Neat Tips About Prepaid Expenses Entry In Balance Sheet

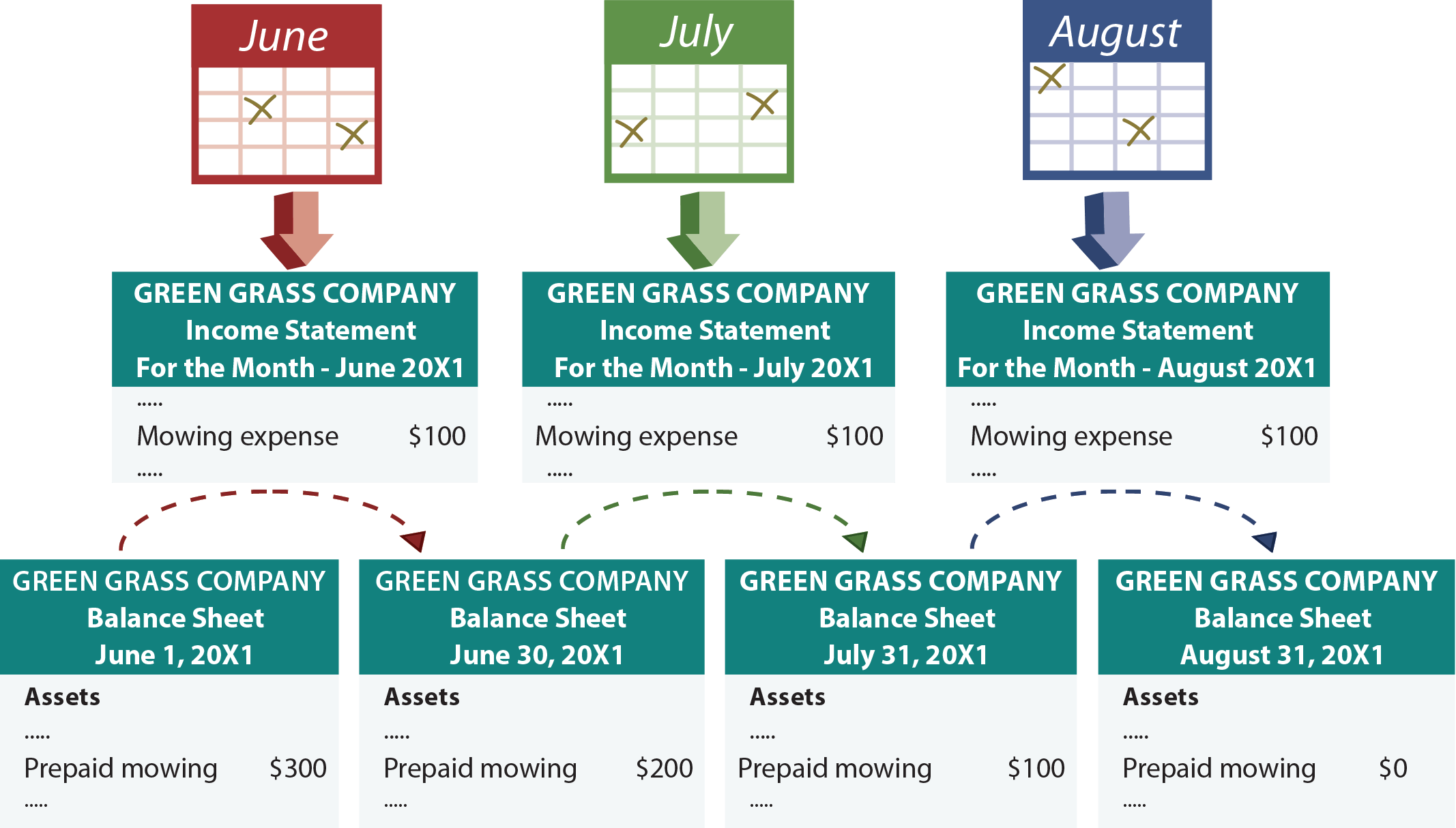

A prepaid expense is an expense that has been paid in advance but from which no gain has yet been realized.

