Formidable Tips About Total Current Liability

:max_bytes(150000):strip_icc()/Macys2Financial_Report-ConsolidatedBalanceSheets-a57a21ad292a49b1846aef6bb5c377c7.jpg)

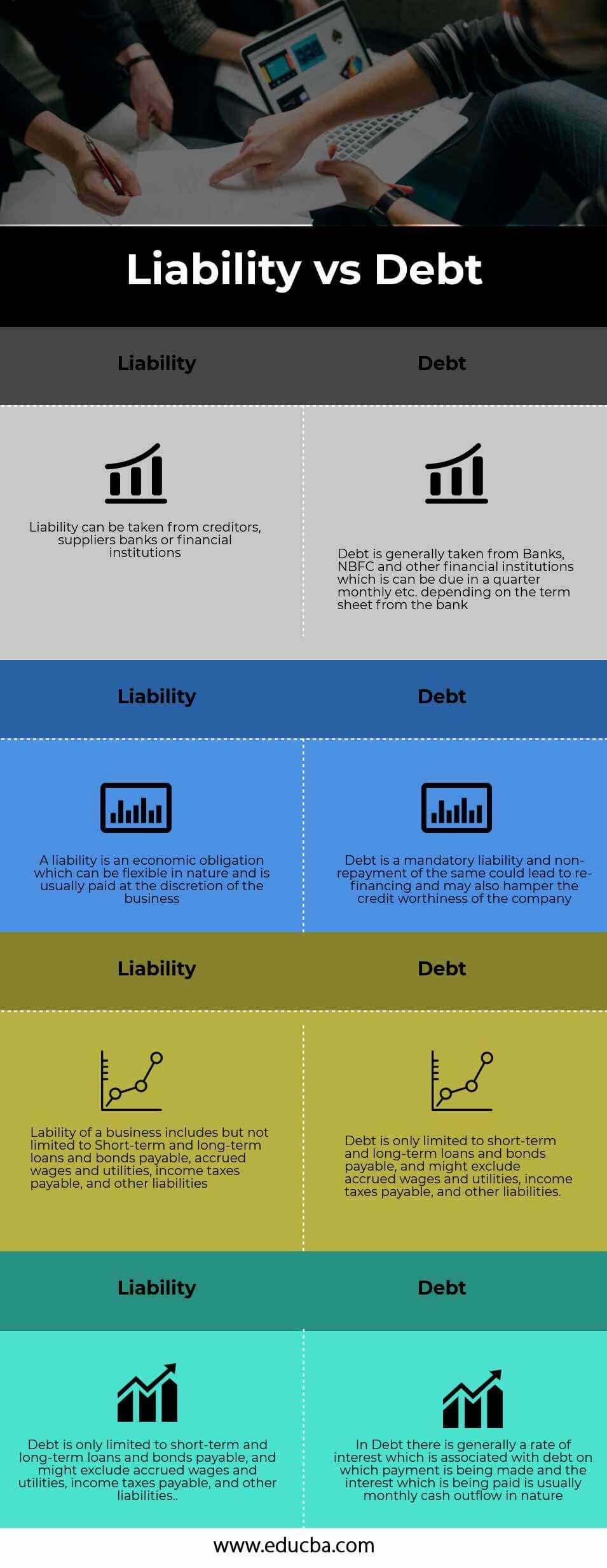

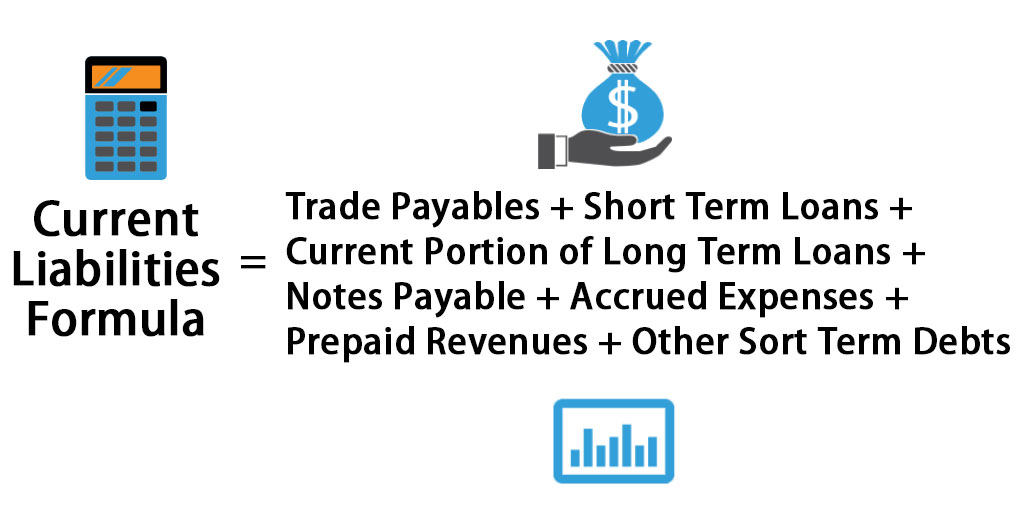

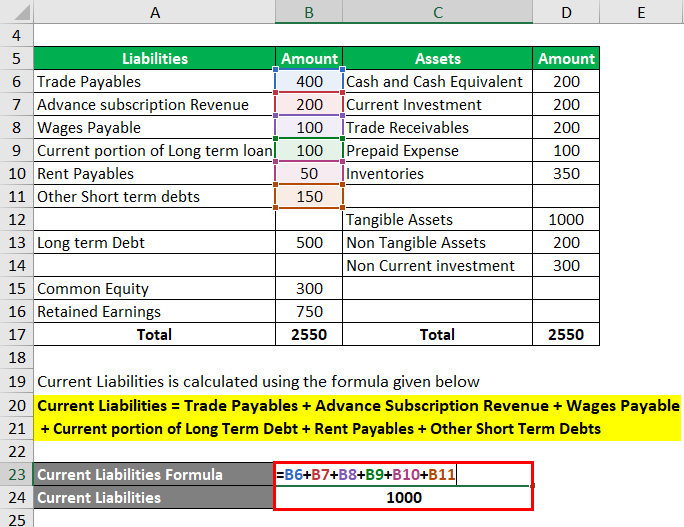

