Fine Beautiful Info About Statement Of Revenues And Expenditures

Revenue (also referred to as sales or income) forms the beginning of a.

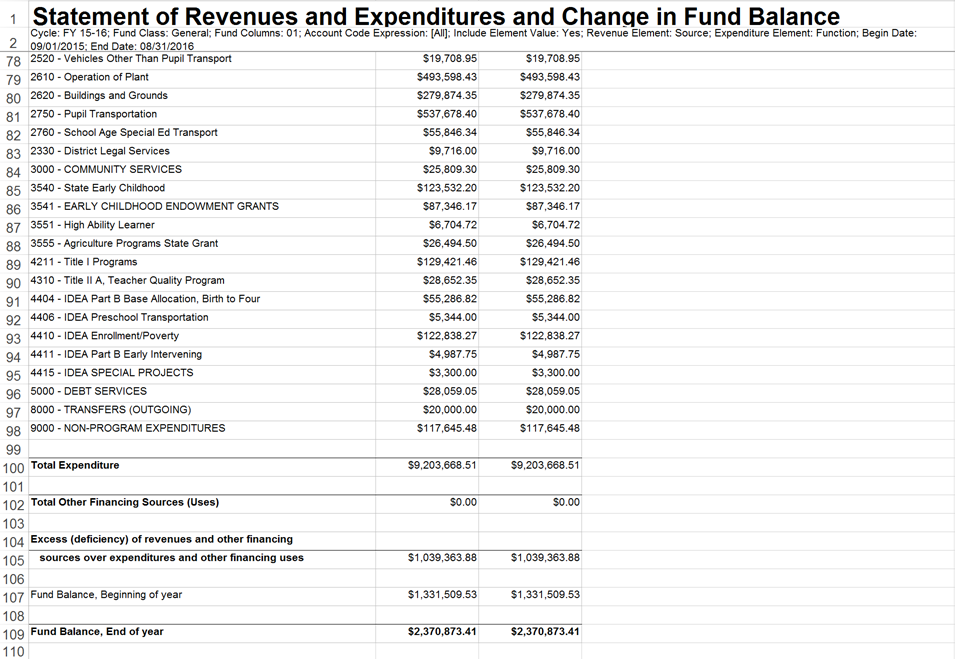

Statement of revenues and expenditures. Access this report using reports>financial statement >statement of revenues and expenditures. Statement of revenues and expenditures access this report using reports>financial statements>statement of revenues and expenditures. Statement of revenues and expenditures reports.

It is an important document because it tells you the company’s biggest areas of expenditures and revenues. Full year 2023 financial highlights: Yarilet perez gains & losses vs.

