Heartwarming Info About Accounting For Deferred Income Projected Balance Sheet Format Proprietorship Business In Excel

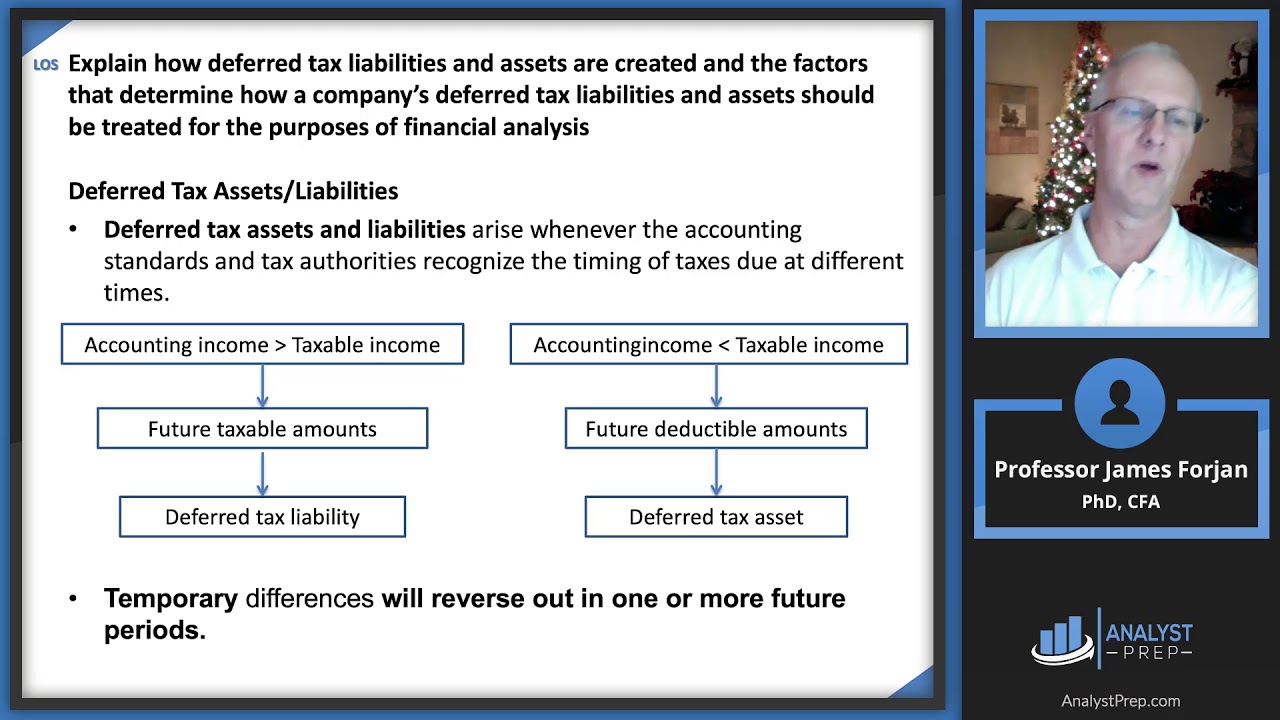

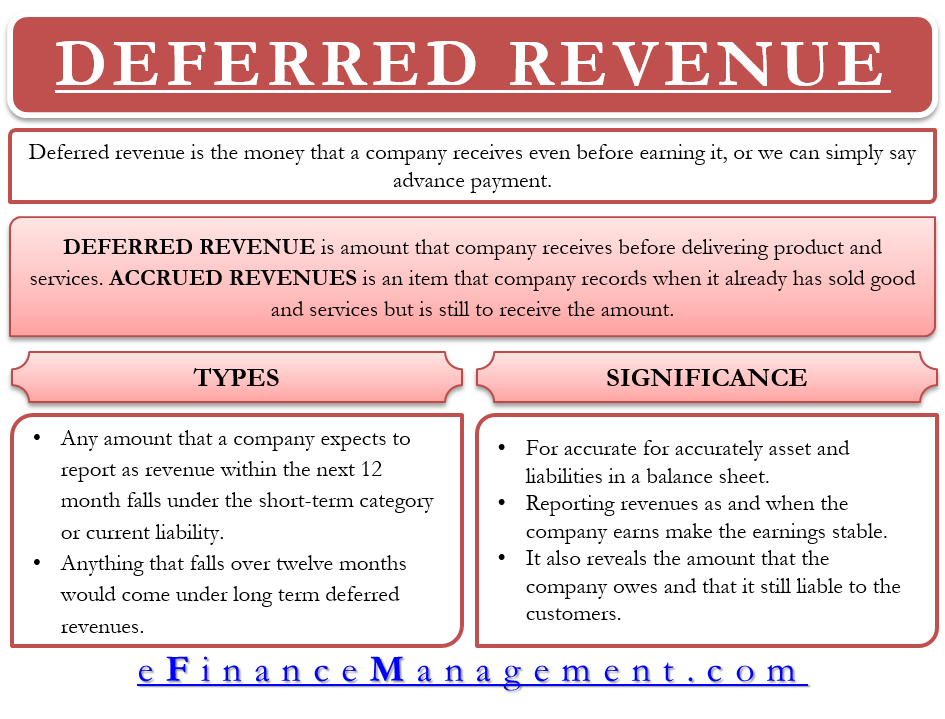

This article has been a guide to deferred revenue journal entry.

