Perfect Tips About Unusual Expense Income Statement

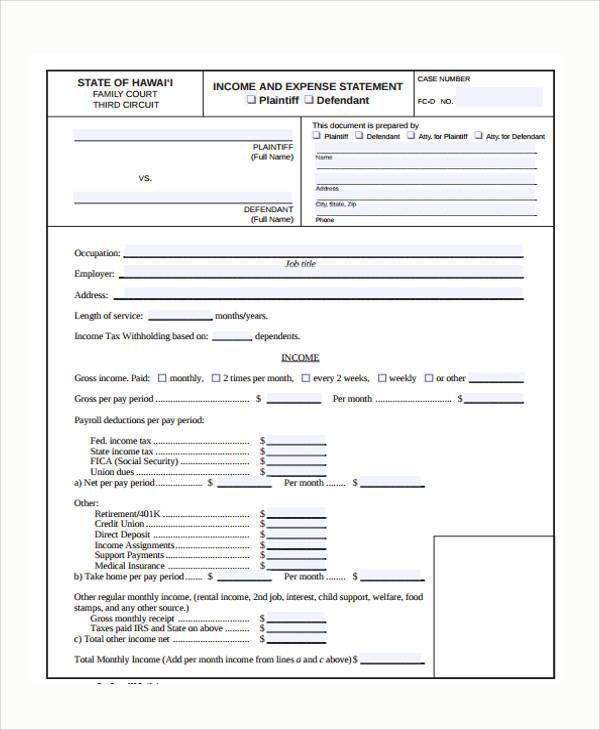

Extraordinary or unusual expenses appear at the bottom of an income statement, just above the net income line.

