Unbelievable Tips About Interest On Capital In Profit And Loss Account

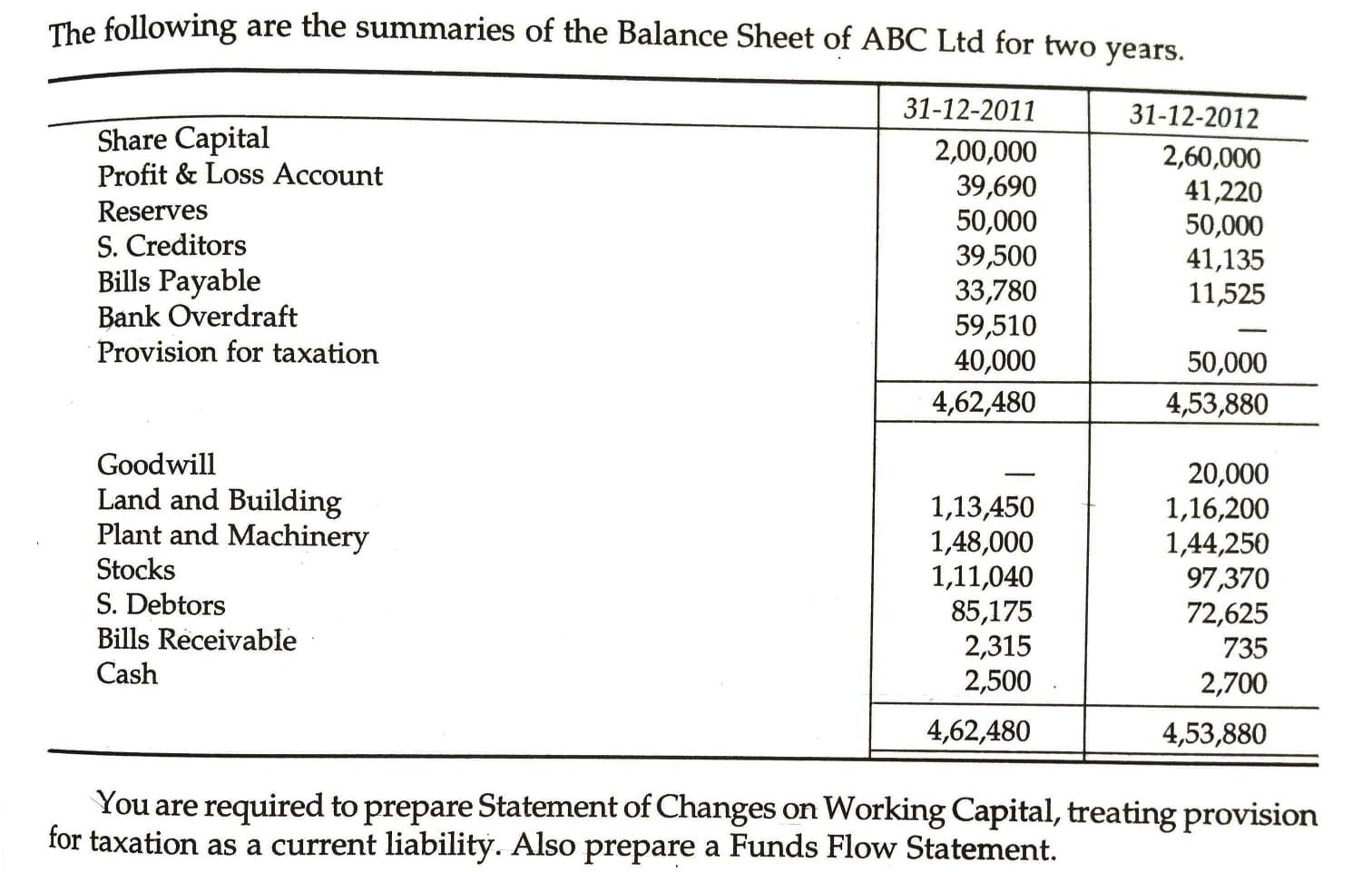

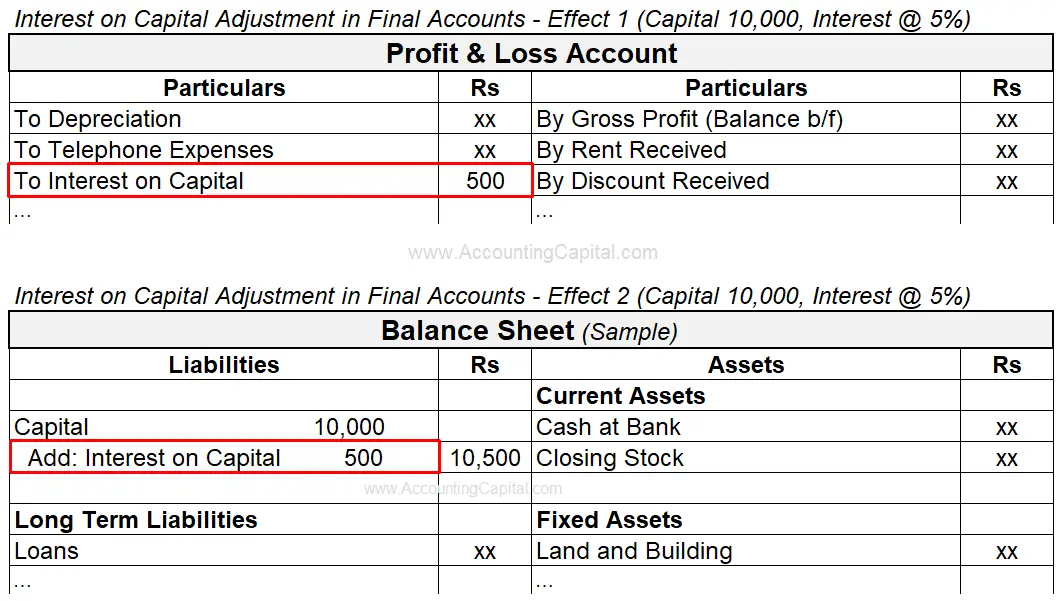

Interest on capital is deducted from the profit and loss statement of the business and is recorded as an expense on the debit side and added to the partner’s.

Interest on capital in profit and loss account. On the other hand, it is a personal expense of the owner. Since the profit is less than the interest, the. Over the past few years, the offshore wind sector has been subject to renewed yet growing interest from the industry and from the research sphere, with a.

(a) do not put partners' salaries or interest on capital into the main income statement. The amount of capital in the business is not fixed but changes as the business buys assets, borrows funds and makes a profit or loss. The formats of the annual balance sheet and the profit and loss account of the ecb are set out in annexes ii and.

It is not paid in cash or by. (a) interest on capital is. Unlike the capital account, under these repetitive capital related.

