Wonderful Tips About Profit And Loss Income Statement

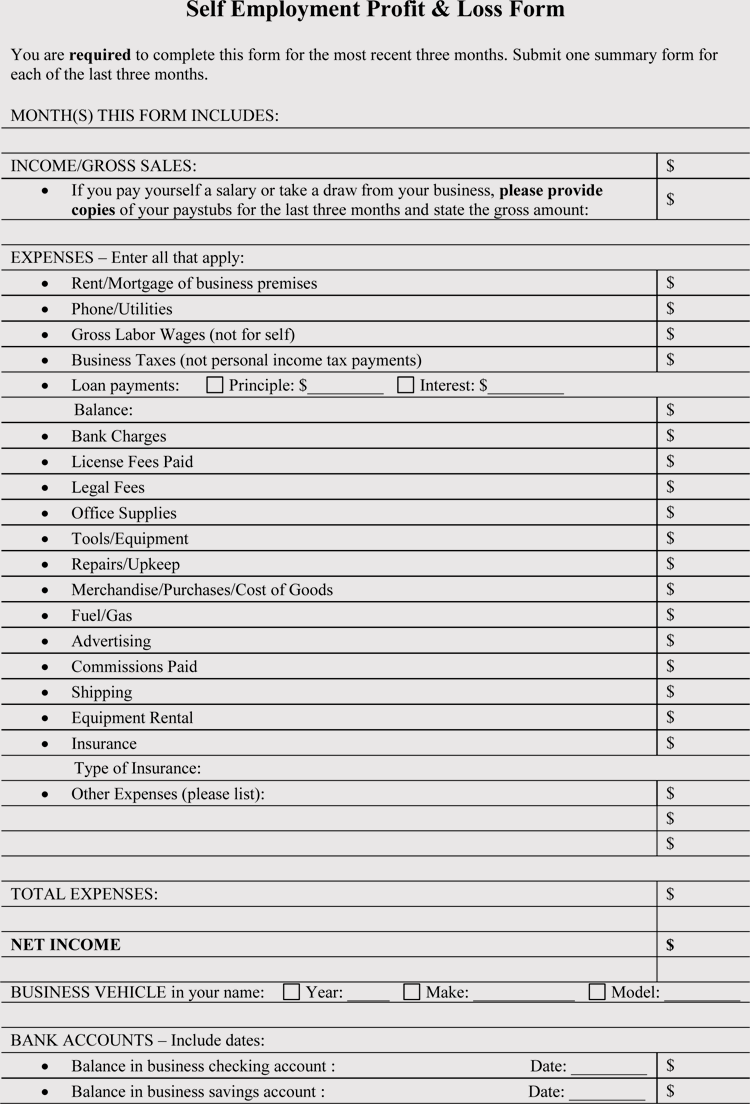

