Casual Info About Other Comprehensive Income Statement Format Of Balance Sheet As Per Companies Act

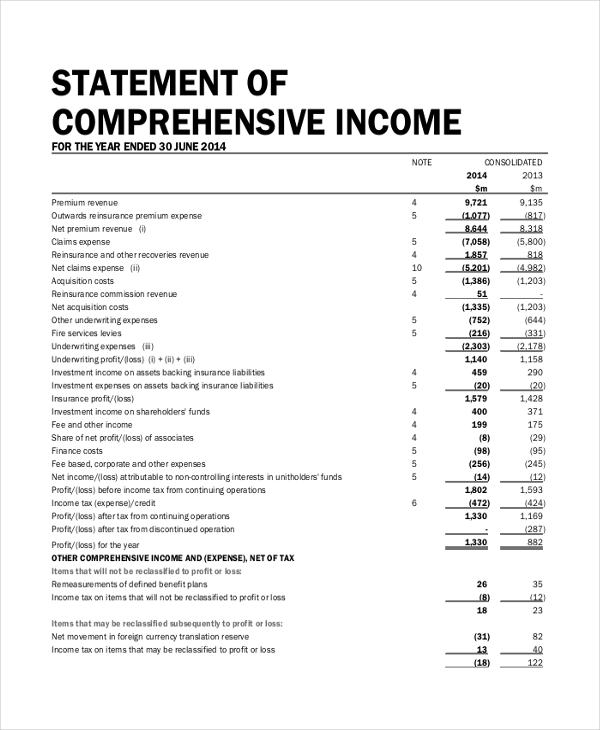

12 as per paragraph 81, an entity shall present the components of profit or loss and components of other comprehensive.

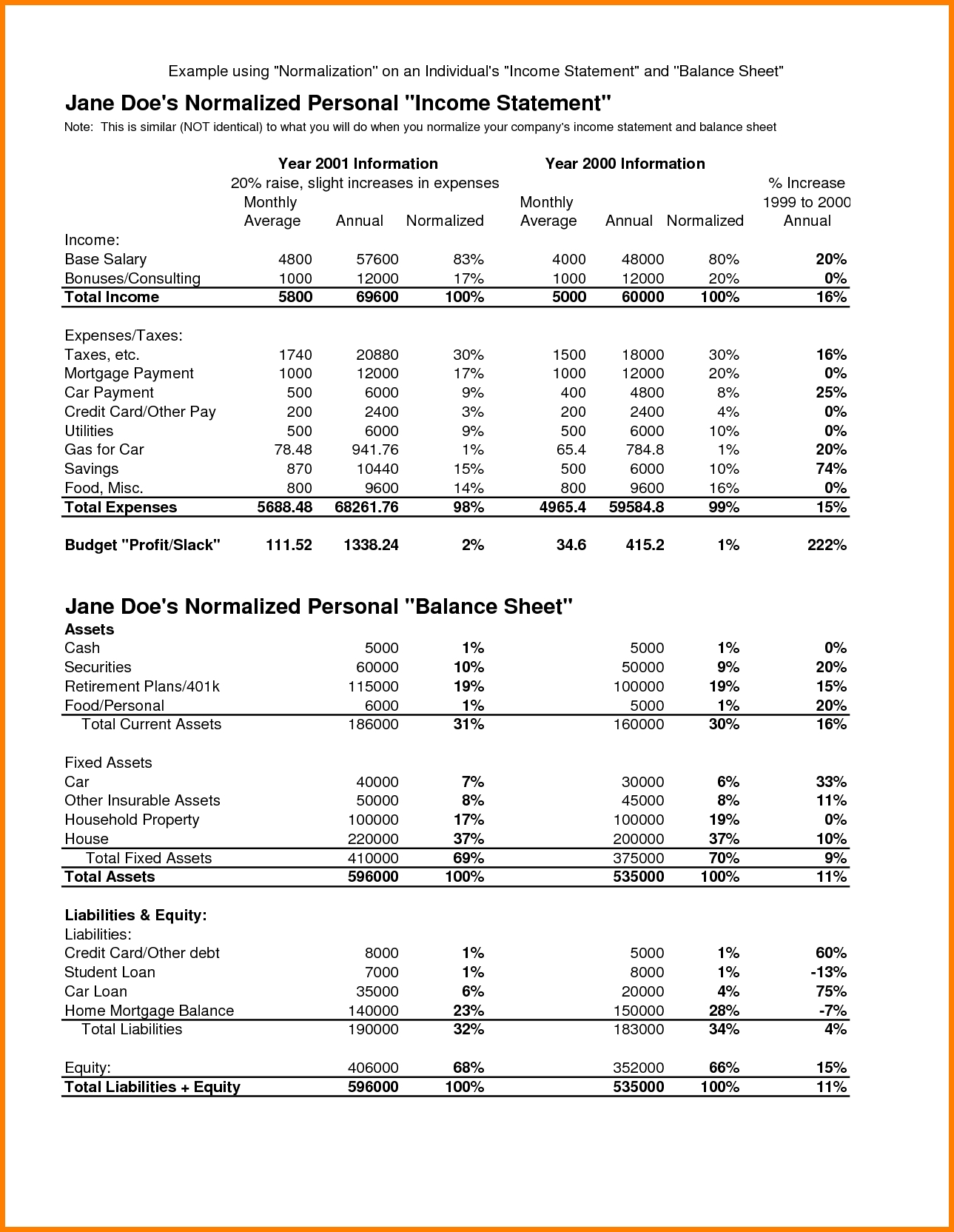

Other comprehensive income statement format of balance sheet as per companies act. (1) this section applies if—. Comprehensive income and a change in terminology in the titles of financial statements.

