Amazing Info About Adjustment In Preparation Of Financial Statement

2 record transactions to journal;

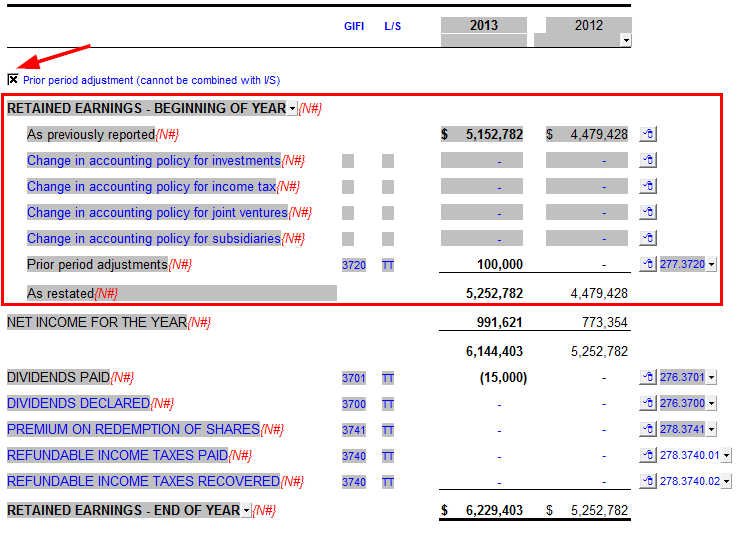

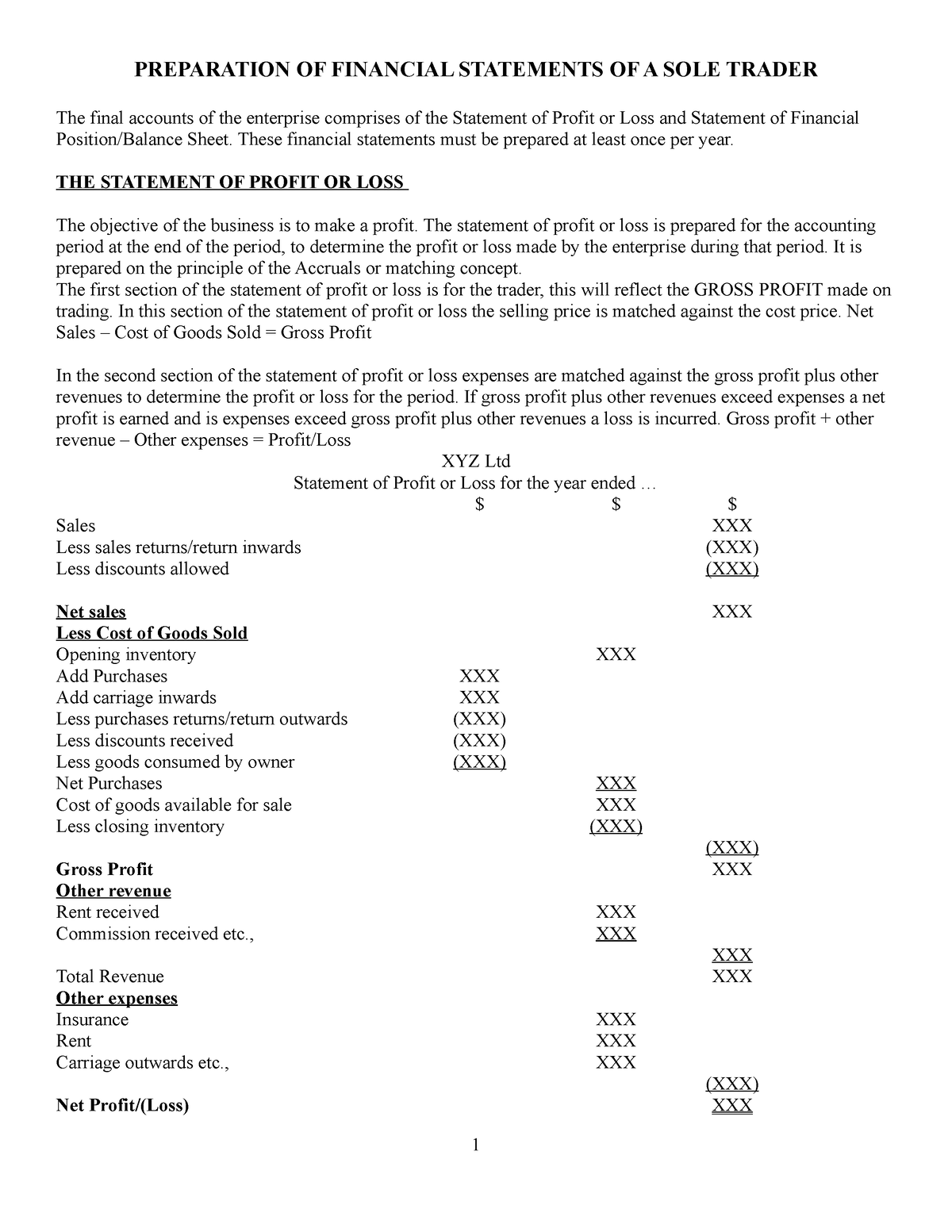

Adjustment in preparation of financial statement. An entity shall apply this standard in preparing and presenting general purpose financial statements. The adjustment required to eliminate this unrealised profit would be: These adjustments are crucial for presenting a true and fair view of a company’s financial status.

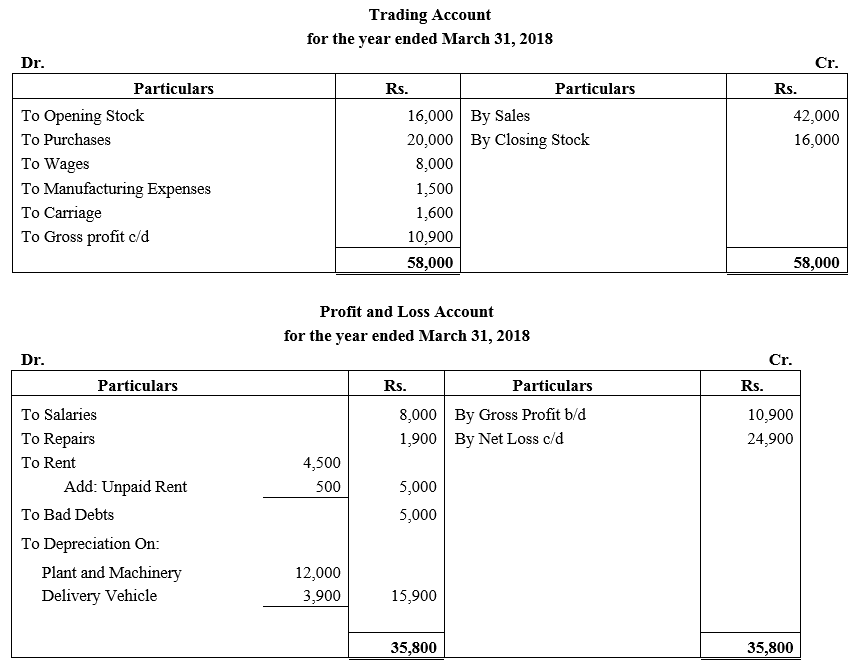

Dr cost of sales $500 cr inventory (sofp) $500 This helps us in getting the actual profit or loss for the year and the accurate financial position of the company. 3 post journal information to ledger;

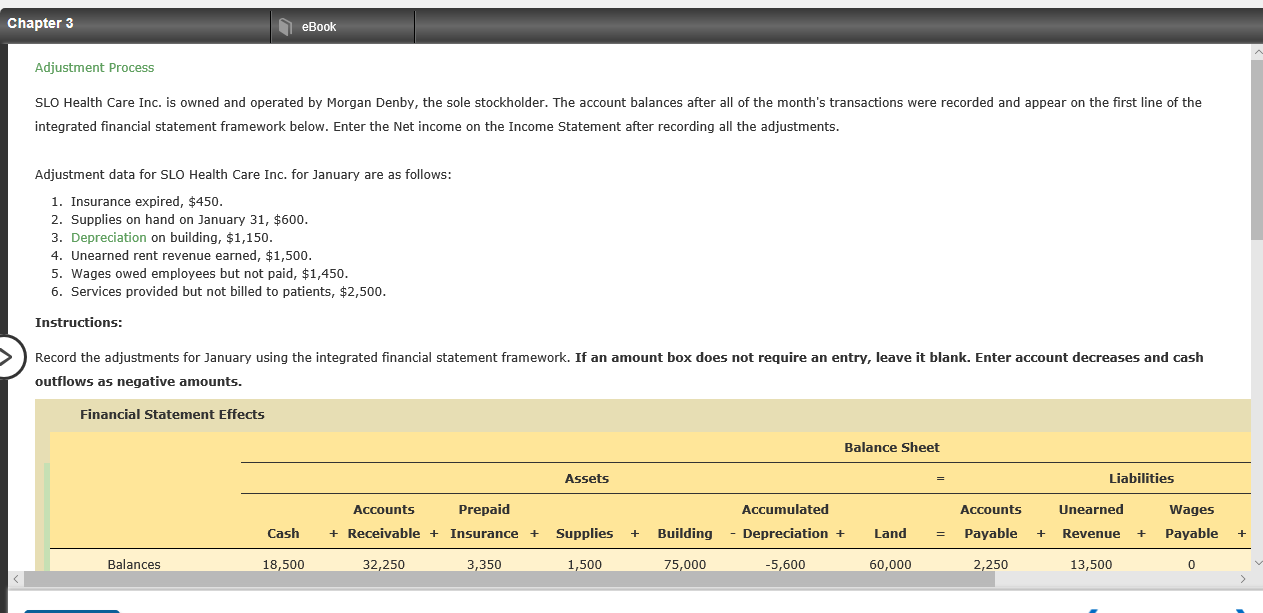

Adjustments in final accounts refer to changes made to certain financial entries at the end of an accounting period. Explain the need for an adjusting entry in the reporting of unearned revenue and be able to prepare that adjustment. Accrued expenses, prepaid expenses, accrued revenues, and.

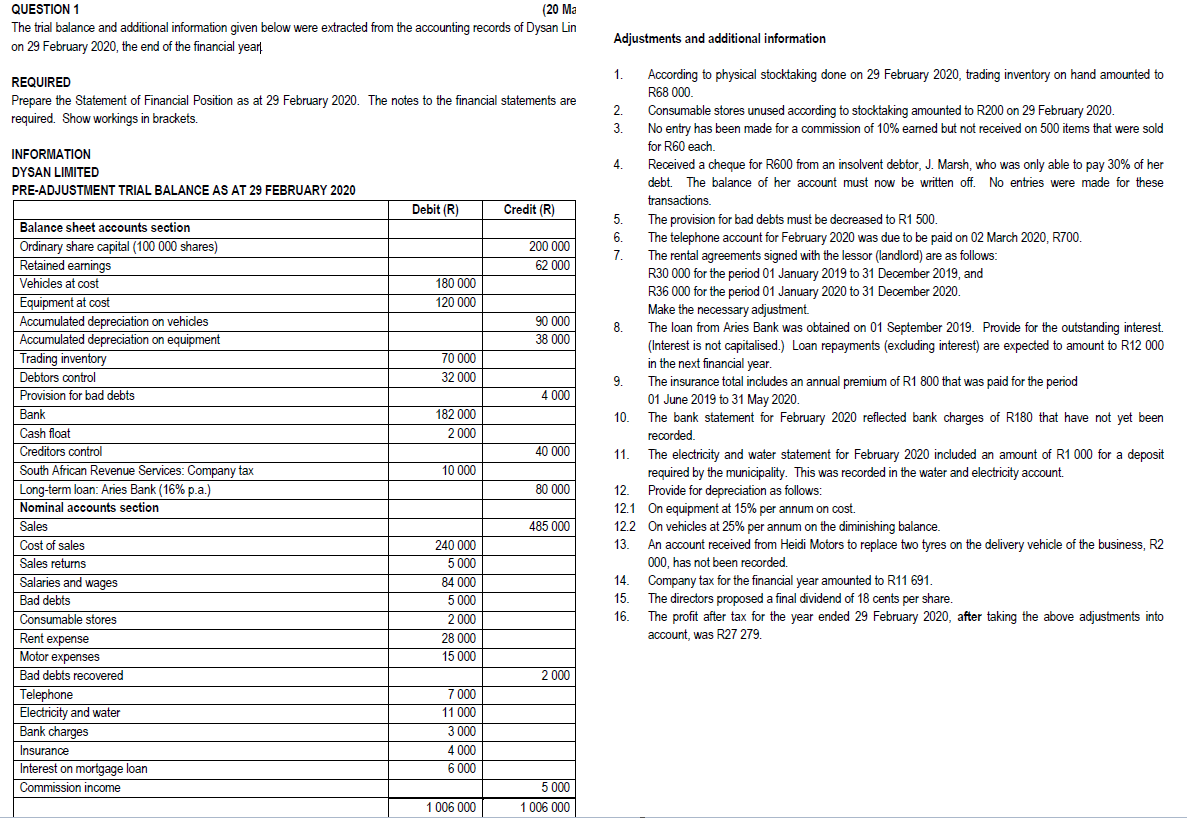

Adjustments to financial statements inventory. Students should study ts grewal solutions class 11 accountancy available on studiestoday.com with solved questions. With macroeconomic, geopolitical, and regulatory pressures.

Statements of previous periods and with the financial statements of other entities. Remember, closing inventory is a component of cost of sales so the adjustment for pup affects both the statement of profit or loss and the statement of financial position. While the average deal size increased 14 percent, owing to a handful of large deals, the number of companies changing hands fell 27 percent from a year earlier.

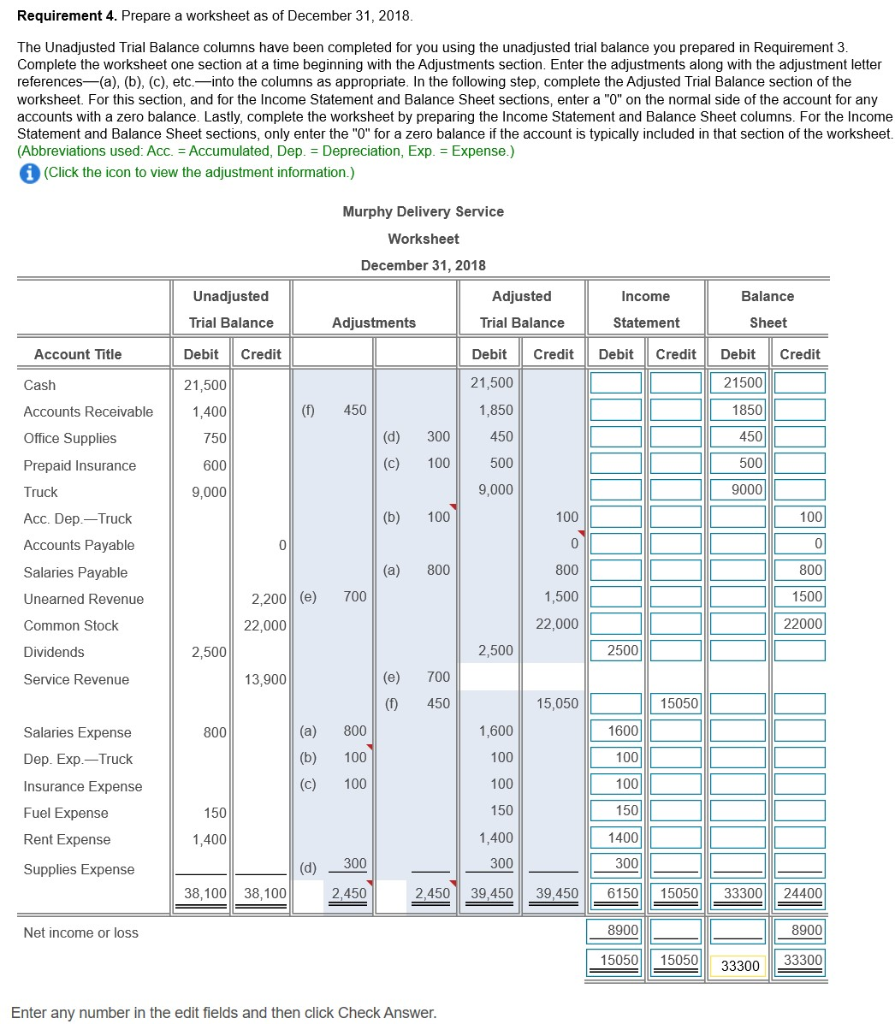

They are ready to be included in financial statements. It sets out overall requirements for the presentation of financial statements, guidelines for their structure and minimum requirements for their content. You might question the purpose of more than one trial balance.

There are several steps in the accounting cycle that require the preparation of a trial balance: From this information, the company will begin constructing each of the statements, beginning with the income statement. Income statement s will include all revenue and expense accounts.

There are four types of account adjustments found in the accounting industry. Chapter 14 focuses on adjustments needed in the preparation of financial statements to ensure accuracy. Here is the list of all solutions.

If a reporting company’s accounting system recognizes an expense as it grows, no adjustment is necessary. He has been teaching accountancy and economics for cbse students for the last 18 years. Explain the purpose and construction of closing entries.

To know the correct net profit or net loss of the business for an accounting year. Closing stock outstanding expenses prepaid or unexpired expenses It covers a range of adjustments, such as outstanding expenses, prepaid expenses, accrued income, and unearned income.

:max_bytes(150000):strip_icc()/financialstatements-final-d1268249b5284b3989c979ee82f2869e.png)