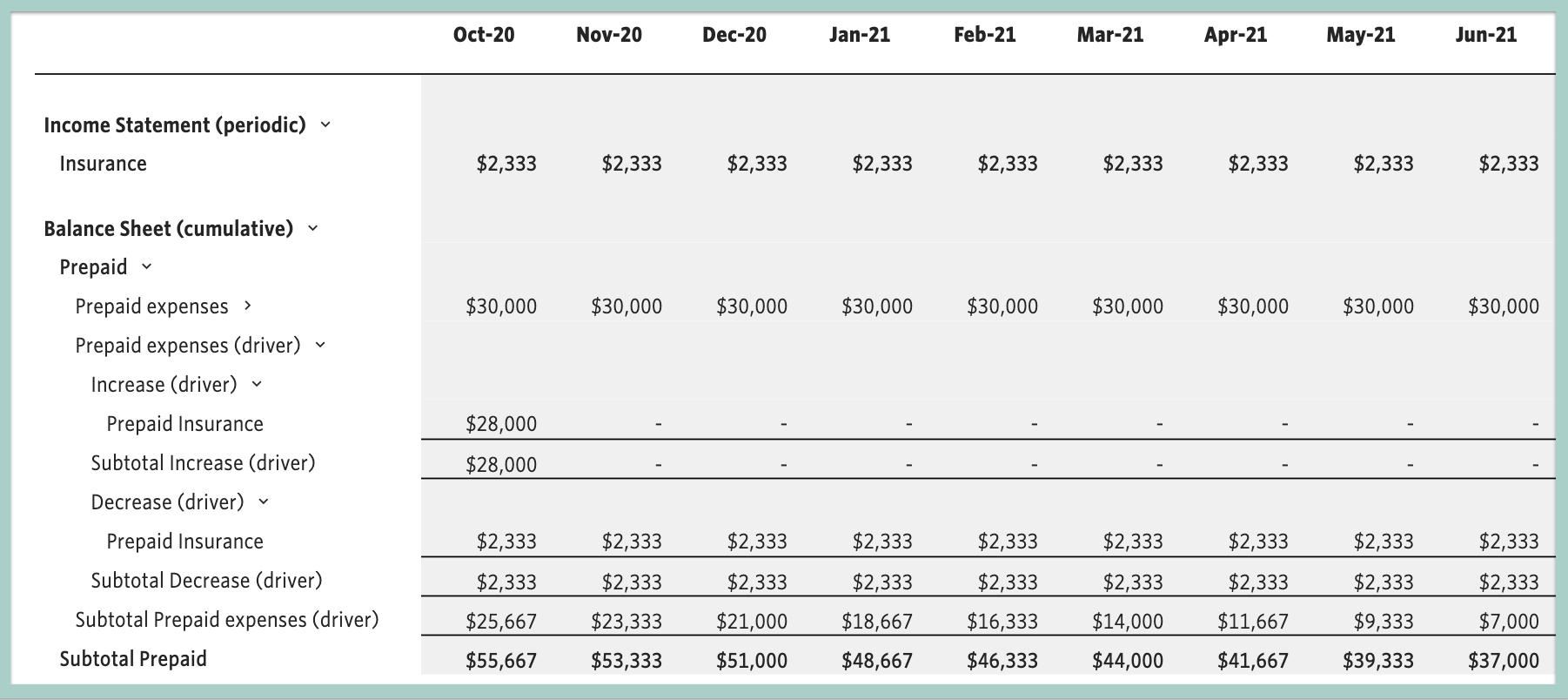

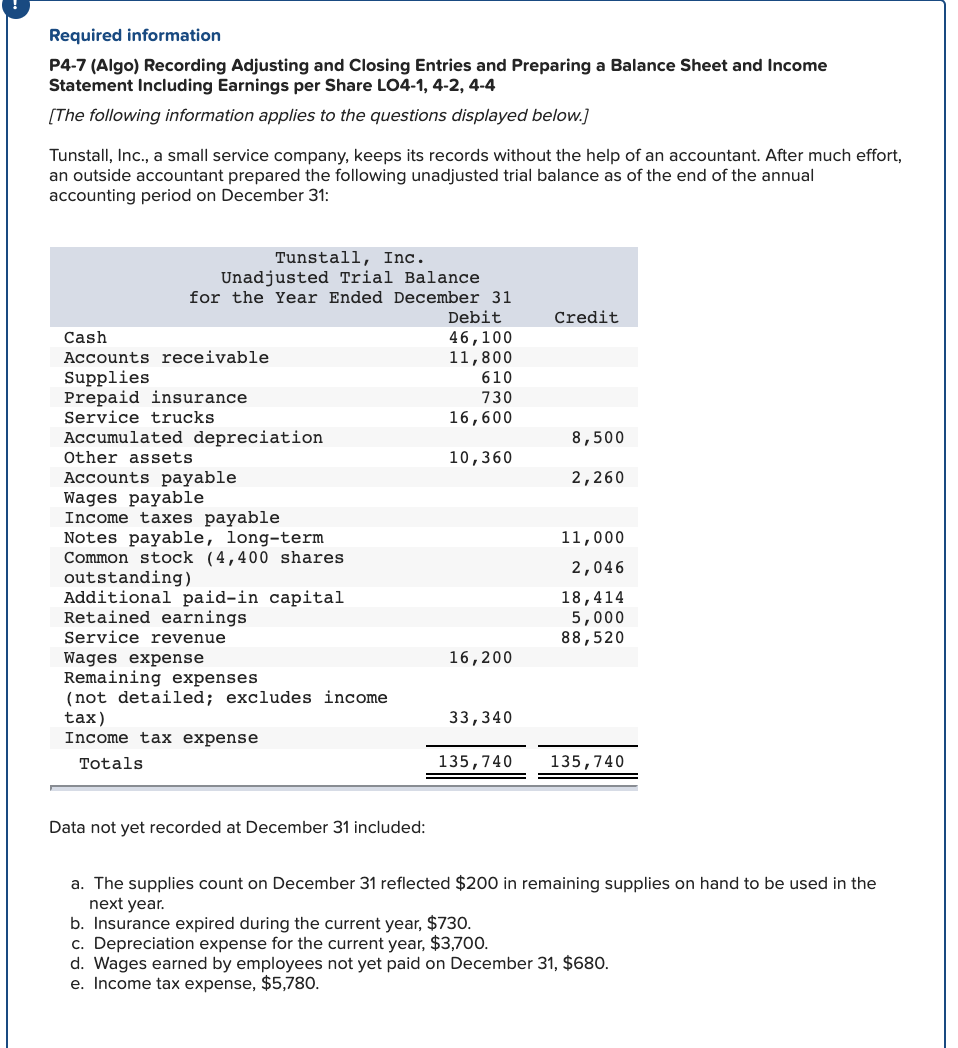

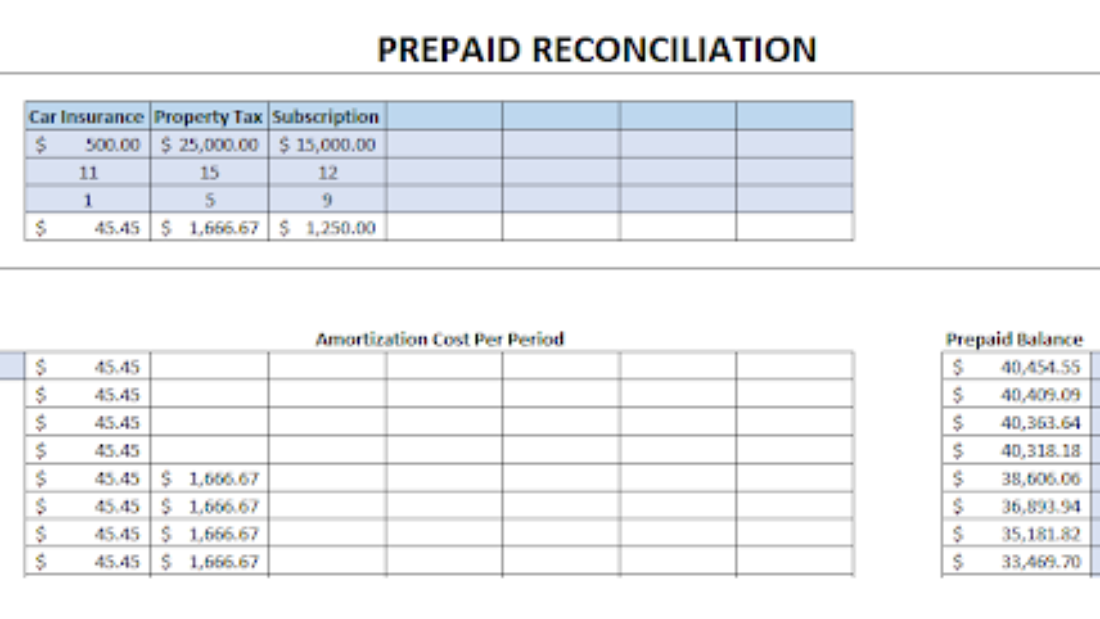

Prepaid expenses entry in balance sheet. In this journal entry, the supplies account is a prepaid expense that will be recognized as an expense when it is used. For example, the following screenshot from the balance sheet of. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash.

