Unbelievable Info About Liability Cash Flow

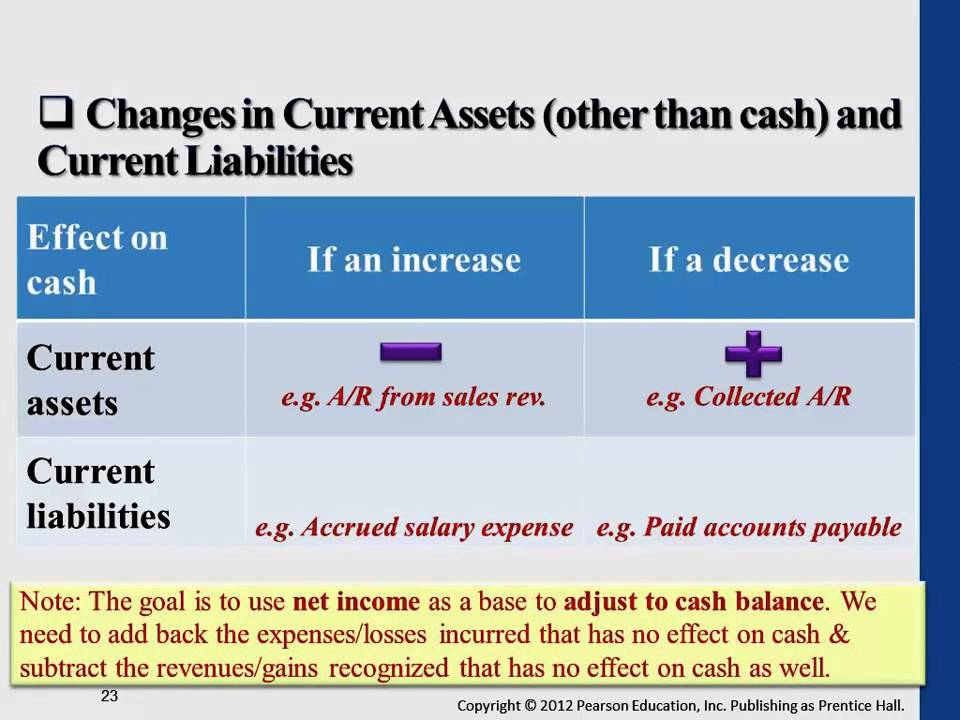

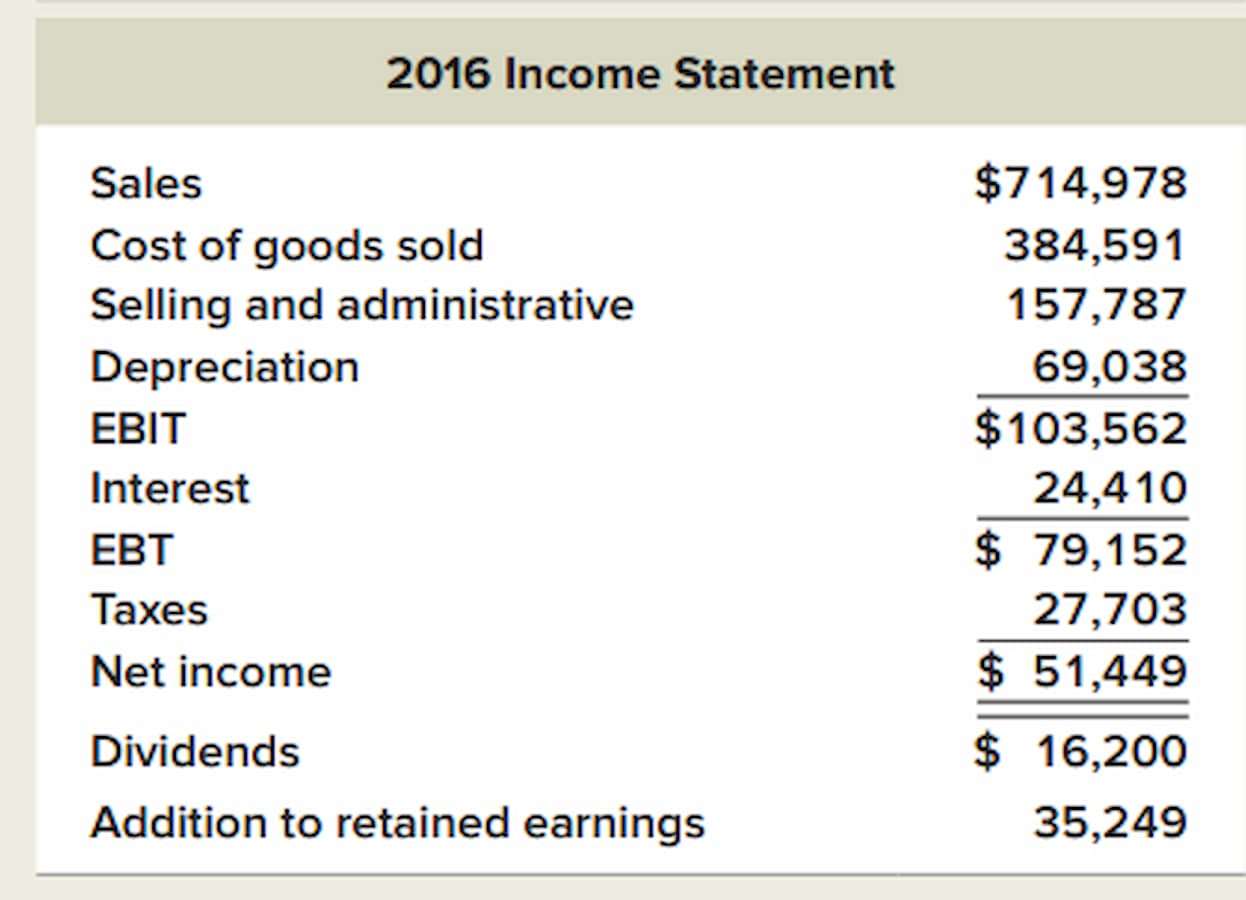

