Divine Tips About Comparing Financial Ratios

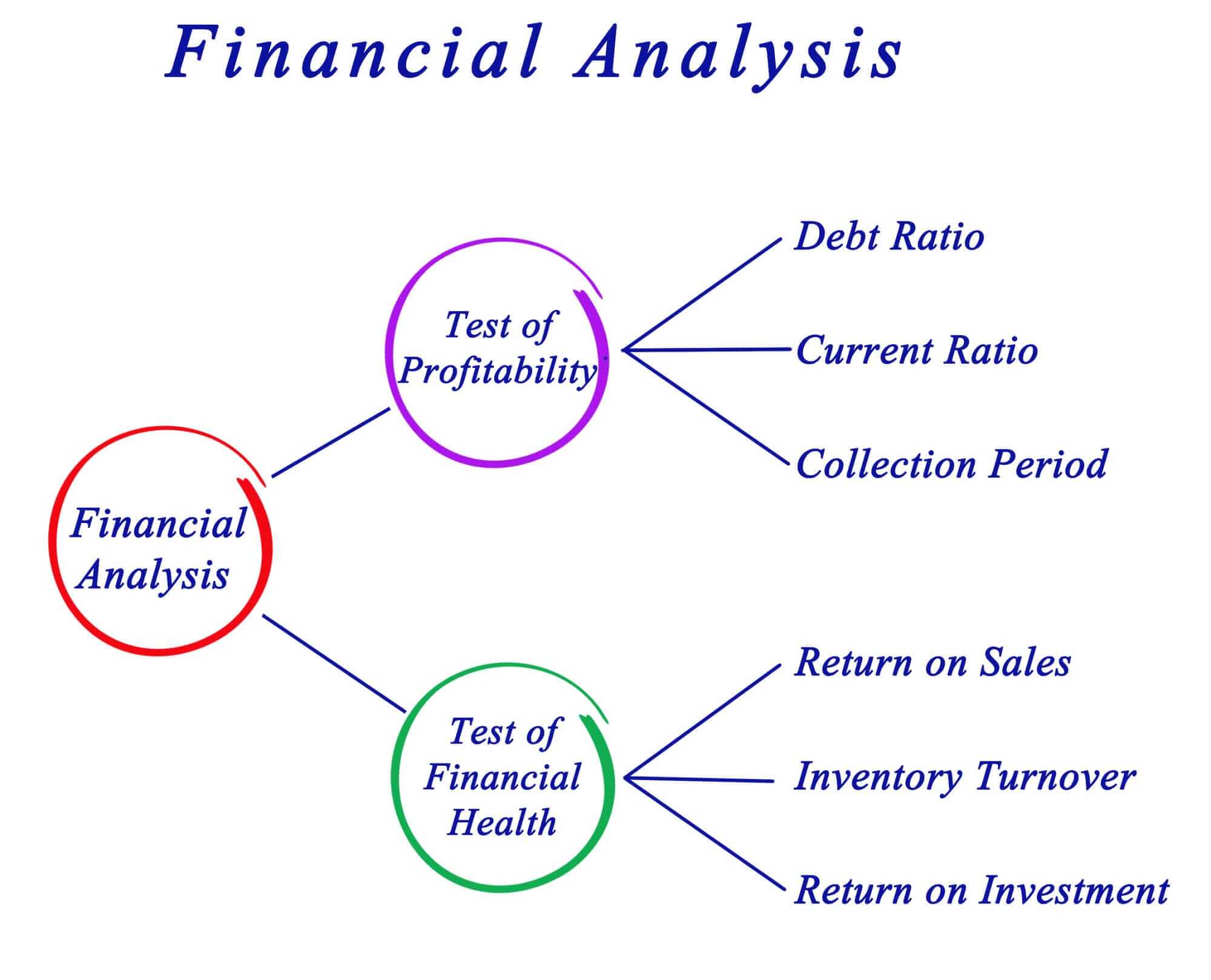

Financial ratio analysis is just one way to determine the financial health of a company.

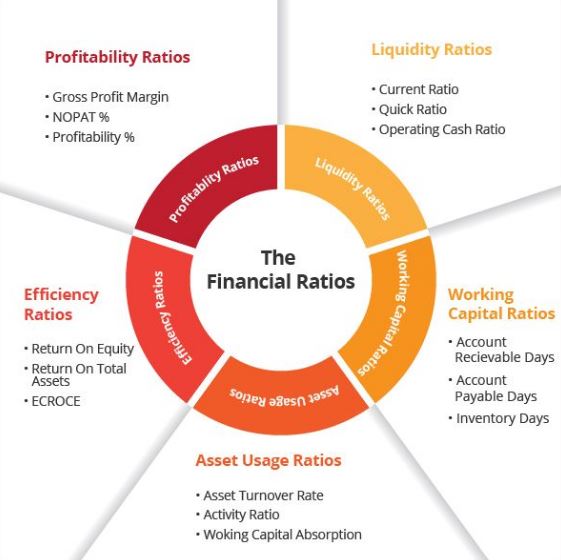

Comparing financial ratios. The resulting ratio can be interpreted in a way that is more insightful than looking at the. Key financial ratio types. Ratio analysis, in simple terms, brings out the relationship among selected items of financial.