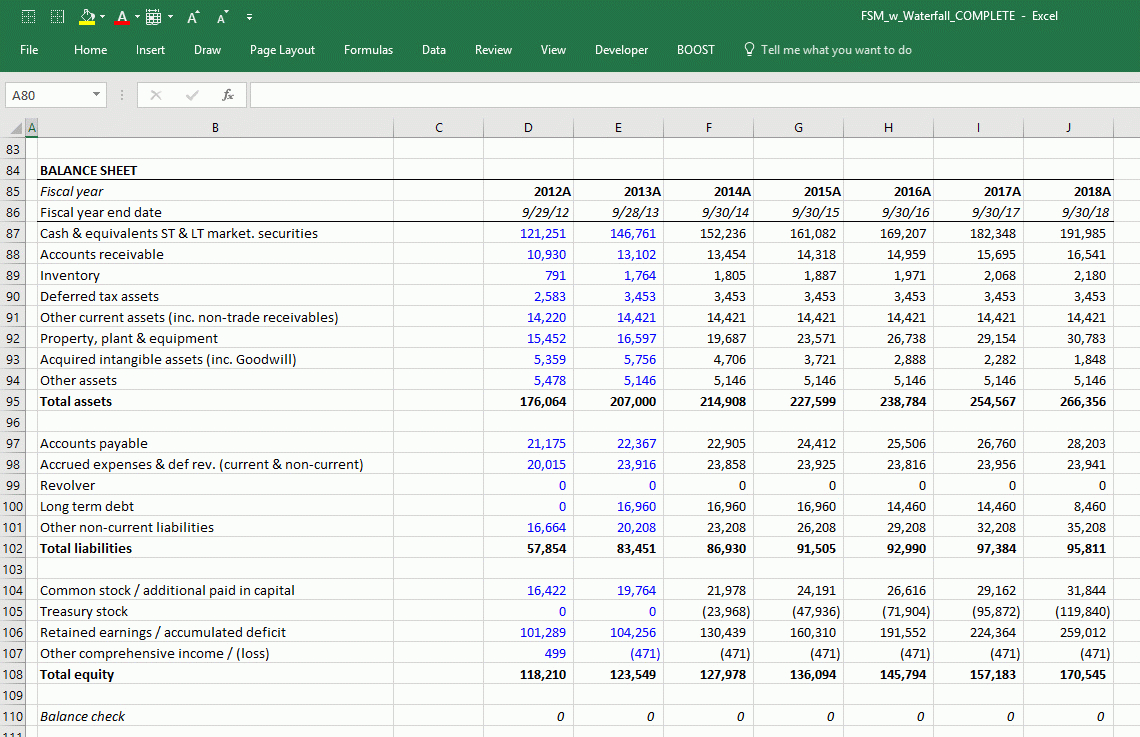

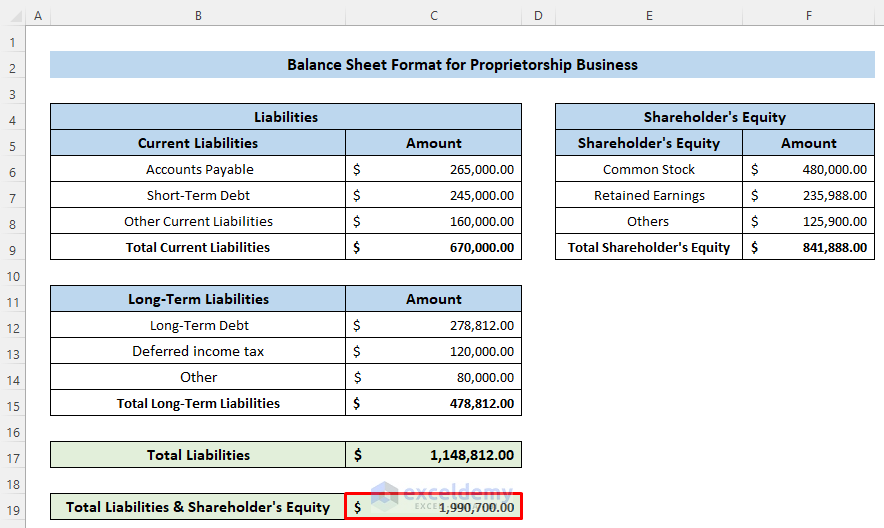

Accounting for deferred income projected balance sheet format for proprietorship business in excel. Increasing the cash and increasing deposit/deferred income on the liability side Paid for but not yet “earned”) income will be 334. However, we will explain this approach in seven steps.

