Fabulous Info About Cash Equivalents In Balance Sheet

![[Solved] Calculate the Asset Turnover for Chrissie's Cooking Supply](https://media.cheggcdn.com/media/2c5/2c5f5dc2-543d-4a92-9ddd-82c94ab518e7/phpbW4MBk.png)

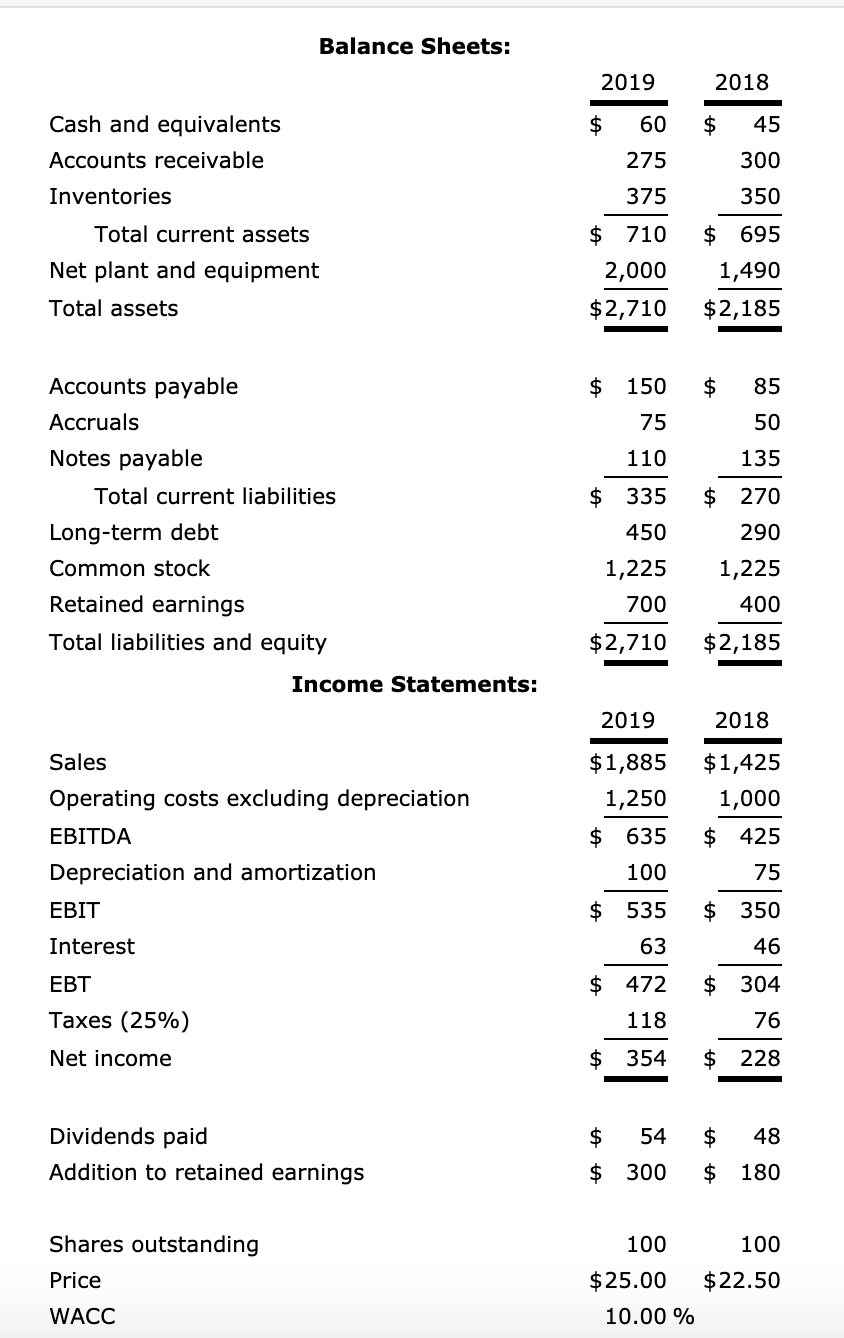

Cash and cash equivalents in balance sheet and restricted cash.

