First Class Info About Cash Flow From Operating Activities Definition

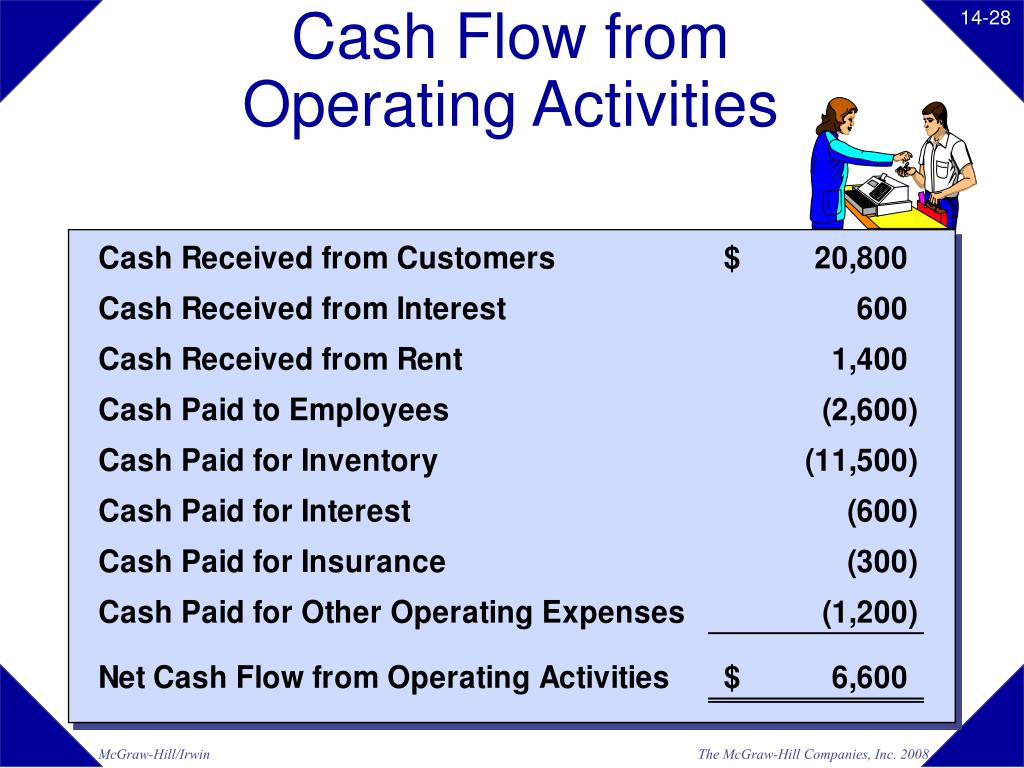

Salaries paid out to employees cash paid to vendors and suppliers cash collected from customers interest income and dividends received income tax paid and interest paid