Expenses are outgoings, such as the cost of buying products.

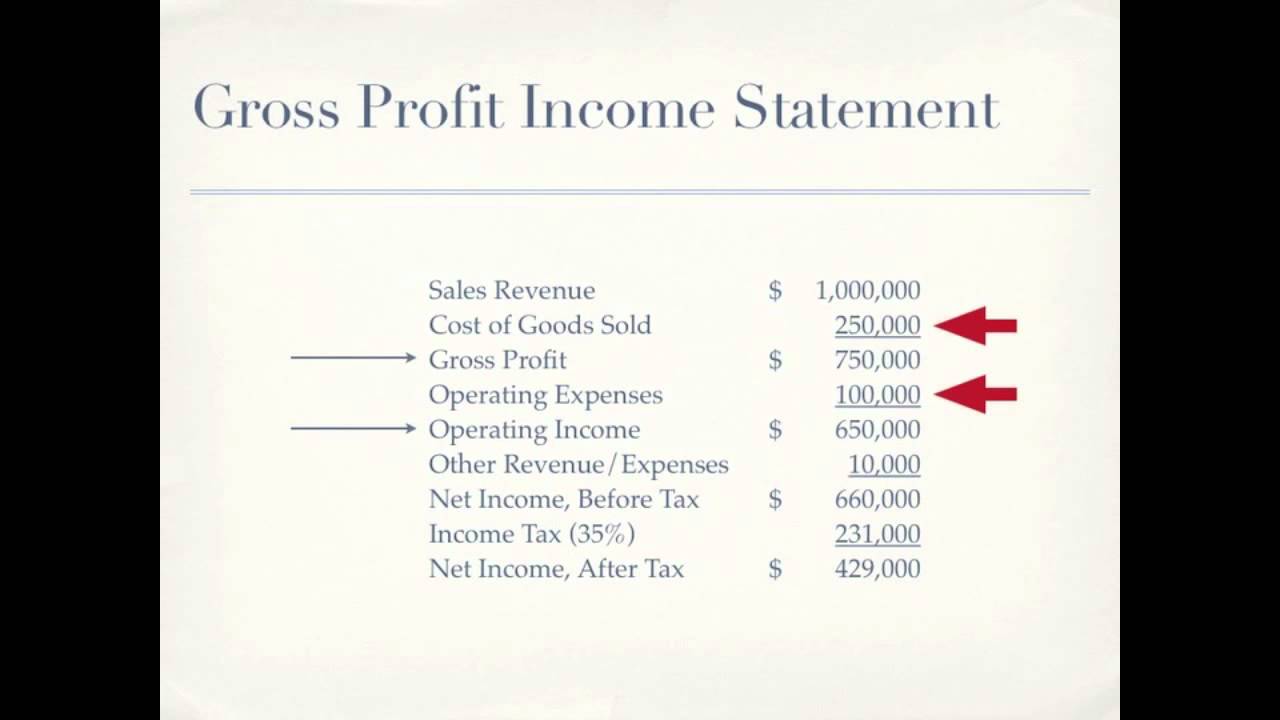

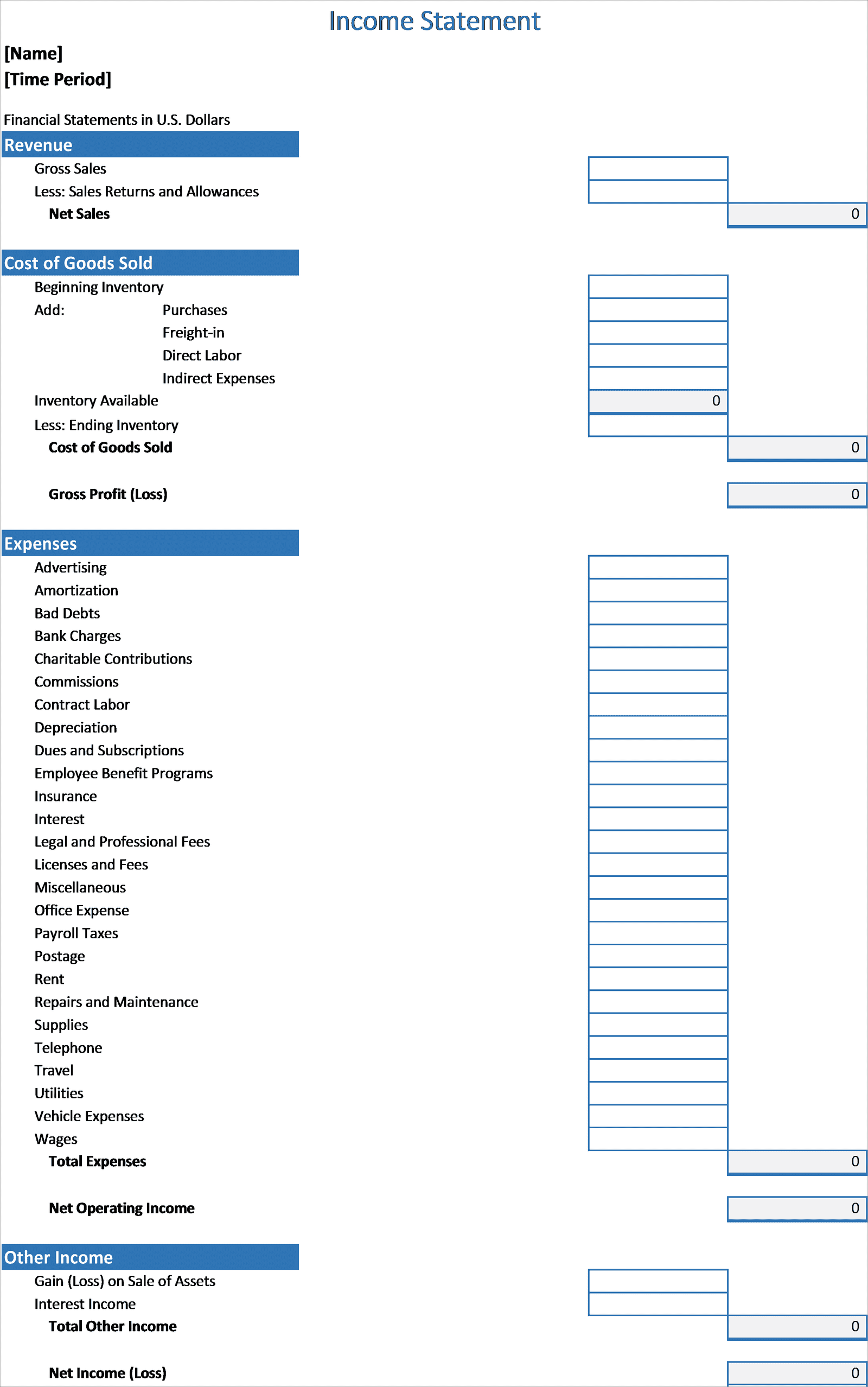