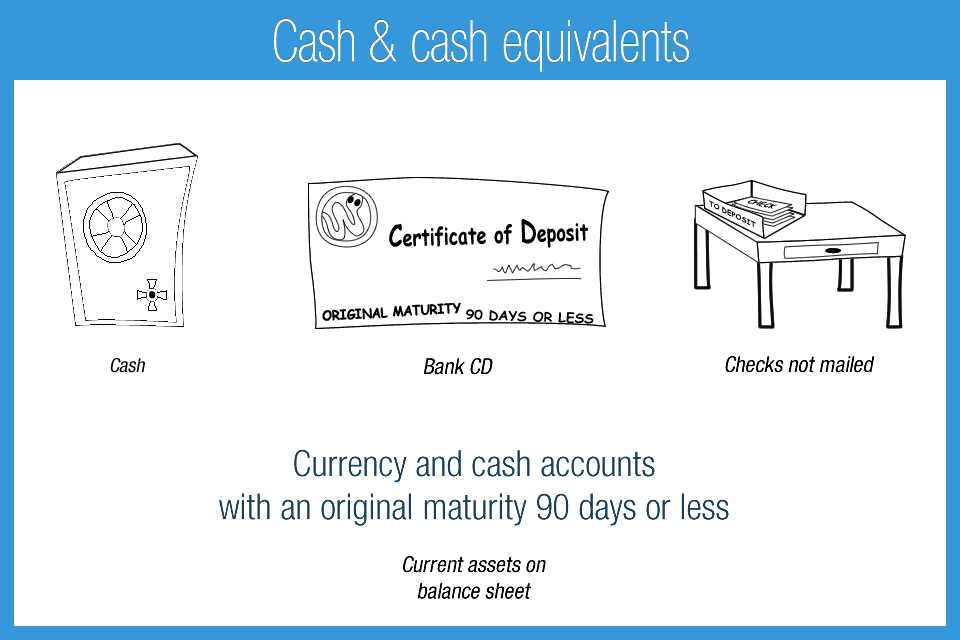

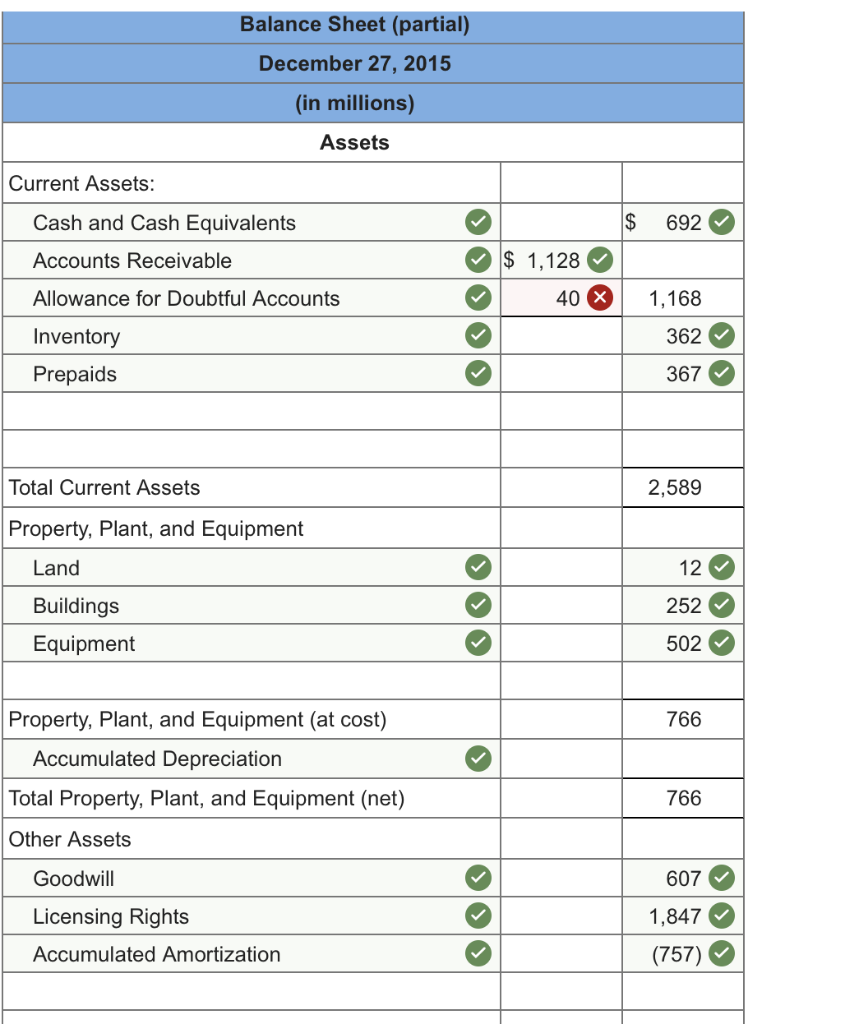

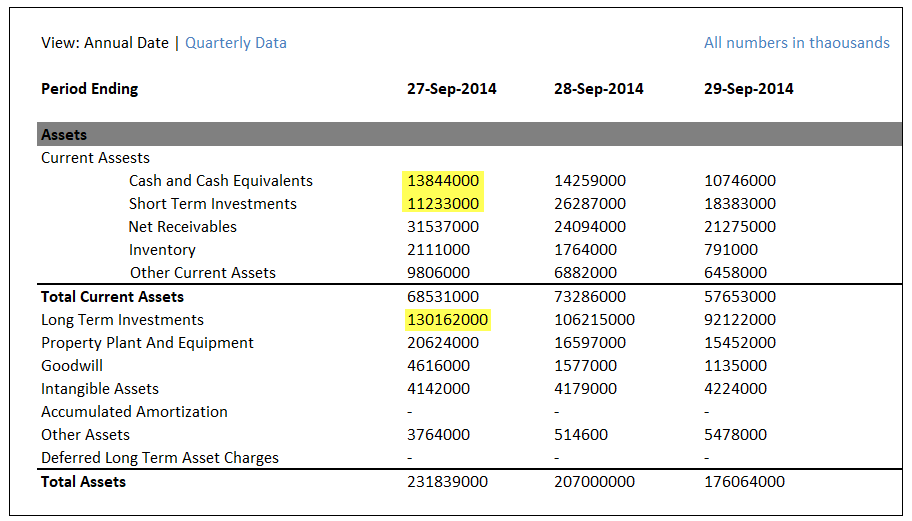

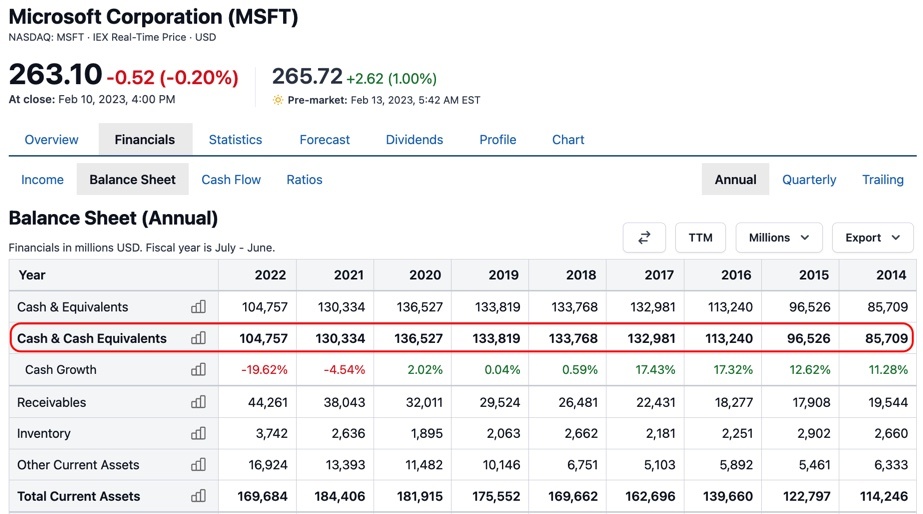

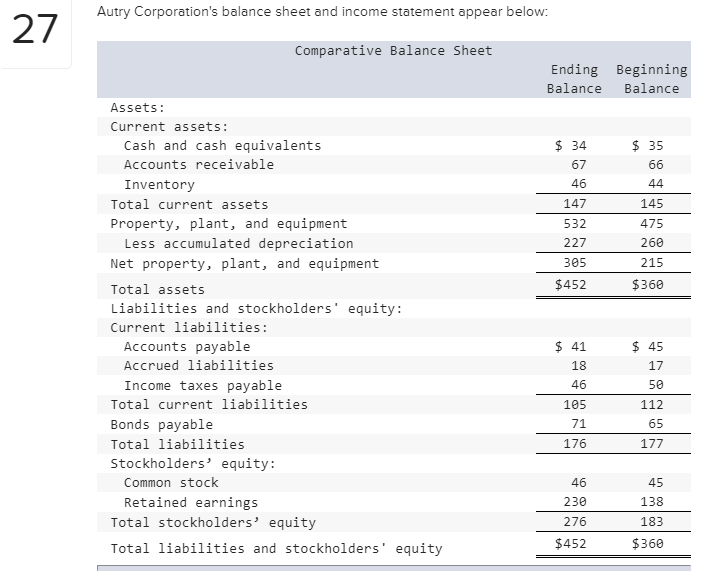

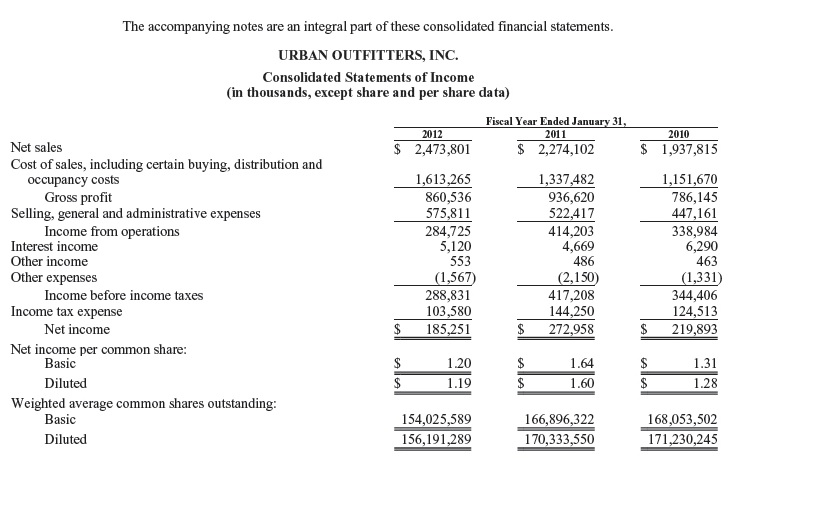

Cash equivalents in balance sheet. Cash and cash equivalents are items on a company’s balance sheet that refer to the value of assets held in cash or easily converted to cash. Cash and cash equivalents are reported in the balance sheet showing the total balance at the reporting with a comparative figure of the previous reporting balance. The cash equivalents line item on the balance sheet states the amount of cash on hand plus other highly liquid assets readily convertible into cash.