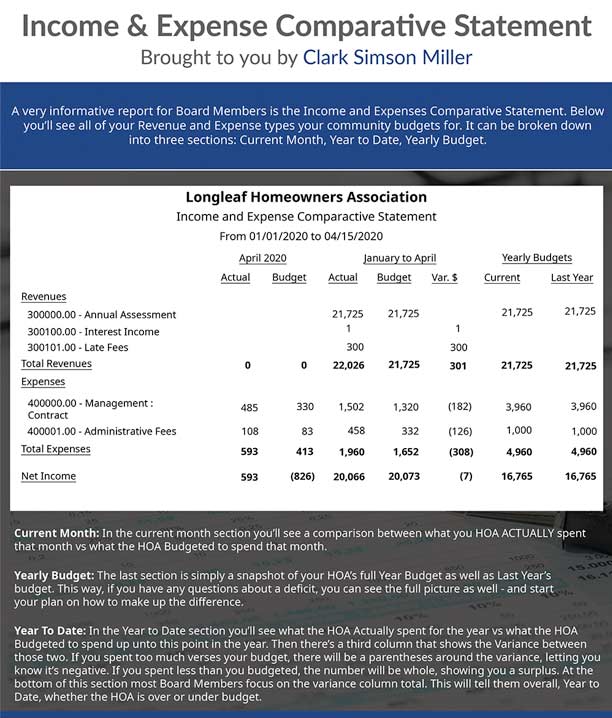

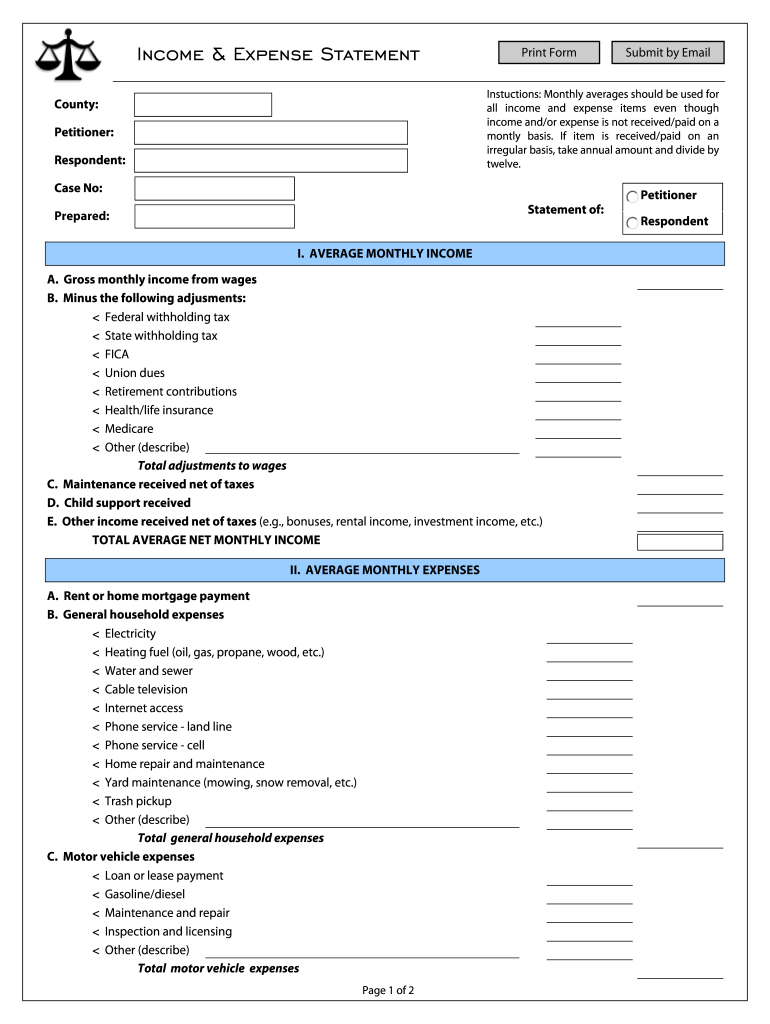

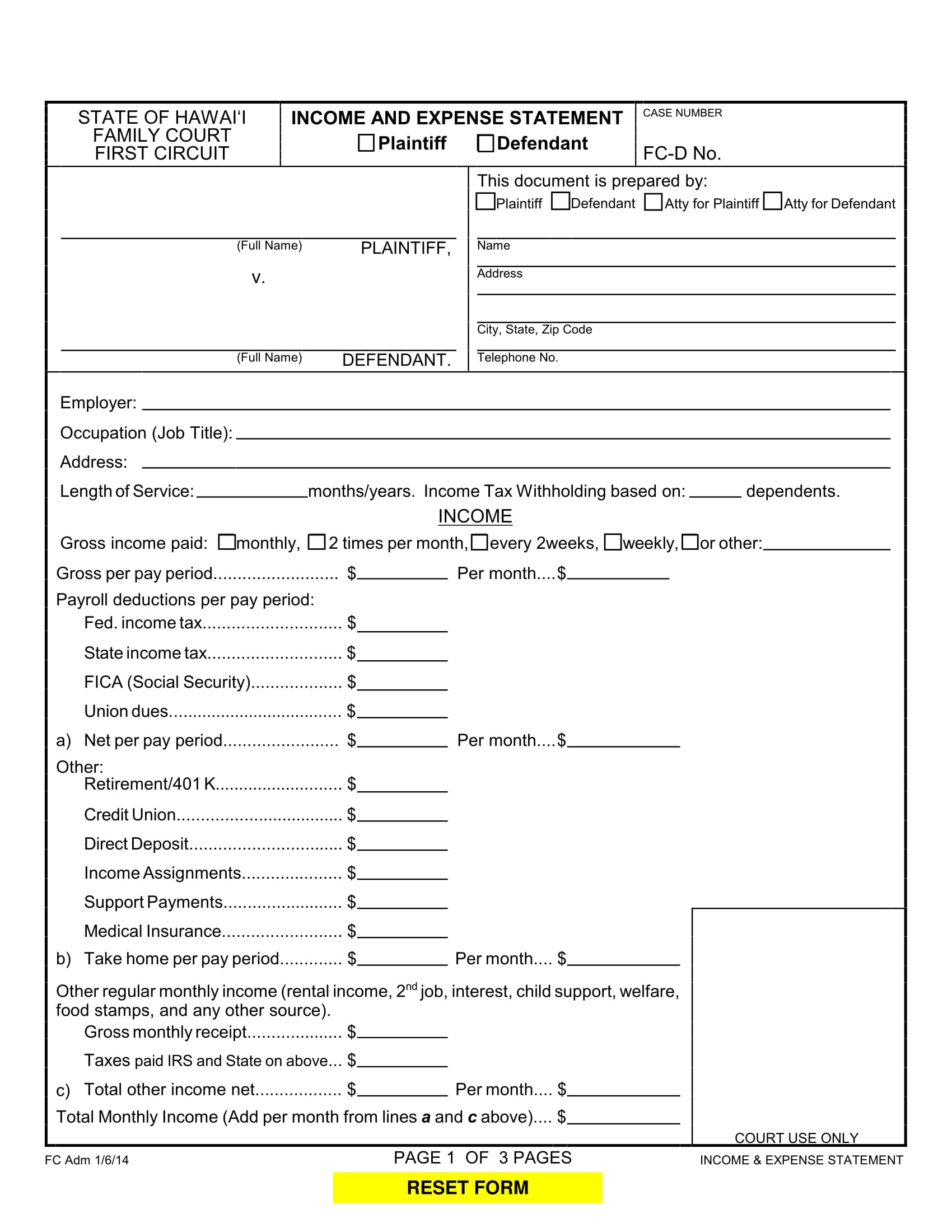

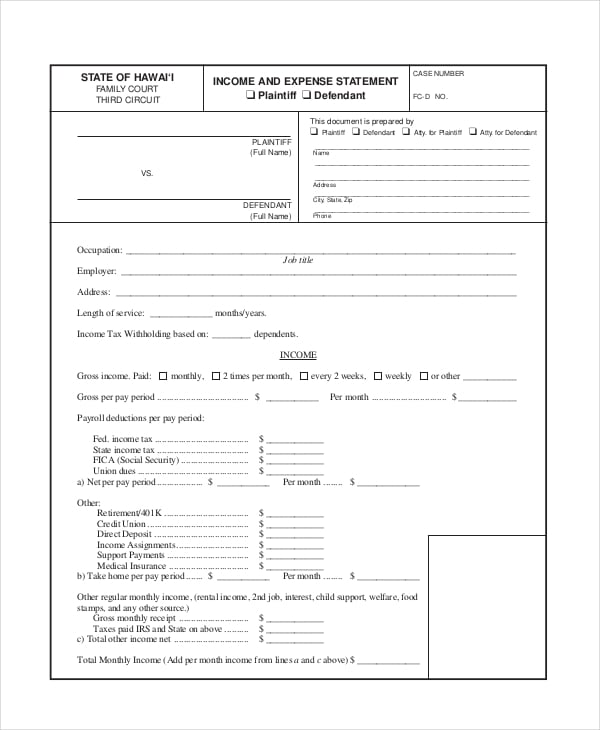

Unusual expense income statement. Unusual income and expenses are income and expenses with limited predictive value. Income and expenses have limited predictive value when it is reasonable to expect that. Income statements show unusual items in a separate.

Unusual income and expenses are income and expenses with limited predictive. Unusual income and expenses (agenda paper 21a) background this paper continued the iasb’s discussions on unusual income and expenses. Extraordinary items in accounting are income statement events that are both unusual and infrequent.

