Smart Tips About Payroll Balance Sheet

January 10, 2019 04:34 pm here is how to understand this:

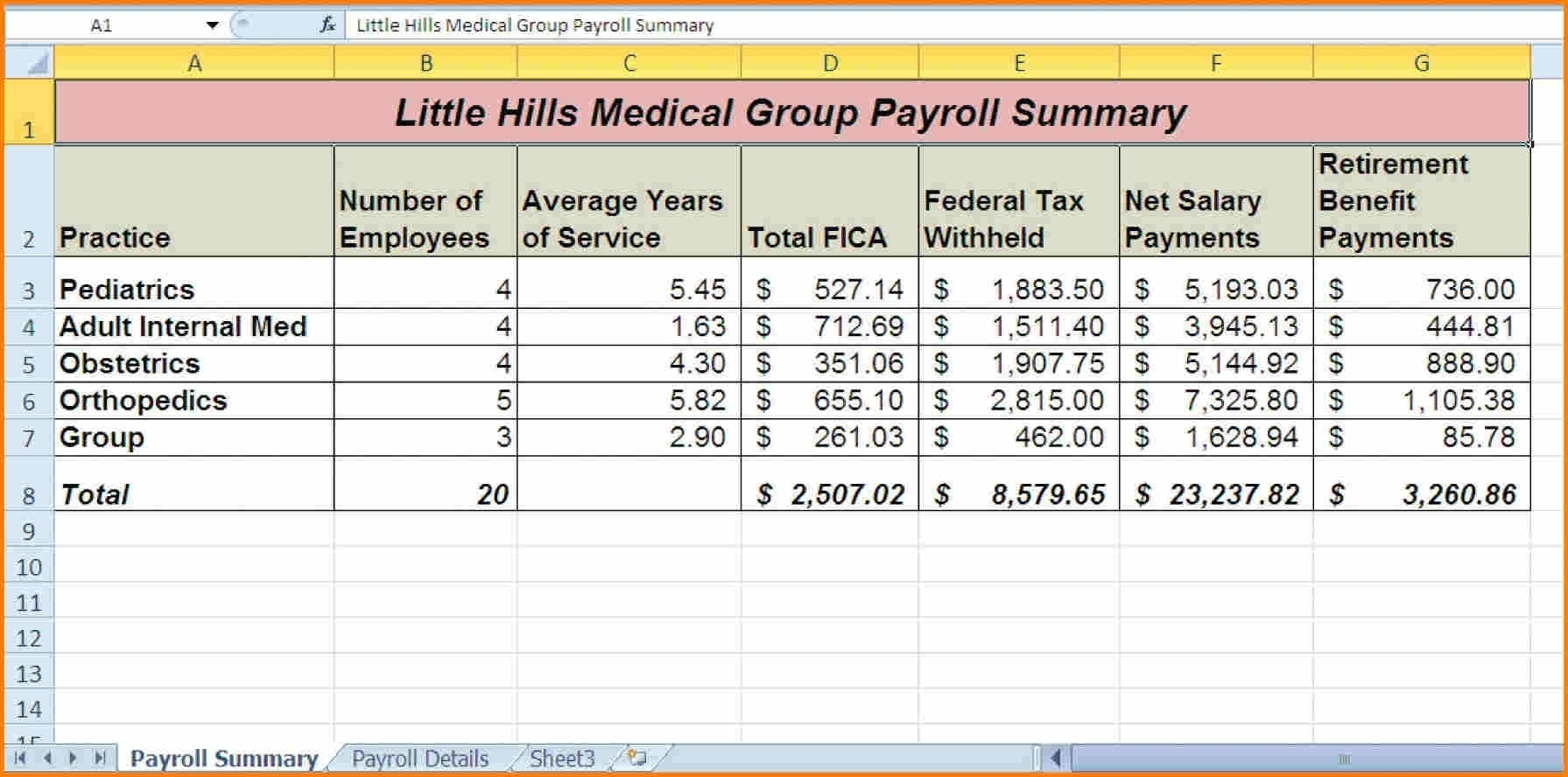

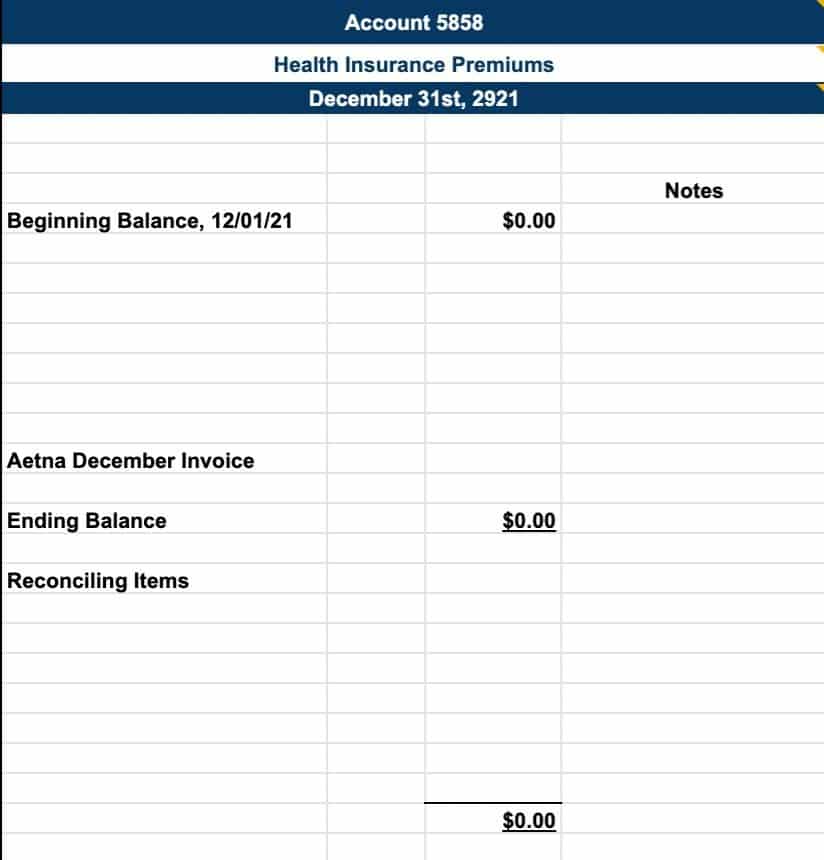

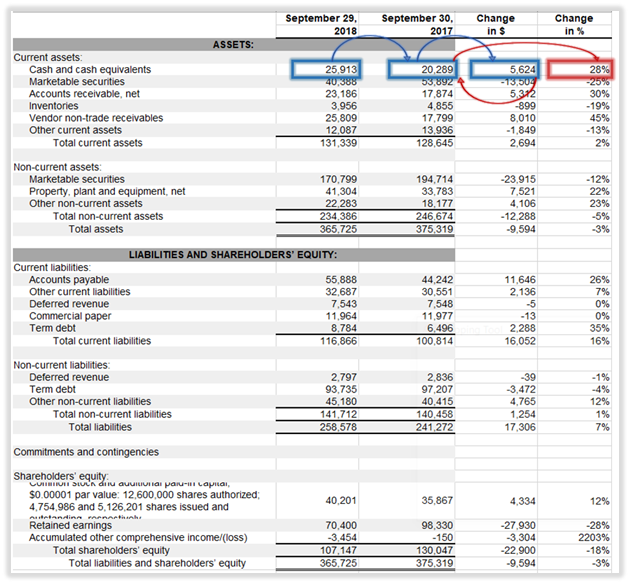

