Looking Good Info About Net Cash Outflow

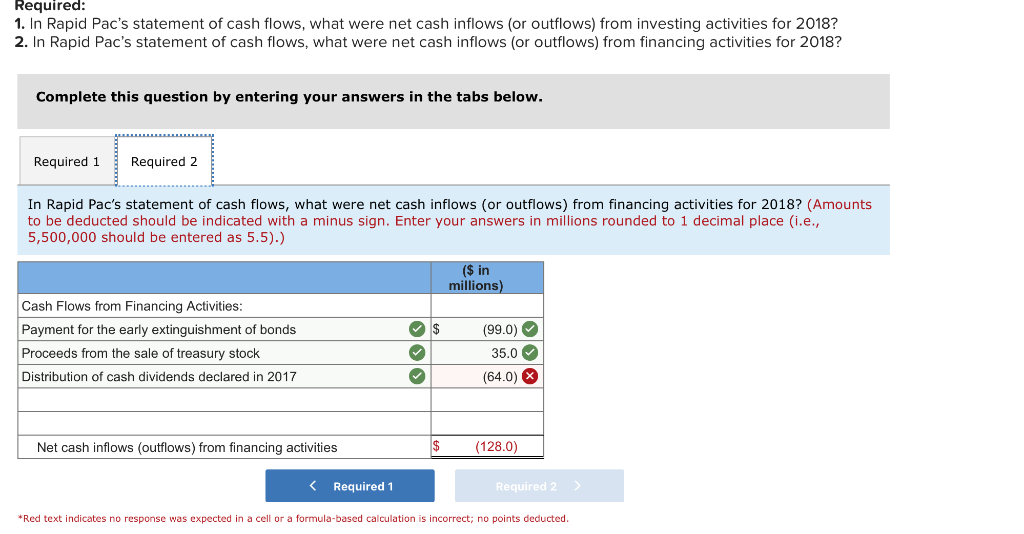

These expenses are categorized in the cash flow statement and can impact a.

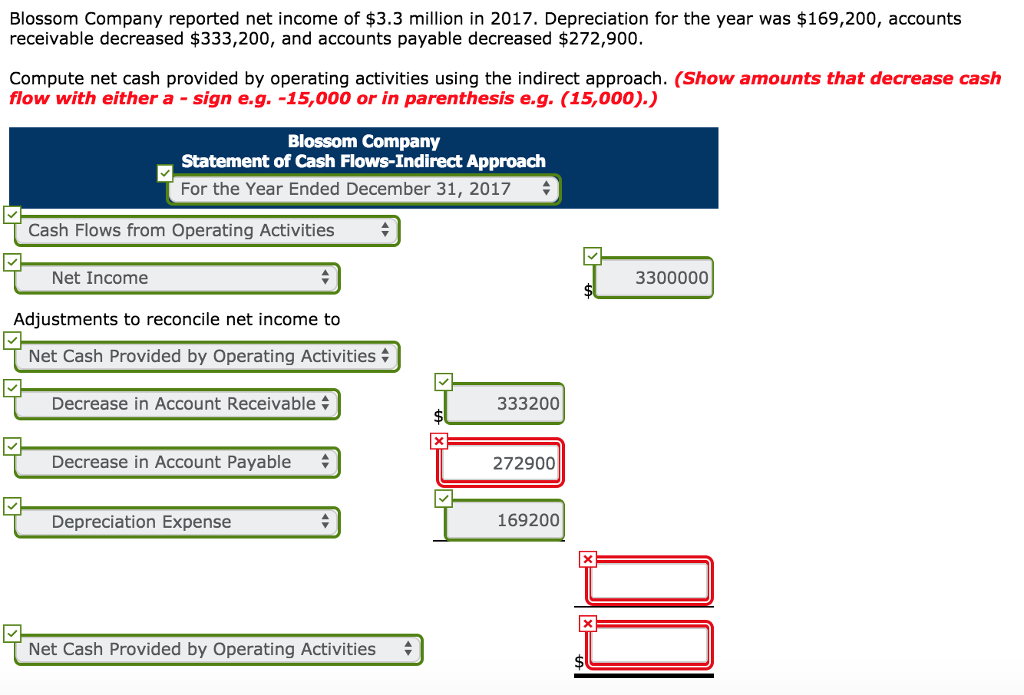

Net cash outflow. This concept is used to discern the. Using the indirect method, operating net cash. Net cash flow is the amount of cash generated or lost over a specific period of time, usually over one or more reporting periods.