Current liabilities are an enterprise’s obligations or debts that are due within a year or within the normal functioning cycle.

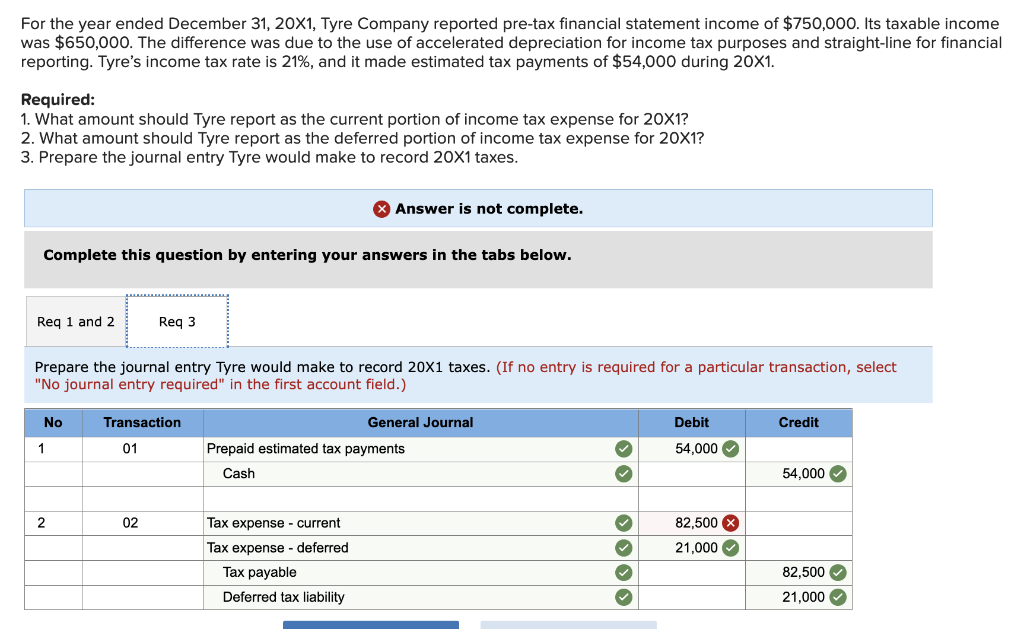

Total current liability. A liability requires a future, specified payment at specified dates. 6 fall under the scope. Current liabilities are financial obligations that a company owes within a one year time frame.