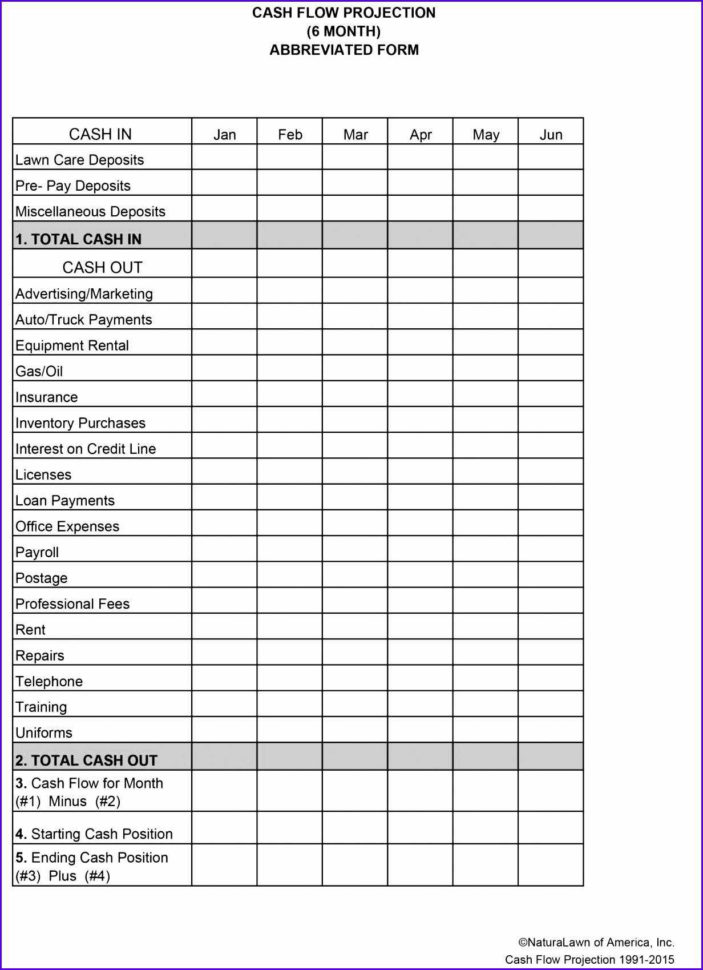

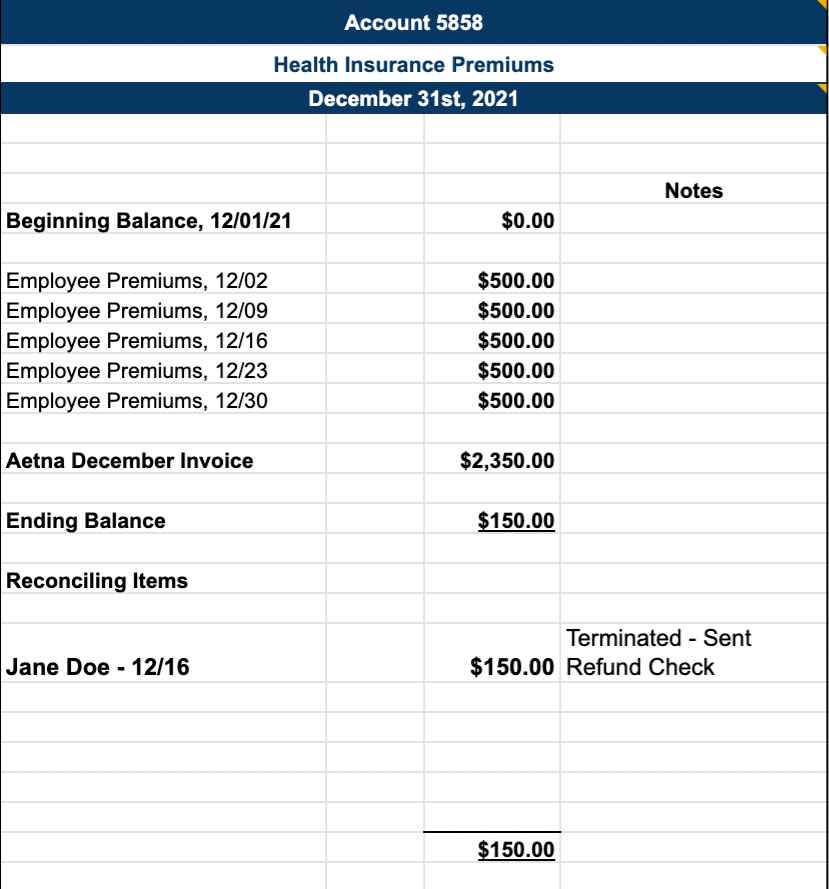

Payroll balance sheet. Payroll includes the gross pay due to the employee and employer taxes. Where does the balance sheet get the figure for payroll liabilities? open the payroll liability balances report. These amounts affect the bottom line of your income statement, which affects the assets and liabilities on your balance sheet.