A guide to prepaid expense accounting by volha belakurska 8 minute read as a financial. Likewise, the $5,000 is recorded as a prepaid expense in. These are both asset accounts and do not increase or decrease a company’s.

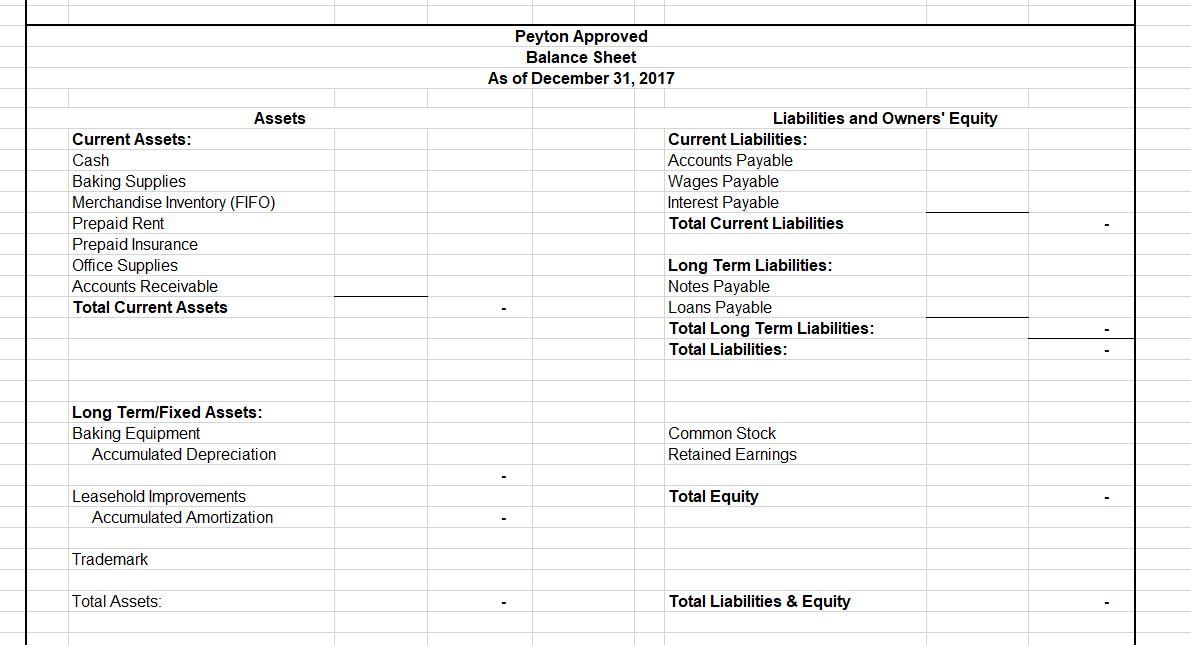

Prepaid expenses, or prepaid assets as they are commonly referred to in general accounting, are recognized on the balance sheet as an asset. The company will initially record the amount paid as the prepaid expense at the time the company will initially record the amount paid as the prepaid expense at the time of. The “prepaid expenses” line item is recorded in the current assets section of the balance sheet.

The initial journal entry for a prepaid expense does not affect a company’s financial statements. Prepayments) represent payments made for expenses which have not yet been incurred or used. The gaap matching principle prevents expenses from being recorded.

Prepaid expense a/c (a newly opened account) Prepaid expenses will allocate to income. In other words, these are advanced payments by a.

Therefore, there will be no changes in the totals. Expense transferred to profit and loss account / income statement. Prepaid expenses are first recorded in the prepaid asset account on the balance sheet.

The expense is then gradually recognised over. Present expenses are not recorded in the income statement since they are the balance sheet account and effect only balance sheet. For example, refer to the first example of prepaid rent.

When a business pays in advance for products or services that. Accounting business april 14, 2023 prepaid expenses journal entry: Some utility bills interest expenses again, anything that you pay for before using is considered a prepaid expense.

Journal entries for prepaid expenses the following journal entry accommodates a prepaid expense: Introduction prepaid expenses is a financial maneuver that allows businesses to navigate their financial obligations with finesse. Prepaid rent will increase, while cash will decrease.

What type of account is prepaid expense? In this regard, it is important to consider that prepaid expenses comprise. Accounting articles prepaid expenses prepaid expenses these payments are made in advance for goods or services that a company will receive or use in the.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-04-59546336082445fa8db2dd9bbfcf58cb.jpg)

:max_bytes(150000):strip_icc()/prepaid-expense-4191042-recirc-blue-1d8d154bf0c94ba6858fe12907d2b694.jpg)