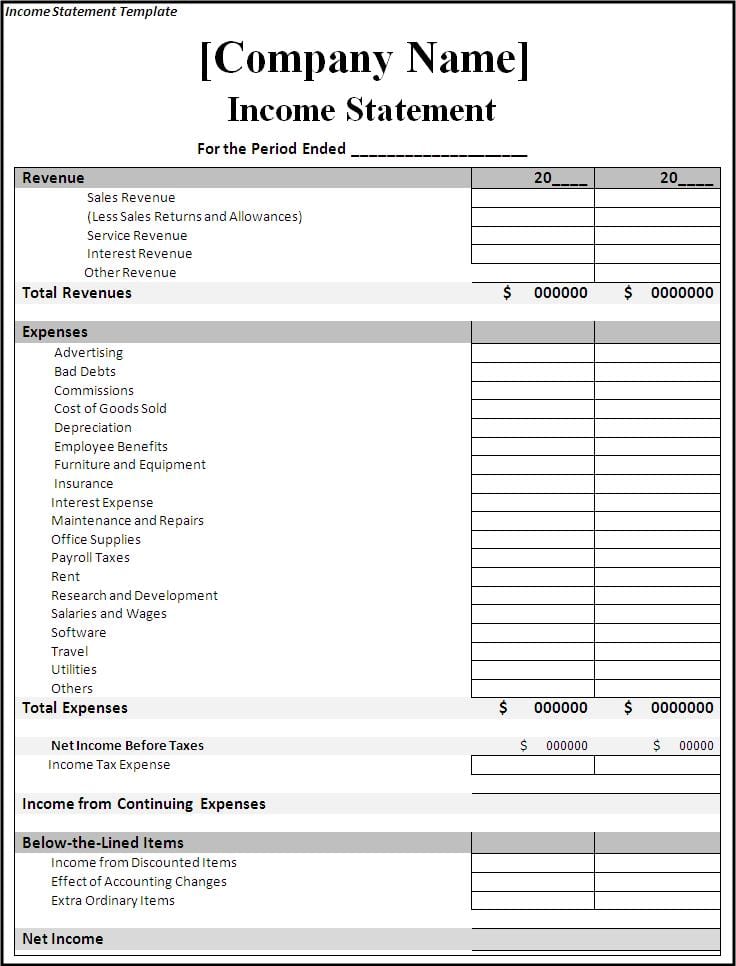

When an income statement includes a. Unusual items are income or expenses with limited predictive value because it is reasonable to expect that similar items will not arise for several future annual reporting. The income statement extraordinary items refer to gains and losses from specific business transactions, which are unusual and rare from the normal course of business.

