What Everybody Ought To Know About The Retained Earnings Statement Should Be Prepared

But several financial statements need to be prepared to calculate retained earnings.

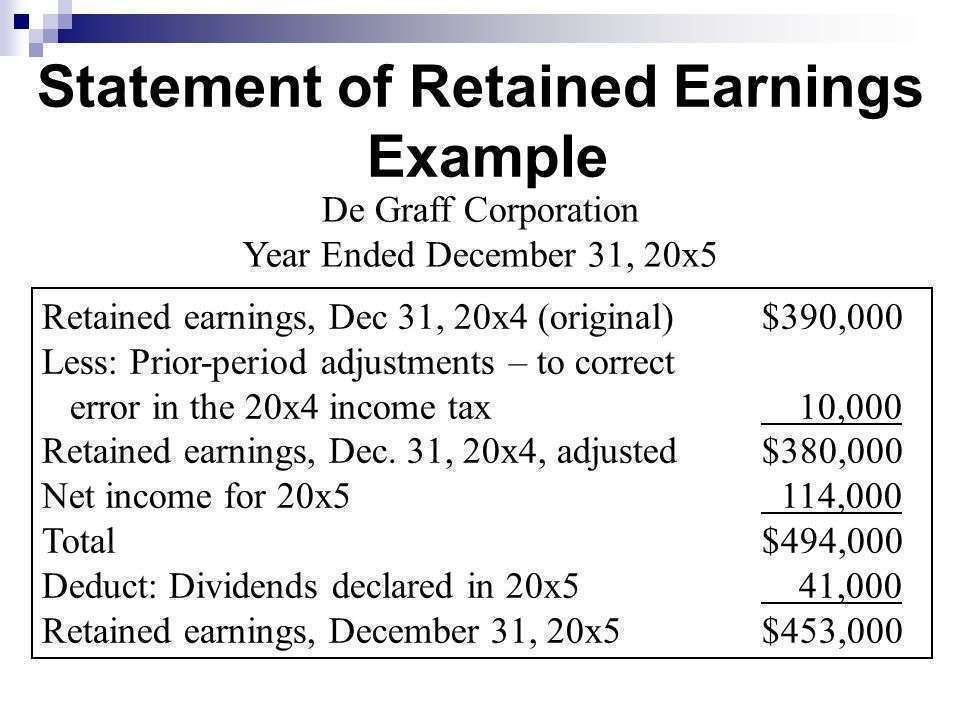

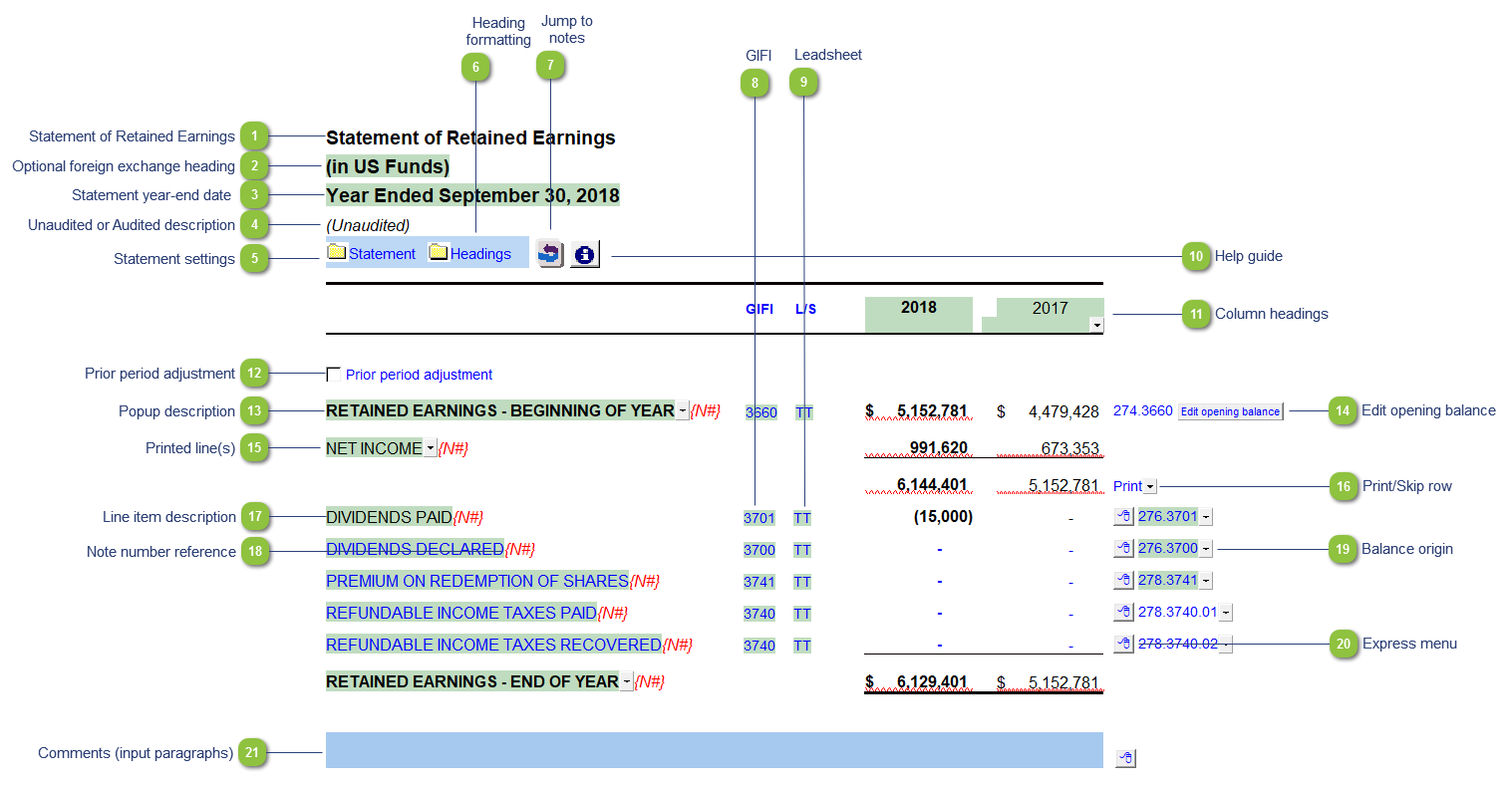

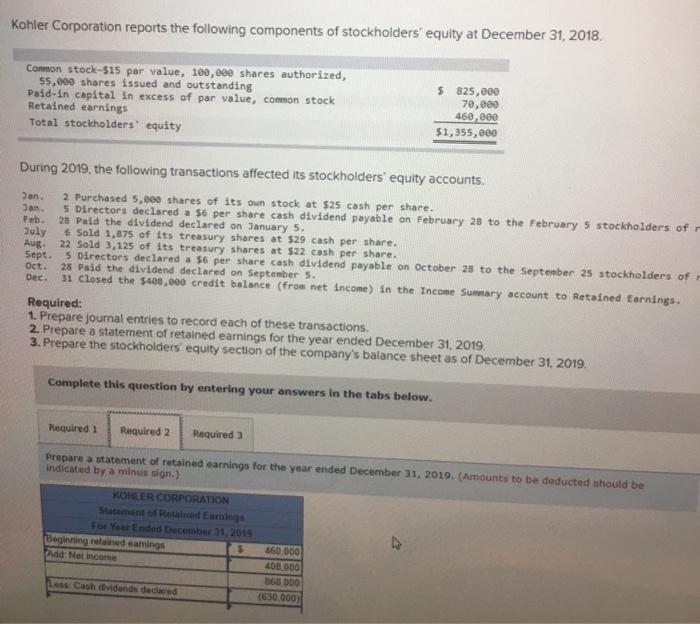

The retained earnings statement should be prepared. Retained earnings are the portion of a company’s cumulative profit that is held or retained and saved for future use. The heading will include the report name, company’s name, and the period for which the report is ready. The numbers provide insight into a company’s financial position and the owner’s attitude toward reinvesting in and growing their business.