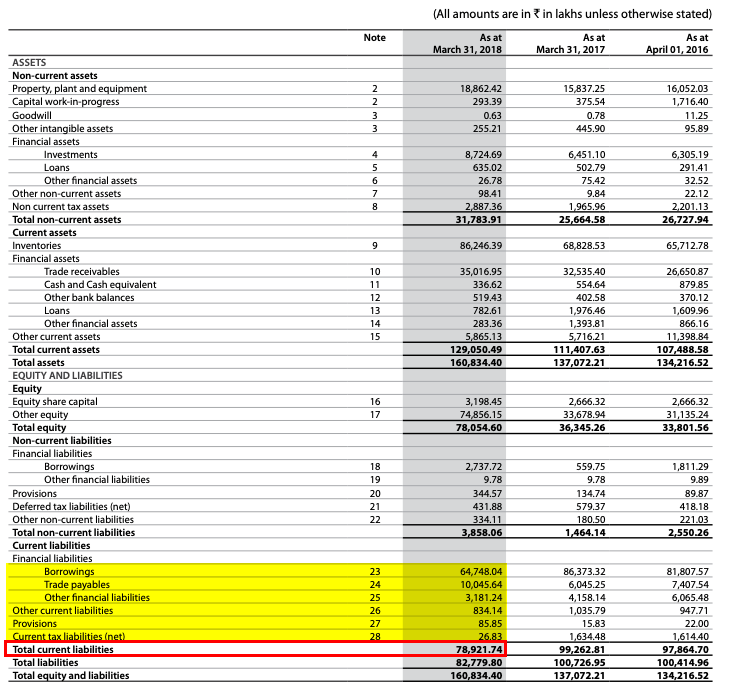

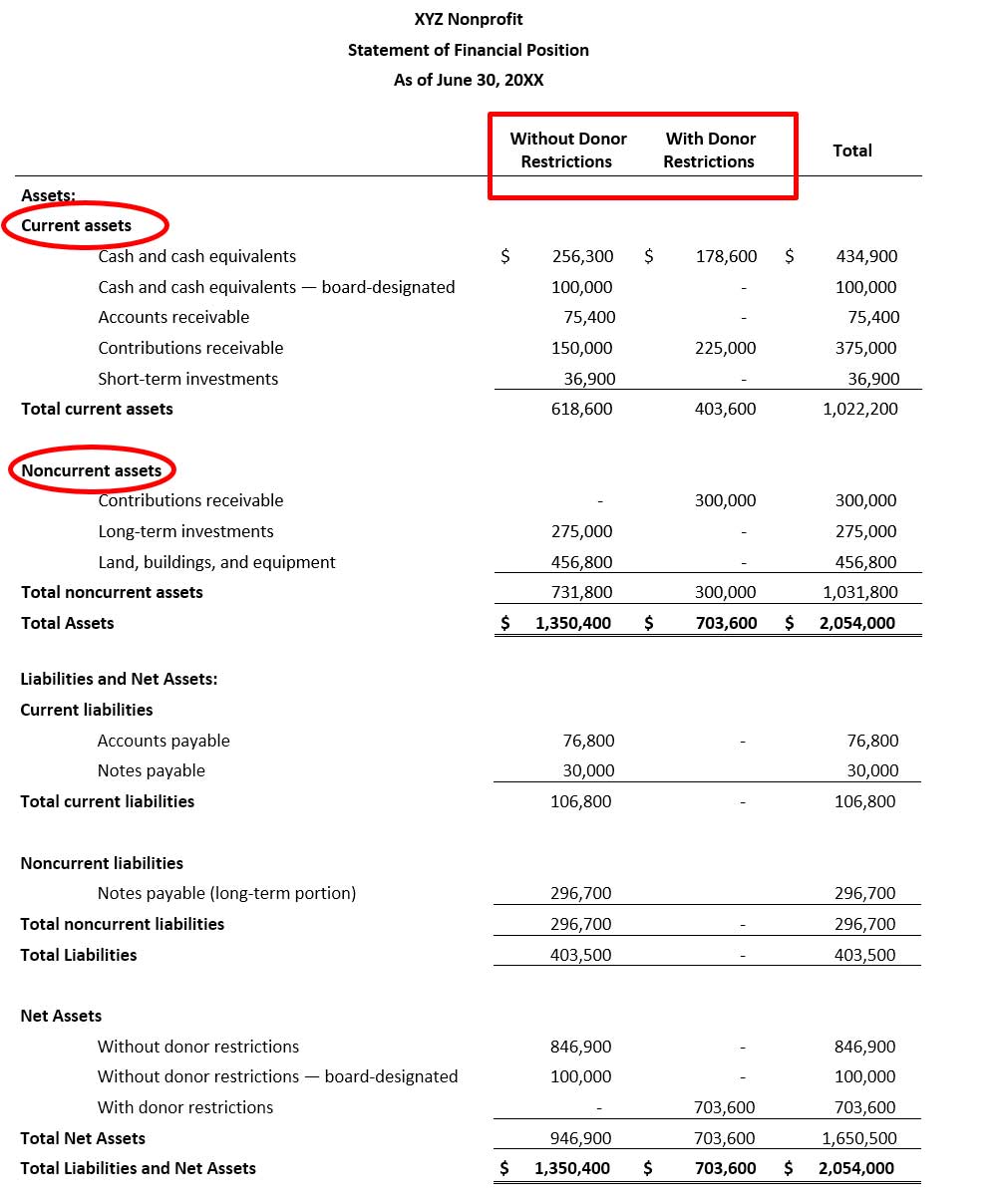

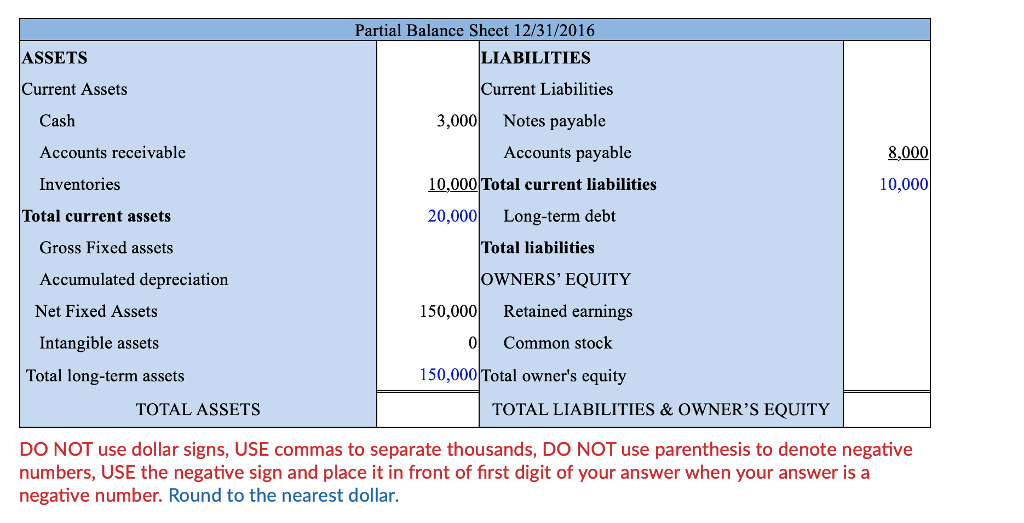

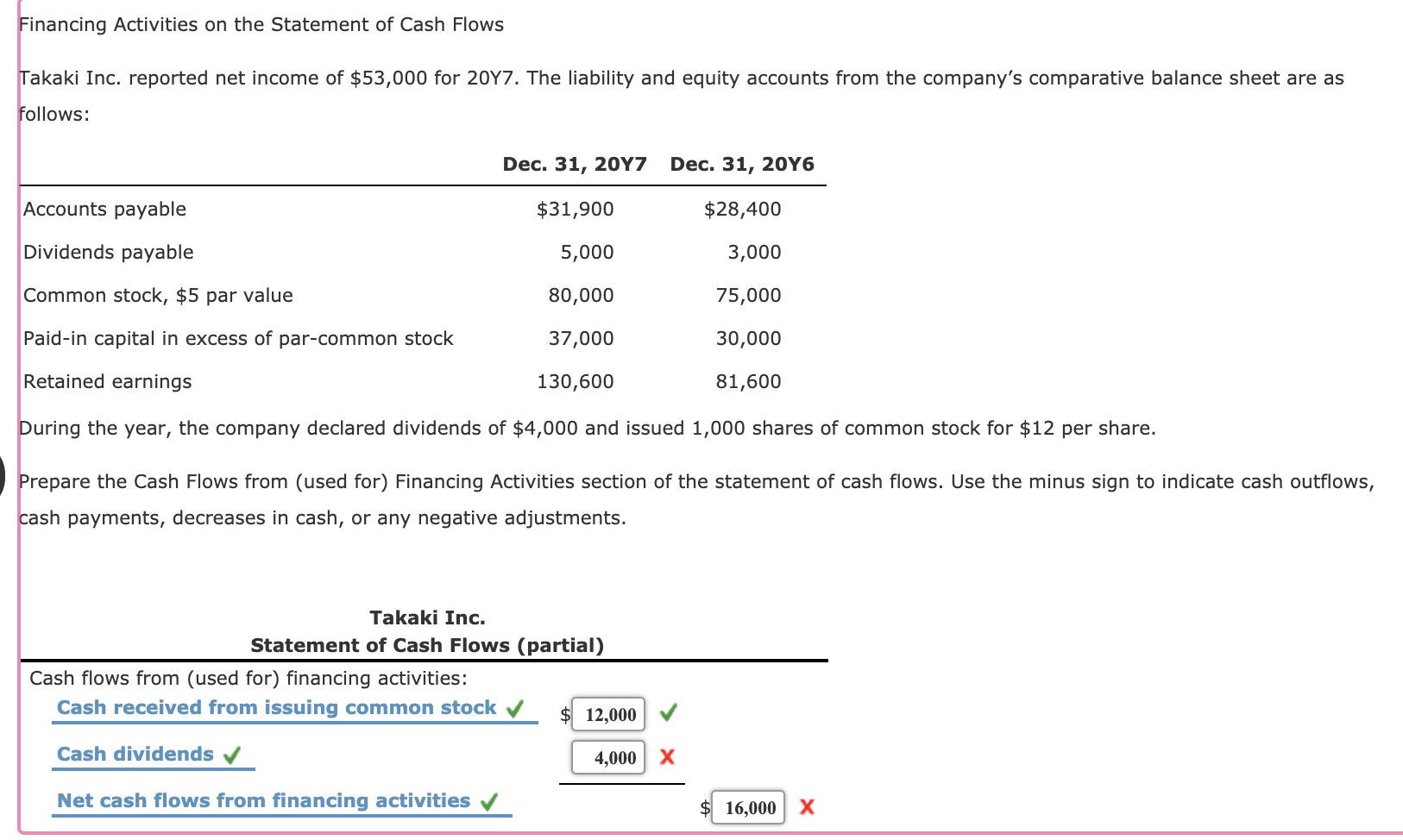

Example of the current ratio formula. Learn about the total current liabilities with the definition and formula explained in detail. Current liabilities are the obligations of the company expected to get paid within one year and are calculated by adding the value of trade payables, accrued expenses, notes.

The shoe store collects a total of $54 from. Current liabilities are paid in cash/bank (settled by current assets) or by the introduction of new current liabilities. Trump's lawyers argued that any actions he took on jan.

For example, assume that each time a shoe store sells a $50 pair of shoes, it will charge the customer a sales tax of 8% of the sales price. Current ratio = current assets / current liabilities. Current liabilities are an enterprise’s obligations or debts that are due within a year or within the normal functioning cycle.