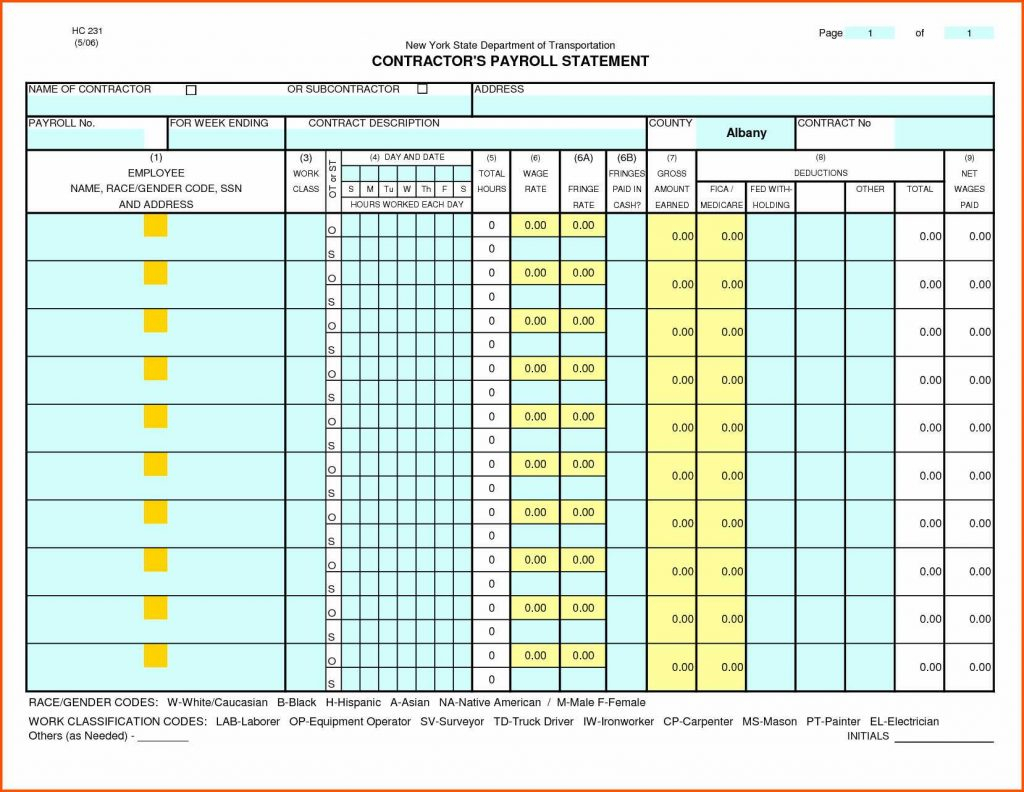

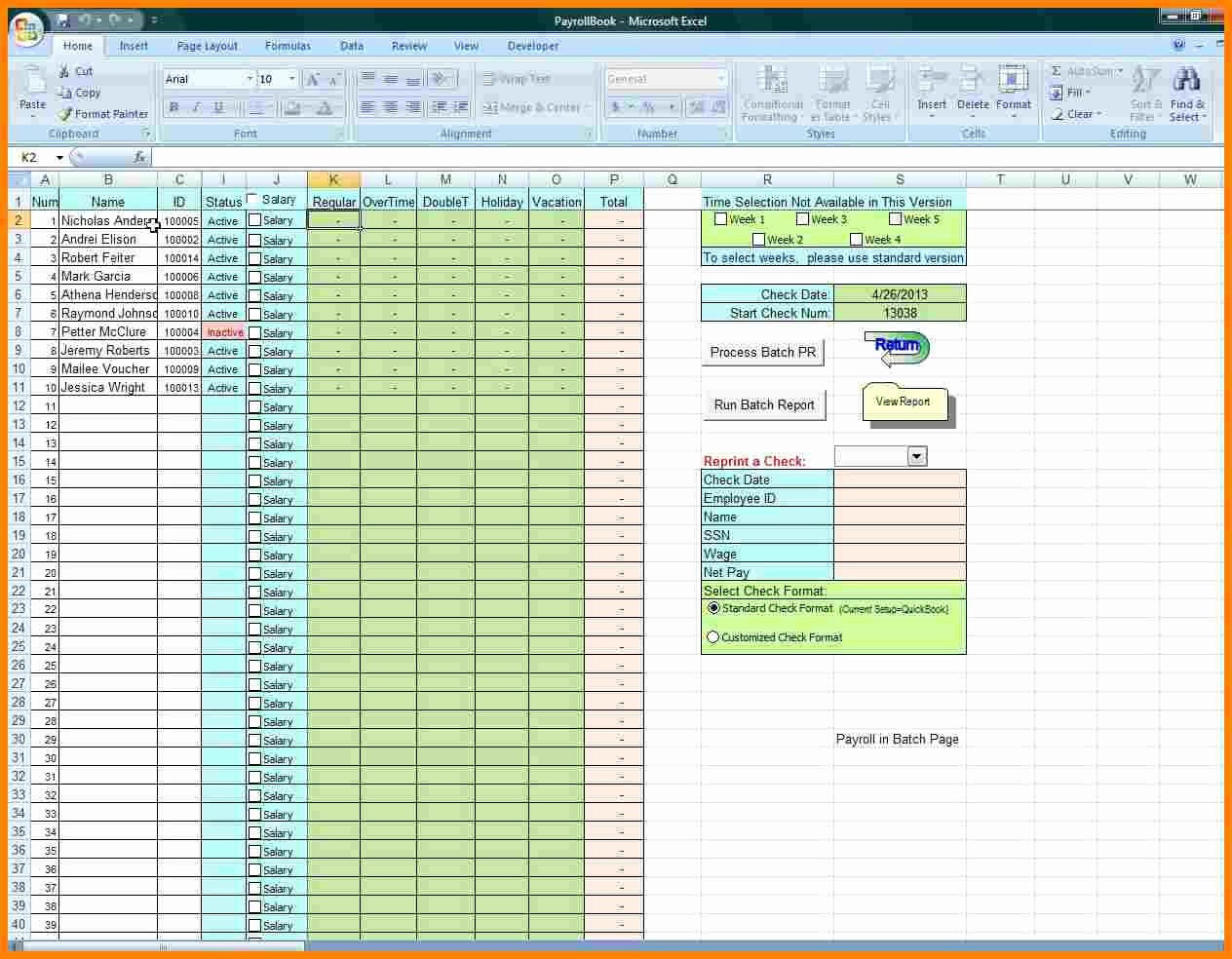

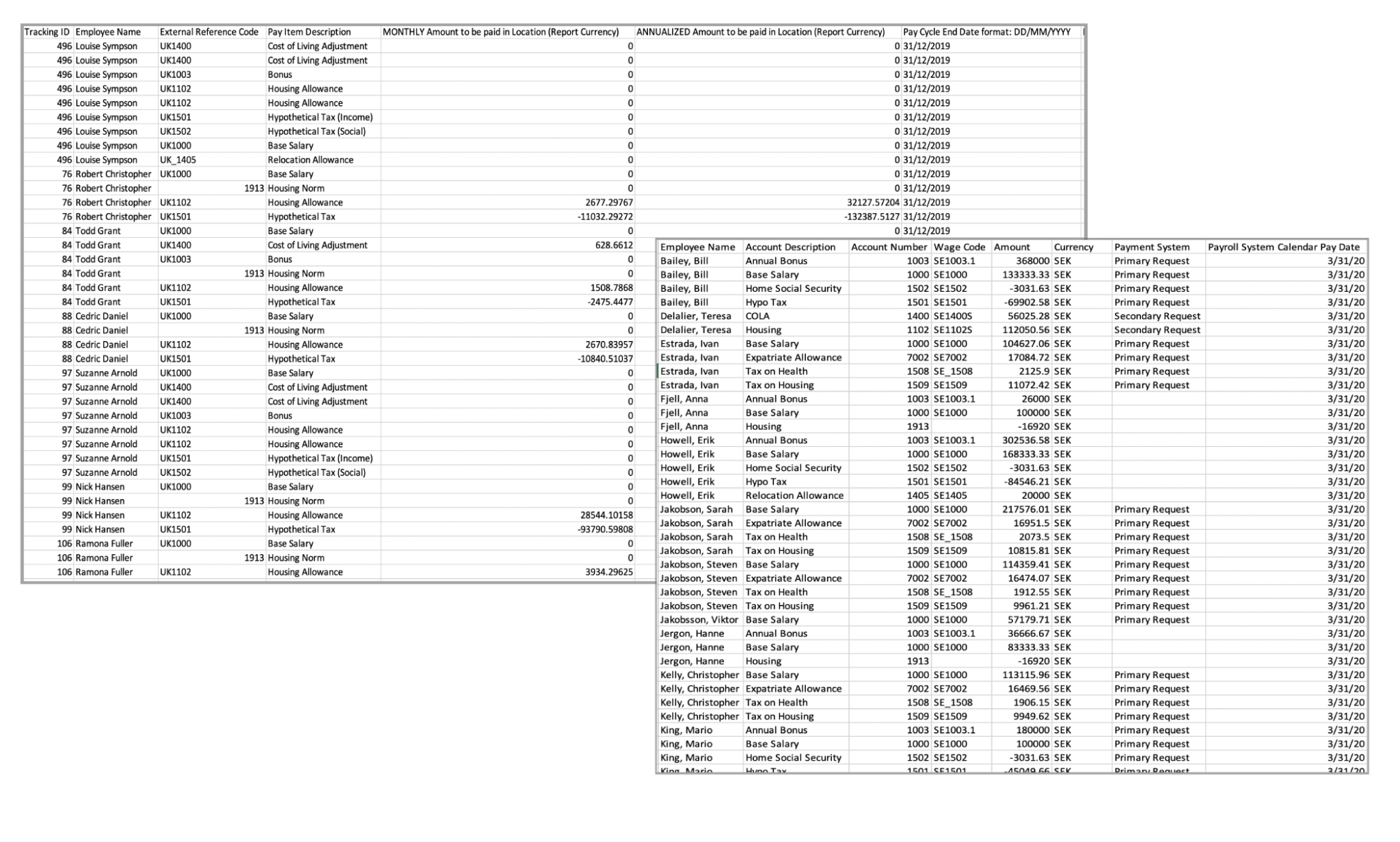

