Here’s A Quick Way To Solve A Info About Understanding Profit And Loss

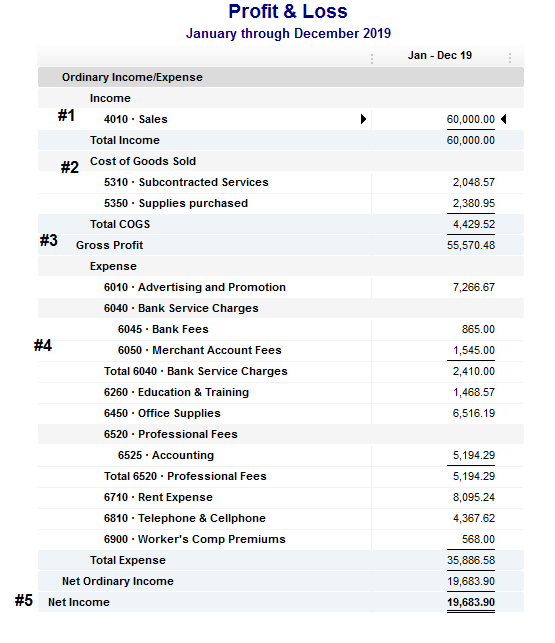

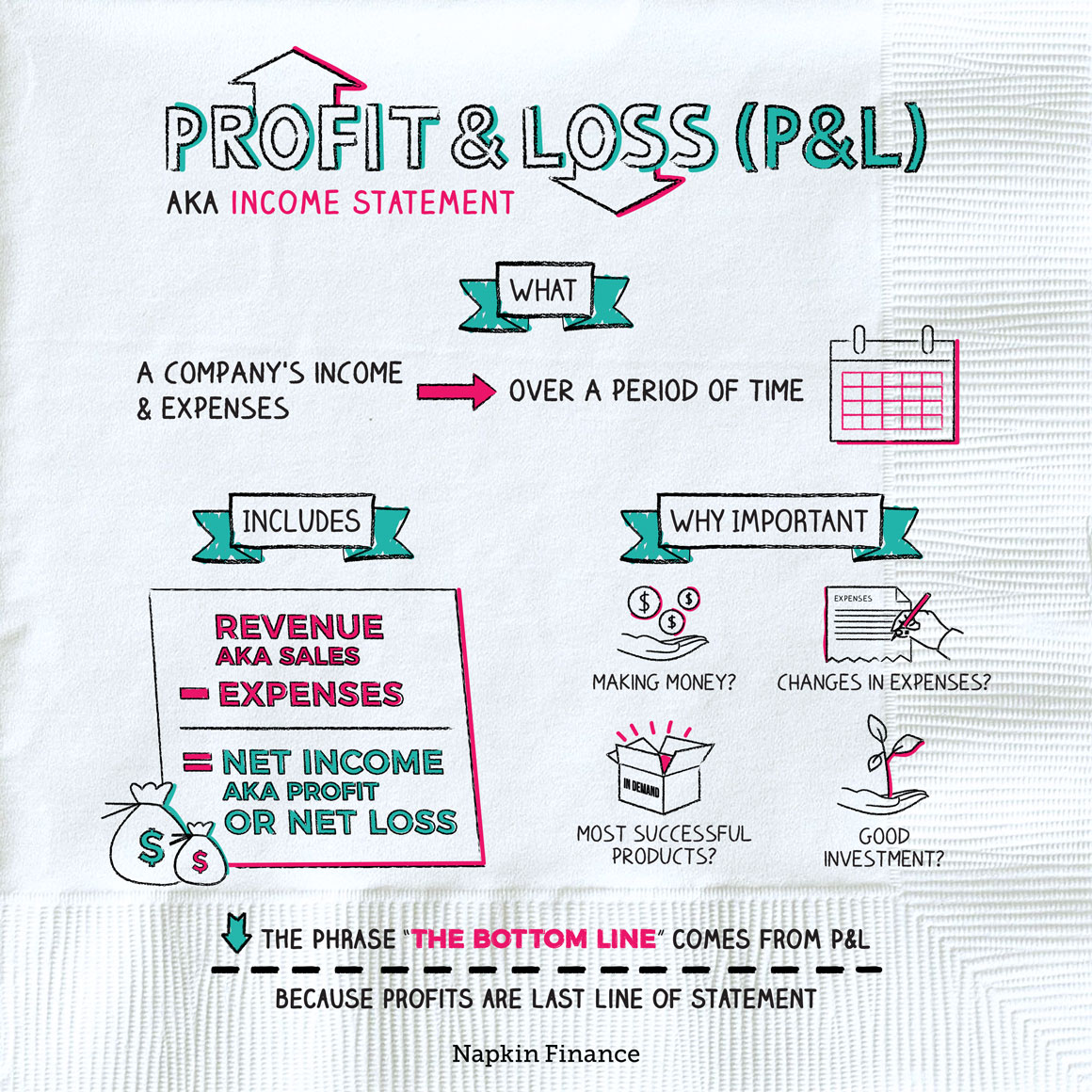

It starts with the top line (total revenue) and ends with t he bottom line (net income or net profit/loss).