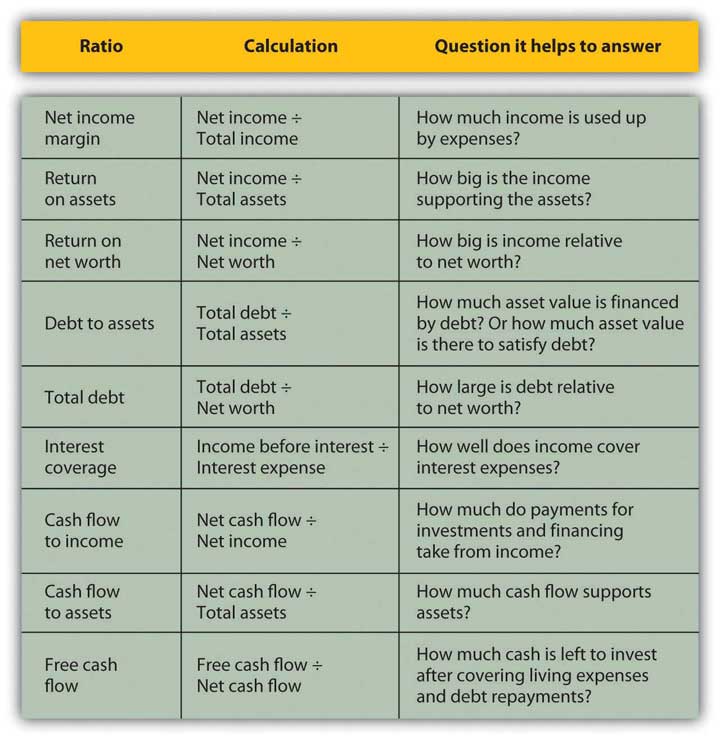

Ratio analysis is a method of analyzing a company's financial statements or line items within financial statements. Financial ratios are usually split. In other words, leverage financial ratios are used to evaluate a company’s debt levels.