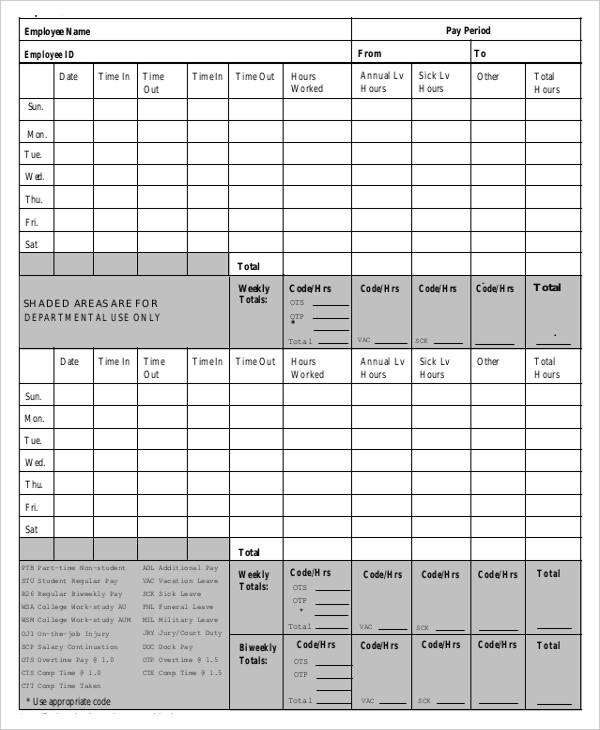

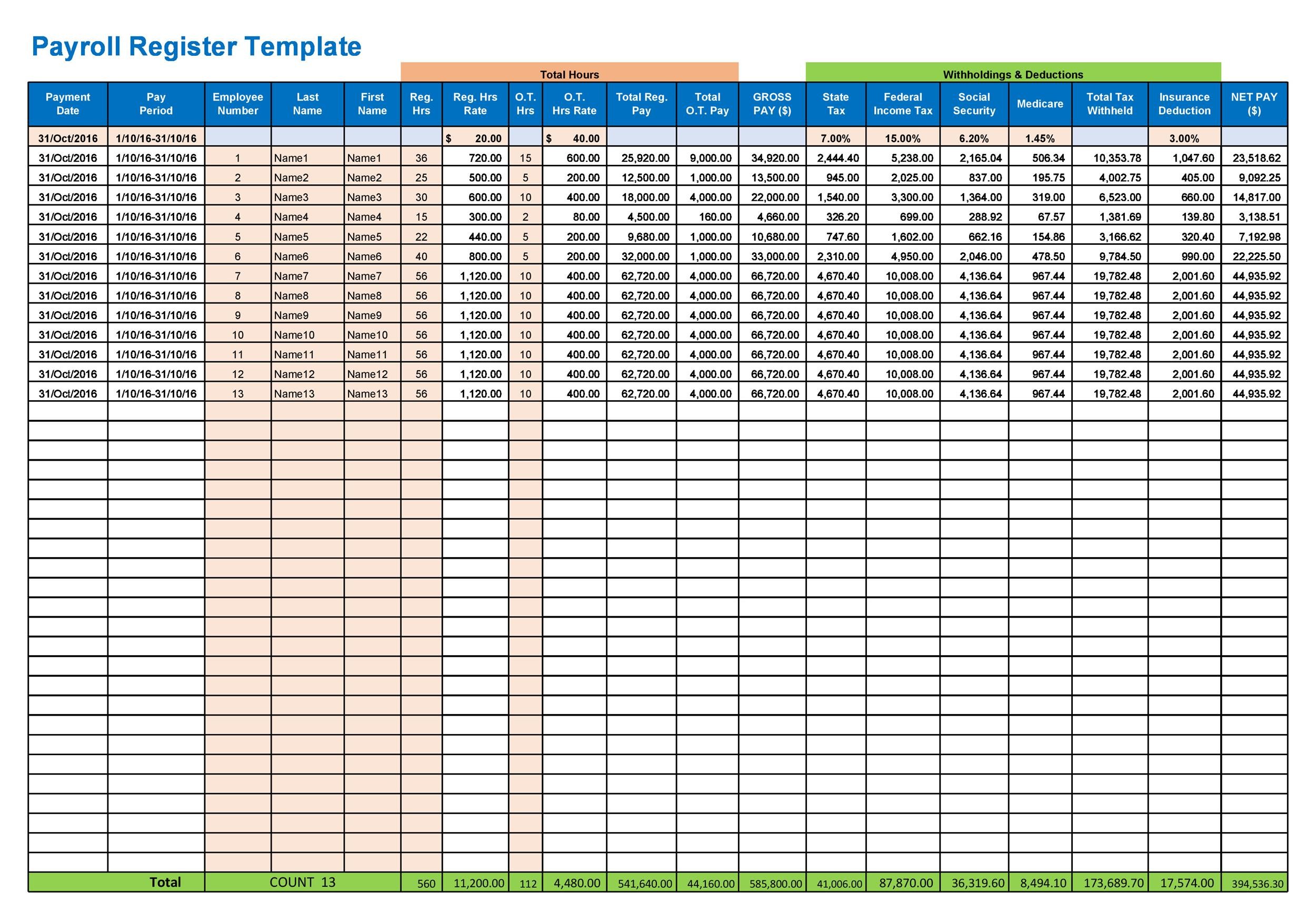

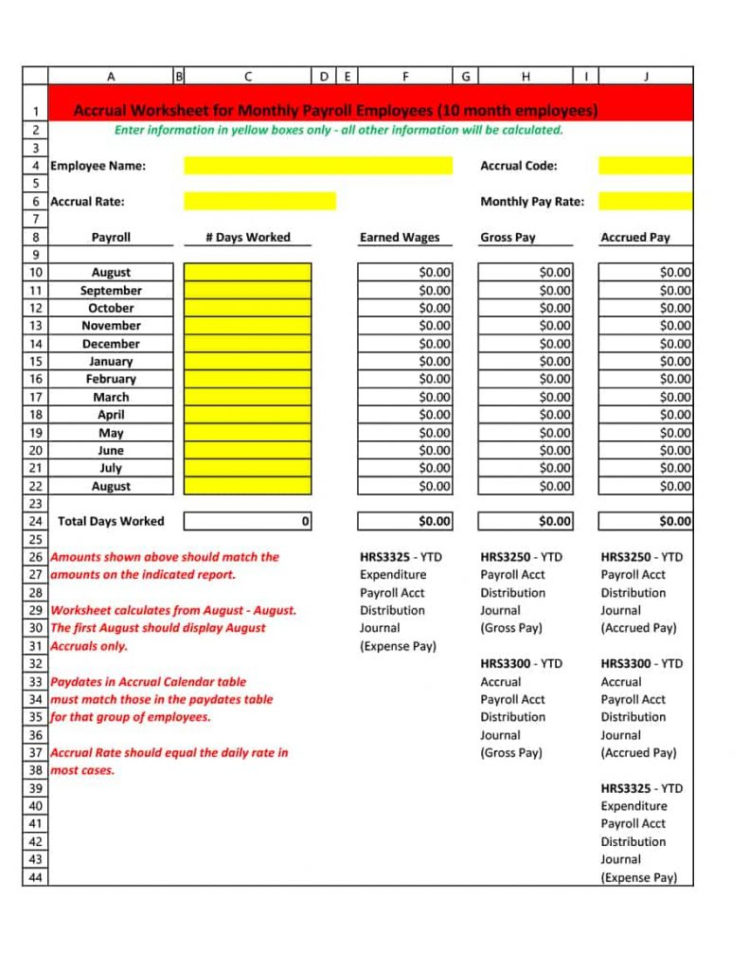

A payroll journal entry is a record of employee earnings for an accounting period. A payroll register template and payroll calculator template. Payroll reconciliation is the process of comparing your payroll register with the amount you plan to pay your employees.

