Can’t-Miss Takeaways Of Tips About Understanding Financial Statements For Dummies

In this guide to financial s.

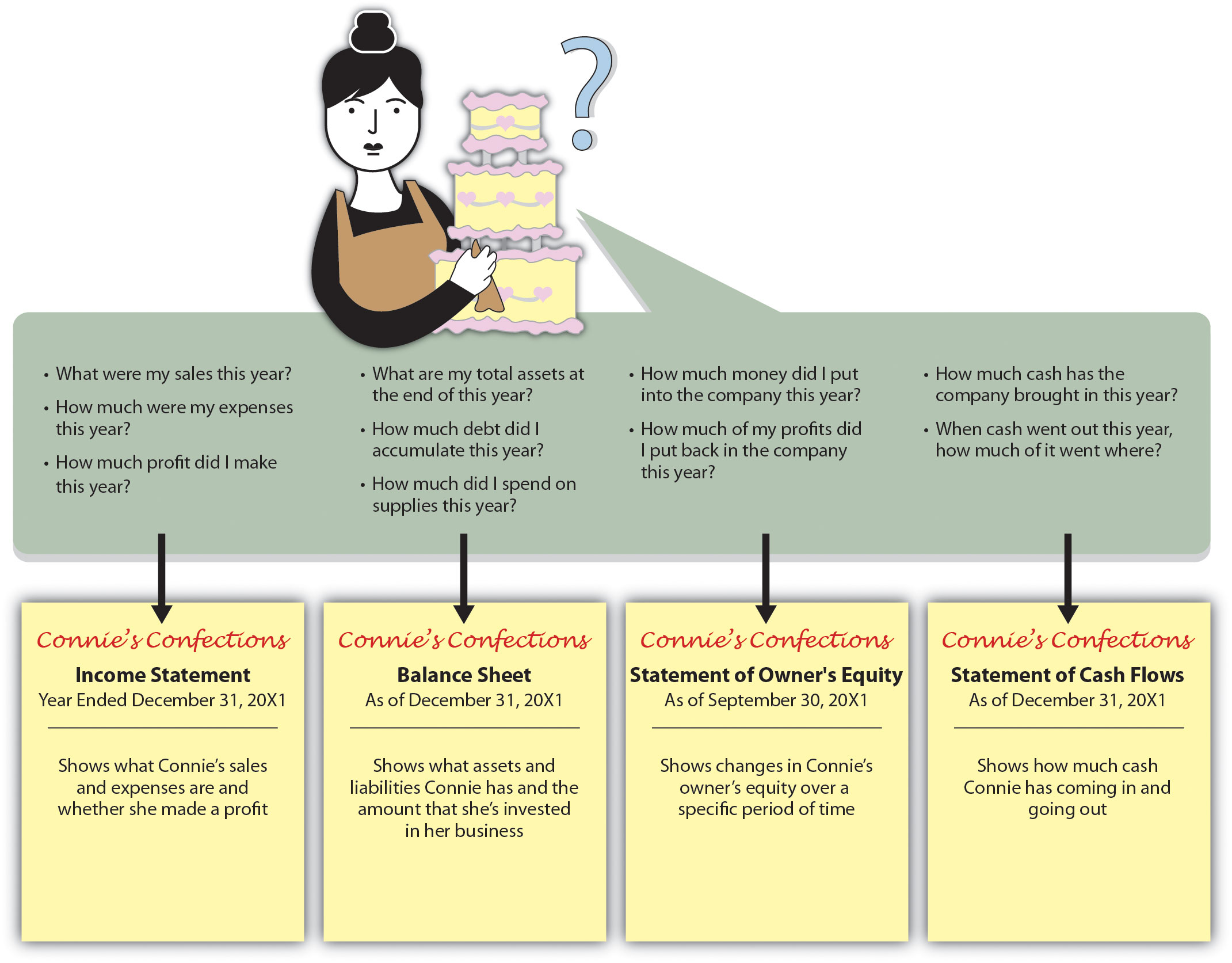

Understanding financial statements for dummies. Learn how to read financial statements. Income statements show how much money a company made and spent over a period of. There are four main financial statements.

Learn how to read these documents, and you will gain insight into your own finances and those of any company you may invest in. Investors can use key reports, such as a balance sheet, cash flow. Whether you’re a business owner, employee, or investor, understanding how to read and understand the information in a balance sheet is an essential financial accounting skill to have.

