Cool Info About Provision For Doubtful Debts In Balance Sheet

Bad debt in accounting bad debt provision.

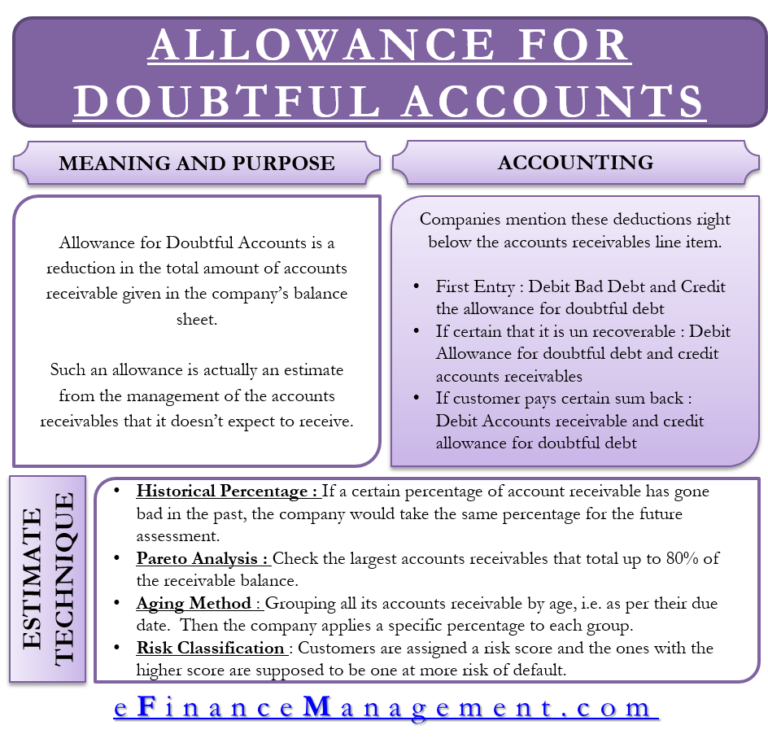

Provision for doubtful debts in balance sheet. Provision for doubtful debts. One of the most common forms of provisions is for doubtful debts. The provision for doubtful debts is an estimated amount of bad debts that are likely to arise from the accounts receivable that have been given but.

If provision for bad &. The provision for bad debts could refer to the balance sheet account also known as the allowance for bad debts, allowance for doubtful accounts, or allowance for. It may not be realised.

