Best Info About Statement Of Financial Position Balance Sheet Difference

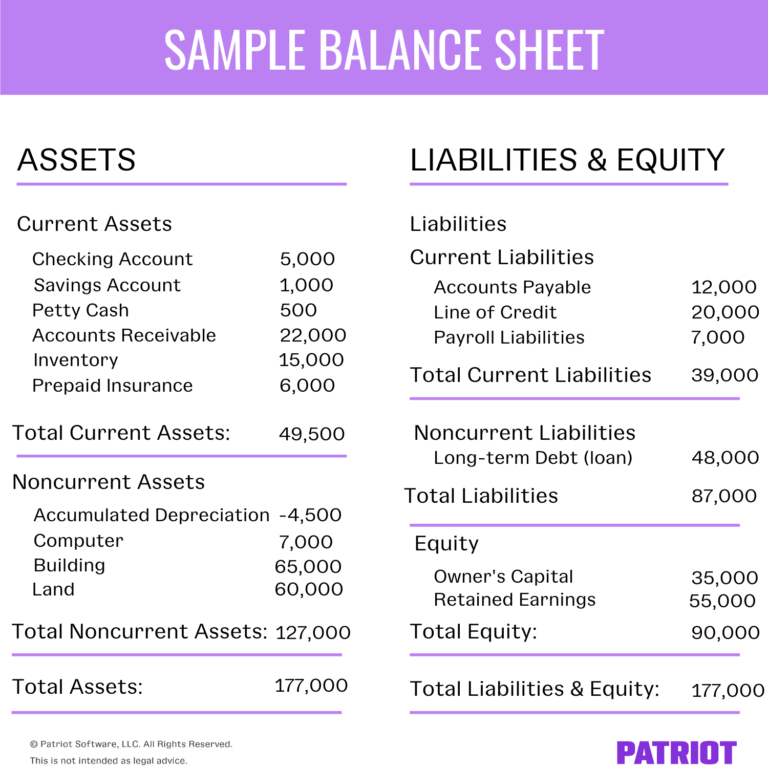

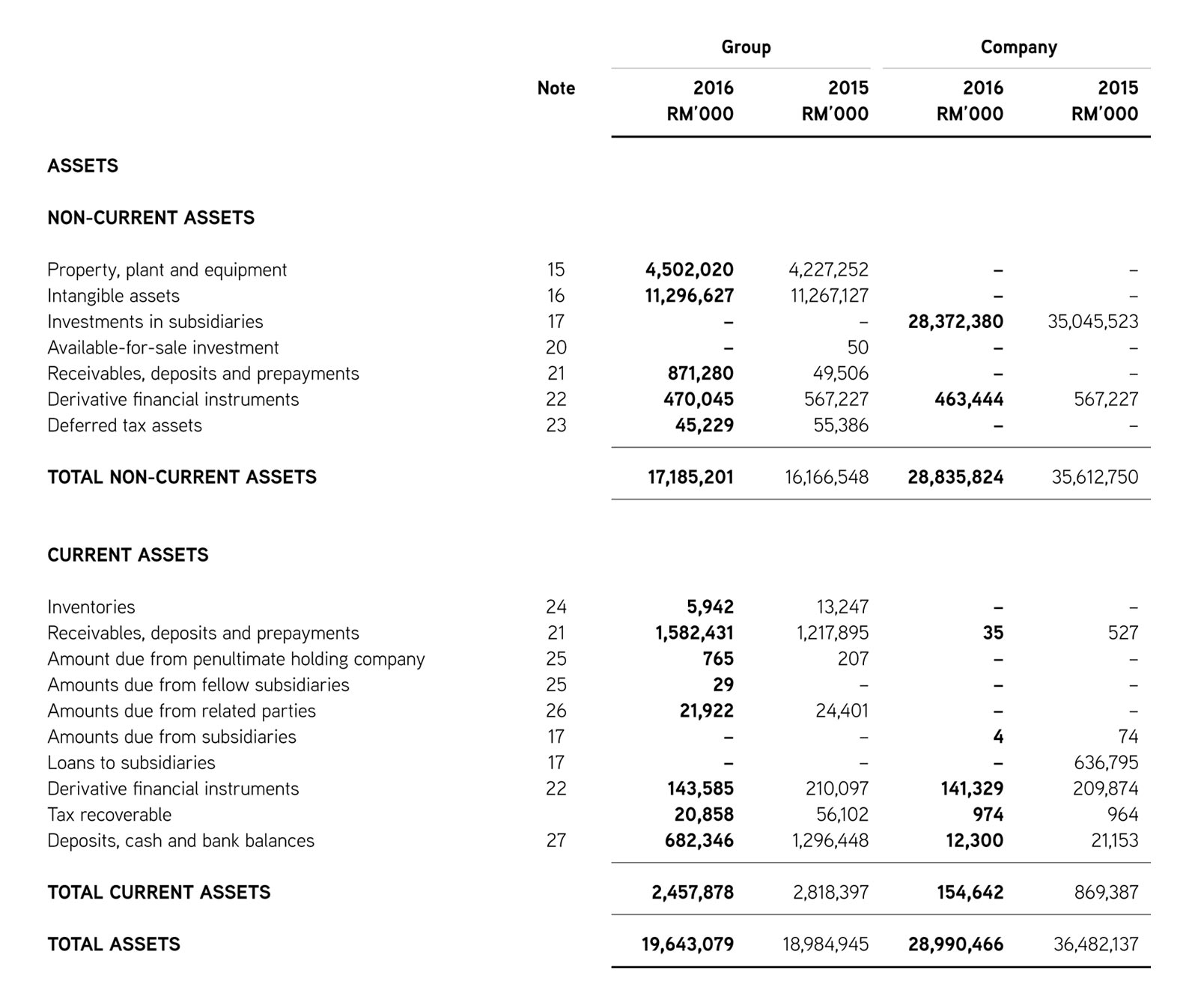

Assets , liabilities and equity.

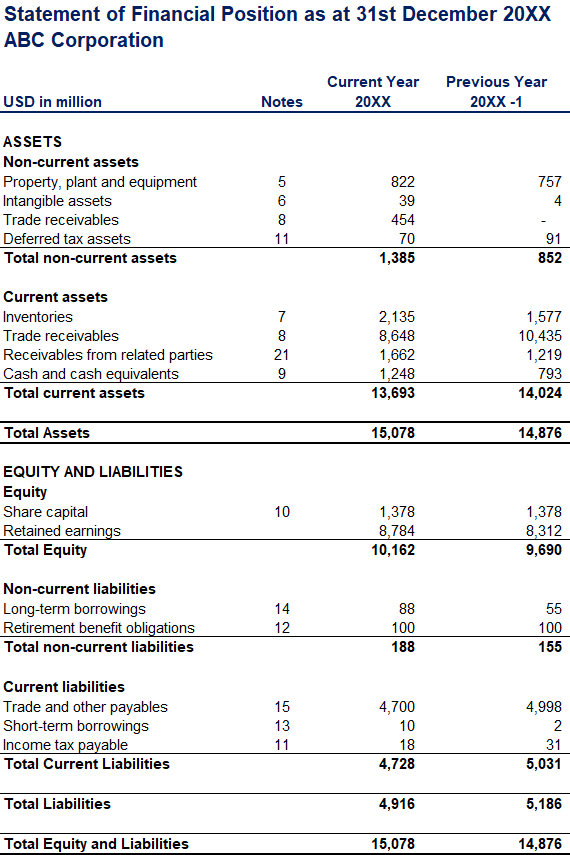

Statement of financial position balance sheet difference. So if your financial statements are prepared based on ifrs, then you should use statement of financial position instead of balance sheet. A balance sheet reveals the assets owned and debts owed by the entity, whereas financial statement reflects the health of the entity. The balance sheet and the statement of financial position are two terms used interchangeably to refer to the same financial statement.

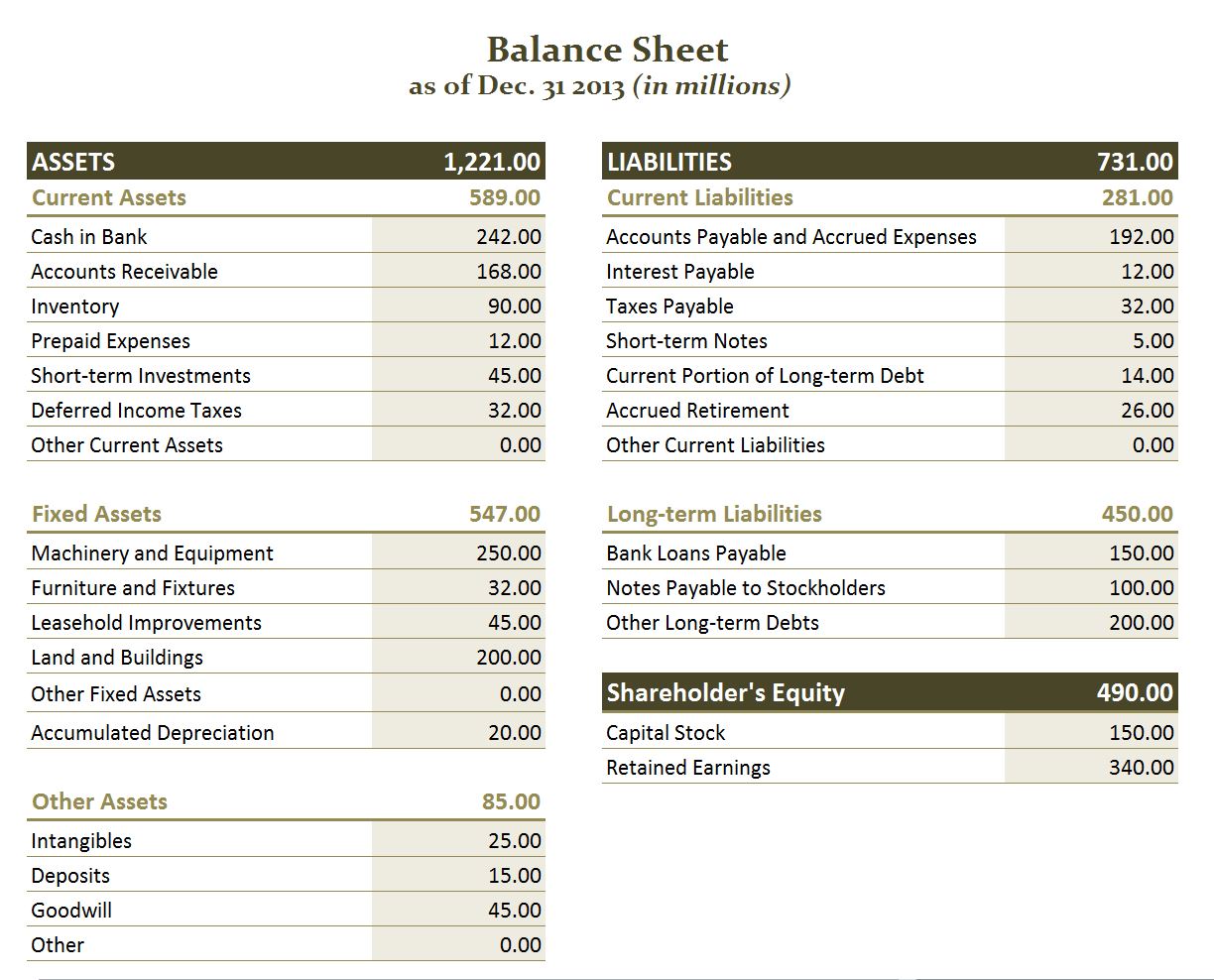

Understanding the financial snapshot of your business. A balance sheet and financial statement both provide a snapshot of a company’s financial position at a specific point in time. Balance sheets can be used.

Noted, ifrs now has changed the words to call balance sheet to statement of financial position. Although it is more formally referred to as the statement of financial position, the term “balance sheet” is used throughout this chapter. Also referred to as the statement of financial position, a.

A balance sheet, or statement of financial position, is a part of a financial statement outlining what a company owns and owes. The balance sheet also description of financial position can confusing by many to be the same thing, but there are, however, a number of differences between balance sheet and statement of financial position. Statement of financial position, also known as the balance sheet, gives the understanding to its users about the business’s financial status at a particular point in time by showing the details of the company’s assets along with its liabilities and owner’s capital.