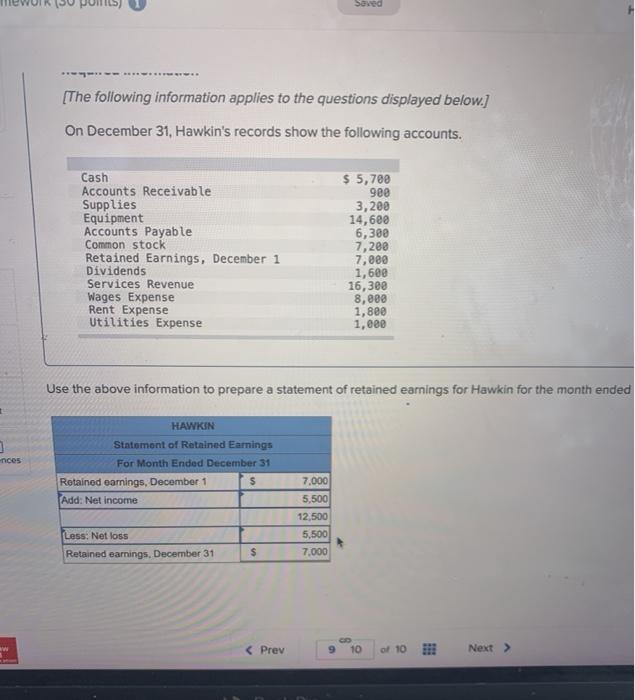

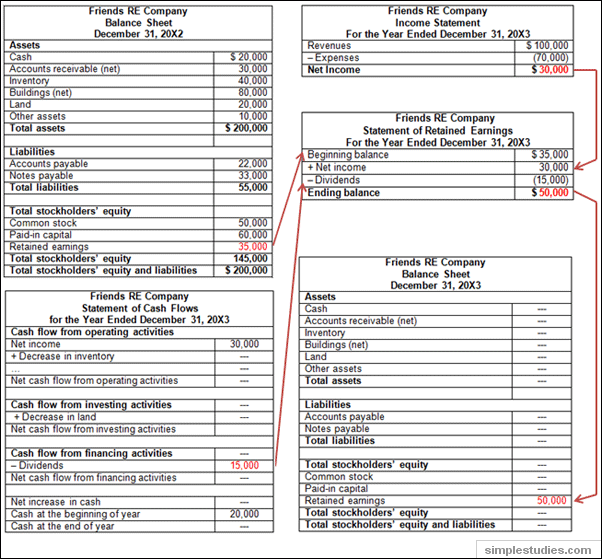

This requirement is the key difference between the statement of retained earnings gaap vs ifrs. Use your net profit (or net loss) from your income statement to prepare your statement of retained earnings. Remember that we have four financial statements to prepare:

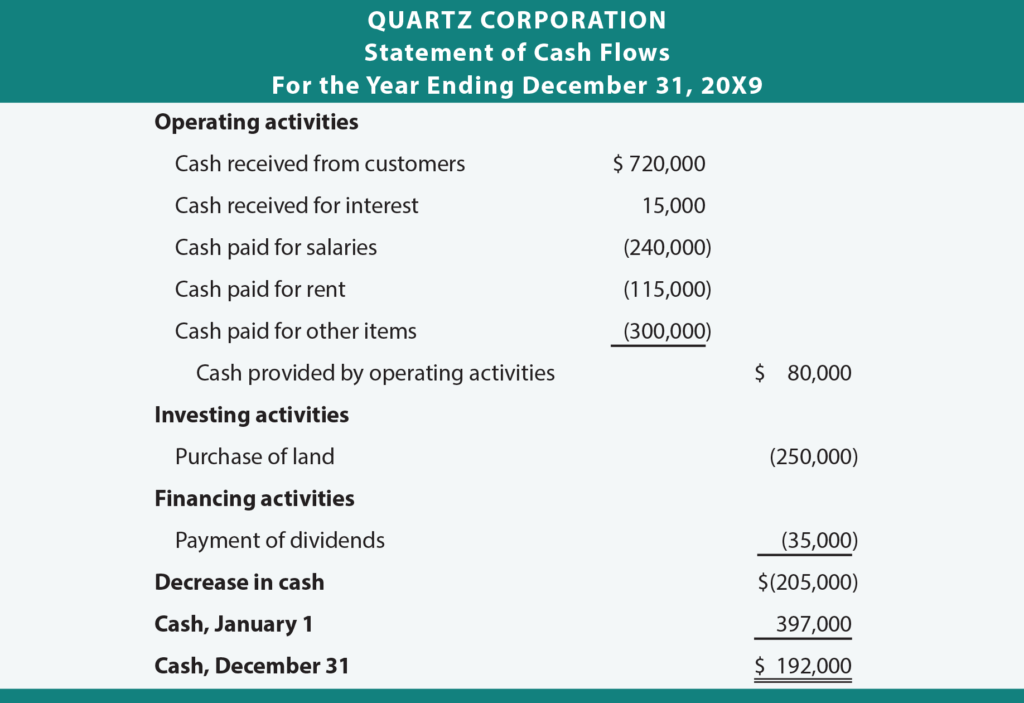

Net income from the income statement must be reported on the retained earnings statement and the ending retained earnings balance must be reported on the balance sheet. An income statement, a statement of retained earnings, a balance sheet, and the statement of cash flows. The statement of retained earnings is a key financial document that shows how much earnings a company has accumulated and kept in the company since inception.

Your statement of retained earnings is the second financial statement you prepare in your accounting cycle. · retained earnings from last period: Retained earnings could be used for funding an expansion or paying dividends.

They can report this information in the third section of the balance sheet, under the shareholder’s equity section. After the income statement and balance sheet this problem has been solved! Hence, ifrs requires that the retained earnings statement should not be prepared combined with the balance sheet or the income statement but as a separate statement.

Note net income that is not included in accumulated retained earnings has been paid out to shareholders as. From “shareholder’s equity” line of your balance sheet. The retained earnings statement should be prepared a.

The statement of retained earnings is a financial statement that is prepared to reconcile the beginning and ending retained earnings balances. Here's how to show changes in retained earnings from the beginning to the end of a specific financial period. However, its weak financial performance indicators makes us a bit doubtful if that trend could continue.

Retained earnings (re) are the accumulated portion of a business’s profits that are not distributed as dividends to shareholders but instead are reserved for reinvestment back into the business. Retained earnings are the cumulative net earnings (profit) of a company after paying dividends; The retained earnings statement should be prepared first because it provides data to compute net income.

Like other financial statements, a retained earnings statement is structured as an equation. When necessary, a company publishes a separate report called a retained earnings statement.

They can be reported on the balance sheet and earnings statement. Total shareholder equity was roughly $273 billion at the end of 2020. Retained earnings came in at approximately $164 billion.

:max_bytes(150000):strip_icc()/statement-of-retained-earnings-final-8500839aff40433dba054ce0af9f9f42.png)