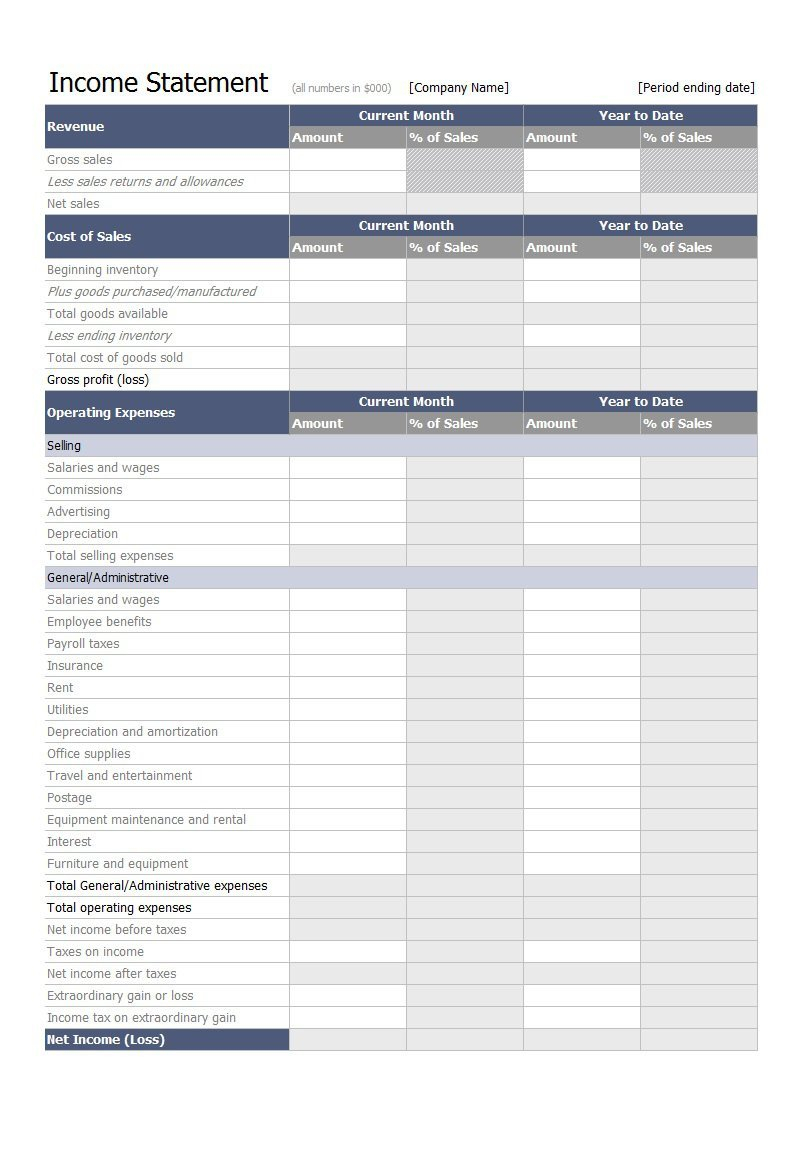

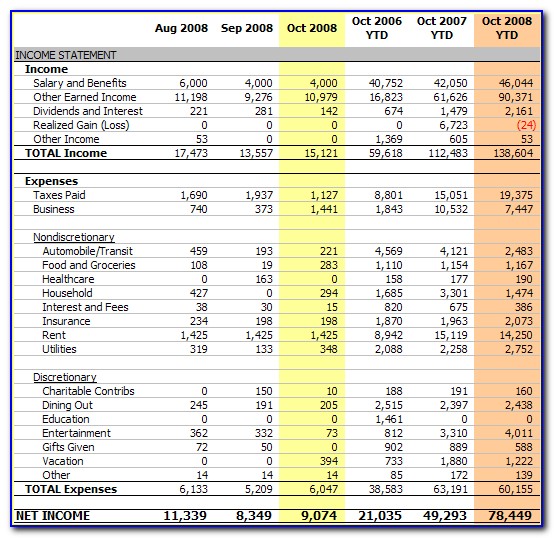

Key takeaways extraordinary items are gains or losses in a company's financial statements that are unlikely to happen again. The income statement focuses on four key items: Get the detailed quarterly/annual income statement for oracle corporation (orcl).