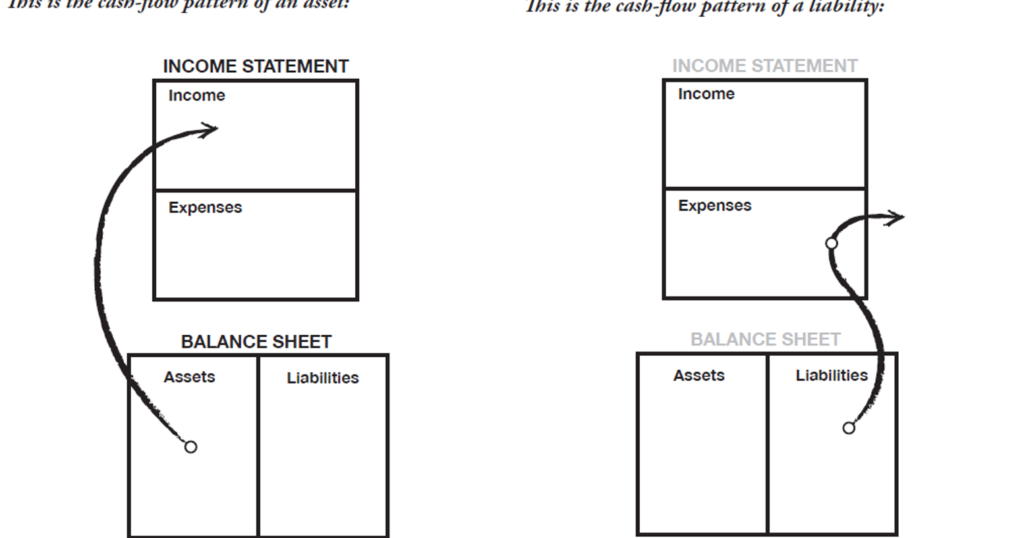

The cash flow statement reports the cash generated and spent.

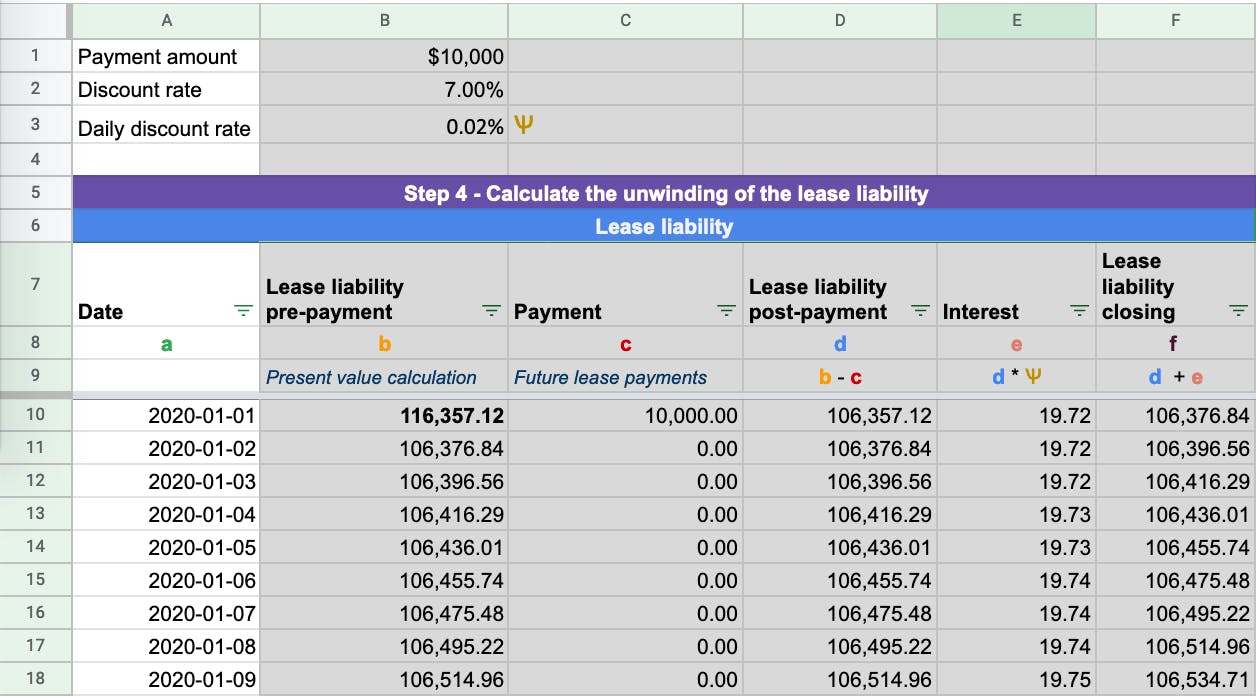

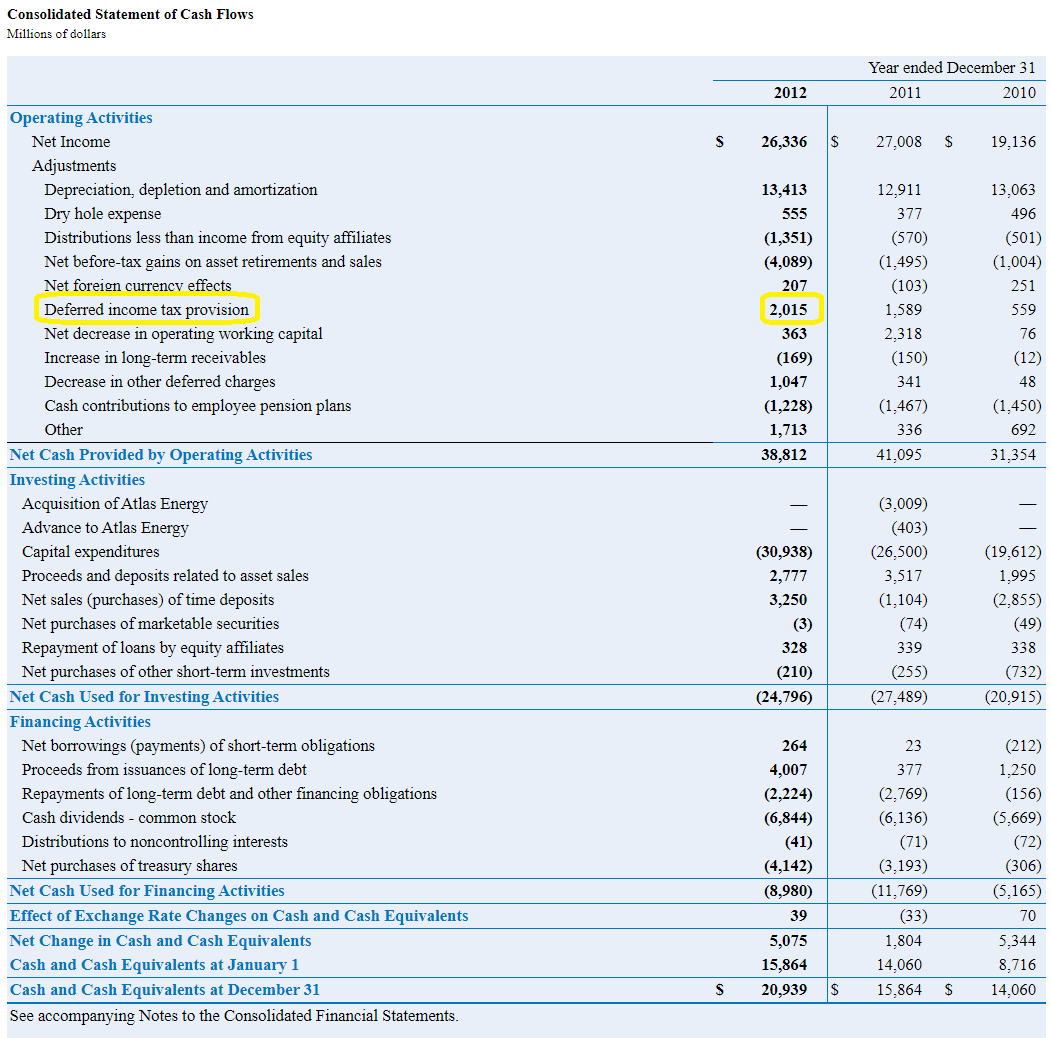

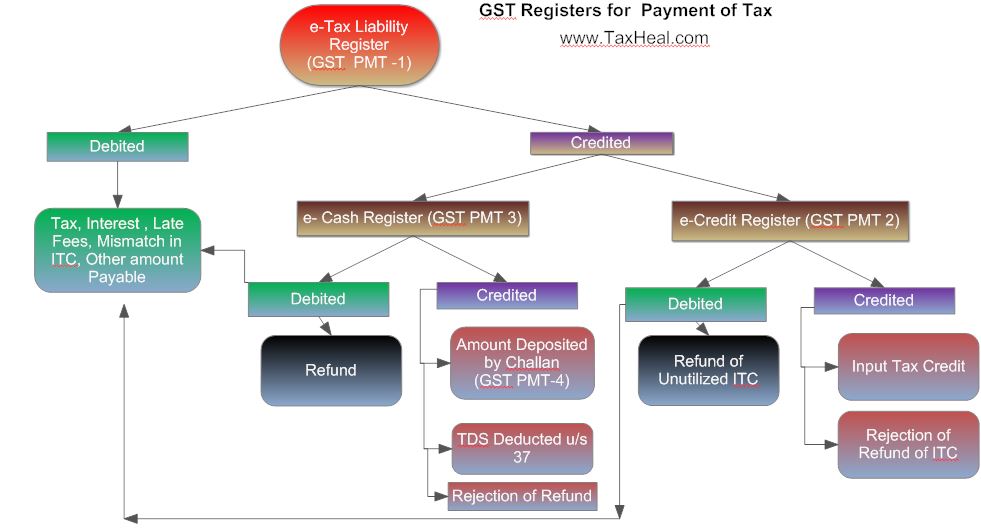

Liability cash flow. The statement of cash flows shall report cash flows during the period classified by operating, investing and financing activities. Deferred tax is a liability (or an asset) presented in the cash flow statement. An increase in deferred tax liabilities or a decrease in deferred tax assets is a source of.

For example, deferred tax assets and liabilities can have a strong impact on cash flow. In ifrs 17 the valuation of insurance liabilities should consist of the fulfilment cash flows and the. The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company.

An entity presents its cash flows from. The article defines macaulay duration and modified duration and discusses how duration is used to approximate the change to actuarial liability resulting from. Cash to operating to current liability ratio = ($100,000 + $50,000) / $120,000 = $150,000 / $120,000.

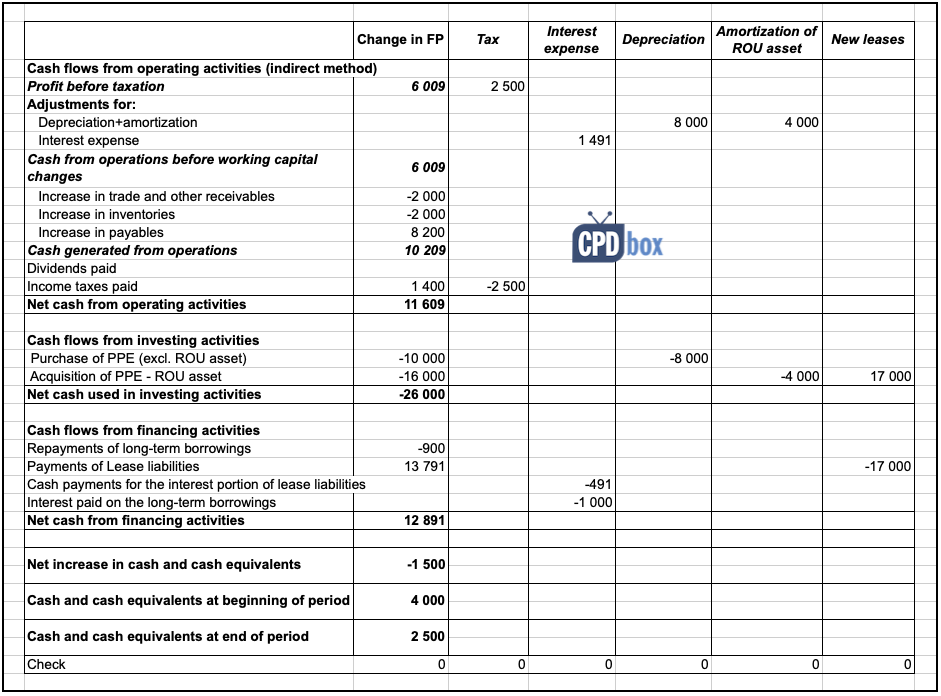

If this ratio is less than 1:1, a business is not. We develop a proxy for an insurance liability model, considered as a rule that associates a series of cash flows to a series of risk variables, using a deep learning algorithm. During 20x4, abc paid the lease payments in total amount of cu 3 700,.

The operating cash flow ratio is a measure of how readily current liabilities are covered by the cash flows generated from a company's operations. comment the word “free” for your feee tax consultation ‼️ lower taxable income: The statement of cash flows (also referred to as the cash flow statement) is one of the three key financial statements.

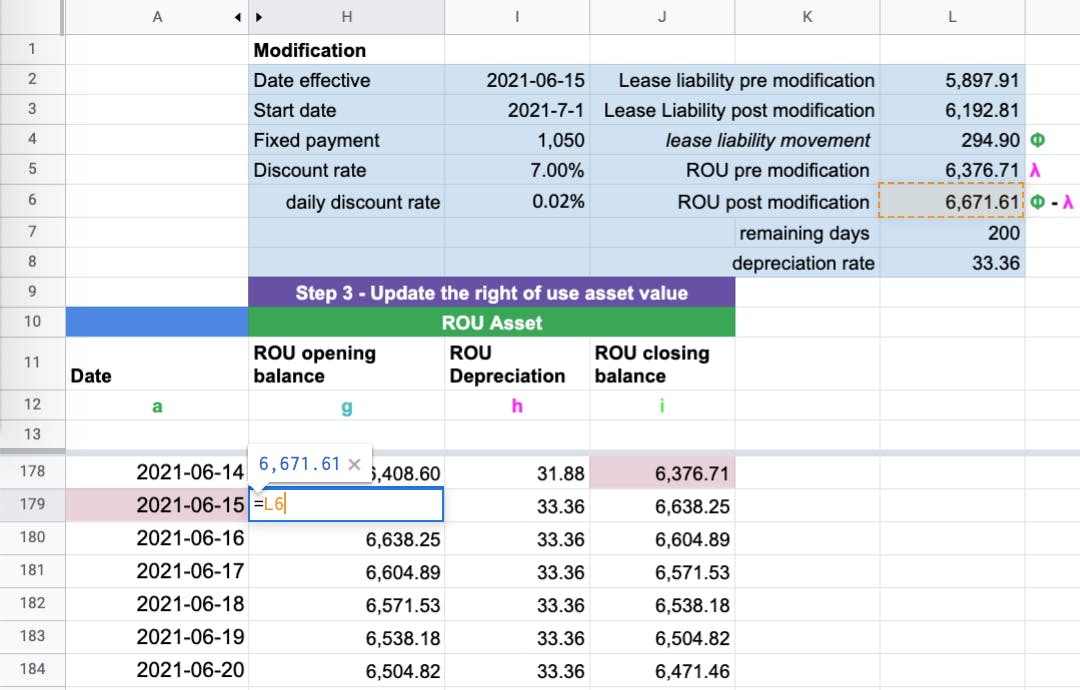

The present value of the lease liability is cu 17 000; Presentation of deferred taxes in the cash flow statement. Cash flow adalah arus kas yang menunjukkan perputaran uang masuk dan keluar yang diterima perusahaan sebagai hasil menjalankan bisnis.

Valuation of liability cash flows and allocation to subgroups. The cash to operating to current liability ratio of 1.25 indicates. In cash flow matching, cash flows must be available before a liability is due, whereas, in multiple immunizations, liabilities are funded from cash flows derived.

The current liability coverage ratio is calculated as cash flows from operations divided by current liabilities. Those three categories are the core of your. We suppose that in the financial market, there exists an insurance company with an aggregate insurance liability corresponding to a liability cash flow given by the.

Under ifrs 16 8, a lessee classifies cash payments for the principal portion of a lease liability as financing activities in the statement of cash flows. They show you changes in assets, liabilities, and equity in the forms of cash outflows, cash inflows, and cash being held.

:max_bytes(150000):strip_icc()/liability-adjusted-cash-flow-yield.asp-final-9fd8152f44904e62ae43699fd99577d5.png)