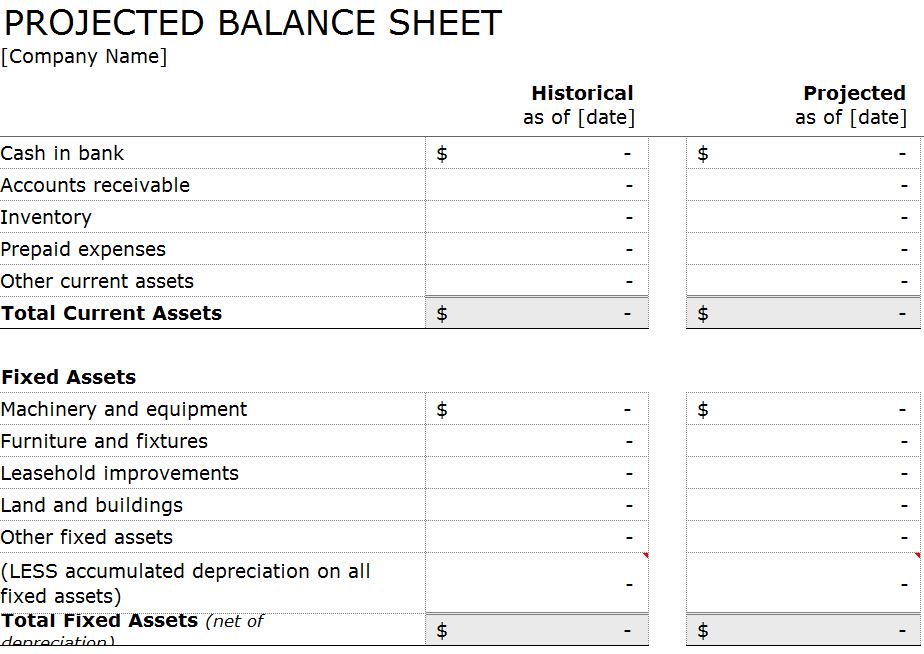

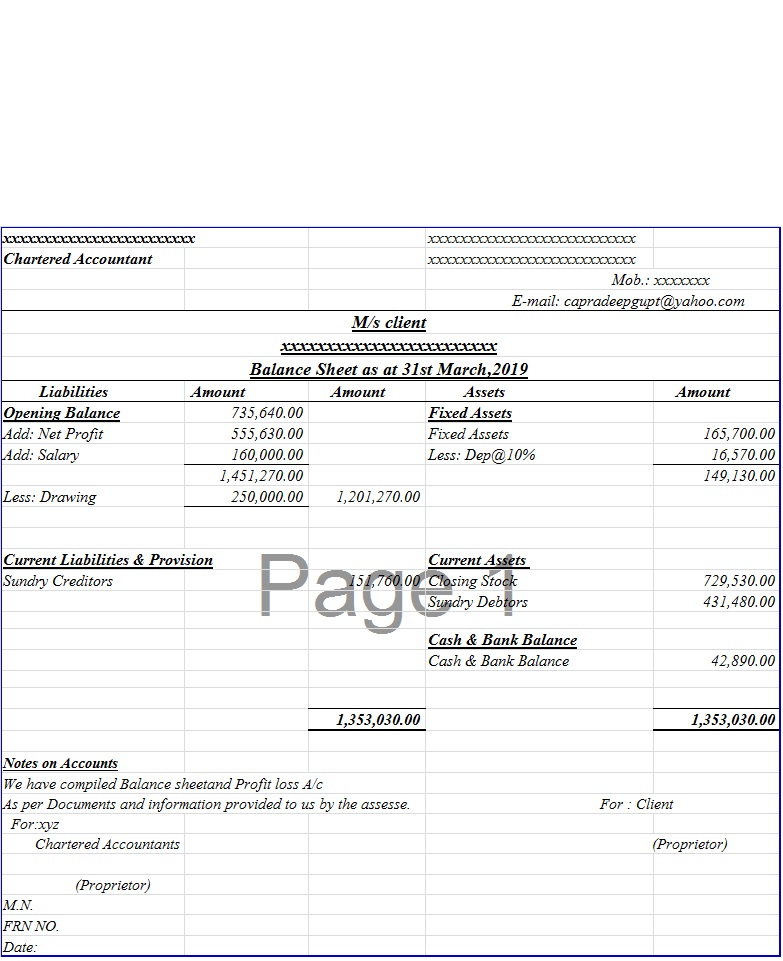

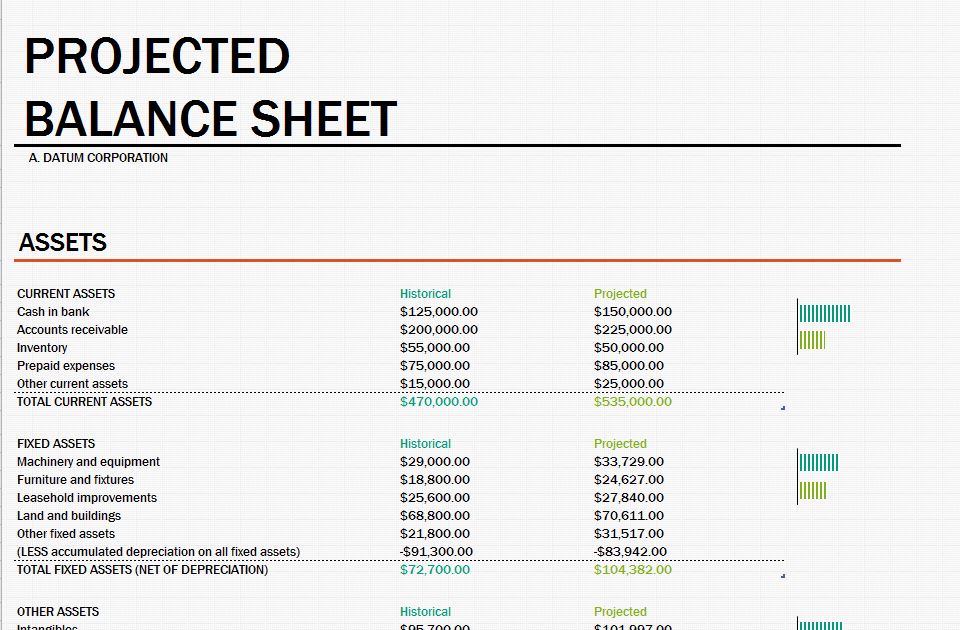

Our templates will help you produce a full pro forma financial model which will include a 5 year projected balance sheet as well. Such payments are not realized as revenue and do not affect the net profit or loss. If you need to create a projected balance sheet for your company, here are some steps to follow to do so:

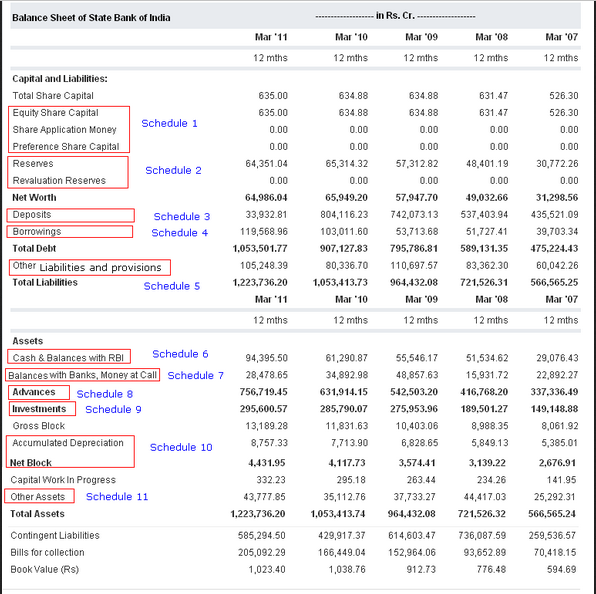

Here, year 1 is 2019, year 2 is 2020, and lastly, year 3 denotes 2021. Included on this page, you'll find many helpful balance sheet templates, such as a basic balance sheet template, a pro forma balance sheet template, a monthly balance sheet template, an investment property balance sheet template, and a daily balance sheet template, among others. Presentation of deferred income.

Copy and paste the data from the invoice template you downloaded into the new sheet. Assets can be categorized into many types. The following are the main accounts we need to cover when projecting balance sheet line items:

It is a tabulation for future performance or projections. The balance is shown on the liability side of the balance sheet as deferred. Balance sheet forecast for a 70+ types of startups.

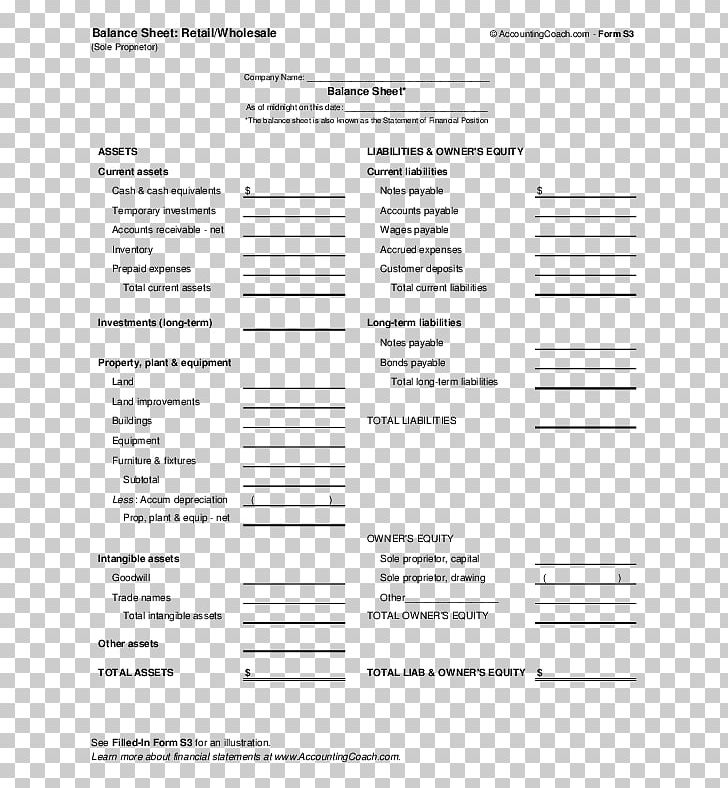

Normally you would need a projected balance sheet to have an idea of how your organization will operate in the future. The main purpose of preparing a balance sheet is to disclose the financial position of a business enterprise at a given date. It has some integral components, whose inclusion is a must in order to make a projected balance sheet.

Projected balance sheet for an acquisition. Grow revenues by inputting an aggregate growth rate. In most cases, it will be classified as a current liability, since it is likely to be settled (and converted into revenue) within one year.

Segment level detail and a price x volume approach. So on for each month. Using an if statement, model should enable users to override with days sales outstanding (dso) projection, where days sales outstanding (dso) = (ar / credit sales) x days in period.

They are things that the company owes to a person or another company, like cash, loans, etc. On the balance sheet, cash would be unaffected, and the deferred revenue liability would be reduced by $100. The amount of deferred (i.e.

Assets = liabilities + owner’s equity assets: Tools required for calculating deferred taxes in excel. To start, you will need the following: