Best Info About Cash Flow From Financing Activities Definition

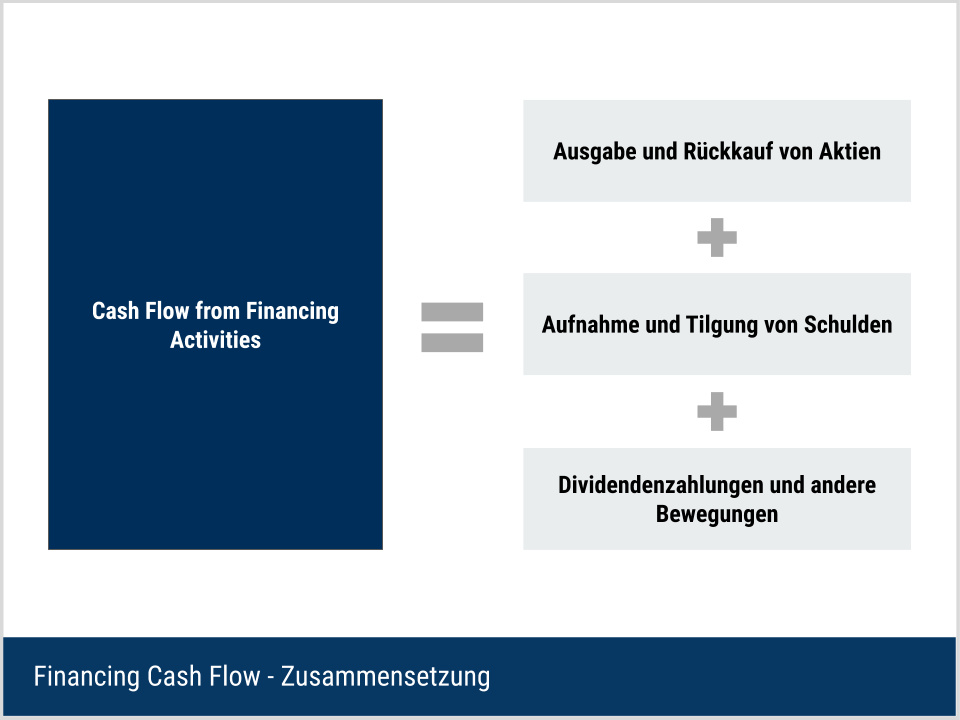

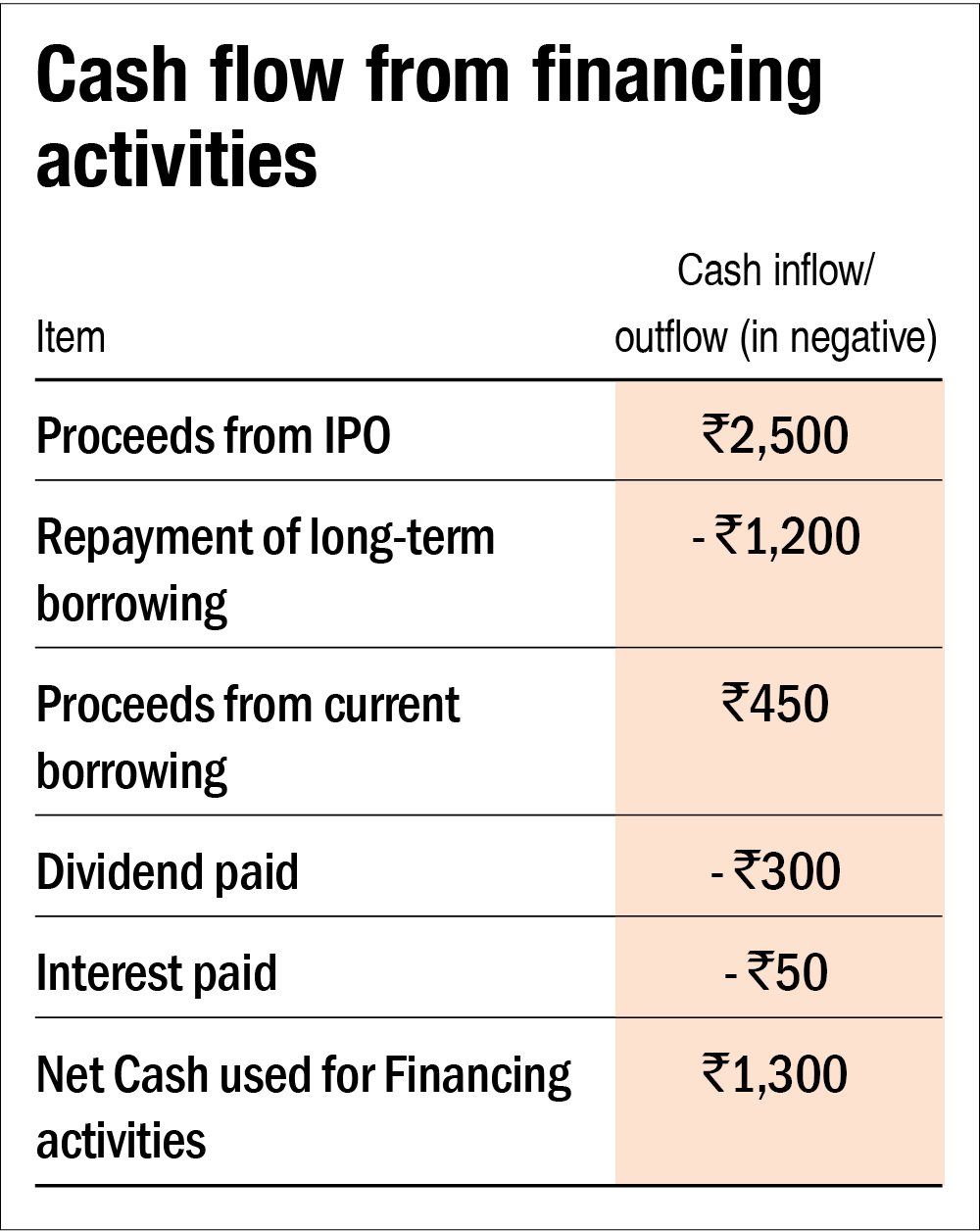

The net cash impact of raising capital from equity/debt issuances, net of cash used for share buybacks, and debt.

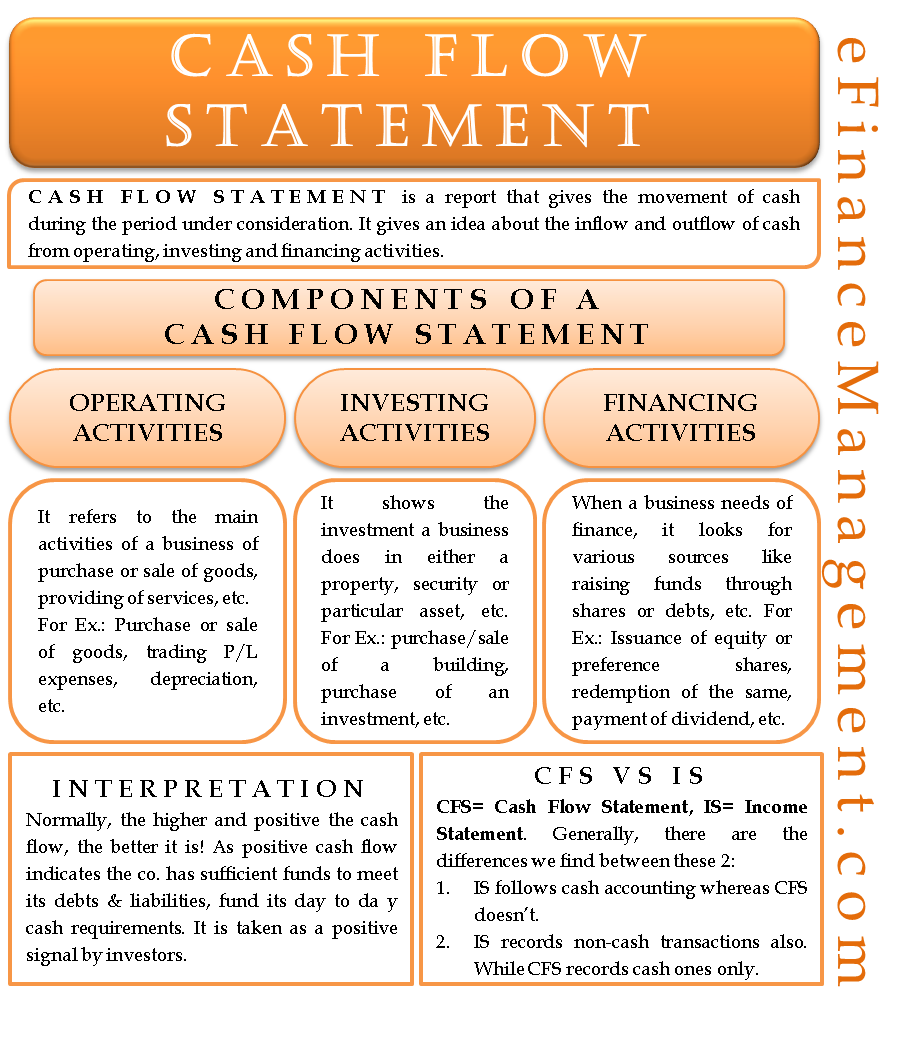

Cash flow from financing activities definition. The cash flow statement is a financial statement that reports a company's sources and use of cash over time. Cash flow from financing activities (cff) is a section of a company’s cash flow statement, which shows the net flows of cash that are used to fund the company. Cash flow from financing activities (cff) is the section of a company’s cash flow statement that shows the inflows and outflows of cash resulting from financing.

Cash flow from financing activities is the net amount of funding a company generates in a given time period. To calculate this, a company needs to know its dividend. The cash flow from financing activities (cff) is part of a company’s cash flow statement.

Cash flow from financing activities refers to the inflow and the outflow of cash from the financing activities of the company like change in capital from the issuance of. Cash flow from financing activities refers to how much funding a company earns within a certain period. Cash flow from financing activities is one of the three categories of cash flow statements.

Cash flow from financing activities is the third section of an organization’s cash flow statement, outlining the inflows and outflows of cash used to fund the business for a. What are cash flows from financing activities? Financing activities refer to the transactions involved in raising and retiring funds.

The section of the cash flow statement titled cash flow from financing activities accounts for inflows and outflows of cash resulting from debt issuance and. In a company's cash flow statement, cash flow from financing activities is the section that is crucial for evaluating the organisation's financial performance and. Cash flow from financing activities.

Cash flow from financing activities definition. The financing activity in the cash flow statement focuses on how a. Finance activities include the issuance and repayment of equity,.

Ias 7 statement of cash flows requires an entity to present a statement of cash flows as an integral part of its primary financial statements. Financing activities include transactions involving debt, equity, and dividends. Cash flow from financing activities (cff):

It shows how much cash the company has generated or used from its. It’s essential because it mirrors your financial health and is the. Cash flow from financing activities includes cash transactions that increase or decrease a company's equity and/or.

Cash flows from financing activities is a line item in the statement of cash flows. Cash flow from financing activities provides investors. Cash flow is the heartbeat of your small business, reflecting the movement of money in and out.

The former is associated with cash inflow, and the latter denotes cash outflows. The portion of the net cash generated by a company over a certain time period that goes into funding the firm itself is called cash flow from financing. A company's cash flow can be categorized as cash.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/cashflowfinvestingactivities-recirc-8787bbde413f4036b2f8cfad5c4c6a99.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

:max_bytes(150000):strip_icc()/cashflowstatement-recirc-blue-777721714b8f49a5b5103337a8510653.jpg)

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)