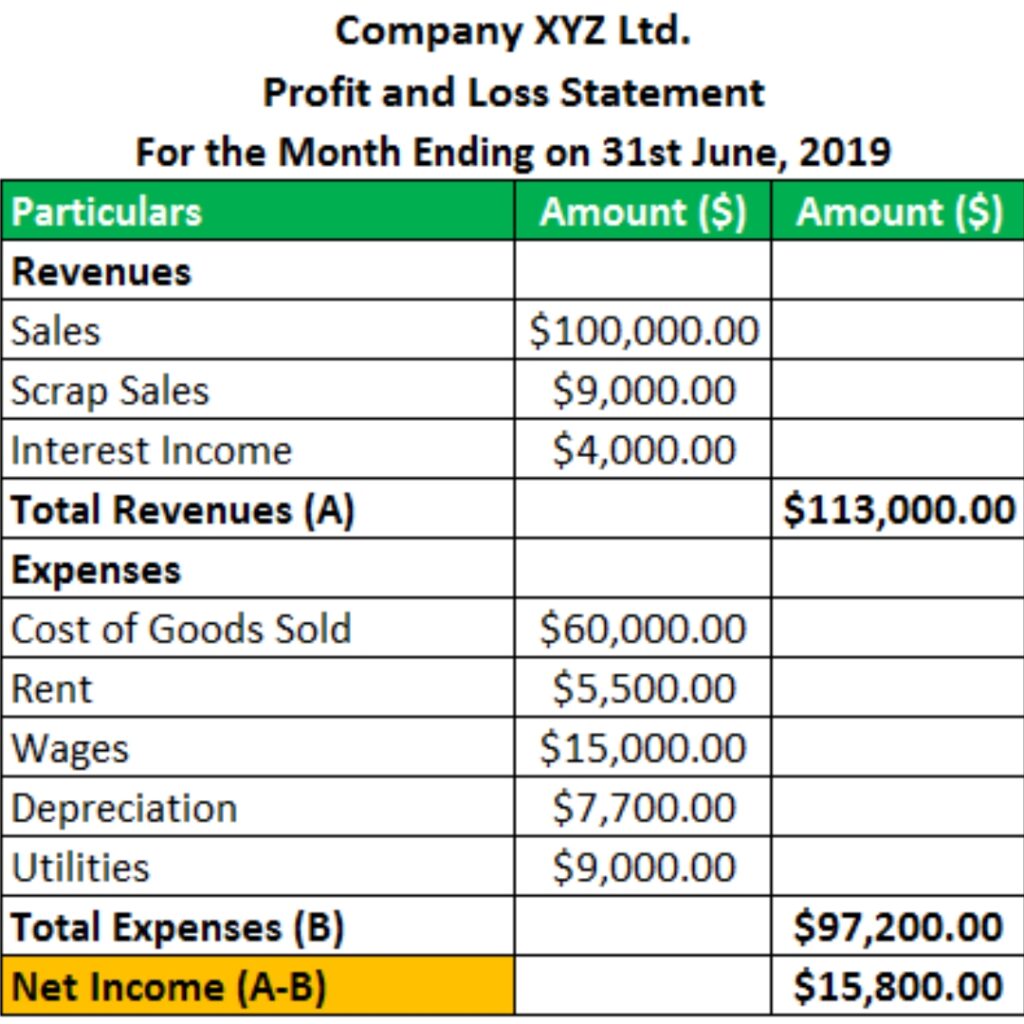

Interest on capital is an expense for the business and is added to the capital of the proprietor thereby increasing his total capital in the business. Interest at a normal rate is calculated on owner's capital and is charged to the income statement (or profit and loss account) for the purpose of ascertaining what. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and.

The profit available is ₹30,000, whereas the interest due on capital is ₹60,000 (i.e., ₹40,000+₹20,000). Only indirect expenses are shown in this account. Net profit transferred to the.

Prepare profit and loss appropriation account and the partner’s capital accounts at the end of april 30 th, 2020, after considering the following items: (a) fixed capital account a firm prepares fixed account with very basic capital related transactions. Payments designated for dividend payments.

Since the merger was first proposed in october 2021, legal , regulatory and financial questions have swirled about the. They belong only in the division of profit statement section. Salary 30,000 interest on capital account 4,000 interest on loan account.

Profit and loss appropriation account. All the items of revenue and expenses. Profit and loss account is made to ascertain annual profit or loss of business.

Interest on capital, 5. (b) do not include drawings. In case of a sole proprietorship, there is a single owner and any addition in the capital in form of net profit or reduction in form of.

The profit from the profit and loss account is shown on the credit side, whereas the distribution of profit among partners is shown on the debit side. Interest on capital account 2,000 interest on drawings account 500 partner b: Questions on capital, reserves, provisions and loss.