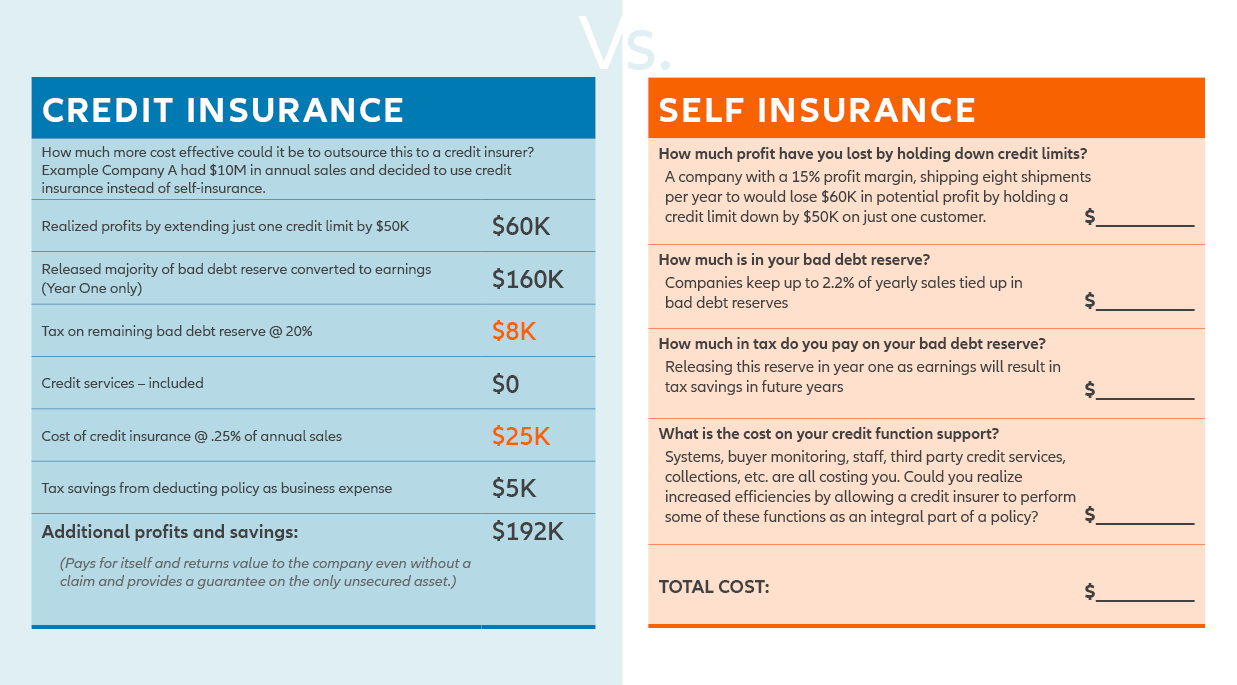

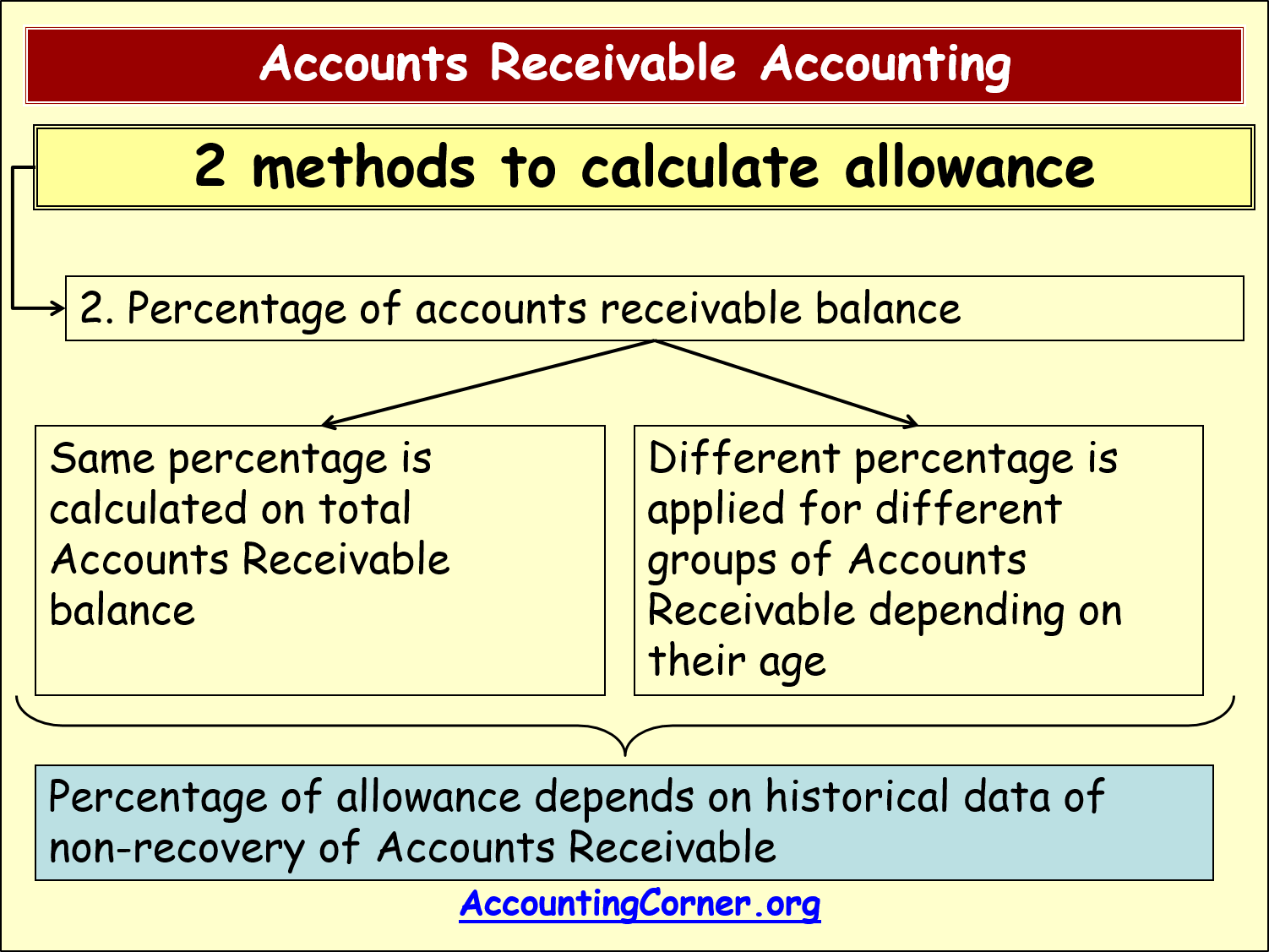

An allowance for doubtful debt is an estimate of how much of the trade receivables balance of a business will become irrecoverable in the next accounting. To this end, a new account is opened in the books called provisions for bad debts account, or provisions for doubtful debts account. Company a decides to create a provision for doubtful debts that will be 2% of the total.