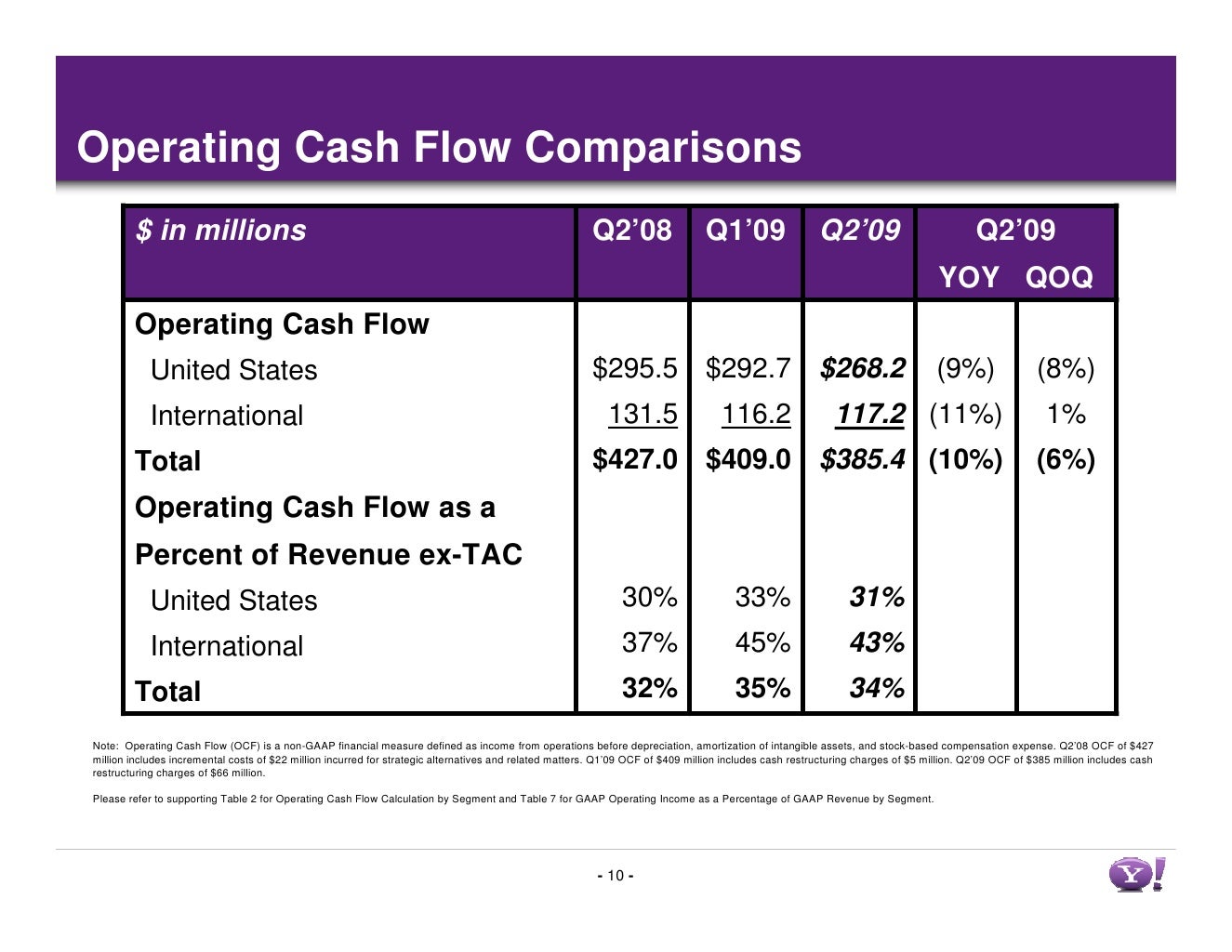

Cash flow from operating activities definition. Cash flow from operating activities formula the “cash flow from operations” is the first section of the cash flow statement, with net income from the income statement flowing in as the first. Q4 net cash from operating activities improved by $105.5 million; It represents the amount of cash a company spends or earns from carrying out its operating activities over a period.

Operating cash flow—also referred to as cash flow from operating. The ocf calculation will always include the following three components: The calculation is used to understand how much money a business is making without considering the secondary sources, such as.

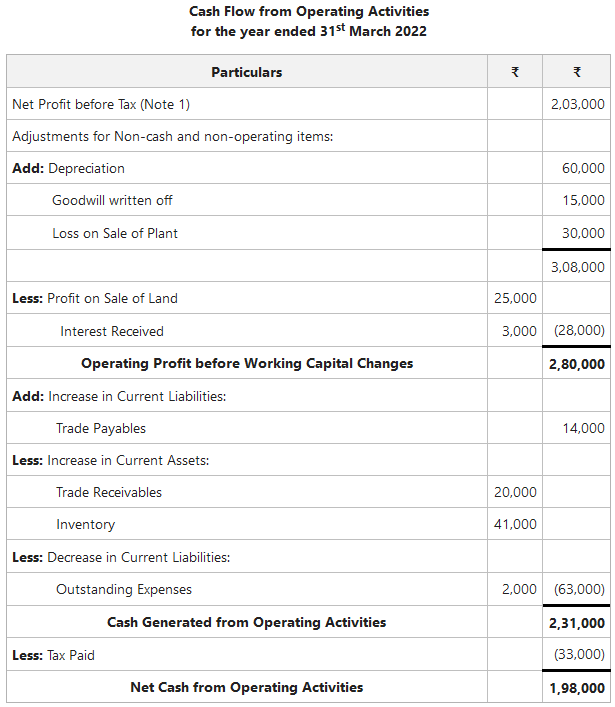

This is typically calculated by taking a company’s net income, factoring in depreciation expenses, then adjusting for any gains or losses on sales and assets. This information is used to determine the viability of the core operations of a business, since positive cash flow is needed to maintain and grow a firm’s operations. What is cash flow from operations?

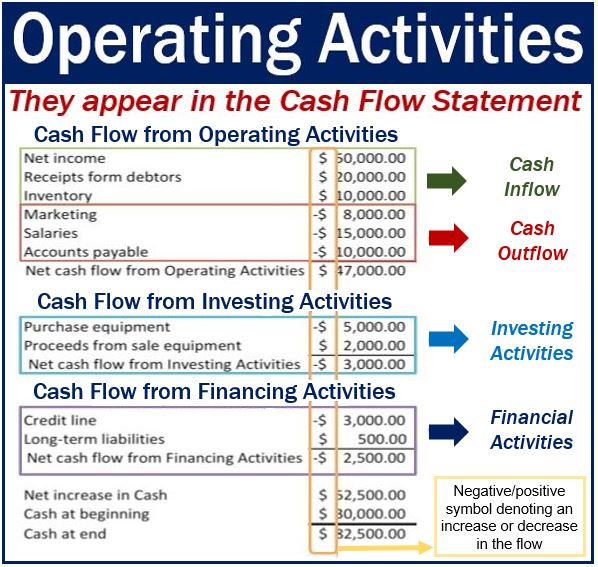

Net cash flow from operating activities is a financial metric that indicates the amount of money a company brings in from its ongoing, regular business activities, such as manufacturing and selling goods or providing a service. Net cash provided by operating activities for the fourth quarter was $79.7 million, a significant. Cash flow from investing activities is a section of the cash flow statement that shows the cash generated or spent relating to investment activities.

After some adjustments, it can be considered as net income. Cash flow from operating activities may also be referred to as operating cash flow (ocf) or net cash provided from operating activities. Cash flow from operating activities represents the total amount of cash generated from operating activities throughout a specified period.

Cash from operating activities focuses on the cash inflows and outflows from a company's main business activities of buying and. Operating cash flow definition. Operating cash flow is an operating income after deducting operating expenses.

Operating activities include generating revenue, paying Examples of the direct method of cash flows from operating activities include: Cash flow from operating activities (cfo) is cash that comes from the operating activities of a firm.

It represents if the company has a positive or negative cash flow from business operations. Operating cash flow: The cash flow from operations is the first section of the cash flow statement and includes money that goes into and out of a company.

It does not include any investing or financing activities. Operating cash flow (ocf) is how much cash a company generated (or consumed) from its operating activities during a period. Article summary cash flow from operating activities (cfo) refers to the cash inflows and outflows generated from a company’s primary operations.

Operating cash flow represents the cash impact of a company's net income (ni) from its primary business activities. The operating cash flow is the amount of cash generated by a business, for a specific period, through its normal operating activities within a particular period. Operating activities operating activities are the transactions that enter into the calculation of net income.

/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-01-5374391bf75040dfa769ad9661c90b89.jpg)

:max_bytes(150000):strip_icc()/terms_c_cash-flow-from-operating-activities_FINAL-e4025a9df8de40059fc1b585394c4b8b.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-02-c2254626b9bb4e8eacbfaf47e4e83784.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)