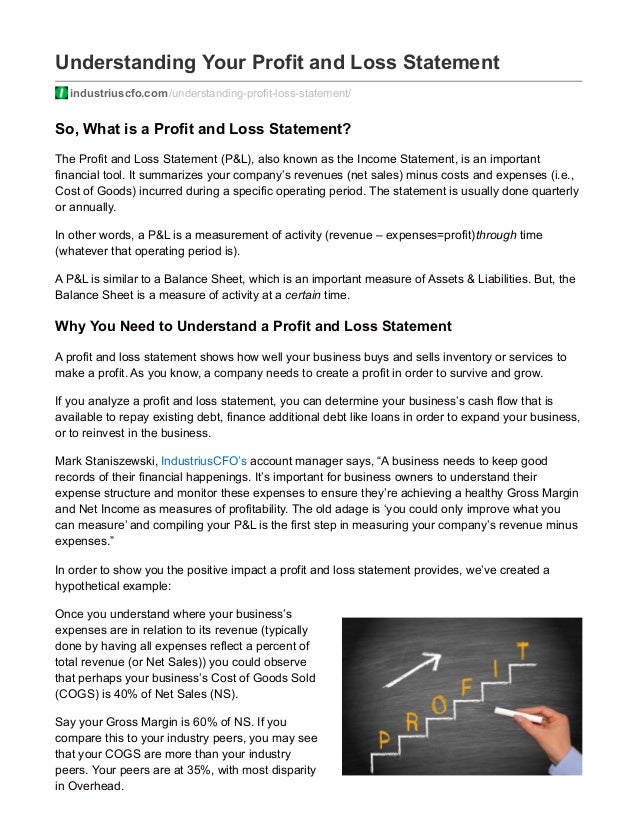

Understanding profit and loss. Like balance sheets, a profit and loss sheet is a way to represent complicated info in a simple manner. You use irs schedule c to report all business income and losses. On the simplest level, you create a p&l by deducting the costs of running the organization from its income.

It’s sometimes referred to as an ‘income and expenditure account’ or a ‘statement of financial performance.’. Measures net income or loss over a defined period of time. Also known as an income statement;

Understanding the profit and loss statement (plus a template to download) the profit and loss (p&l) statement is a pivotal gauge of financial performance. According to the irs, an activity qualifies as a business if you engage in the activity for the primary purpose of profit, and continue the activity regularly. The oil and gas company's earnings statement showed that adjusted net income totalled 513 million euros ($556 million) in.

Based on the values of these prices, we can calculate the profit gained or the loss incurred for a particular product. A calculation to show how your tangible assets lose value over time. This enables you to see if you have a profit or loss for the period under.

The rising costs overshadowed a decent holiday quarter. Understanding the schedule c excess business loss limitation. Here are the most common terms in the profit and loss account that you need to understand:

Profit and loss compared to other financial statements the p&l, also referred to as the income statement or statement of revenue and expense, is typically used alongside other key financial reports like the balance sheet and cash flow statement to determine the health of a business. A profit and loss statement, or a p&l statement or income statement, is a financial document that summarizes a company's revenues, expenses, and profits/losses over a given period. The starting point for any p&l is the sales and income that the organization makes and earns.

A p&l statement provides information about whether a company can. This is your income minus the cost of goods sold, expenses and taxes. Calculate the total business profit or loss and input.

Profit and loss statement (p&l): Bringing together a company’s revenues, costs, and expenses, p&l speaks of profitability and shapes strategic decisions. However, it only works if done correctly.

Example of a p&l statement. Understanding financial statements to understand a company’s financial position—both on its own and within its industry—you need to review and analyze several financial statements: Online governance training for non profit organisationsgovernance training for non profit organisationsgovernance is a system of checks and balances which help leaders of not for profit organisations steer and grow their organisation.

A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. Understanding the key elements of a p&l statement is crucial for any business owner. Then, it subtracts the costs of making those goods or providing those services, like.