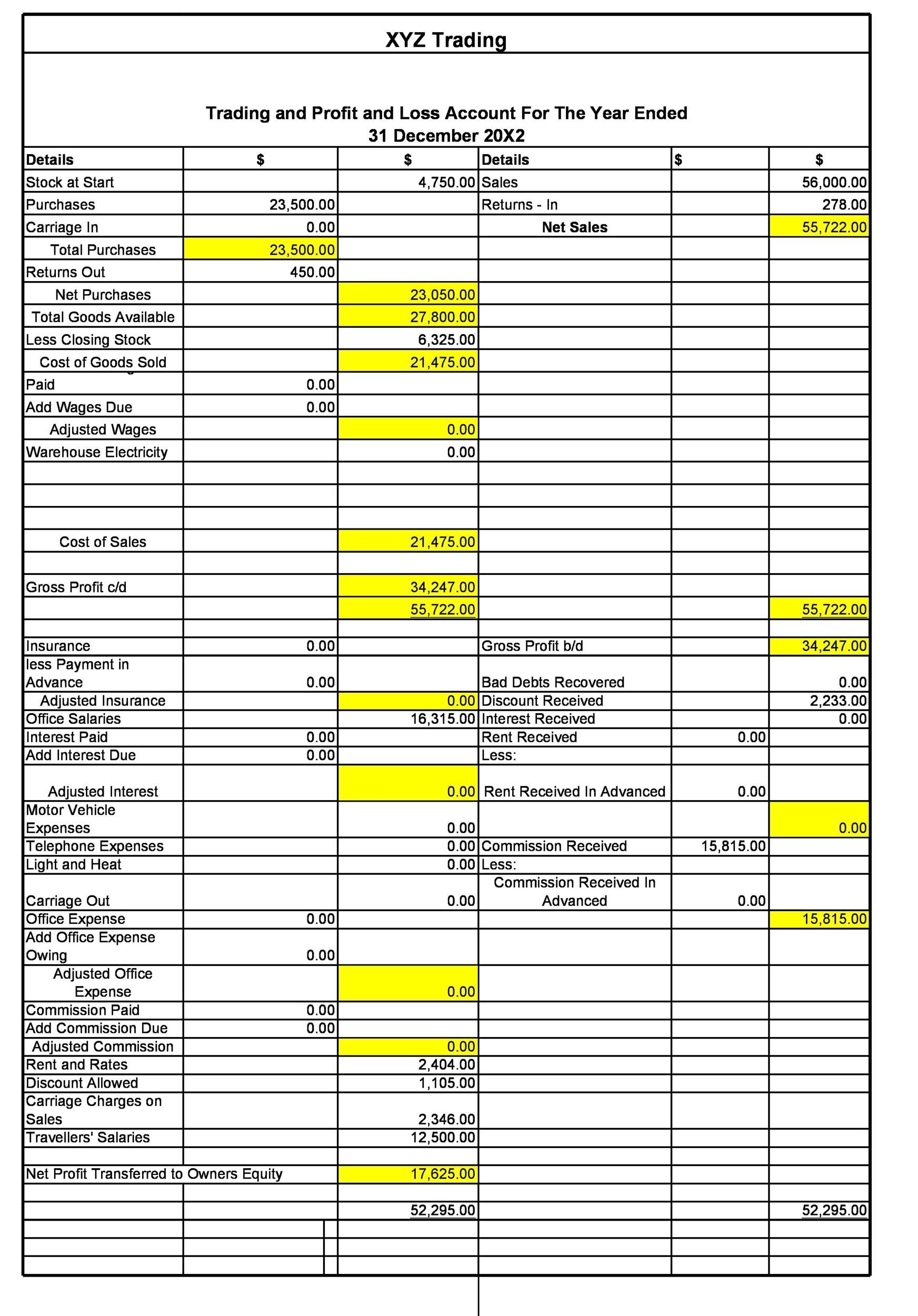

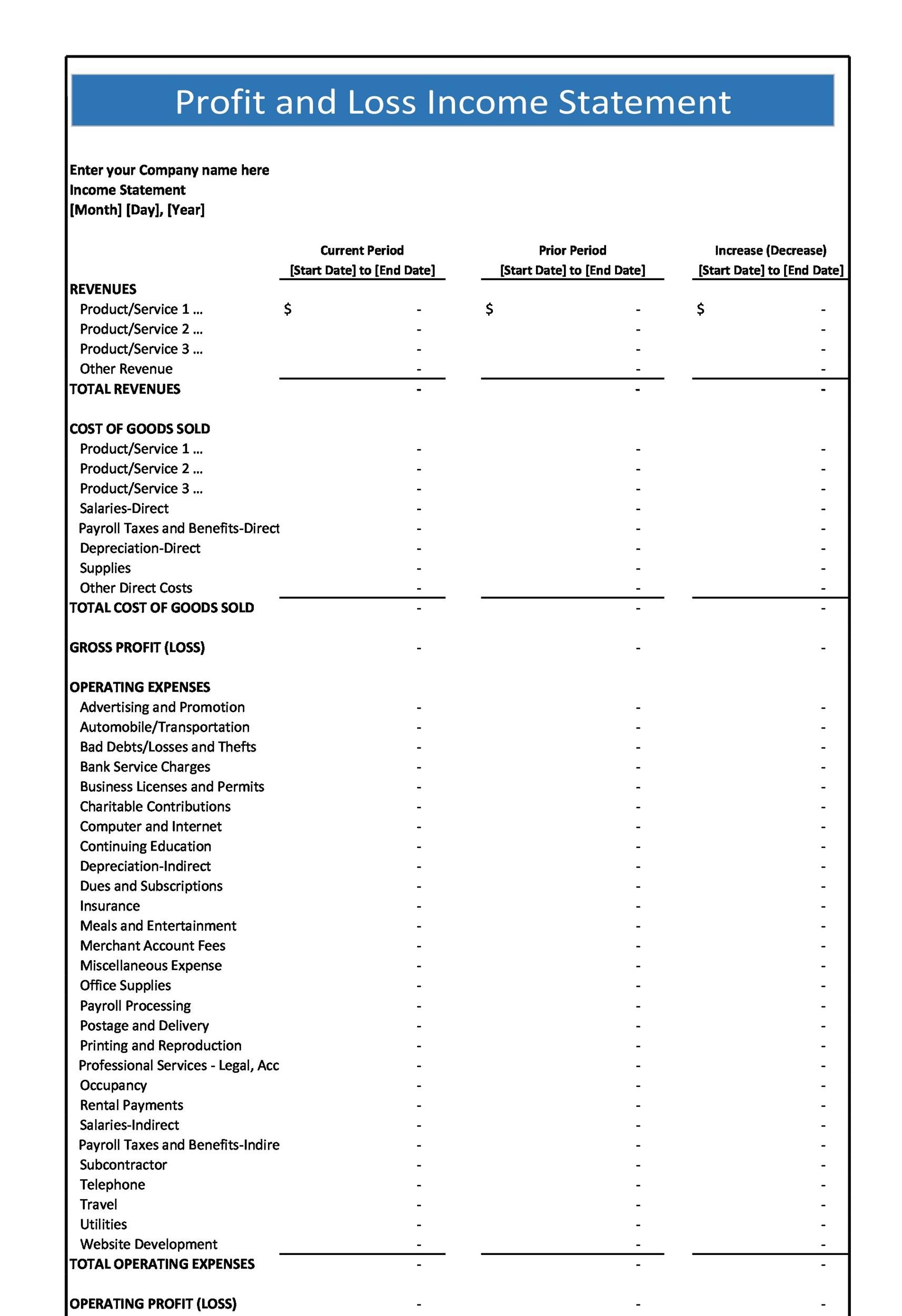

