Peerless Info About Reconciling Items Balance Sheet

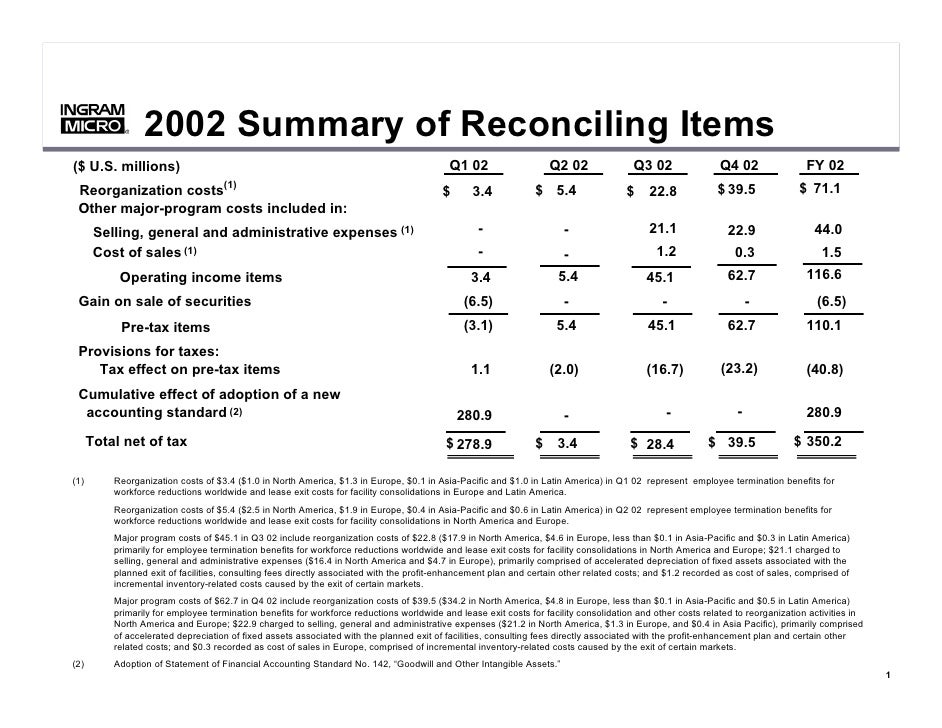

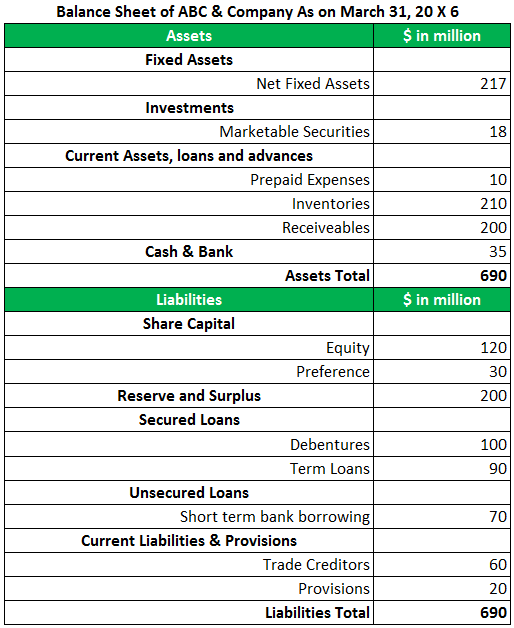

Balance sheet reconciliation is a process that involves comparing and matching the balances of the various accounts in a company's balance sheet to ensure the accuracy.