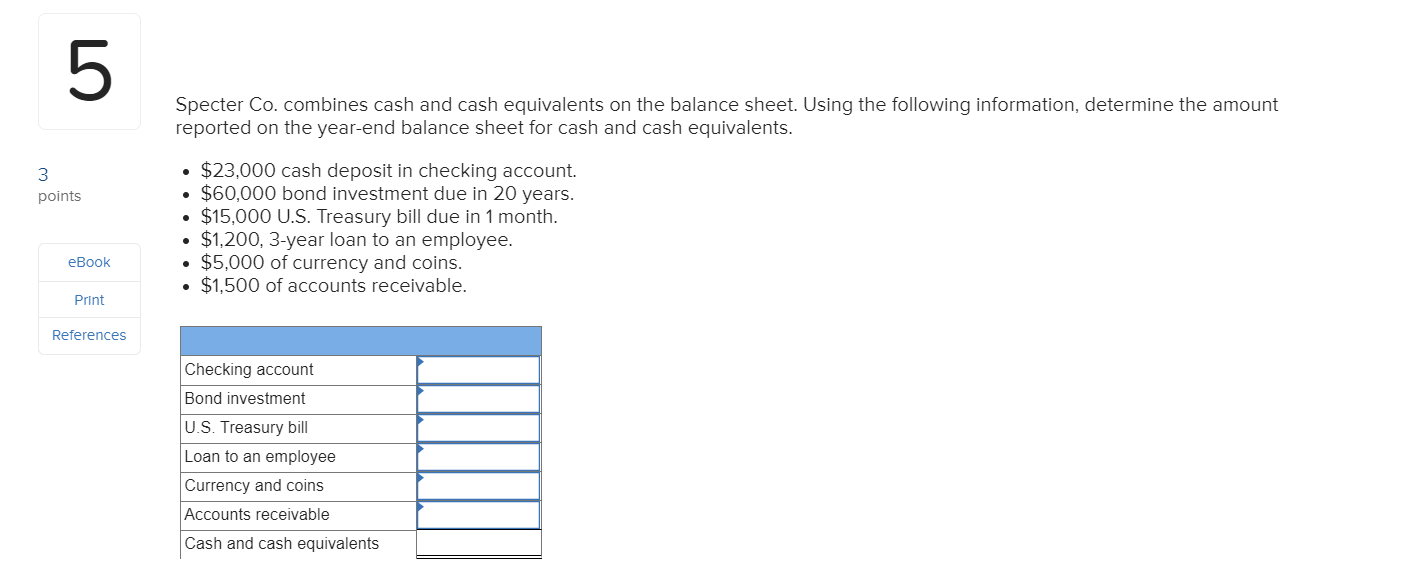

Cash equivalents include bank accounts and marketable securities, which are debt securities with maturities of less than 90 days. Cash equivalents can be reported at their fair value, together with cash on the balance sheet. Cash and cash equivalents are liquid assets, which may include treasury bills and certificates of deposit.

The beginning and ending balance of cash, cash equivalents, restricted cash, and restricted cash equivalents and any other segregated cash and cash equivalents. Cash and cash equivalents mainly refer to the line items on the balance sheet that represent the underlying value of the company’s assets that are in the form of cash or. Cash equivalents are the total worth of cash on hand that includes similar goods to cash;

Cash equivalents can be reported at their fair value, together with cash on the balance sheet. Cash and cash equivalents ( cce) are the most liquid current assets found on a business's balance sheet. Cash and cash equivalents is a line item on the balance sheet, stating the amount of all cash or other assets that are readily convertible into cash.

The metric calculates a company's ability to repay. Cash and cash equivalents refers to the line item on the balance sheetthat reports the value of a company's assets that are cash or can be converted into cash immediately. Cash equivalents, in general, are highly liquid investments in an entity’s balance sheet.

Fair value will be their cost at acquisition plus accrued interest to the. Cash equivalents are assets, typically investments that are so liquid and easily converted into cash that they might as well be currency. Cash and cash equivalents must be in the current assets section on the.

Marketable securities are equity and debt securities. For example, cvs health, an. Asset categories include:.

Fair value will be their cost at acquisition plus accrued interest to the date of the. They have a maturity of three months or less with high credit quality, and are unrestricted. Net working capital is equal to current.

The cash ratio is the ratio of a company's total cash and cash equivalents to its current liabilities. What is included in cash equivalents? For an investment to be.

/InvestoApple2jpeg-da0c6b0acbc7478d9df0caf561ad0afc.jpg)

:max_bytes(150000):strip_icc()/CCE-009ecb73dfd94702821efed1264573af.jpg)