Reading financial statements course. Overall, financial statements are a valuable tool for understanding a company’s financial performance and position, and can help you make informed financial decisions. To understand a company’s financial position—both on its own and within its industry—you need to review and analyze several financial statements:

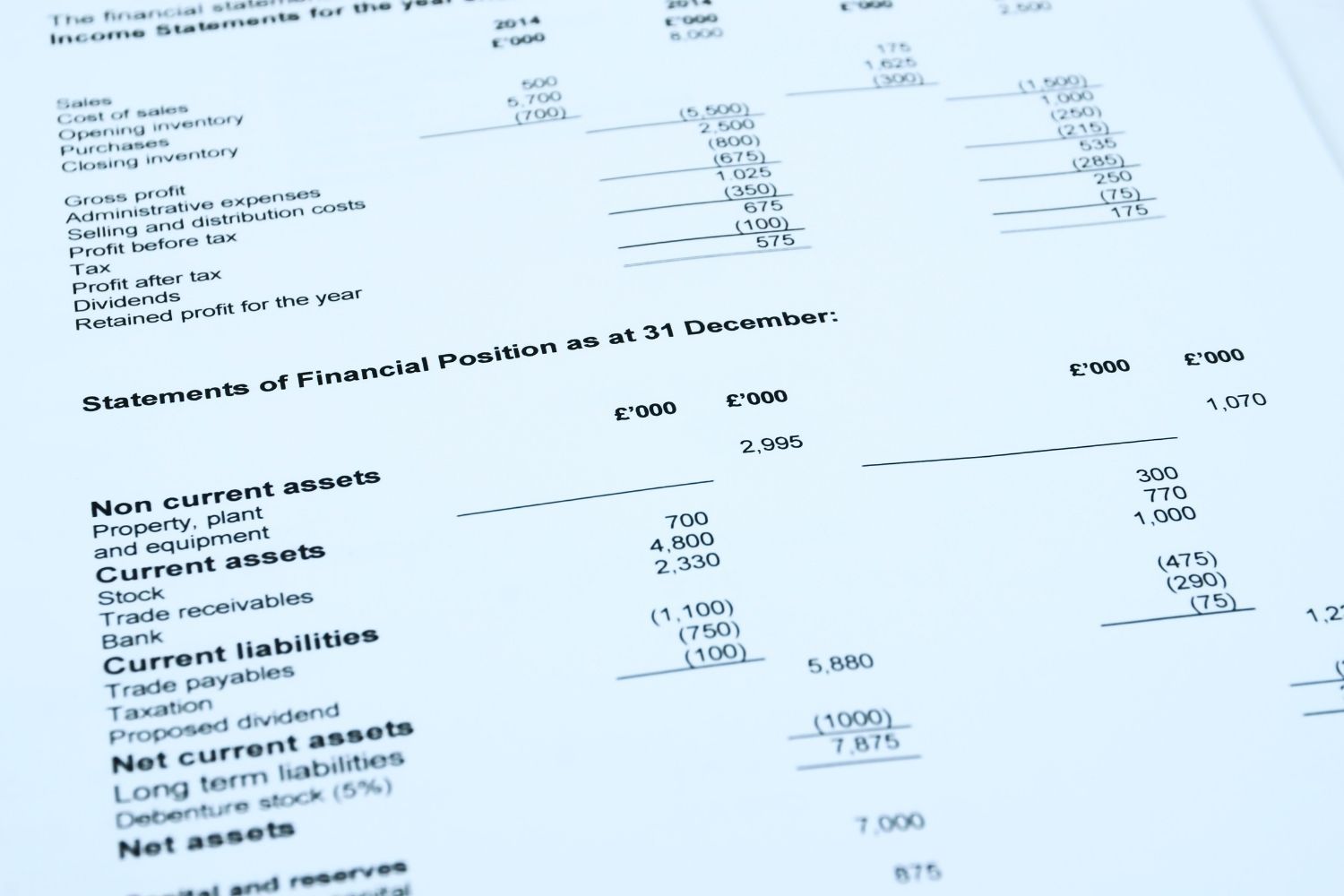

They serve two broad purposes: Balance sheets, income statements, cash flow statements, and annual reports. Balance sheets show what a company owns and what it owes at a fixed point in time.

There are four main financial statements. Assets = liabilities + owners’ equity. The value of these documents lies in the story they tell when.

Reading financial statements for stocks is a must to pick good companies. Understanding the basics of financial statements provides investors with valuable information about a company's financial health. Balance sheets show what a company owns and what it owes at a fixed point in time.

Financial statements answer some important questions investors. A financial statement is the report card of a business. Components of a complete set of financial statements.

Financial statements are documents containing summarised data that describe an organisation’s financial activities, such as income, expenses, assets, liabilities, net worth, etc. Financial statements are often audited by government agencies and accountants to ensure. In this free course, we use a company's financial statements and annual report to understand the financial strength of a company and help us make informed.

In most cases they are audited to ensure accuracy for tax, financing, or investing purposes. The balance sheet, the income statement, and the statement of cash flows; A methodically work through of the three financial statements in order to assess the financial health of a company.

The 3 financial statements explained to you in detail. Financial statements are written records that report information about a business’s financial performance and activities during a given period of time, and its financial position at a specific point in time, providing an overall picture of the financial health of the business. Notes to the financial statements:

:max_bytes(150000):strip_icc()/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)