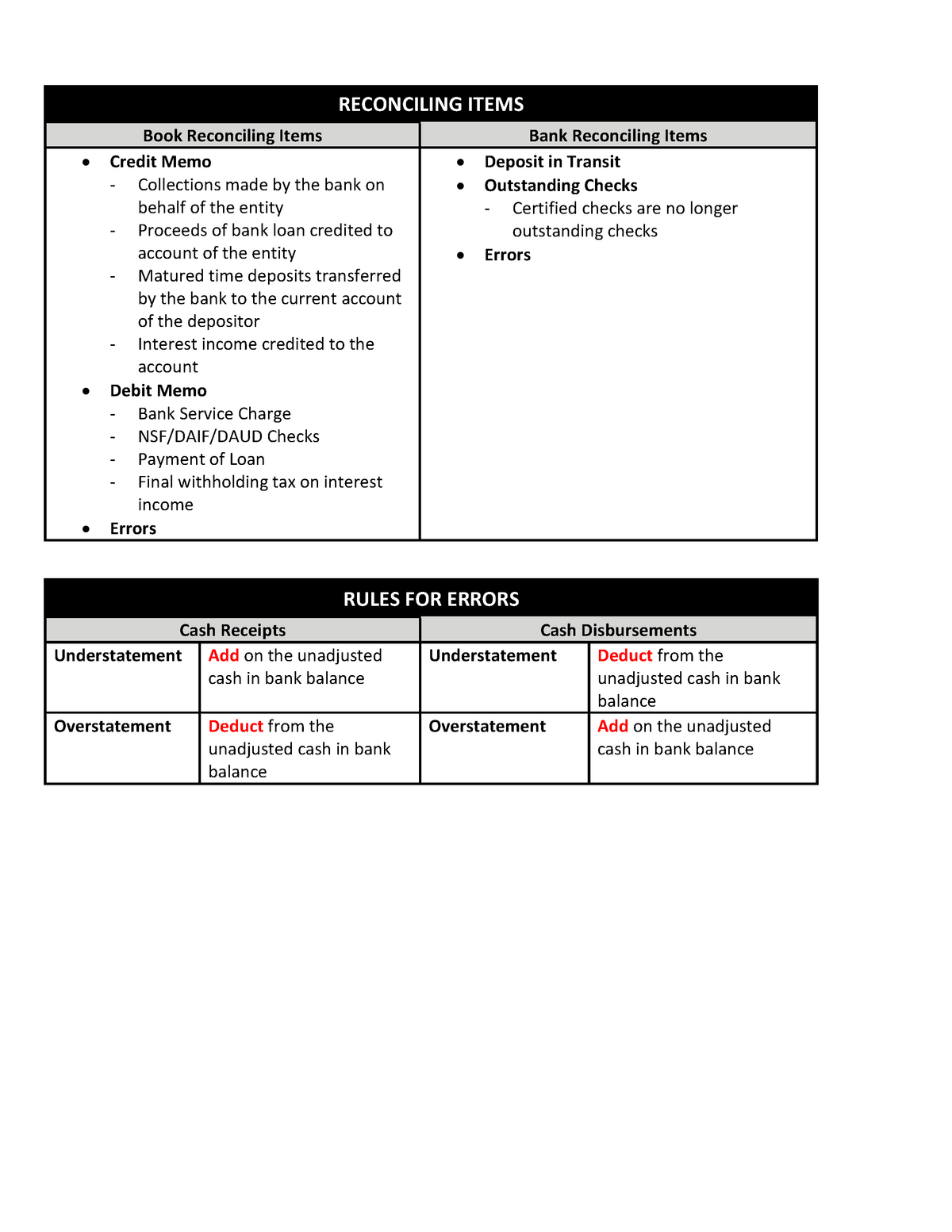

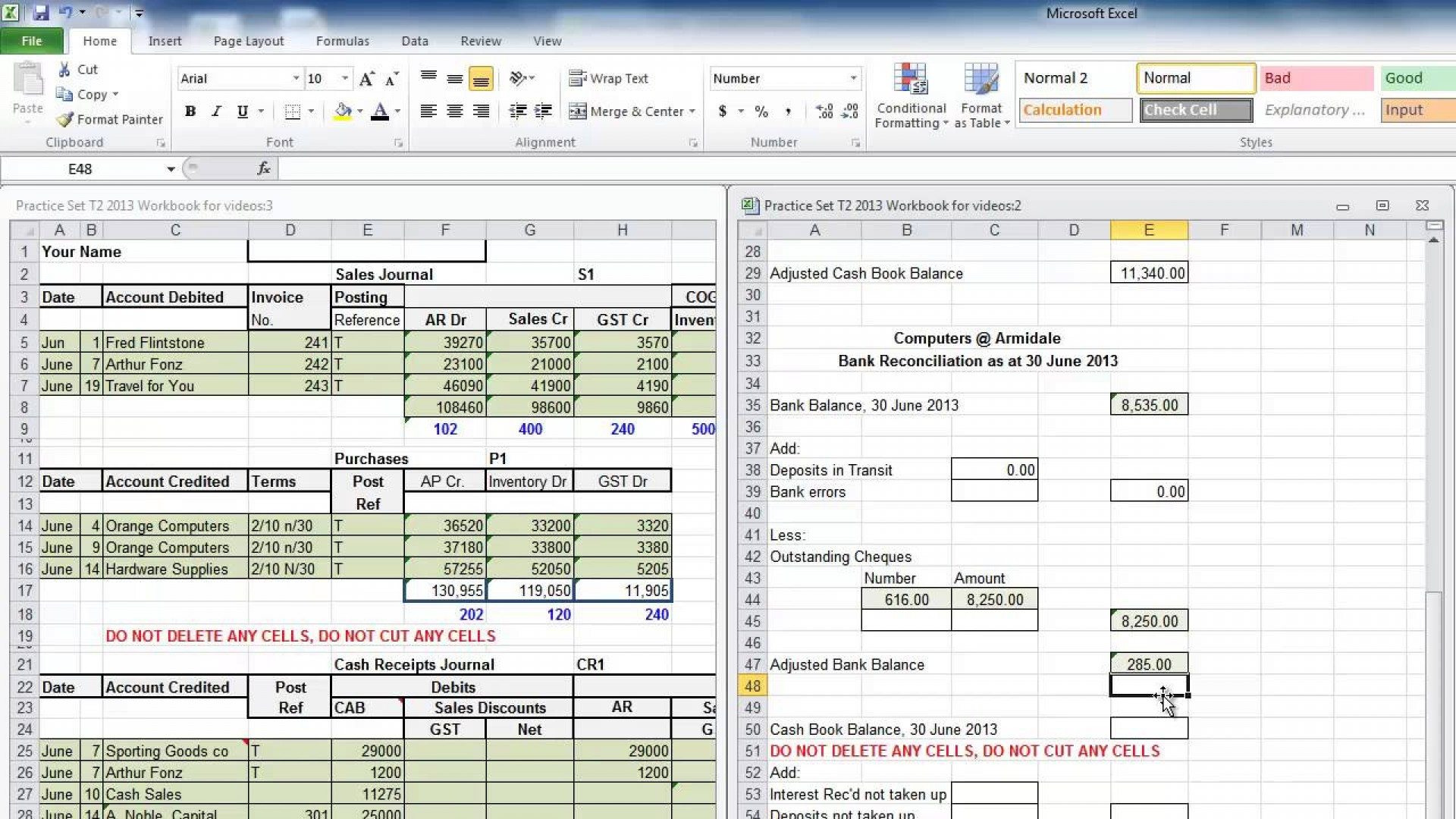

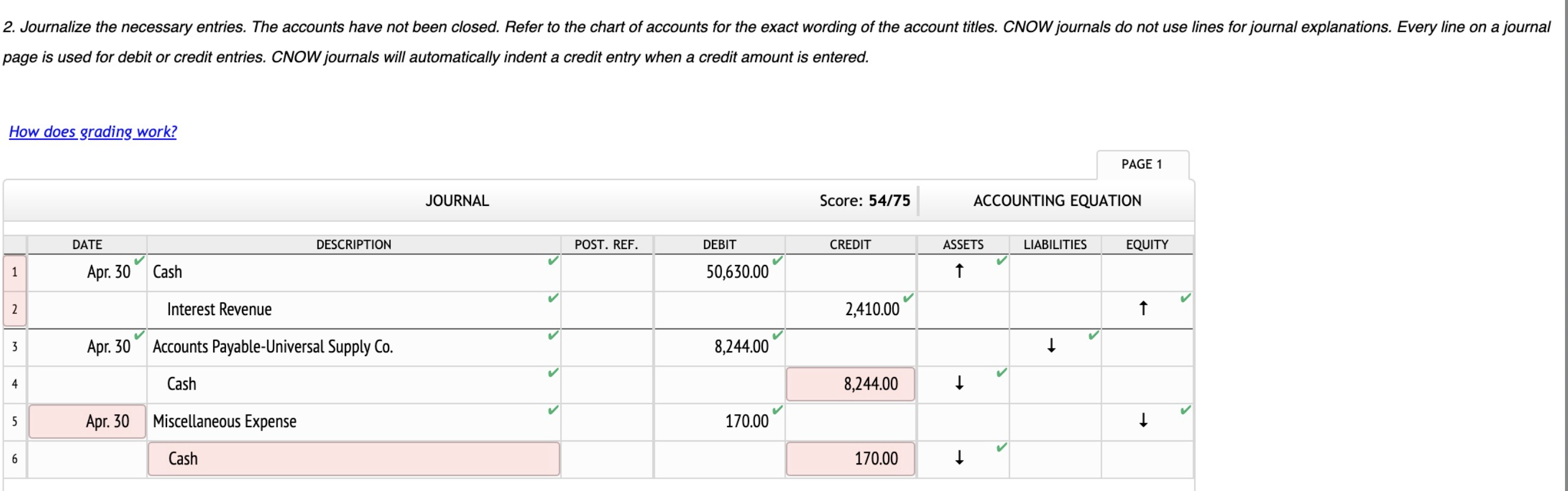

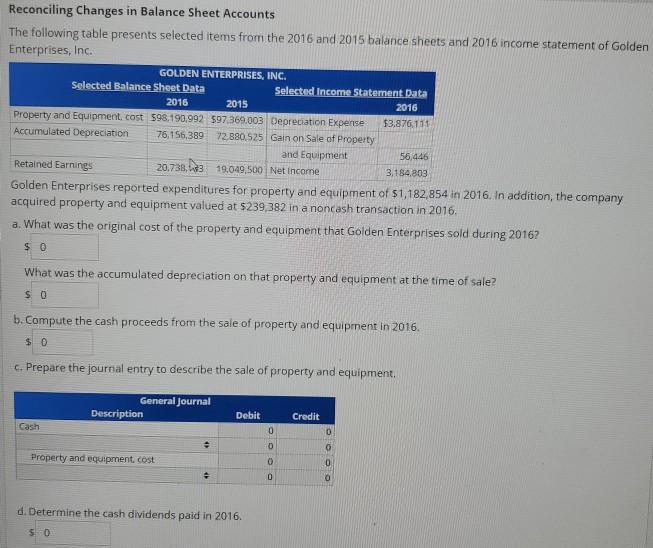

Reconciling items balance sheet. The register balance is, of course,. Reconciling balance sheets is the process of comparing and matching the balances of accounts on the balance sheet with the corresponding balances in. Accountants must reconcile credit card transactions, accounts payable, accounts receivable, payroll, fixed assets, subscriptions, deferred accounts, and other.