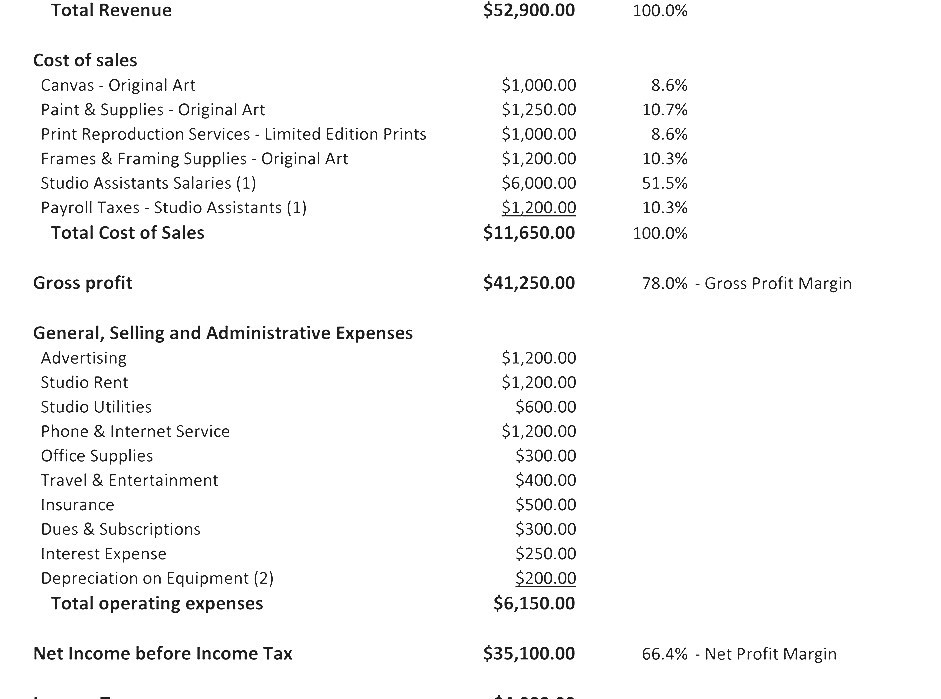

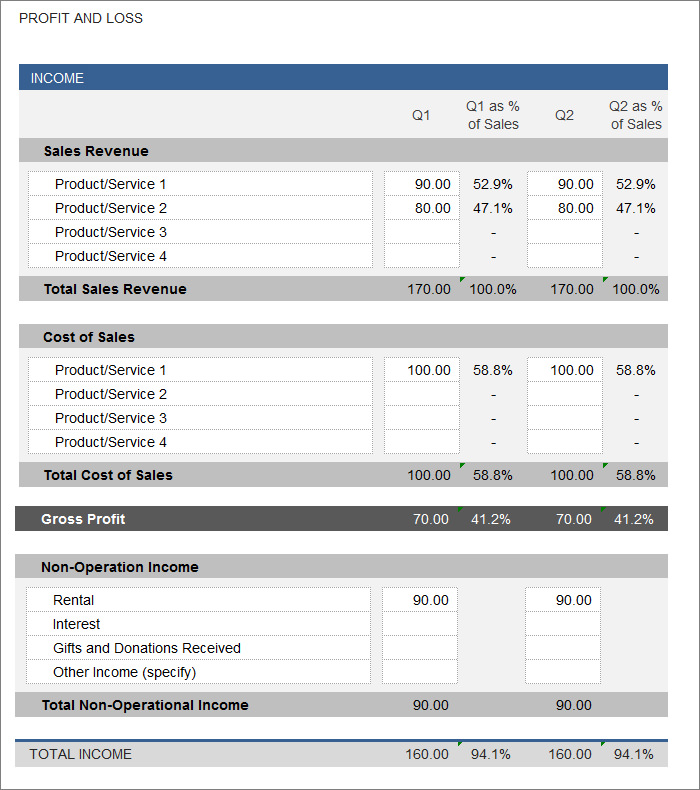

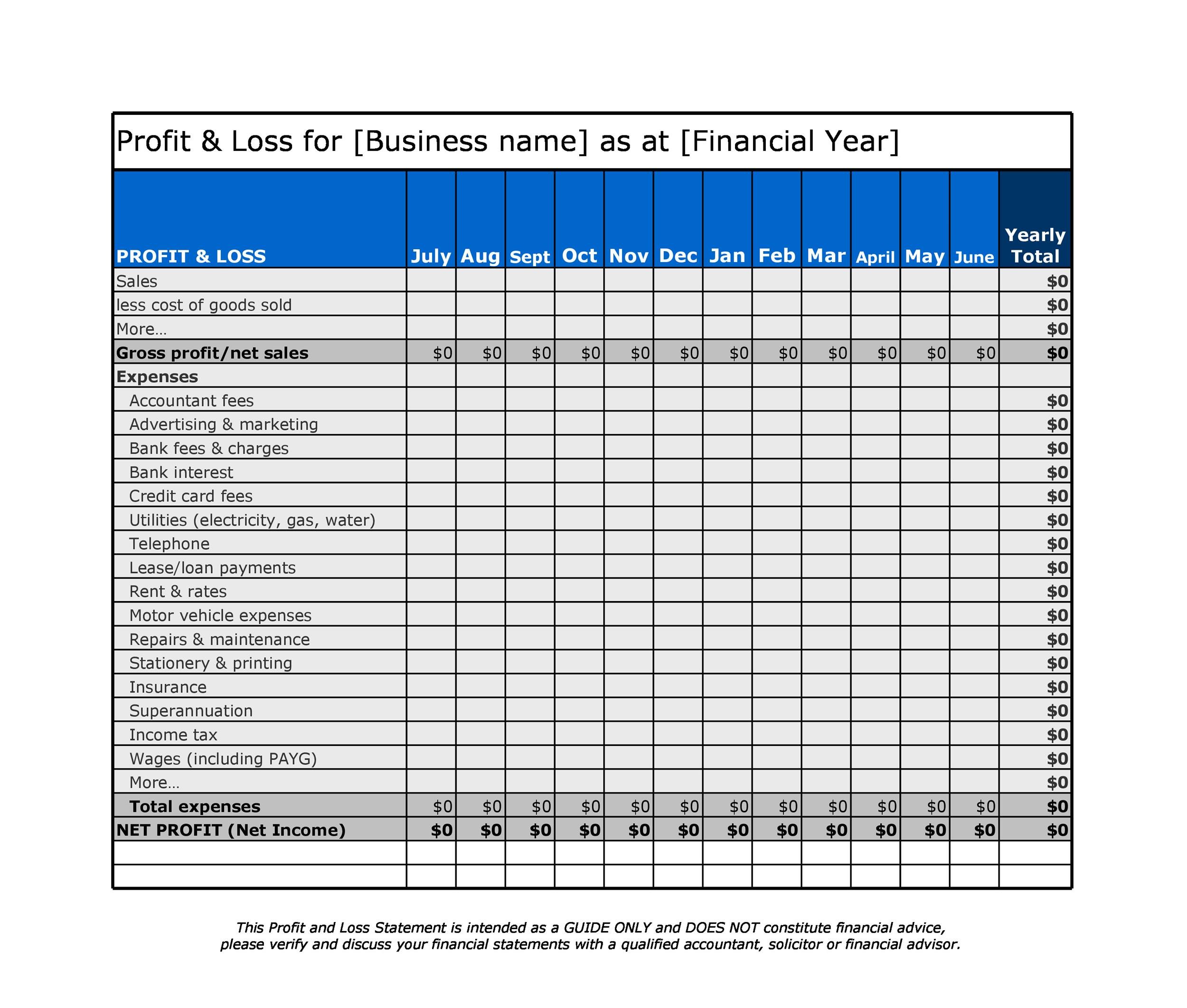