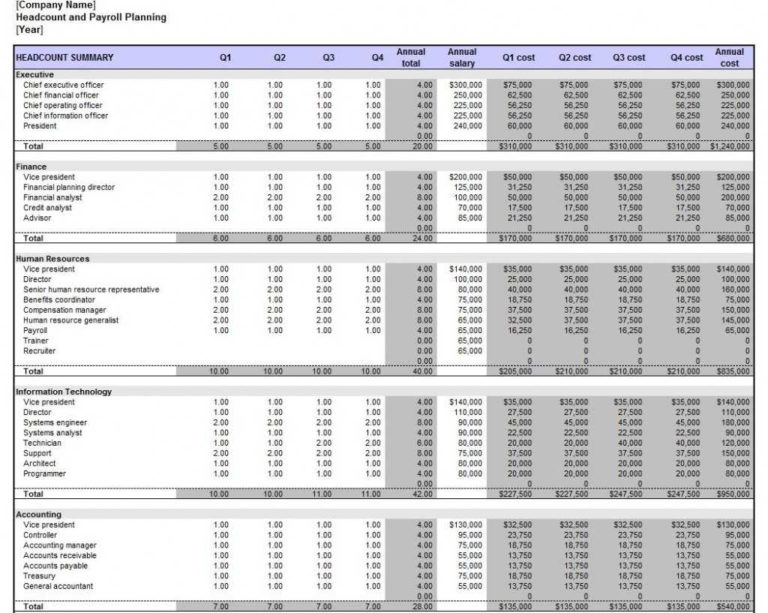

Payroll is the aggregate expenditure on wages and salaries incurred by a business in an accounting period. Types of payroll liabilities employee compensation, taxes, and voluntary deductions all generate payroll liabilities. What is a balance sheet?

It can also refer to a listing of employees giving details of their pay. A payroll journal entry is an accounting method to control gross wages and compensation expenses. A balance sheet, also referred to as a “statement of financial position” details your company’s assets, liabilities, and owners’ equity.

You may encounter errors or inaccurate info when you run the report. A balance sheet is a snapshot of a company's financial picture at a particular moment, reflecting both tangible and intangible assets. Set it, for instance, to last calendar year, columns by month.

They help and manage the salaries, wages, bonuses, and commissions payable to the business employees. All accounts credited in the entry are current liabilities and will be reported on the balance sheet if not paid prior to the preparation of financial statements. It provides a basis for computing rates of return and evaluating the company's.

Let's illustrate these concepts with four payroll examples: Here is a sample of estimated 2024 mlb team payrolls as noted by fangraphs: Set up monthly payroll reconciliation sheets ;

Payroll accounting is an essential function for growth as well as large businesses. An accountant typically includes these entries in the company's general ledger before its financial statements. This entry usually includes debits for the direct labor expense, salaries, and the company's portion of payroll taxes.

A balance sheet reports a company's assets, liabilities and shareholder equity at a specific point in time. Example of payroll journal entries. Here are how the most common payroll liabilities are paid:

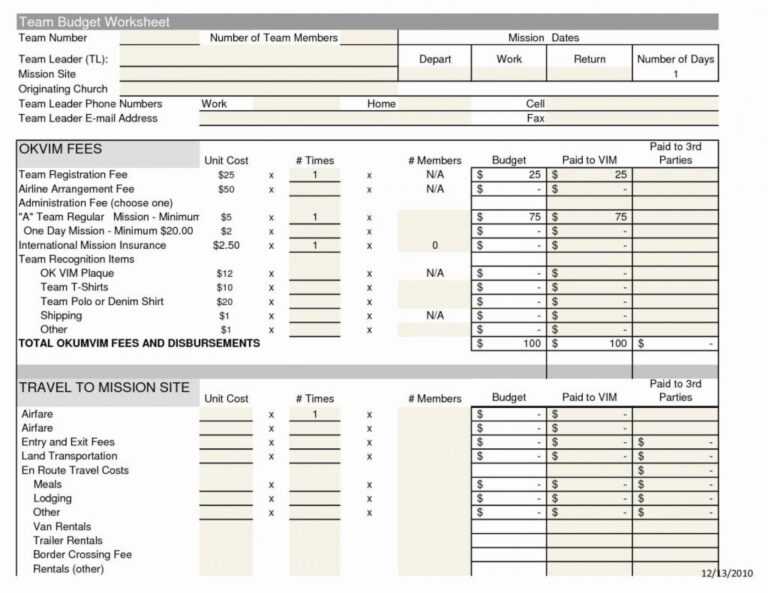

List your payroll balance sheet accounts ; Discover best practices to manage and record your payroll! Payroll liability and balance sheet report figures explained.