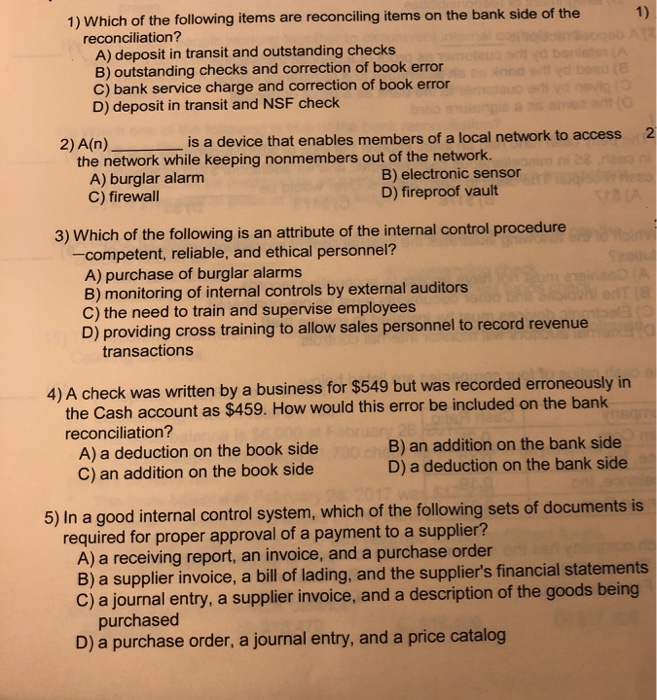

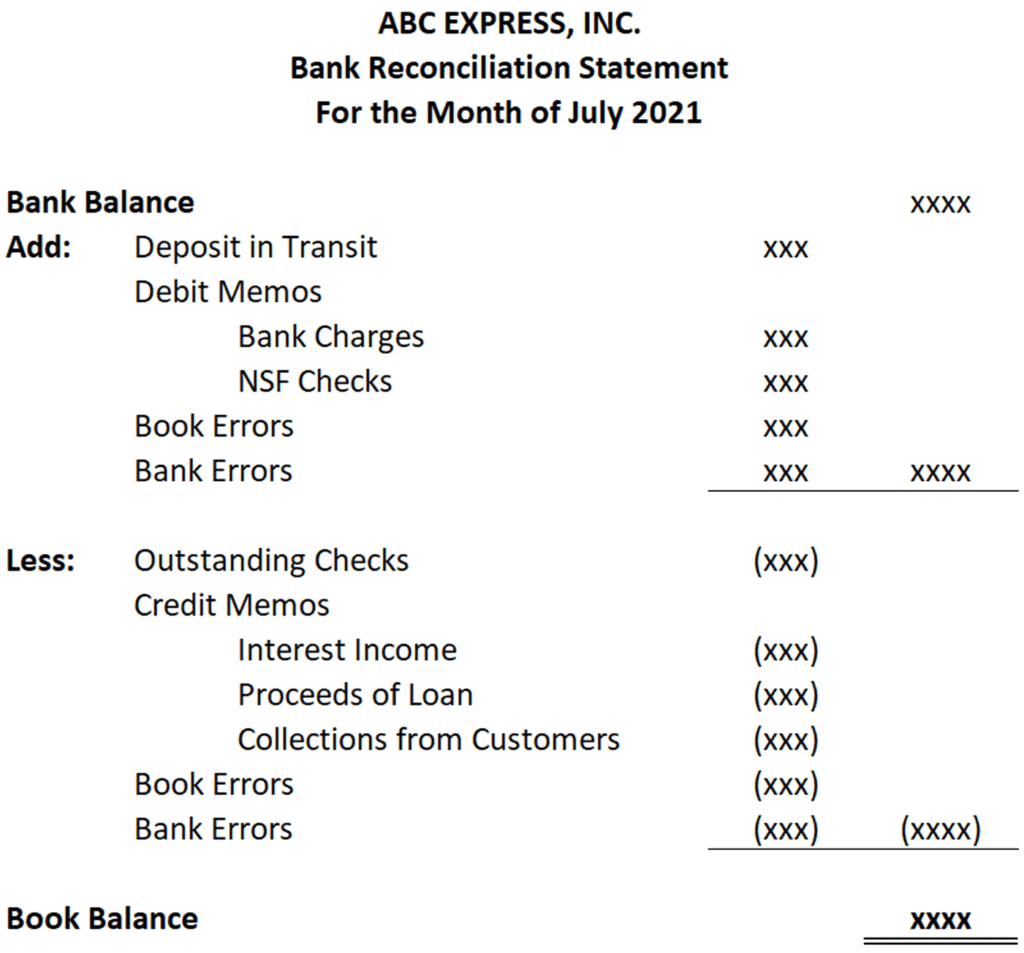

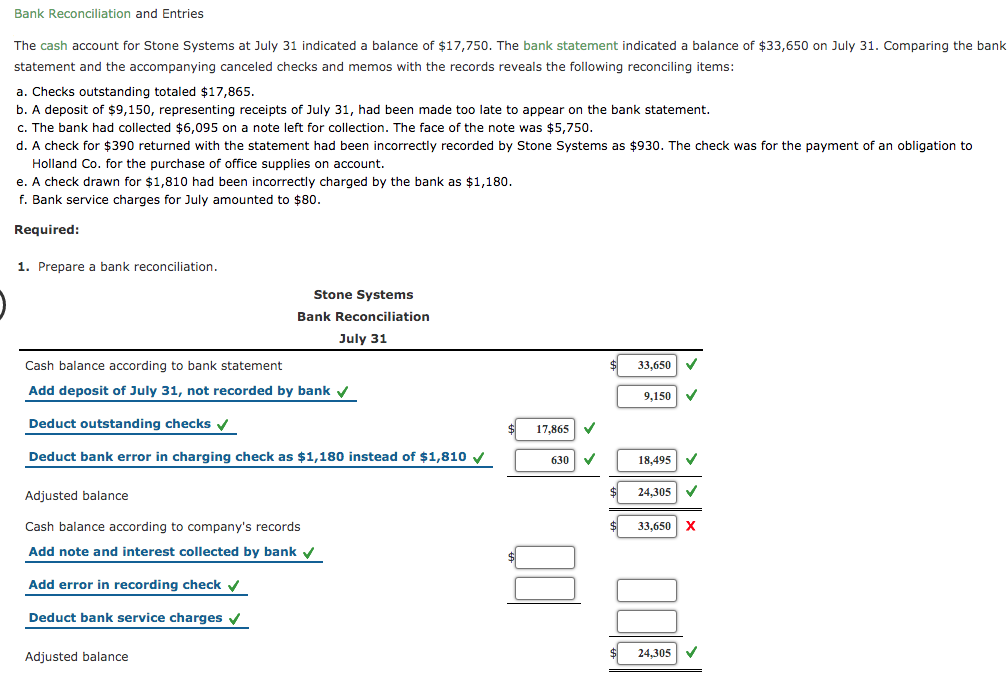

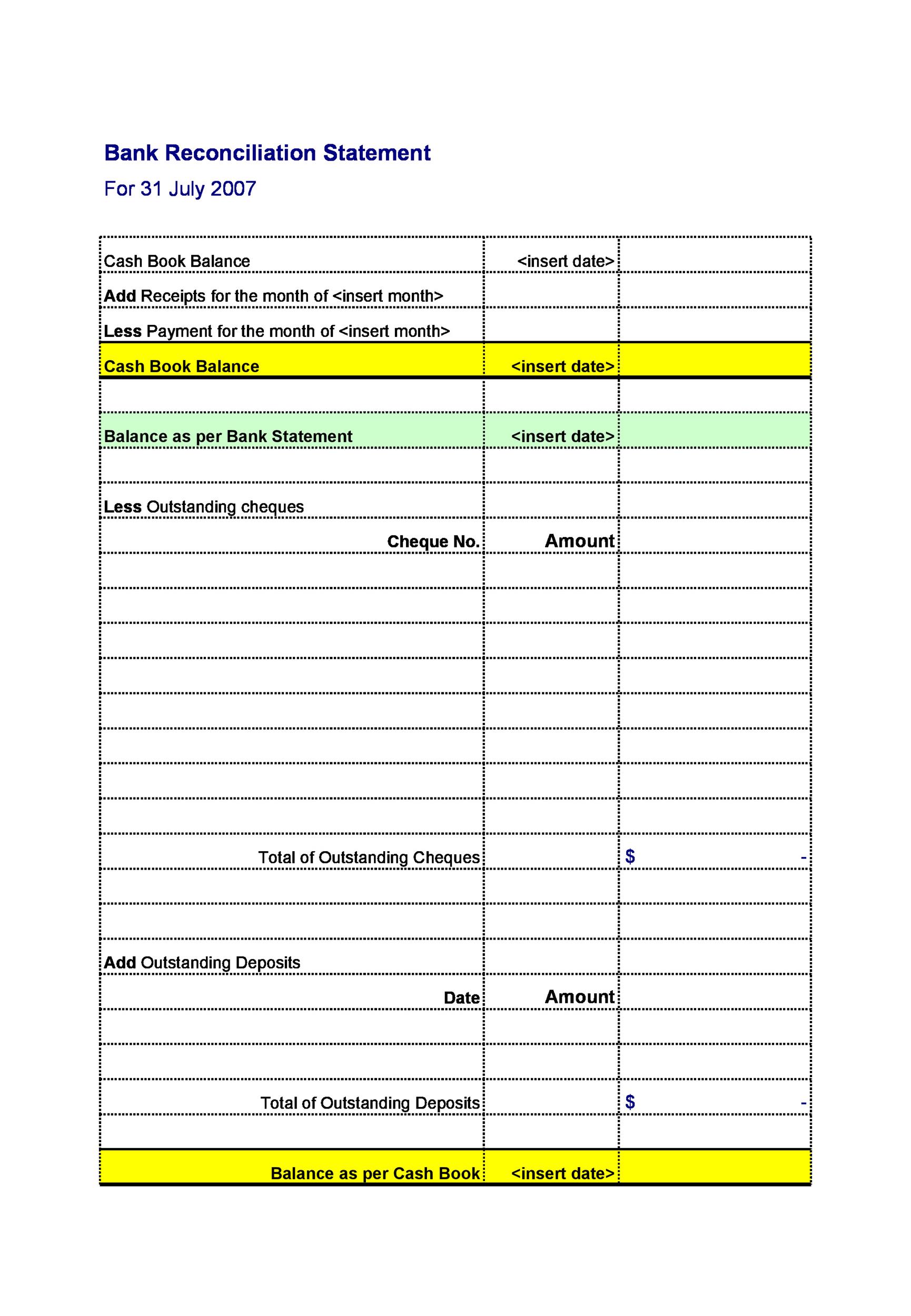

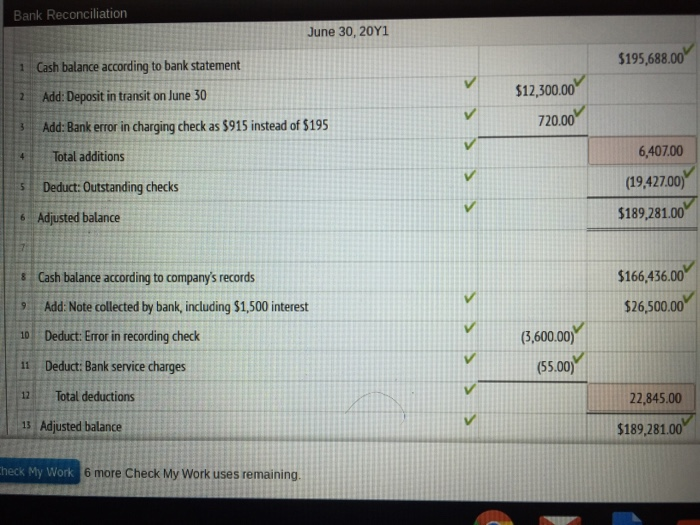

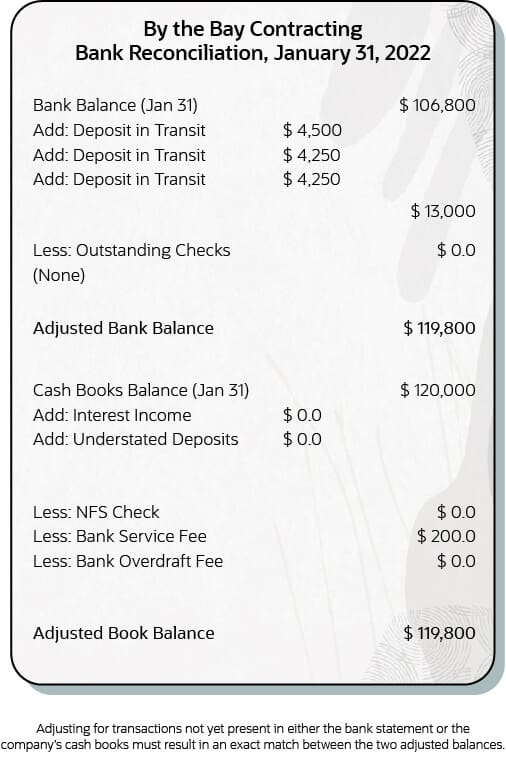

The first step requires the preparation of a separate work paper for each balance sheet account. Gather the necessary account information. A bank reconciliation statement is a document that compares the cash balance on a company’s balance sheet to the corresponding amount on its bank statement.

