Beautiful Work Info About Statement Of Financial Position Income Cash Flows

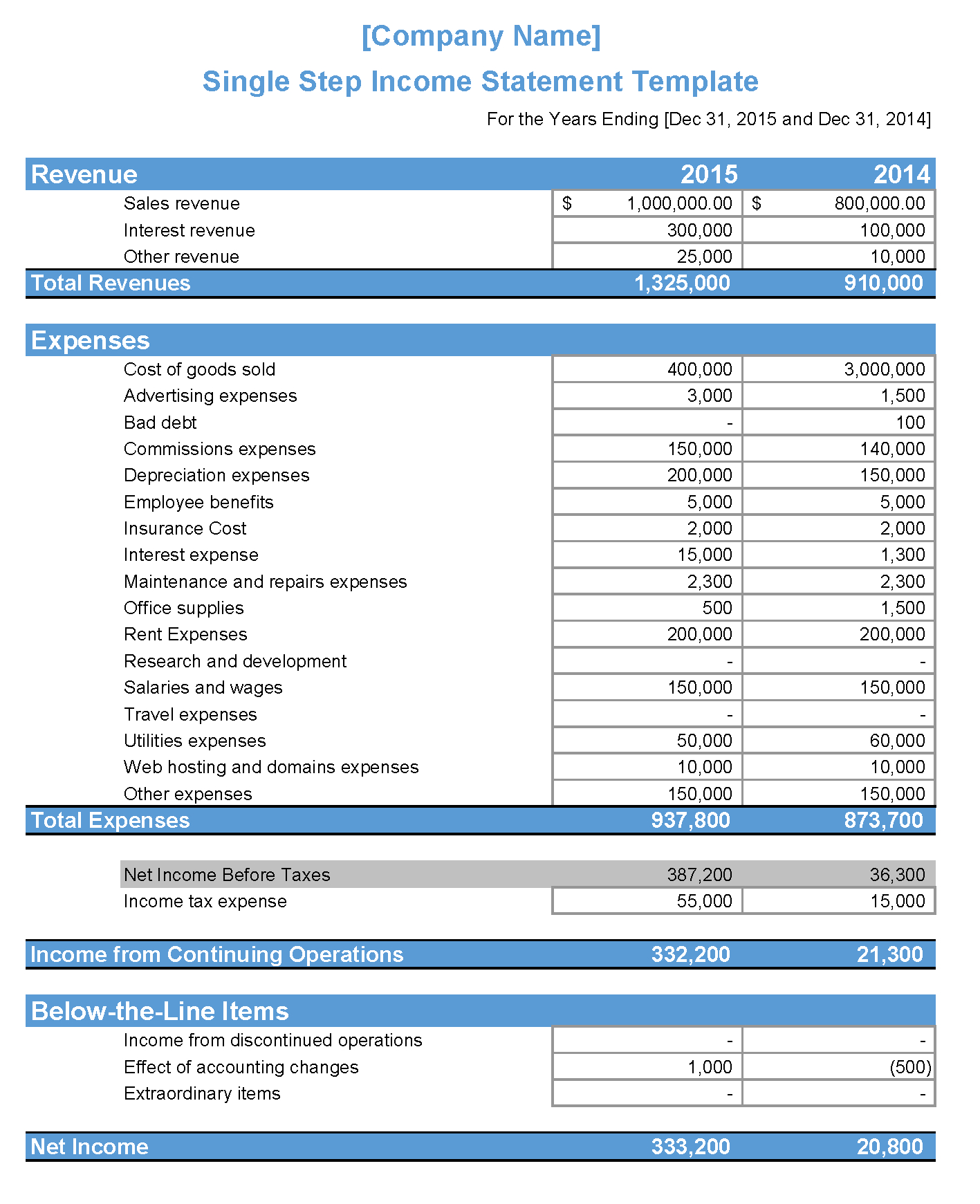

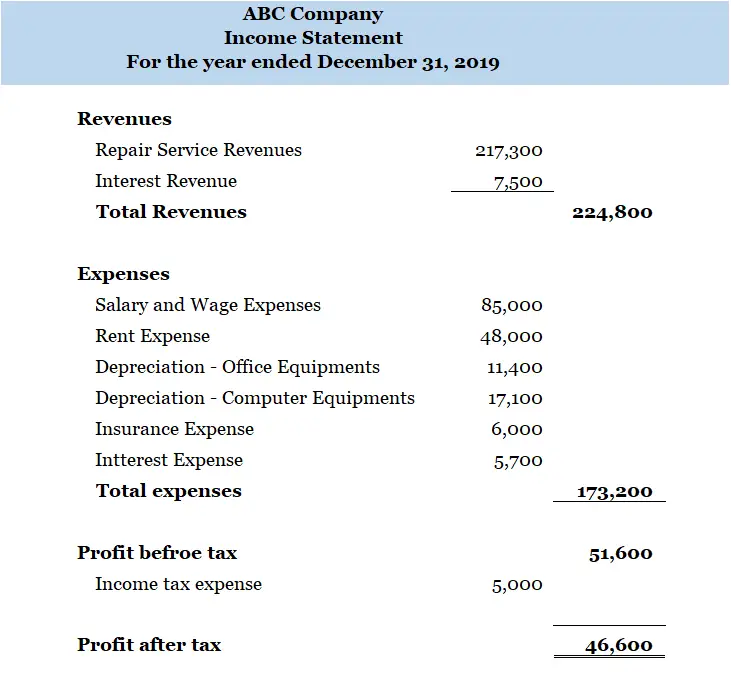

The fourth and final financial statement prepared is the statement of cash flows, which is a statement that lists the cash inflows and cash outflows for the business for a period of time.

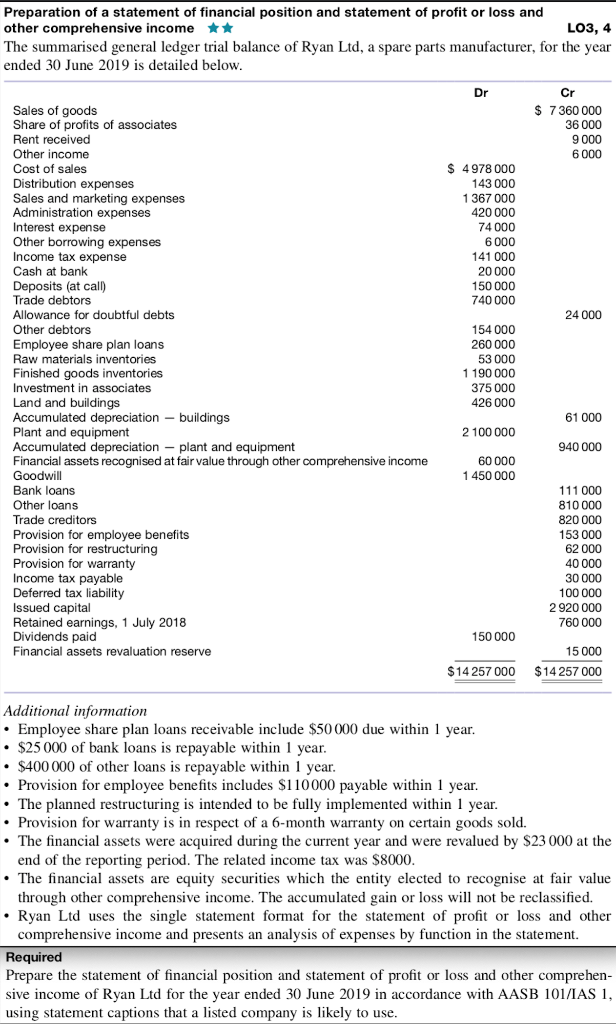

Statement of financial position income statement statement of cash flows. The three financial statements are: It is a crucial statement, as it shows the sources of and uses of cash for the firm during the accounting period. The cash flow statement is linked to the income statement by net profit or net loss,.

The statement of cash flows is prepared by following these steps: An entity presents its cash flows from operating, investing and financing activities in a manner which is most appropriate to its business. The cfs measures how well a.

Along with income statements and balance sheets, cash flow statements provide crucial financial. An income statement compares revenue to expenses to determine profit or loss. The cash flow statement and the income statement are two of the main financial statements.