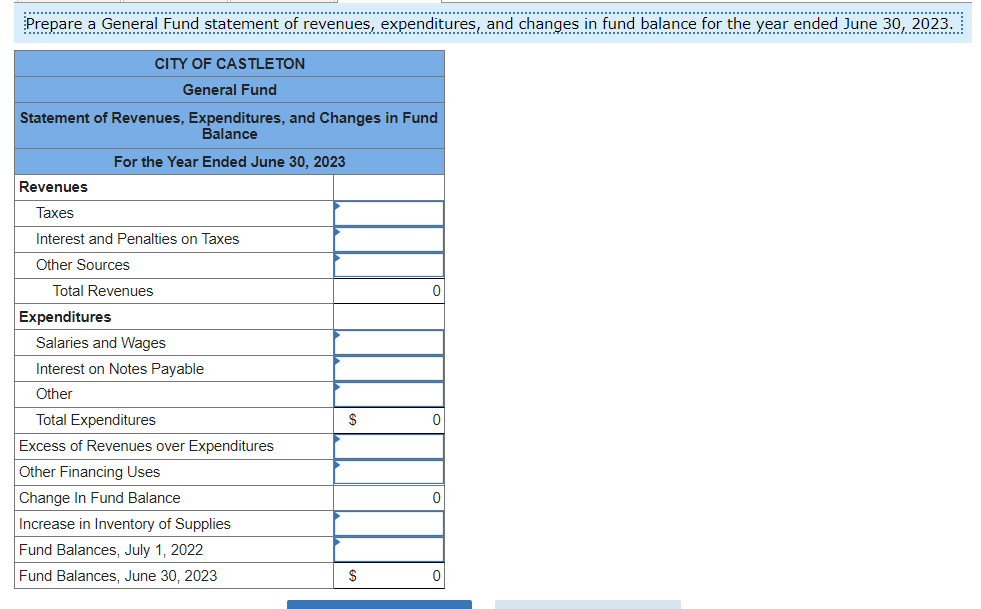

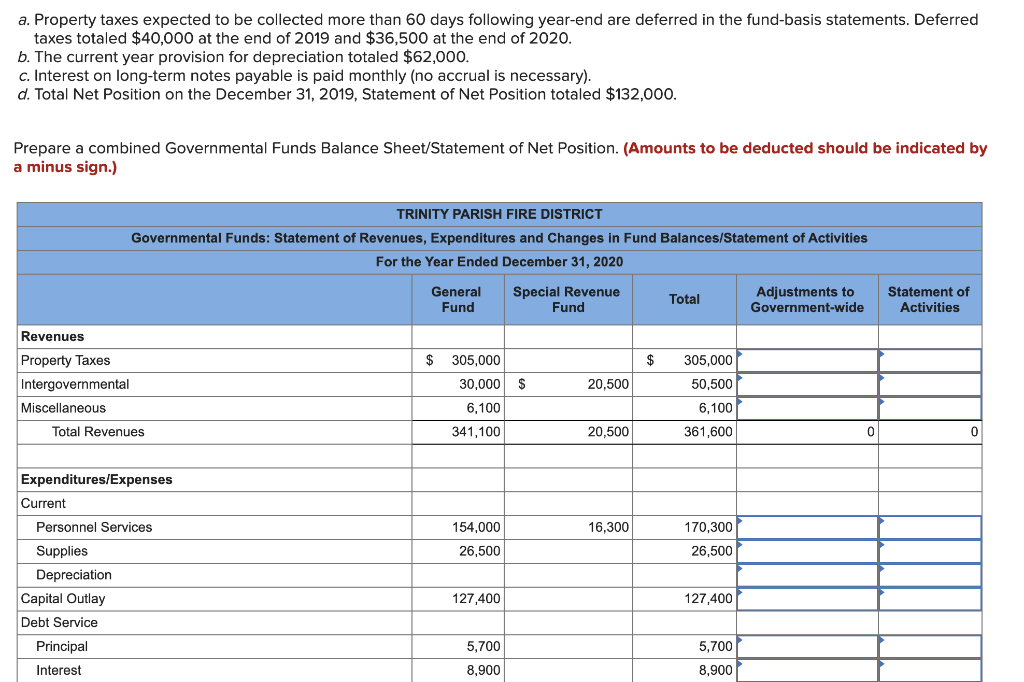

Yarilet perez what is revenue? A statement of revenues, expenditures, and changes in fund balances (srecfb) is a financial statement that summarizes the government's revenues,. Revenues indicate how much your business earned over the period shown.

Revenue is the value of all sales of goods and services recognized by a company in a period. The profit and loss statement lets you take advantage. The statement of revenues, expenditures, and changes in fund balances is the income statement prepared by governmental organizations, which tracks in the inflow and outflow of funds or resources.

There are two main parts to an income statement: On the income statement, net income is computed by deducting all expenses from all revenues. In preparing the financial statements, management is required to make judgments, estimates and assumptions that affect the reported amounts of assets and liabilities at.

When revenues exceed expenses, companies. Revenue is the money generated from normal business operations, calculated as the average sales price times the number of. It mostly contains the same significant funds as a balance sheet.

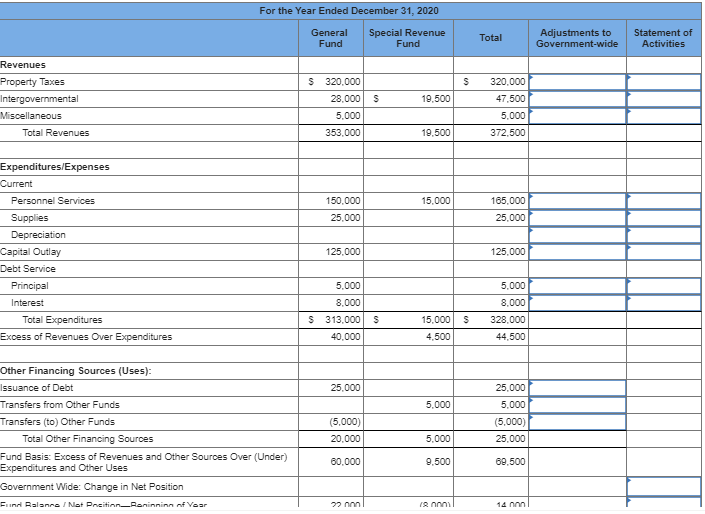

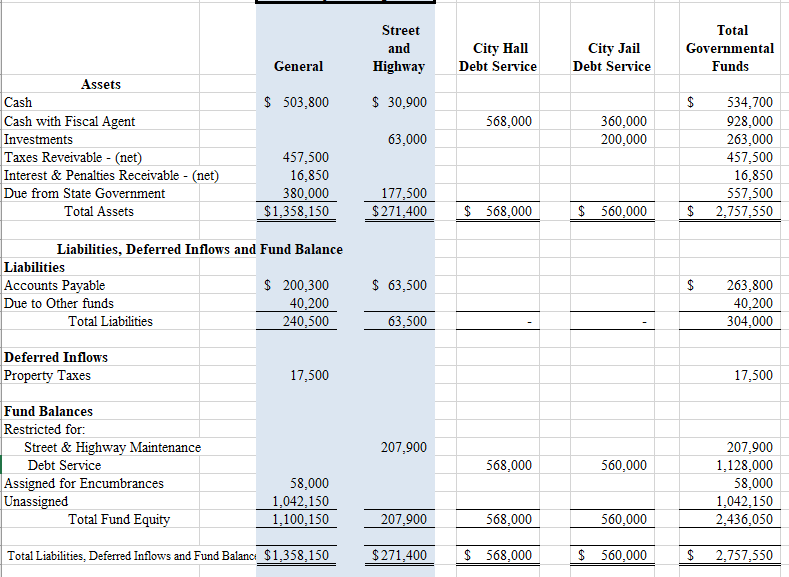

For example, a company buys a $10 million piece of equipment that it estimates to have a useful life of 5 years. When preparing an income statement, revenues will always come before expenses in the presentation. Governmental fund statement of changes in revenues, expenditures, and fund balances shows the sources of revenue in two categories:

T he budget, presented annually in parliament by the union finance minister, is a crucial financial statement outlining the government's planned expenditures and revenues for. An overview most companies report such items as revenues, gains, expenses, and losses on their income. Revenues are presented at the top part of the income statement, followed by.

Expenses, on the other hand, are the costs of providing the goods and services and decrease the value of the business. Once you have the change in net assets, you can compare revenue and expenses by significant program.

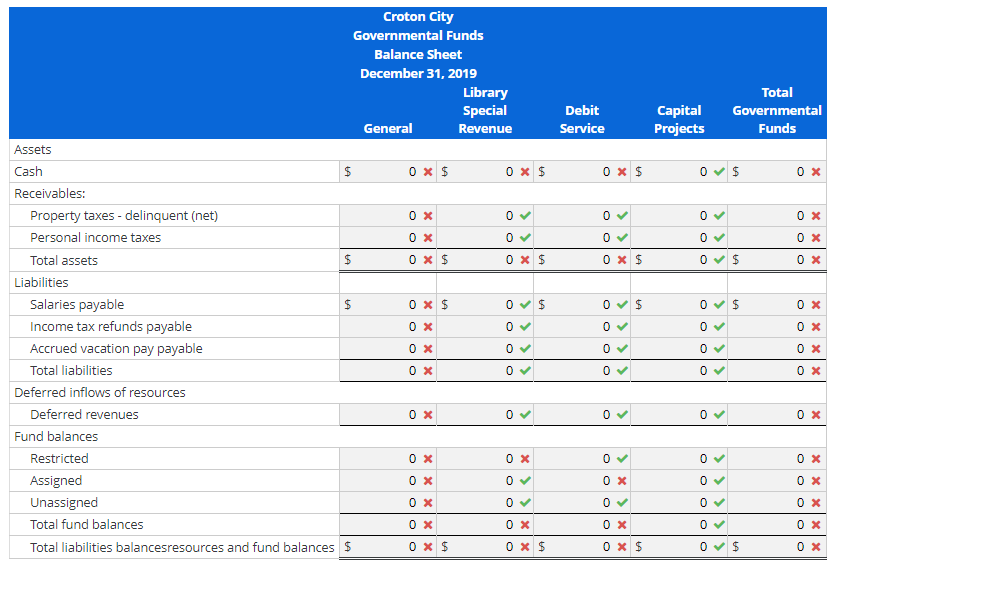

![[Solved] Presented below is the Governmental Funds SolutionInn](https://s3.amazonaws.com/si.question.images/image/images14/1224-B-C-A-T-A(1689).png)

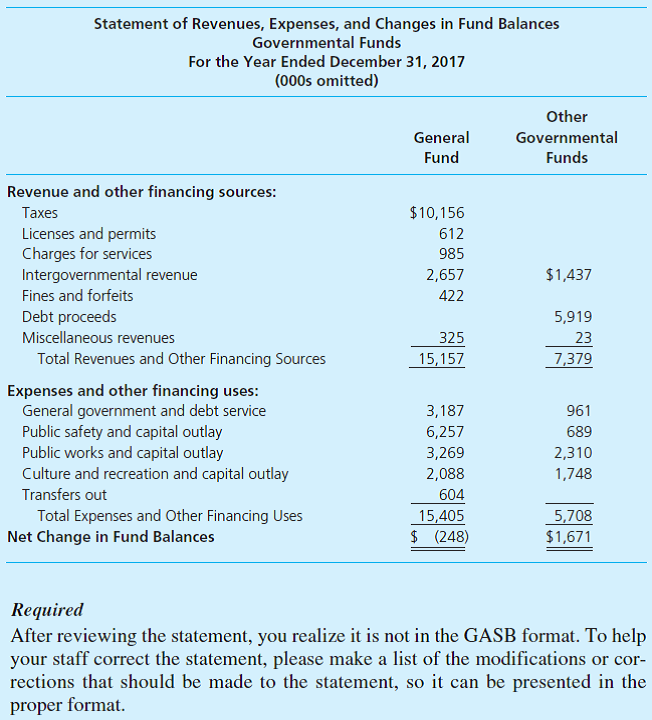

![[Solved] Prepare a skeleton statement of revenues, SolutionInn](https://s3.amazonaws.com/si.question.images/image/images6/342-B-A-G-F-A(4208).png)