It’s a relatively straightforward formula: Obvious examples of cash outflow as experienced by a wide range of businesses include. The basic net cash flow.

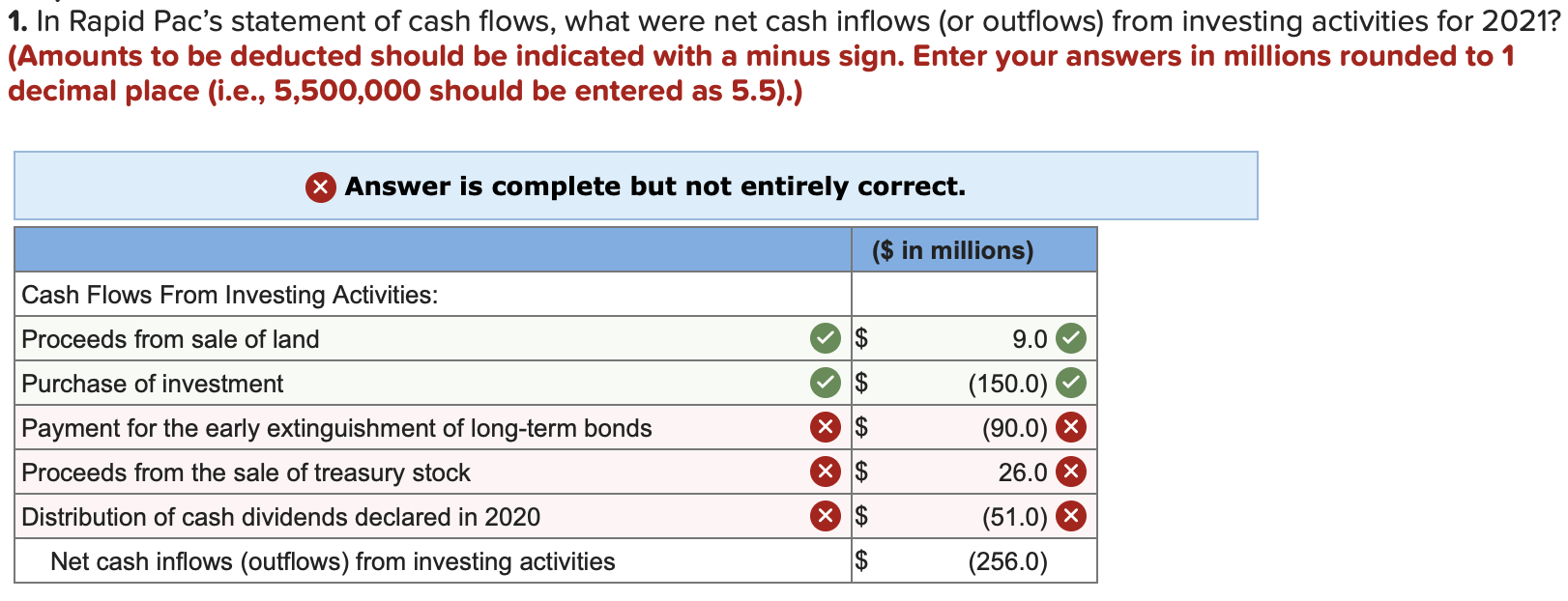

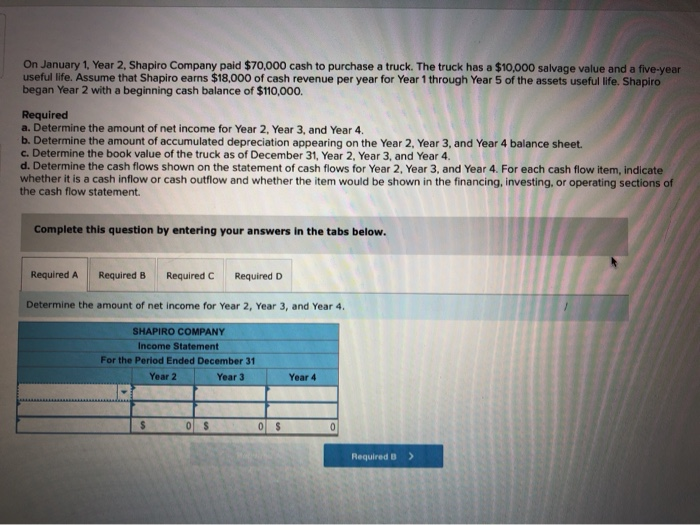

$450,000 + $100,000 + $1,000 = $551,000 to determine the difference, the corporation subtracts 2021's net cash flow. Determine net cash flows from operating activities. The term total net cash outflows 1 is defined as the total expected cash outflows minus total expected cash inflows in the specified stress scenario for the.

As a result, adjusted free cash flow was €1,164 million (fy 2022: Cash outflow is really a fancy way to say expenses—operating costs, debts, any money that’s leaving your business. It is calculated by subtracting a company's total liabilities from its.

Net cash flow is the difference between the cash inflows and outflows of a business. In simple terms, the term cash outflow describes any money leaving a business. The net cash outflow related to restructuring was €1 million (fy 2022:

To find the sum, we add the three values: A cash outflow refers to the movement of money from a business due to various expenses. Thailand’s prime minister pledged to keep up his campaign to pressure the central bank into a rate cut, fueling a buildup of market sentiment that the dispute will.