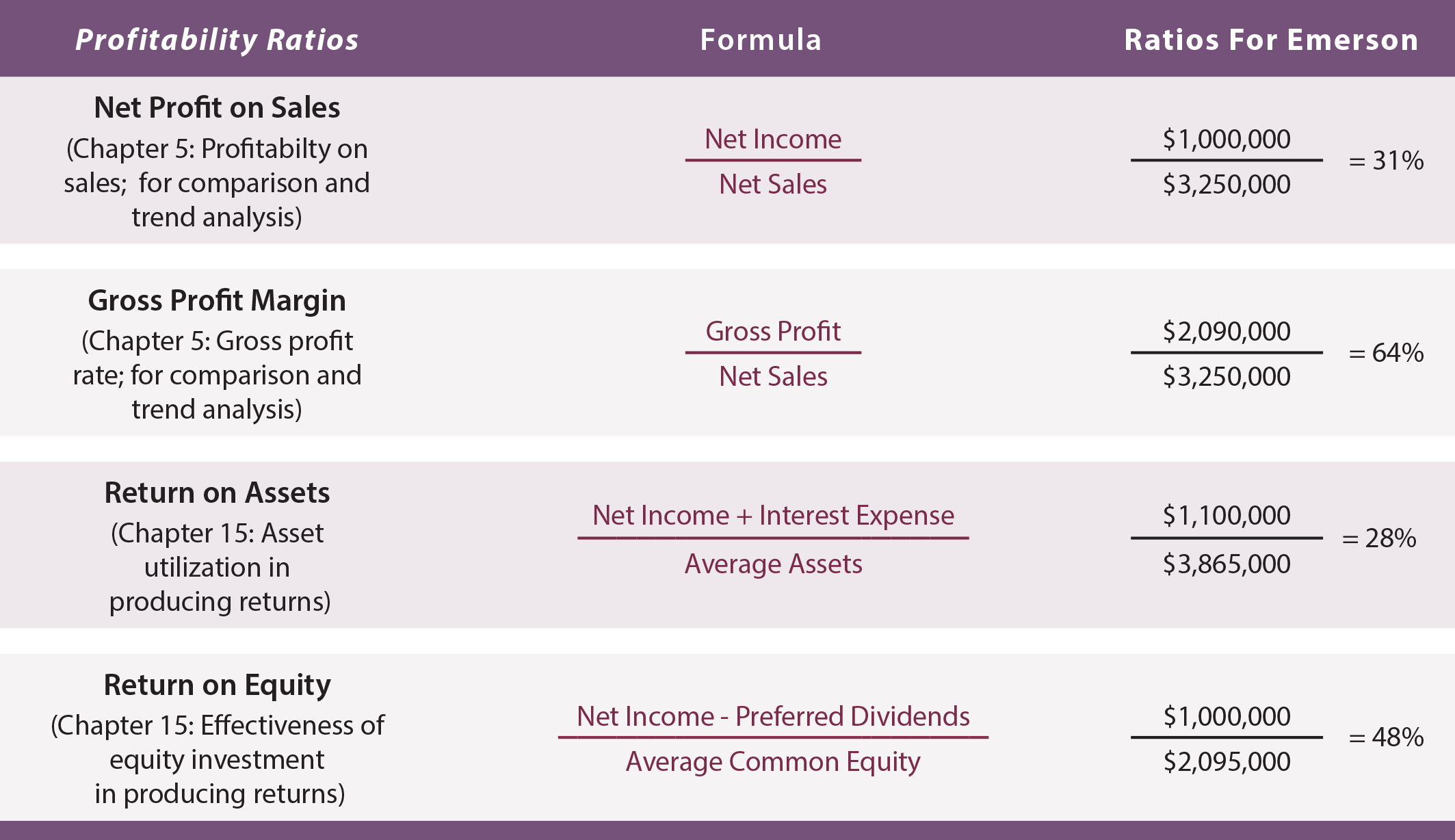

While there are dozens of ratios that can be calculated, most nonprofits can use a handful of them to learn more about their financial condition. Of the many financial ratios used, this section provides a snapshot of the four basic ones. The correct answer is a.

Our explanation will involve the following 15 common financial ratios: Financial ratios are used for industry comparisons, benchmarking, and trend. Financial ratios are powerful tools to help summarize financial statements and the health of a company or enterprise.

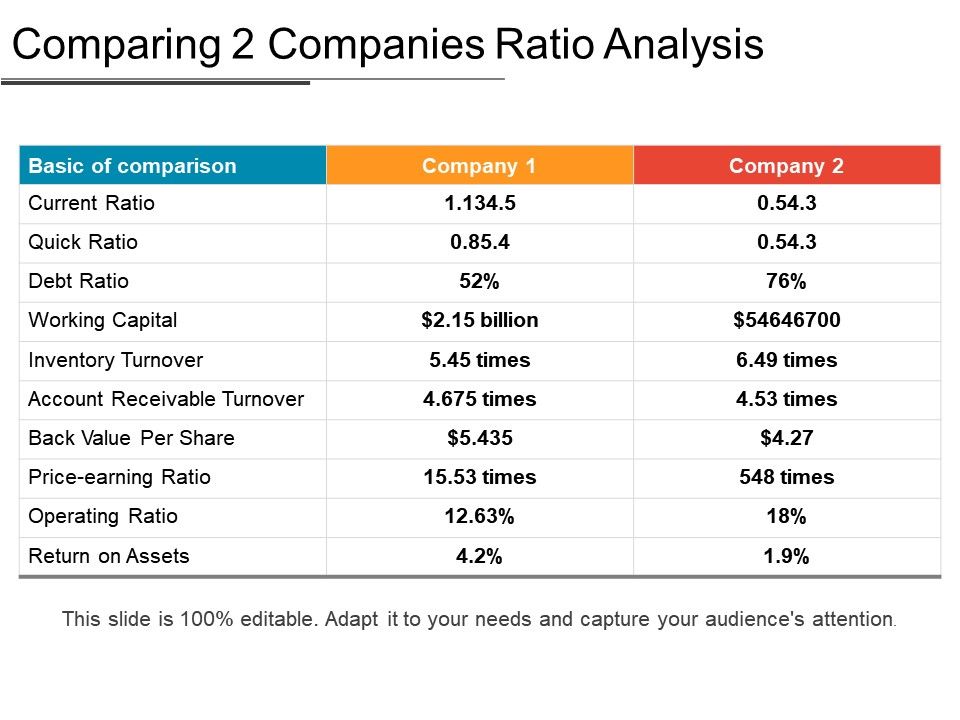

Inventory turnover ratio = cost of goods sold/average inventory = 1,252,000/263,579 = 4.75 for company xyz, and. Comparative ratio analysis is a powerful financial tool that evaluates a company's performance by comparing key metrics over time or against industry peers. A basic comparison of your company.

Any ratio shows the relative size of the two items compared, just as a fraction compares the numerator to the denominator or a percentage compares a part to the whole. Learn the most useful financial ratios here. Financial ratio analysis compares relationships between financial statement accounts to identify the strengths and weaknesses of a company.

For added confidence, a combination of ratios and tools can provide a more complete picture of potential investments. Many ratios are available, but some, like the price. Understanding industry averages helps identify areas of strength.

Ratios—one variable divided by another—are financial analysis tools that show how companies are performing in their own right and relative to one another. Leverage ratiosmeasure the amount of capital that comes from debt. Any ratio shows the relative size of the two items compared, just as a fraction compares the numerator to the denominator or a percentage compares a part to the.

Financial ratios using balance sheet amounts. Industry averages provide benchmarks for comparing a company’s ratios with its competitors. The debt ratiomeasures the relative amount of a company’s assets that are provided from debt:

An overview of how financial ratios are used to aid in company analysis is presented in this lesson. These financial ratios in accounting have a lot of importance in the financial market and provide valuable insight for analysts, investor, management,. Financial ratio analysis is performed by comparing two items in the financial statements.