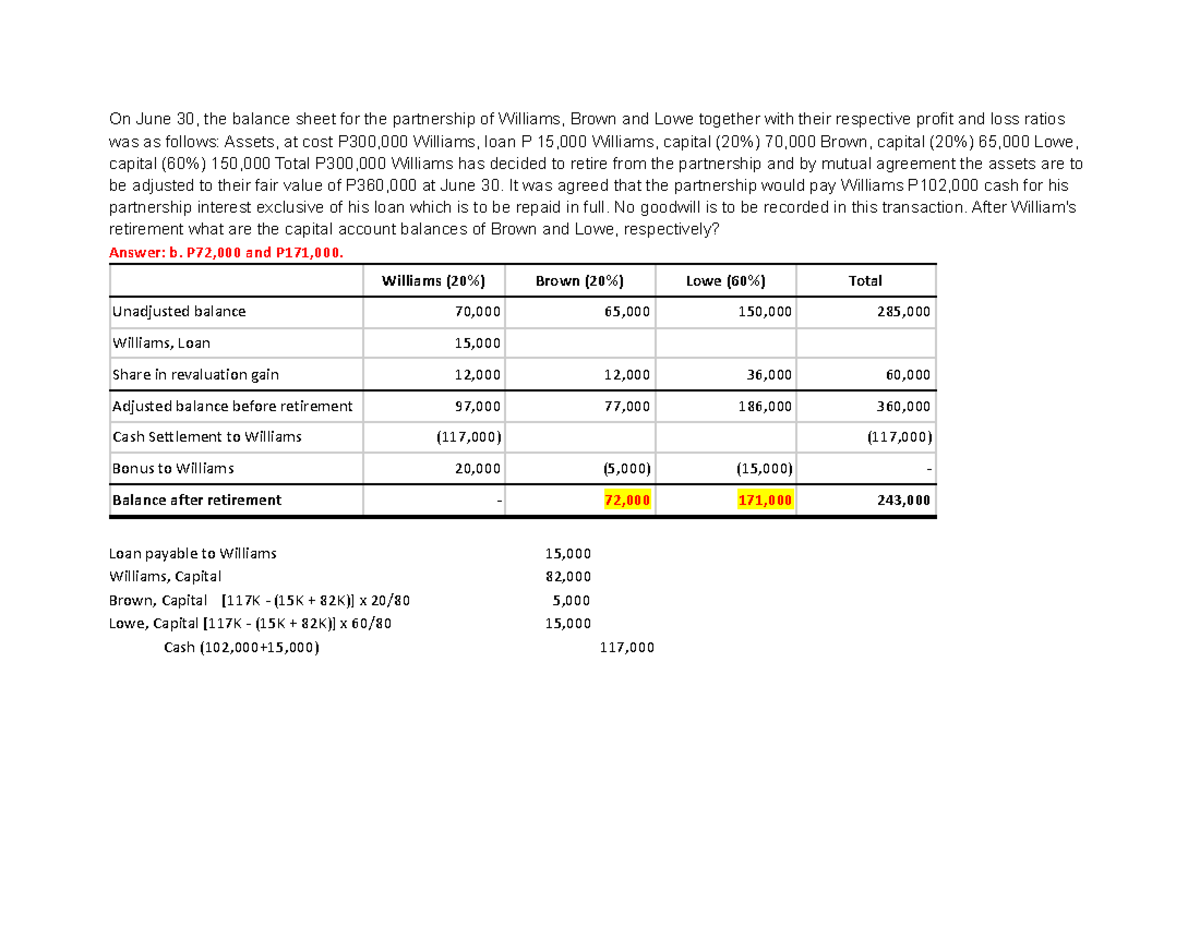

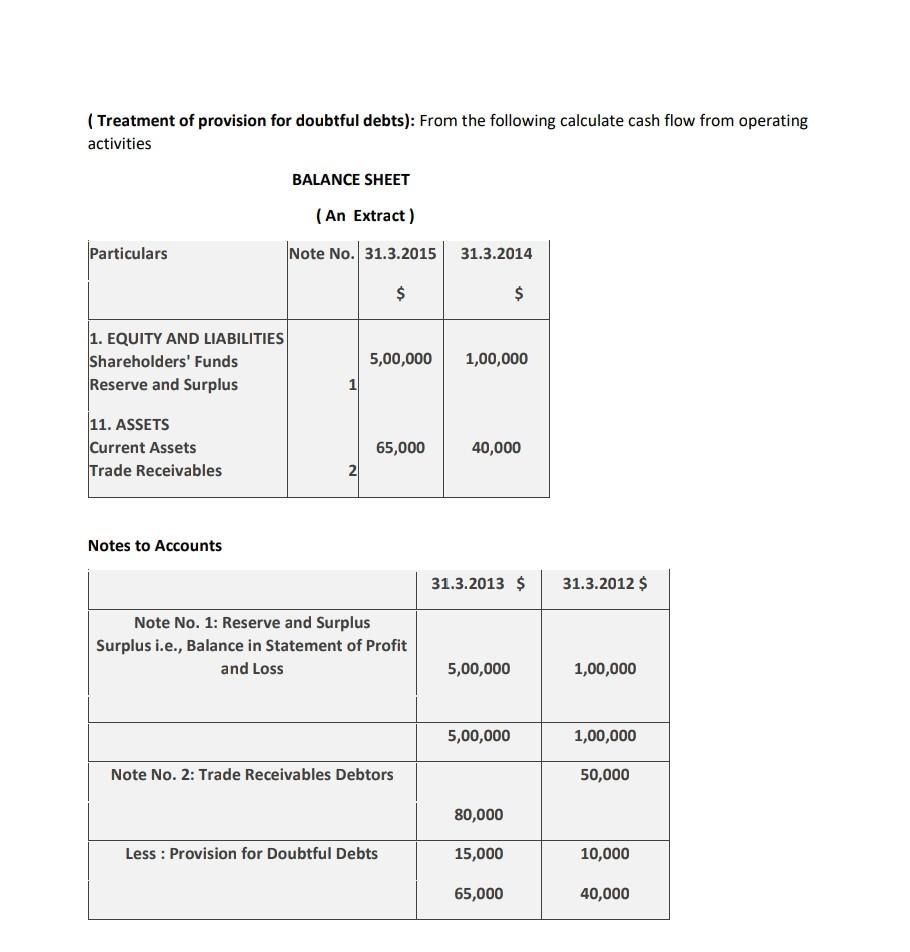

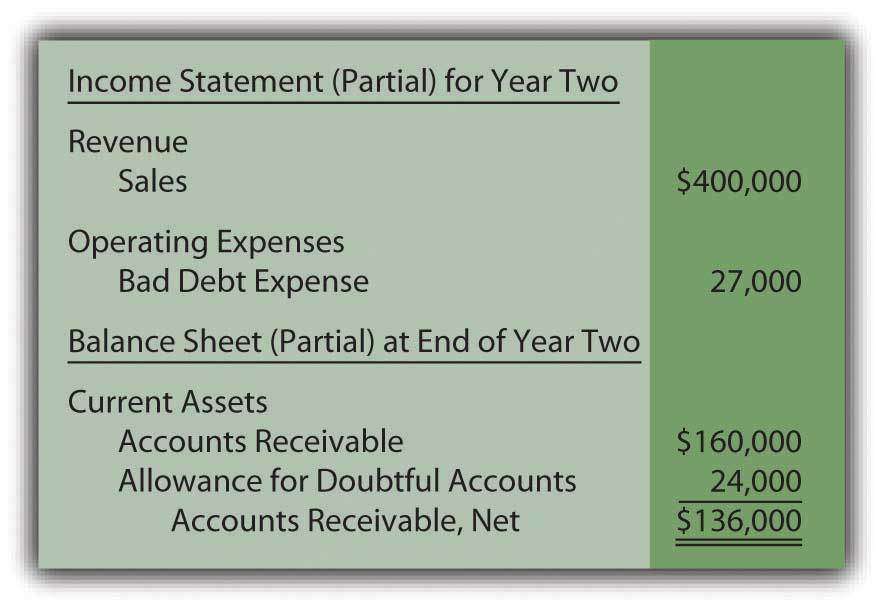

Second, amount of provision for bad & doubtful debts will be deducted from the debtors in the assets side of the balance sheet. For this purpose, provision is created which is known as provision/reserve for doubtful debts. The following journal entry is made to record a reduction in provisions for bad or doubtful debts:

The provision for doubtful debts, which is also referred to as the provision for bad debts or the provision for losses on accounts receivable, is an estimation of the amount of. Bad debts provision explained. To record bad debts in the account books, firms must initially estimate their potential losses.

(imagine that $18 of yours, isn’t that an expense?) credit provision for doubtful debts. Provision for doubtful debts. Provision for doubtful debts, on the one hand, is shown on the debit side of the profit and loss account, and on the other hand, is also shown as a deduction from debtors on the.

Learn how to account for doubtful debts in the balance sheet and income statement. Almost every business entity has some debtors, of which recovery is doubtful. See examples of accounting entries, debit and credit entries, and how to calculate the.

The provision for doubtful debts, often described as the provision for losses on accounts receivable or bad debt provision,. An increase in provision for doubtful debts is an increase in expense. This provision is created on the basis of experiences of the previous.

Imagine company a has a total of £100,000 account receivables at the end of the year. A bad debt provision is a reserve made to show the estimated percentage of the total bad and doubtful debts that need to be written off in. The provision for doubtful debts is an accounts receivable contra account, so it should always have a credit balance, and is listed in the balance sheet directly.

Provision for bad debts account cr:

:max_bytes(150000):strip_icc()/AmazonBS-33b2e9c06fff4e63983e63ae9243141c.JPG)

:max_bytes(150000):strip_icc()/Allowance_For_Doubtful_Accounts_Final-d347926353c547f29516ab599b06a6d5.png)