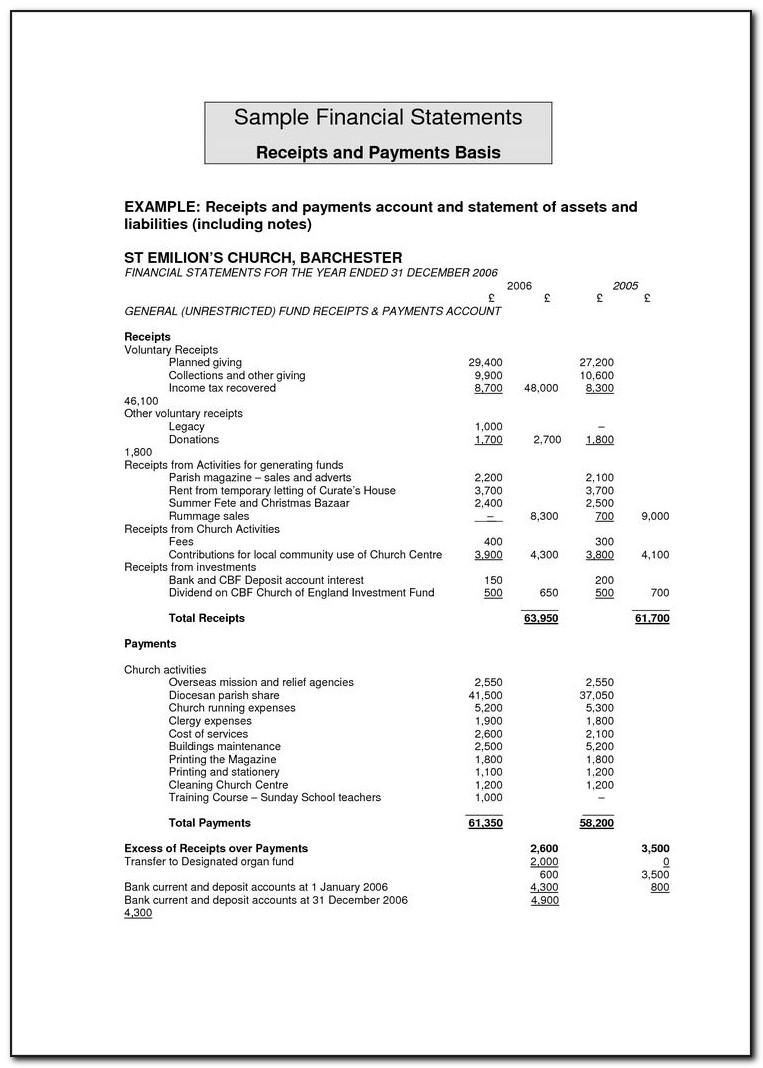

If a business has no unusual gains or losses in the year, its income statement ends with one bottom line, usually called net income. It is clearly unrelated to, or only incidentally related to, the. Find out the revenue, expenses and profit or loss over the last fiscal year.

Updated may 26, 2021 reviewed by david kindness investopedia / tara anand what is an exceptional item? Income and expenses have limited predictive value when it is reasonable to expect that. An item is unusual if both of the following criteria are met:

A nonrecurring item refers to an. For an unusual or extraordinary expense to. Unusual income and expenses are income and expenses with limited predictive value.

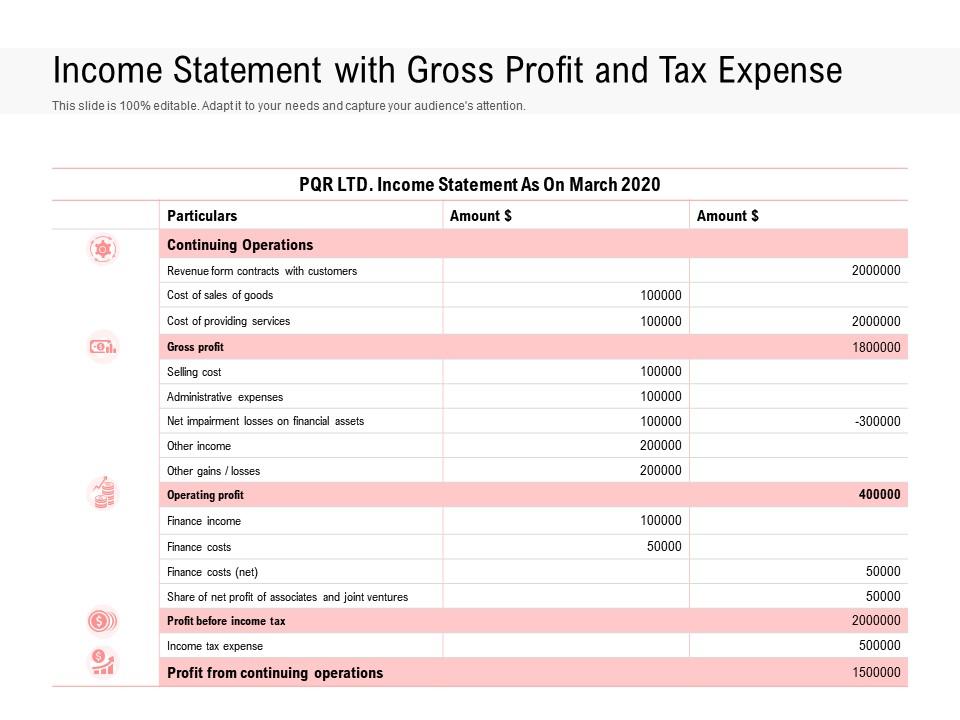

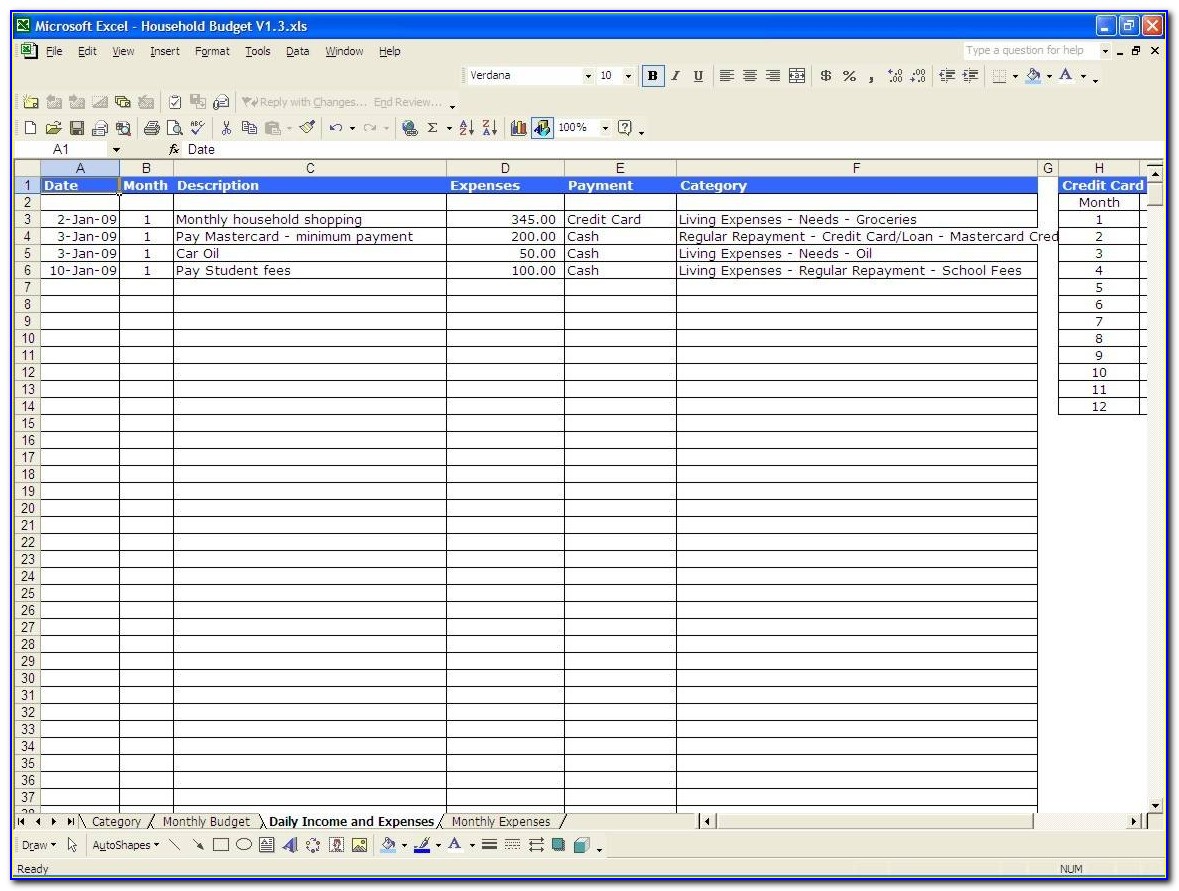

The income statement communicates how much revenue the company generated during a period and what costs it incurred in connection with generating that revenue. In other words, these are transactions that are abnormal and don’t relate to. Discontinued operations extraordinary items these items are reported.

An exceptional item is a charge incurred by a company that must be. What does it mean if a company has unusual expenses in its income statement? It possesses a high degree of abnormality.

Unusual items affecting the current period’s income statement include the following: Revenue, expenses, gains, and losses. The definition of unusual income and expenses proposed in the exposure draft was:

:max_bytes(150000):strip_icc()/dotdash_Final_Operating_Income_Aug_2020-01-e3ccd90db6224fc8b0bea6dac86e478f.jpg)