acquires the assets of company cc for $15m, valuing its assets at $10m and recognizing goodwill of $5m on its balance sheet.