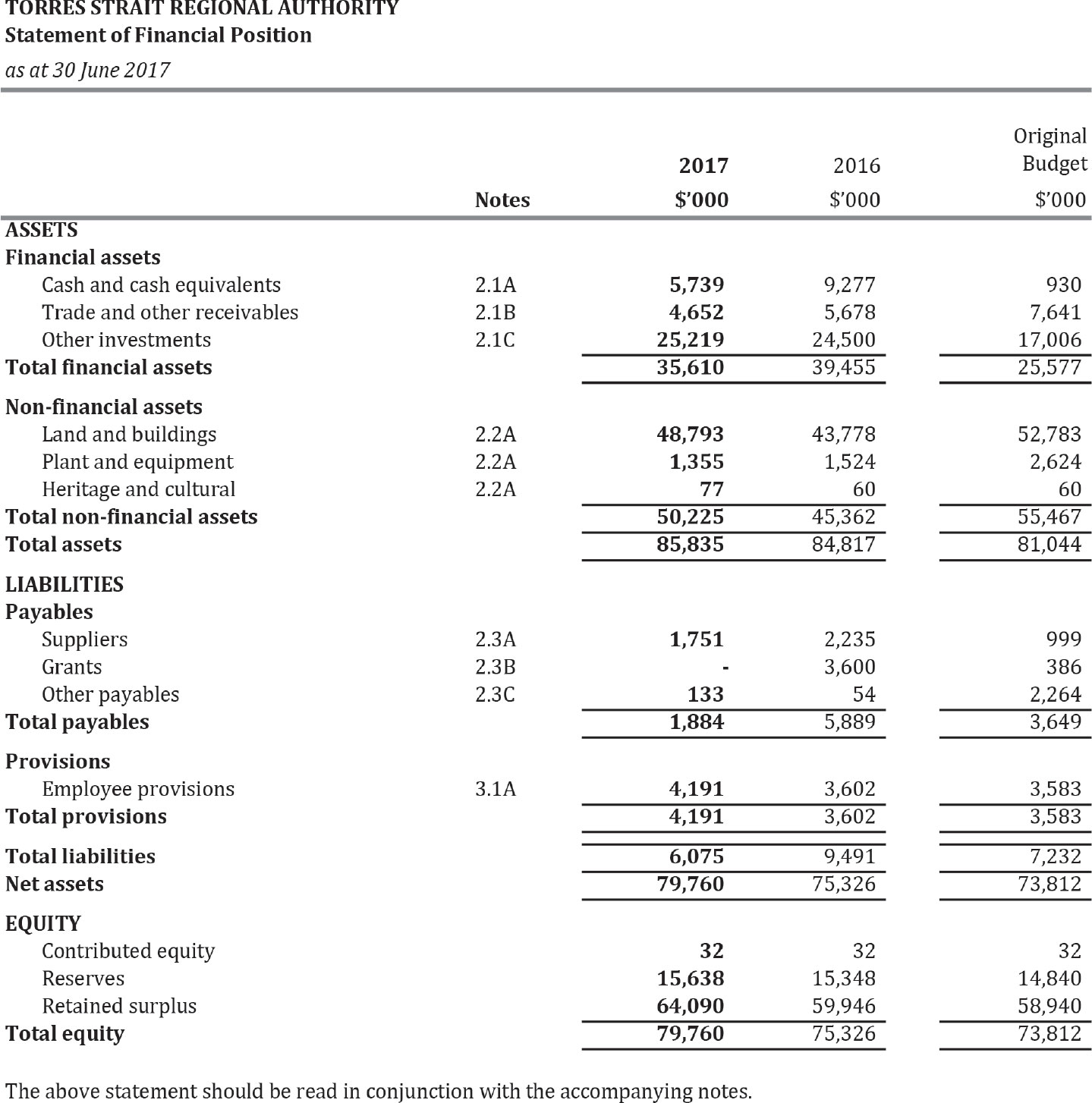

Notes, containing explanatory information and a summary of significant accounting policies. The final financial statement is the statement of cash flows. Data found in the balance sheet, the income statement, and the cash flow statement is used to calculate important financial ratios that provide insight on the company’s financial.

Although the presentation of operating cash flows differs between the two methods,. Ias 7 statement of cash flows requires an entity to present a statement of cash flows as an integral part of its primary financial statements. Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating.

Cash flow statements are one of the three fundamental financial statements financial leaders use. Income statement cash flow statement part of the world considers the statement of stockholders equity as another financial statement. At first glance, this may seem like a redundant financial statement.

The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company. Balance sheet, or statement of financial position, is directly related to the income statement, cash flow statement and statement of changes in equity. In the true sense, explanatory notes in the annual reports should also be called financial statements.

Remember, under accrual accounting, transactions are recorded when they occur, not necessarily when cash moves. Fact checked by ariel courage the cash flow statement and the income statement are integral parts of a corporate balance sheet. The increase (or decrease) in net assets as a result of the net profit (or loss) reported in.

Assets, liabilities and equity balances reported in the balance sheet at the period end consist of: Begin with net income from the income statement. Cash flows are classified and presented into operating activities (either using the 'direct' or 'indirect' method), investing activities or financing activities, with the latter two categories.

Add back noncash expenses, such as depreciation, amortization, and depletion. Sales of goods (either for cash or on credit) if a sale is made for cash, then cash in the business will increase and a sales transaction will have also been created. Determine net cash flows from operating activities using the indirect method, operating net cash flow is calculated as follows:

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)