Cool Info About Opening And Closing Stock In Trial Balance

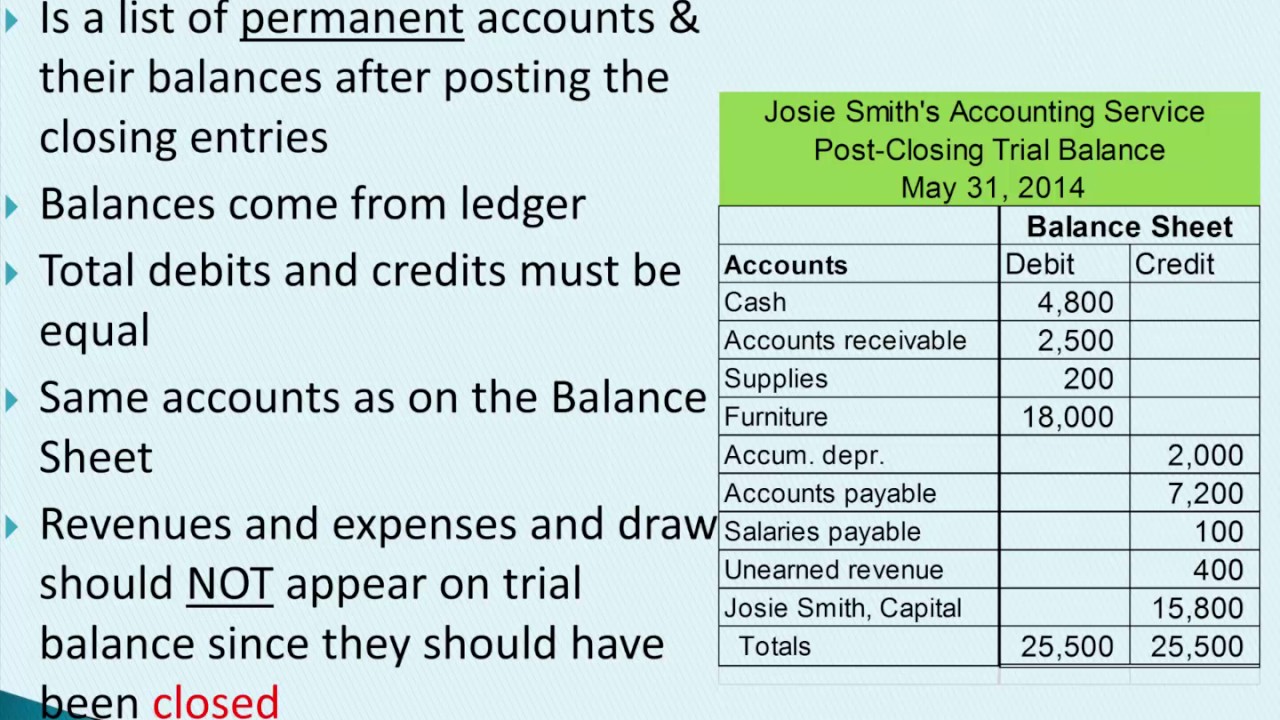

To find the report:

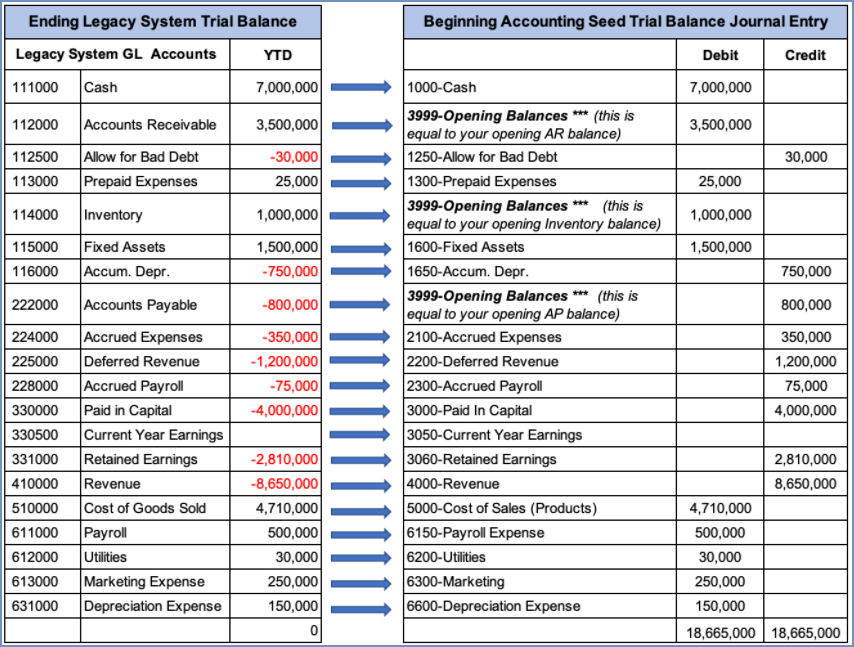

Opening and closing stock in trial balance. In such cases, we need to adjust the purchases for both opening and closing. Correct option is a) the closing stock represents the cost of unsold goods lying in the stores at the end of the accounting period. Look into the reports section.