On monday, trump asked the justices to put that case on hold on immunity grounds. A liability occurs when a company has undergone a transaction that has. An increasing current to total liabilities ratio is usually a negative sign, showing the company’s proportion of total current liabilities are increasing compared to its total.

Current liabilities are financial obligations of a business entity that are due and payable within a year. Current liabilities are the obligations of the company which are expected to get paid within one year and include liabilities such as accounts payable, short term loans, interest. One important difference between current assets and current.

Total liabilities are all debts and obligations a company or person owes to third parties. To calculate the amount of total current liabilities, label cell a8 as total current liabilities, select cell b8 and enter =sum(b2:b7) into the formula bar. Also called current liabilities and listed on the balance sheet, the total current liabilities are the claims to the company’s assets that are due within one year or the cycle of.

Moreover, current liabilities are settled by the use of a. Current liabilities refer to debts or obligations a company is expected to pay off within a year or less.

:max_bytes(150000):strip_icc()/ScreenShot2021-08-21at5.02.29PM-f5d77e3185ff4122a026ba2a6c89c6de.png)

:max_bytes(150000):strip_icc()/liability_sourcefile-1f0b89893f674ff4b2e0f29c0748fe11.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Liabilities_Sep_2020-01-6515e265cfd34787ae2b0a30e9f1ccc8.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Ratio_Jul_2020-03-54eeb2ed66a546ad8c2f1e5e86366170.jpg)