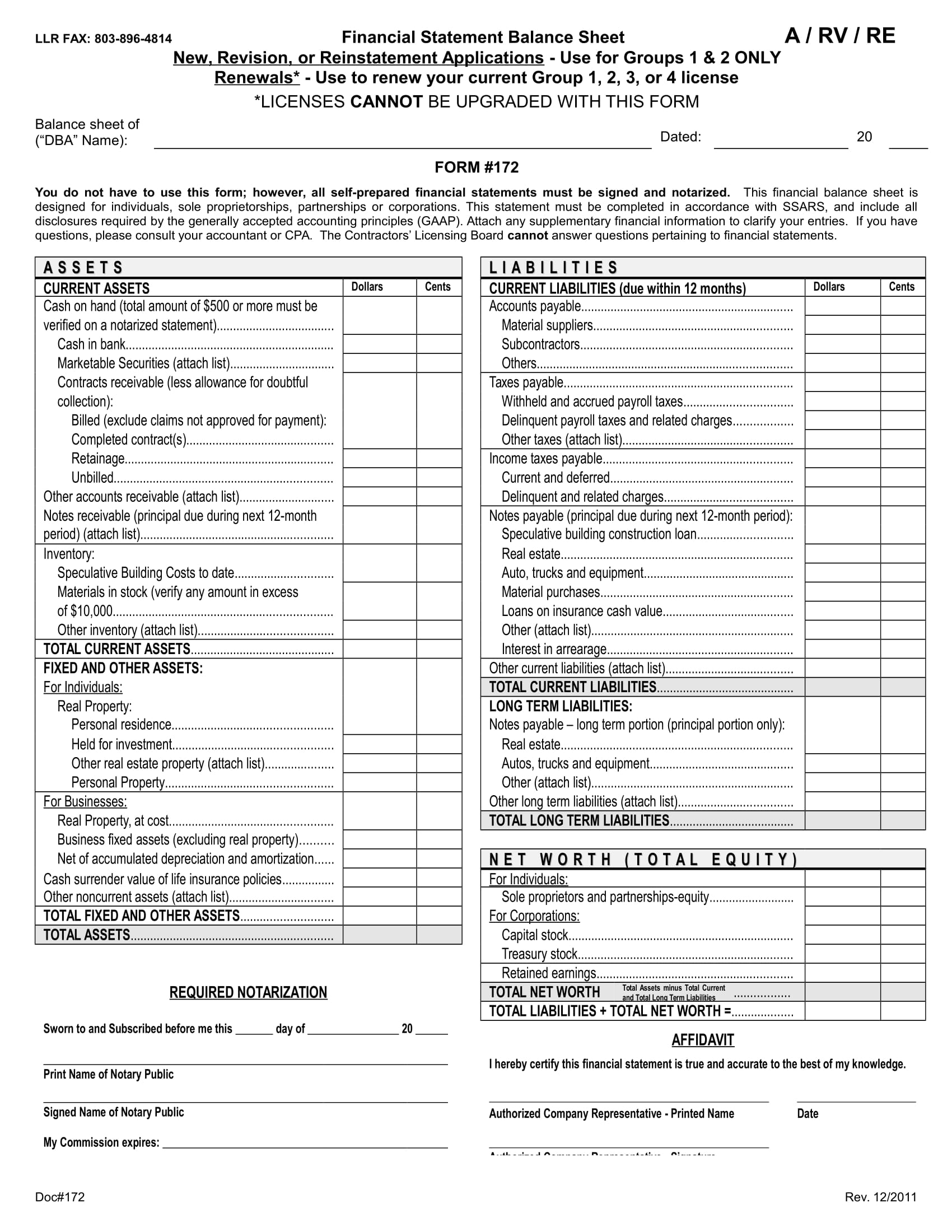

Definition statement of financial position, also known as the balance sheet, presents the financial position of an entity at a given date. The purpose of the statement of financial position/balance sheet (sfp/bs) is to report the assets of a company and the composition of the claims against those assets by creditors and investors at a specific point in time. This chapter provides an overview of the key elements of balance sheets prepared under the nfp reporting model, including the statement’s format, organization, and contents.

The balance sheet (bs), also known as the statement of financial position (sofp), provides a snapshot of a company’s financial situation. Key takeaways the information found on the financial statements of an organization is the foundation of corporate accounting. The company’s balance sheet shows that it holds assets worth $420,549 and liabilities worth $142,266.

It is comprised of three main components: Assets = liabilities + equity. That means learning how to read financial statements, starting with the balance sheet—that snapshot of what a company owns (called assets), and what it owes (called liabilities) as of a certain point in time.

Namely, a financial statement called the statement of financial position (sometimes called the balance sheet ). A financial position or balance sheet statement gives a broad overview of a company’s financial position considering its assets and liabilities, for example, as per the 2021 annual report of amazon. Identify which financial statement each account will go on:

Both, balance sheet and statement is financial position, are financial statements that offer the outline of the manner for. A statement of financial position is another name for your company’s balance sheet. Related business forms definition of statement of financial position the statement of financial position is another name for the balance sheet.

A balance sheet is a part of financial statement, but financial statement is not a part of balance sheet. Financial position refers to how much resources are owned and controlled by a company (assets), and the claims against them (liabilities and capital). The main purpose of the statement of financial position is to provide a concise summary of a company's assets, liabilities, and equity.

![BYS [FINV3004] Statement of Financial Position (Level 1) Build Your](https://buildyourskill.co.uk/wp-content/uploads/2019/02/Balance-Sheet-Pack.jpg)

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)