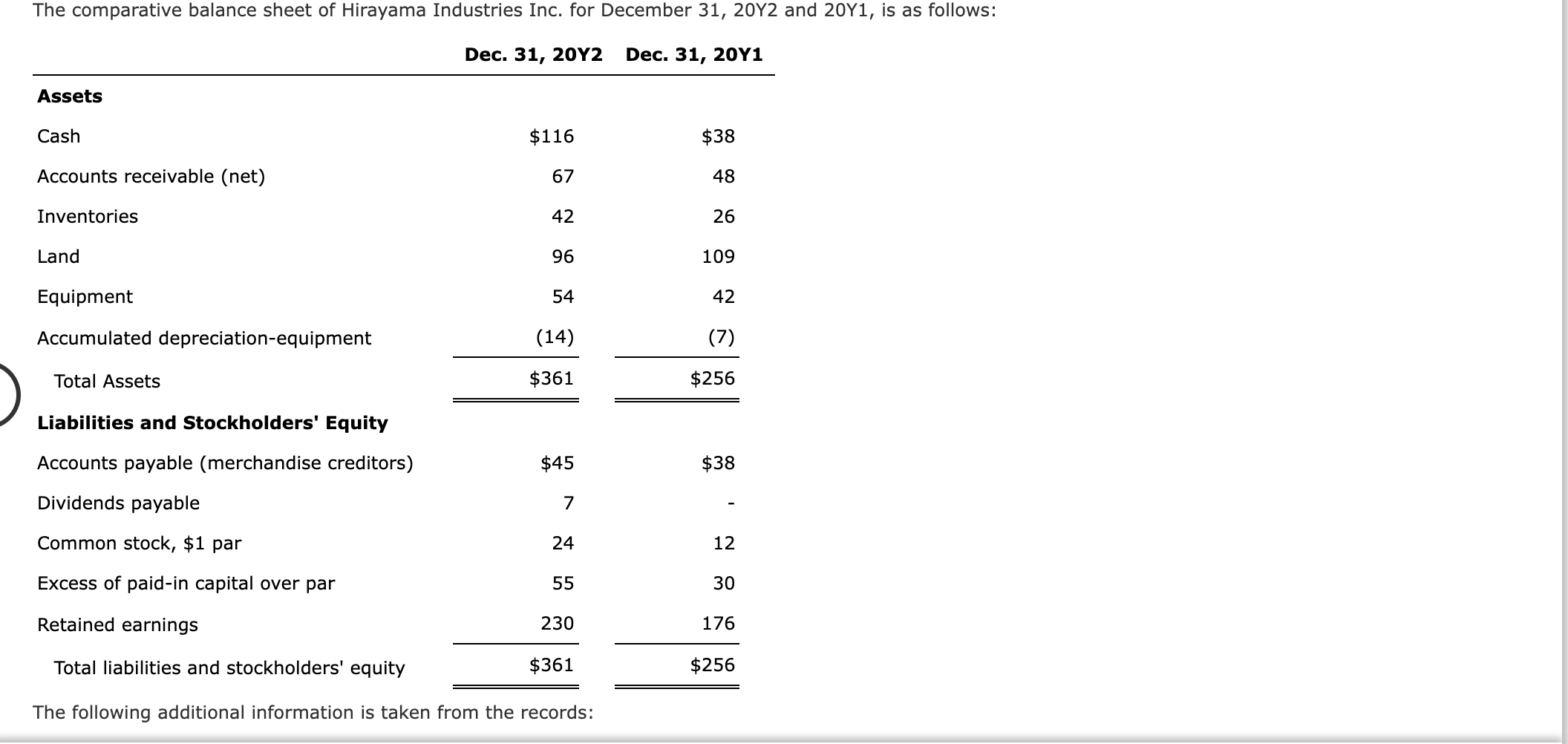

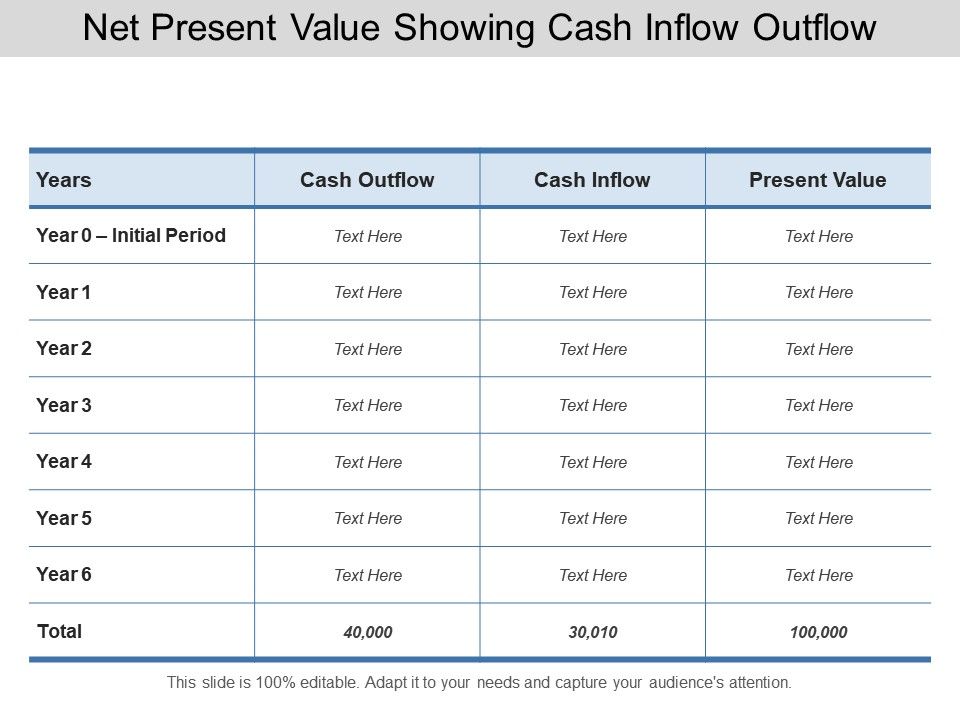

Net cash is a figure that is reported on a company's financial statements. Firstly, determine the cash flow generated from operating. The formula for net cash flow can be derived by using the following steps:

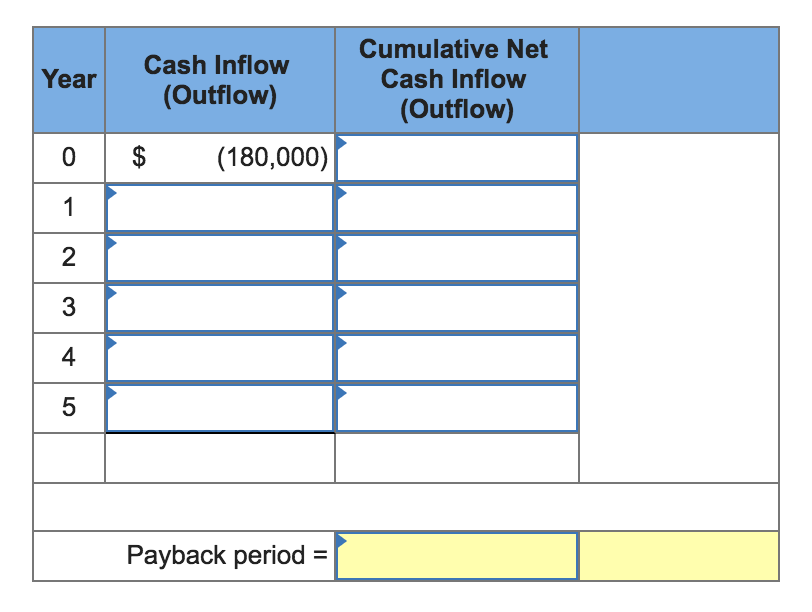

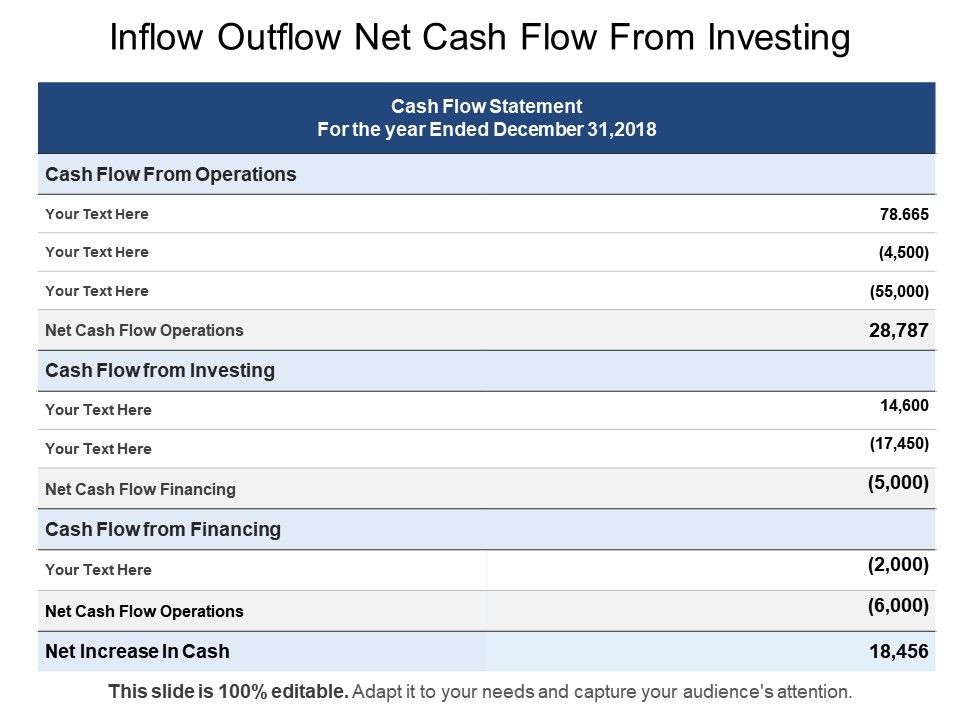

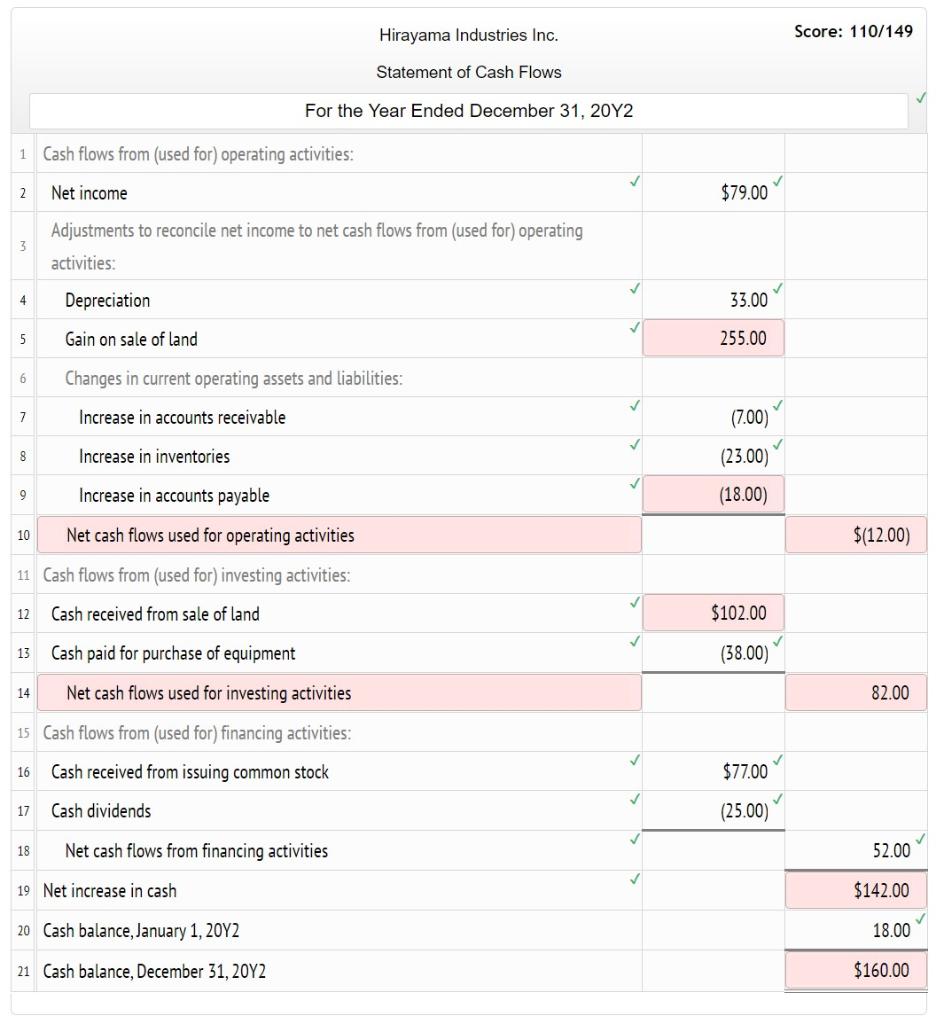

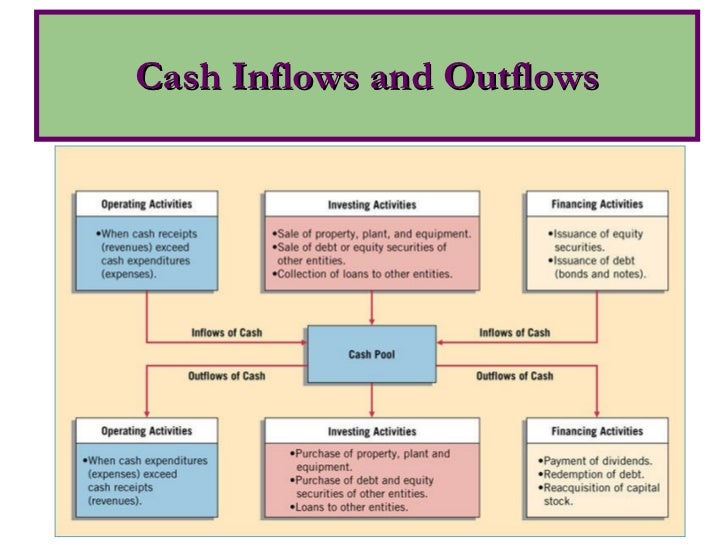

To calculate net cash flow, you need to find the difference between the cash inflow and the cash outflow. Cash flow from investing activities (cfi) is one of the sections on the cash flow statement that reports how much. Net cash flow = net cash flow from operating activities + net cash flow from financial activities + net cash flow from investing.

Net cash flow is the difference between all cash inflows and all cash outflows of a business:

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)