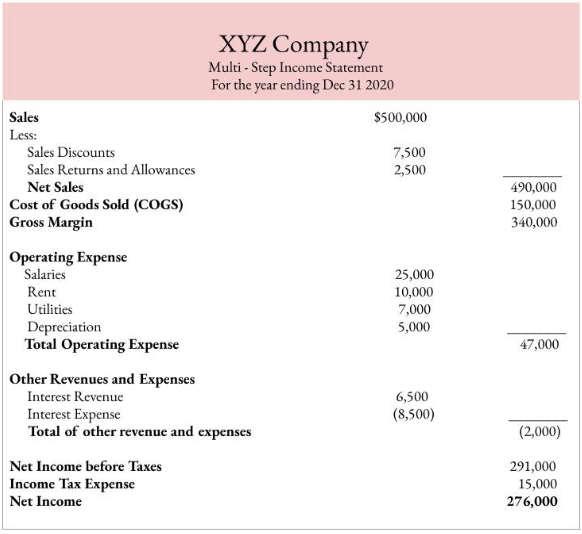

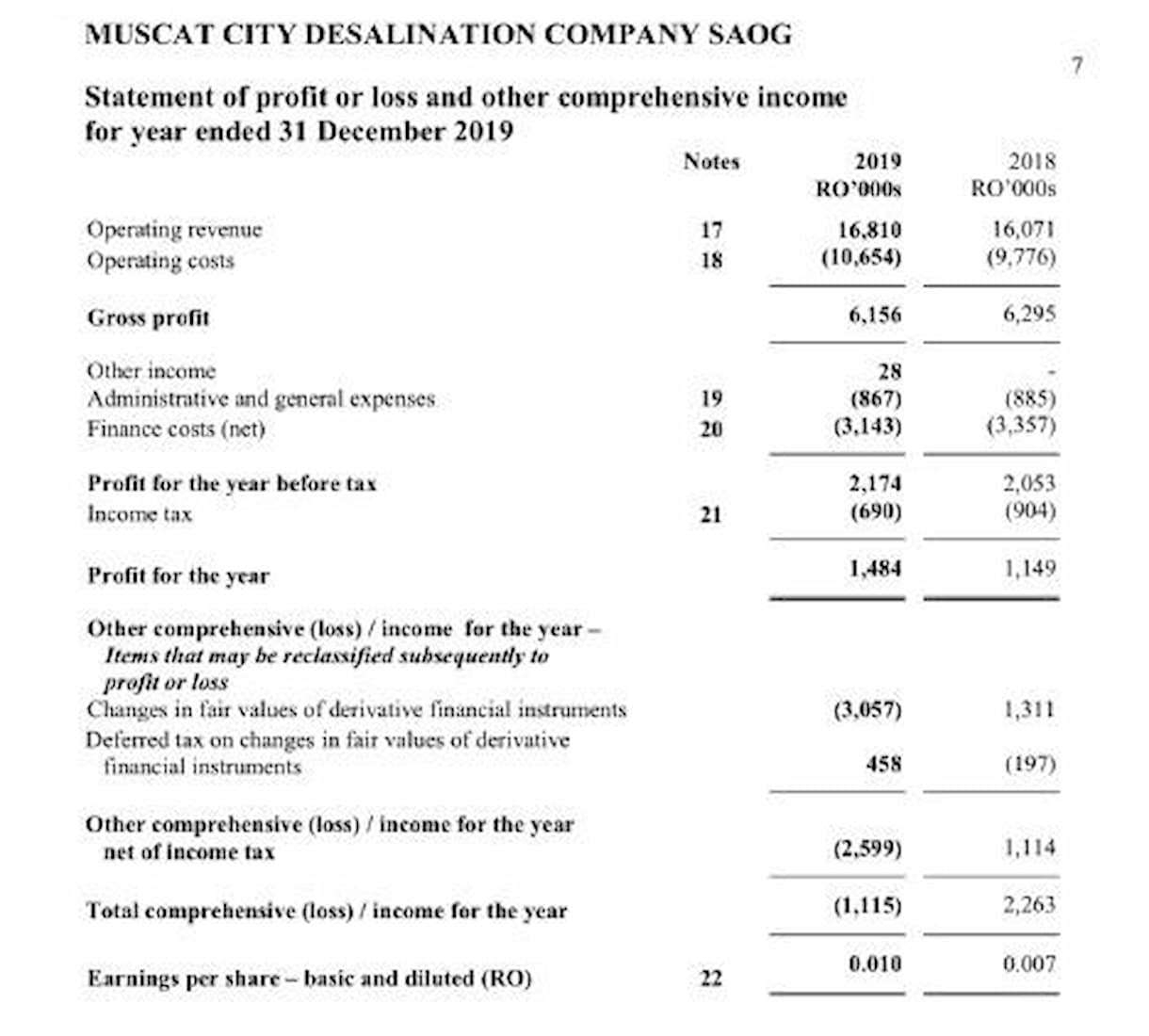

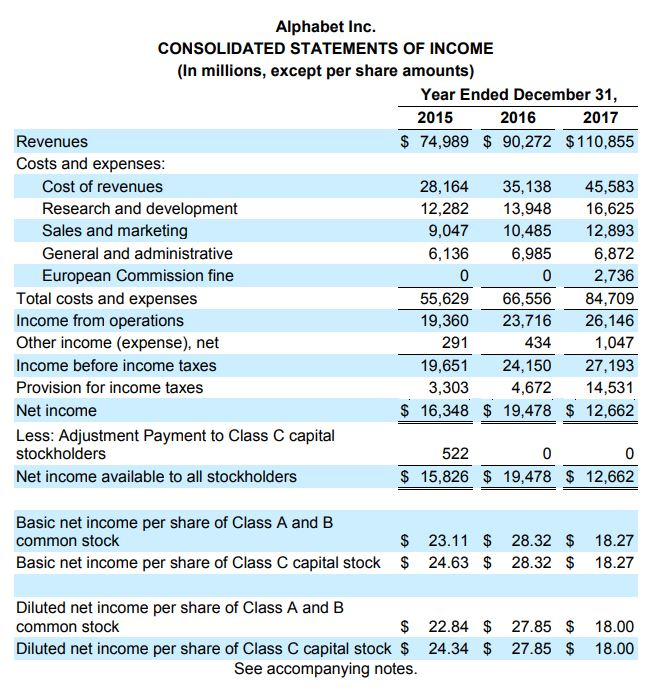

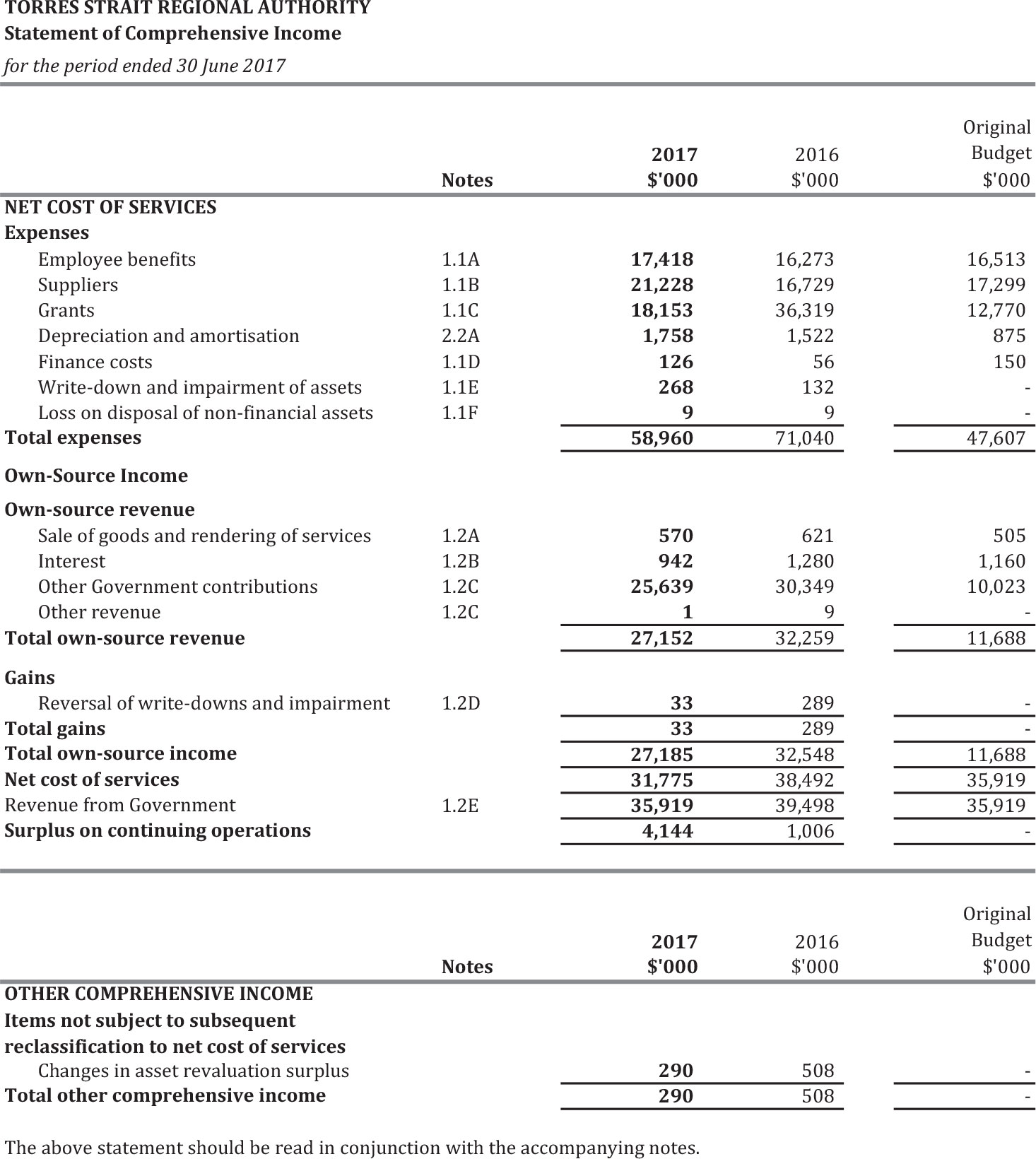

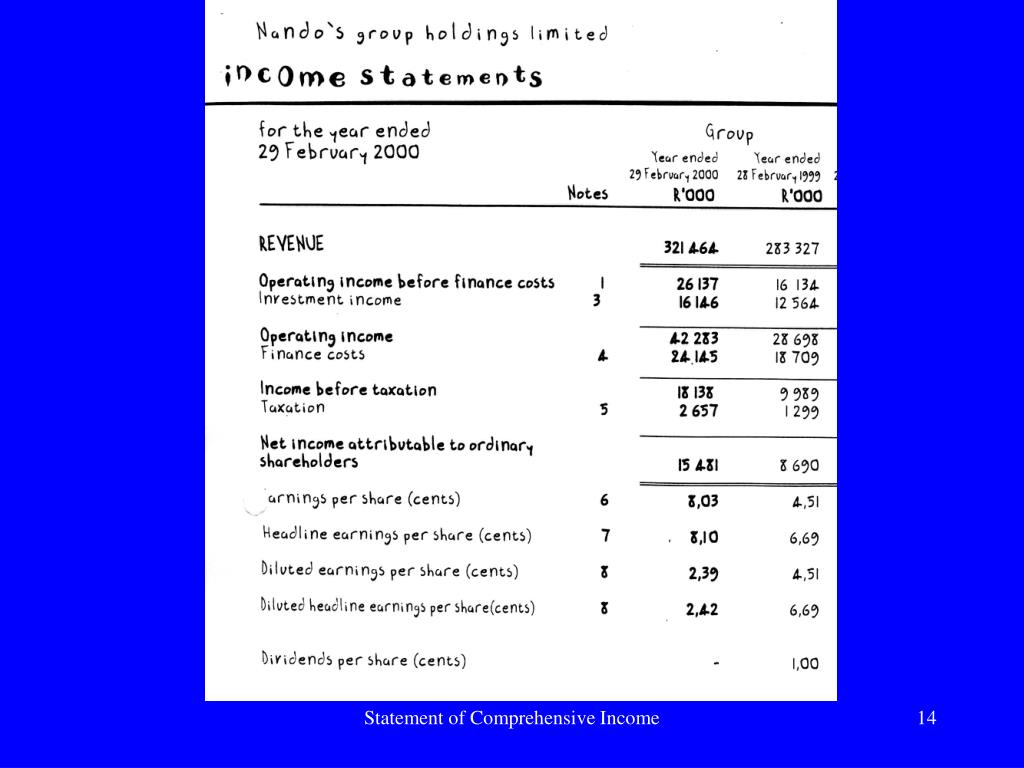

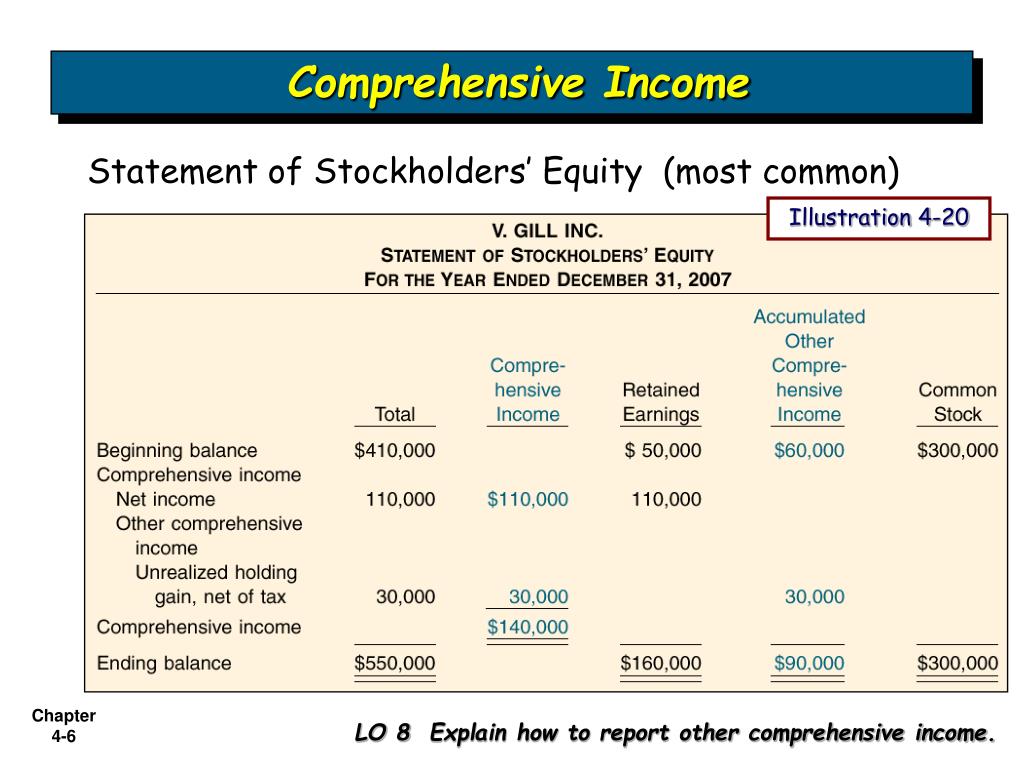

The balance sheet provides a snapshot of a company’s financial position and consists of three main elements: A statement displaying components of profit or loss (an income statement), and a second statement. The statement of comprehensive income is a financial statement that summarizes both standard net income and other comprehensive income (oci).

Other comprehensive income refers to items of income and expenses that are not recognized as a part of the profit. Organising the statement of profit 106 or loss by function of expenses appendix b: The purpose of the statement of profit or loss and other comprehensive income (ploci) is to show an entity’s financial performance in a way that is useful to a wide range of.

2 (40) to include balance sheet, profit and loss account/income and. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset. The standard requires a complete set of financial statements to comprise a statement of financial position, a statement of profit or loss and other comprehensive income, a.

A vertical balance sheet is several columns beginning with. The “other comprehensive income (oci)” line item is recorded on the shareholders’ equity section of the balance sheet and consists of a company’s. Section 172 (1) statement to be made available on website.

Purpose financial statements should be presented to ensure comparability both with the entity’s financial statements of previous periods and with the financial statements of. It is similar to retained earnings, which is impacted by net income, except it includes those items that. Other comprehensive income is shown on a company’s balance sheet.

Statement of comprehensive income refers to the statement which contains the details of the revenue, income, expenses, or loss of the company that is not realized when a. Ind as 1 as well as the act defines a “complete set of. (a) a company is required by section 414cza to include a section 172 (1).

What is other comprehensive income? Every balance sheet of a company must show the items listed in either of the balance sheet formats in section b of this part, and every profit and loss account must show the.

Statements in a complete set of financial statements. Statement of comprehensive income 108 presented in a single.

The net income is the. Notes 6 to 11 16 9. As fixed assets age, they begin to lose their value.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)