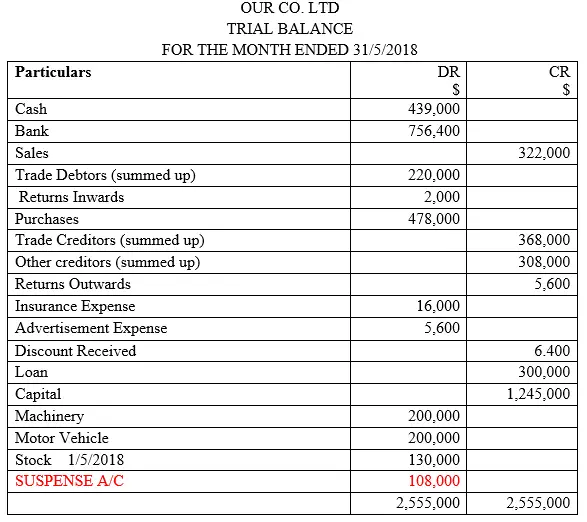

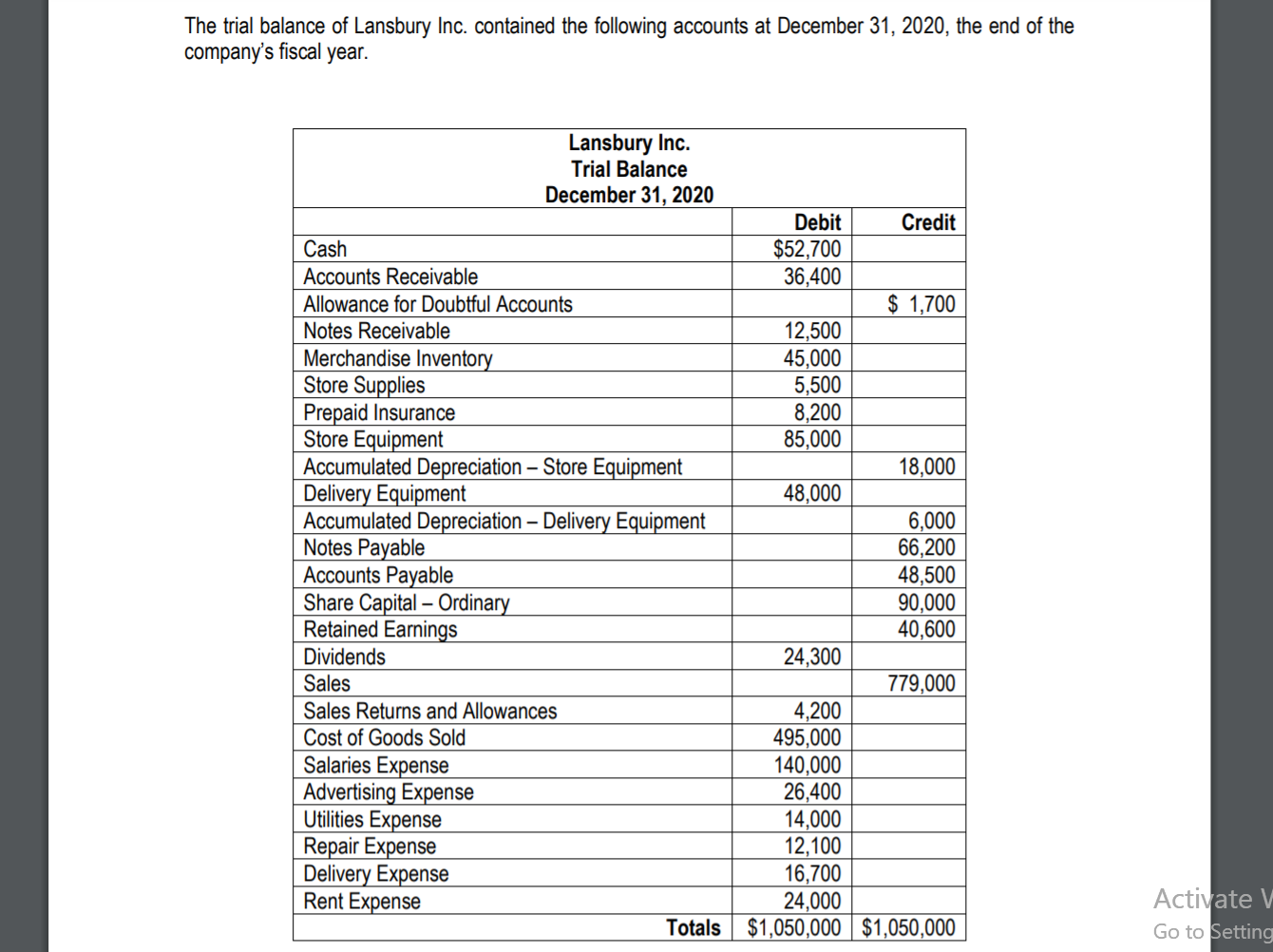

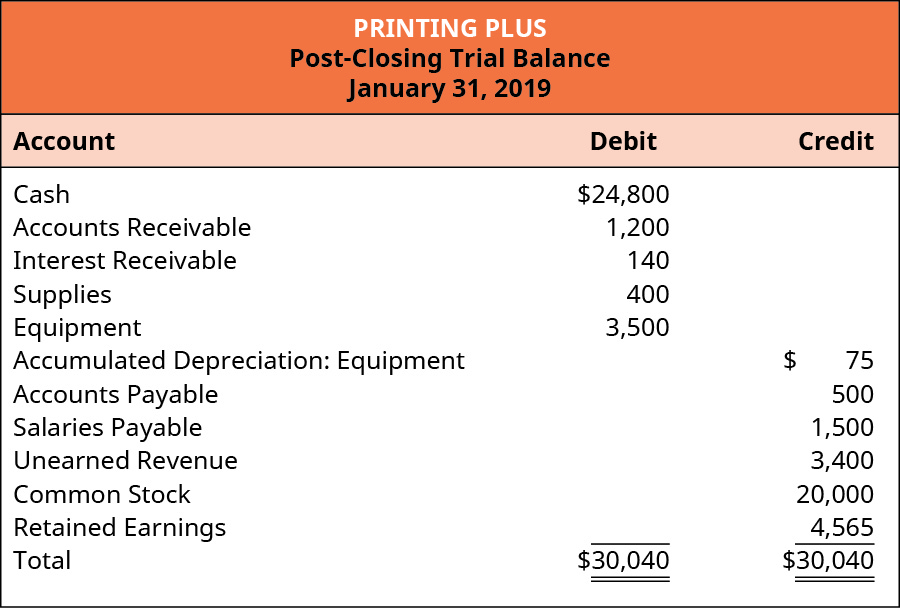

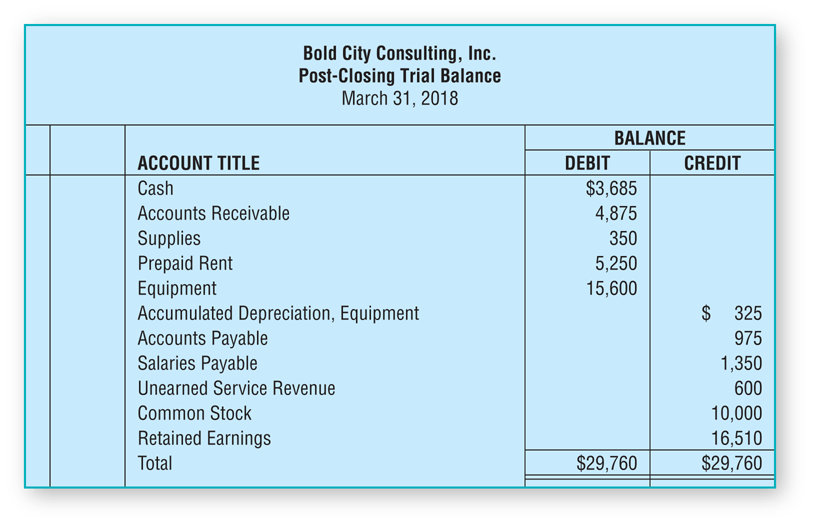

The closing stock of the year becomes the. Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company. Its purpose is to test the equality between debits and credits after the.

An item appearing in the trial balance has to be considered only once in final accounting. Total purchases are already included in the trial balance, hence. The unsold closing stock of the current year is the opening stock of the next year.

Thus, based on its nature, the closing stock a/c appearing in the trial balance, being a real account, is. This statement comprises two columns:. Sometimes, closing stock is recorded in the books of accounts before preparation of trial balance.

Closing stock is not shown in the trial balance. Would it be £13,551 as. Closing stock is the balance of unsold goods that are remaining from the purchases made during an accounting period.

How it works by default, the profit and loss report calculates gross profit without opening and closing stock: Given that the current year's unsold closing stock will be sold in the next. The two types of the accounting treatment of closing stock are as follows:

Click on the transactions button. A trial balance is an important step in the accounting process, because it helps identify. Recommended articles closing stock explained closing stock represents the value of the inventory remaining at the end of an accounting period, usually a fiscal year.

Opening stock account which has a debit balance is recorded in the debit column of the trial balance. Closing stock is computed by taking the beginning inventory plus all of the purchases or goods that were received during the accounting period and subtracting out. Closing stock is shown in the trial balance.

Yes that does make sense, what i really needed clarifaction on was, the figure for closing stock that i need to put in the adjustments for closing stock. After this posting, 5200 is. When you start using opening and closing stock, the opening stock value at the start of the year is posted to the opening stock nominal code, 5200.

Navigate to the financials tab. The closing stock balance shown in the trial balance represents an asset and thus the closing stock a/c is a real account. The opening balance is usually that balance which is brought forward at the beginning of an accounting year from the end of a previous accounting year.