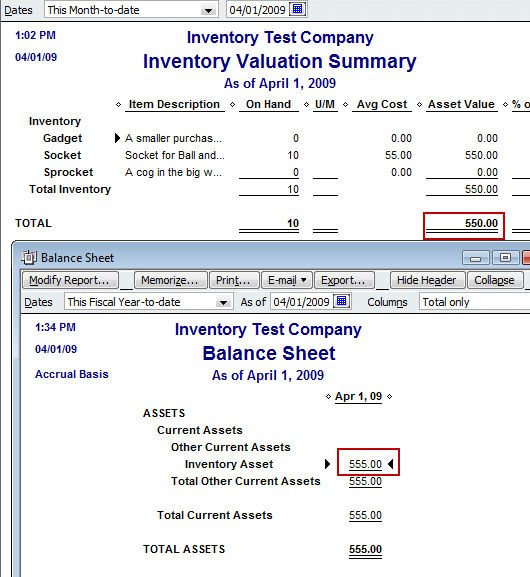

The bank reconciliation has been completed. Balance sheet reconciliation is the process of checking that closing balances on external statements match that of the general ledger entries and accounts. This balance sheet reconciliation is free to.

This reconciliation process involves the following steps: Accounting december 29, 2023 what is reconciliation in accounting? Identify the accounts to be reconciled.

6 key steps step 1: At its core, balance sheet reconciliation involves reconciling the accounts listed on the balance sheet with their corresponding entries in the general ledger. This includes cash accounts, accounts receivable, accounts payable,.

This includes the general ledger for the account and any supporting. How to reconcile balance sheet accounts: Ali mercieca , finance writer and editor, ramp 1 4.8 rating no personal credit checks or founder guarantee.

Summarize the ending balances in all revenue accounts and verify that the aggregate amount matches.