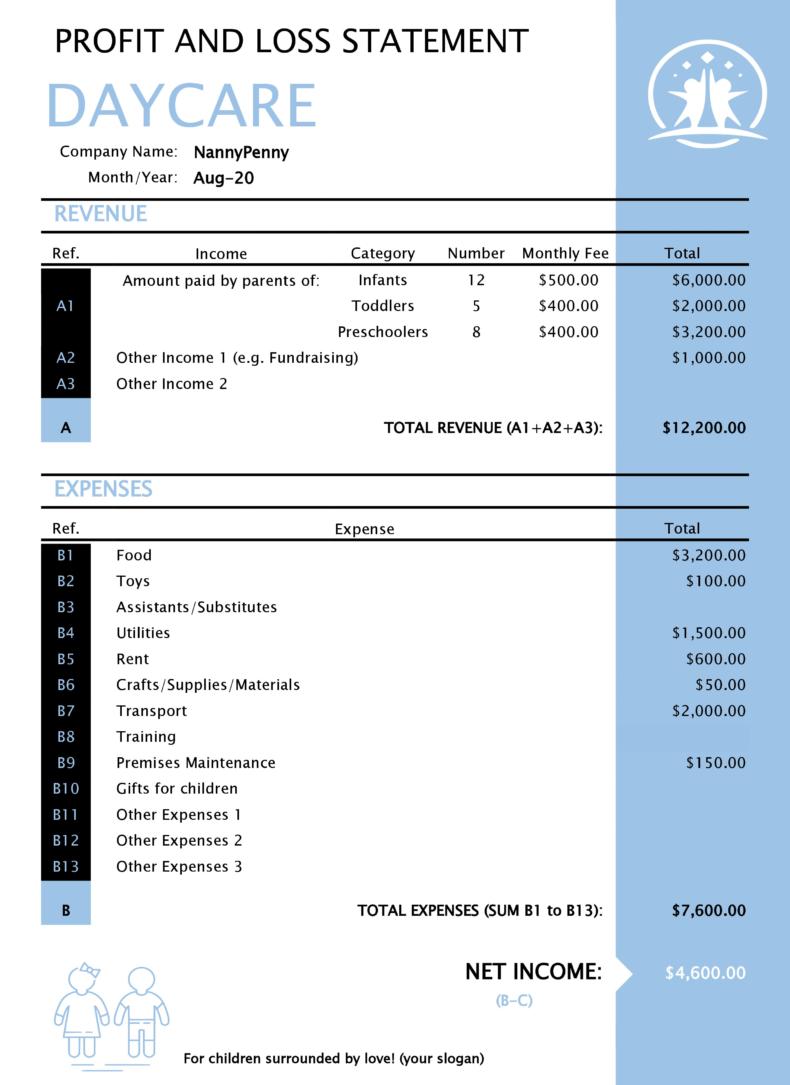

Profit and loss and income statement. The single step profit and loss statement formula is: Profit and loss statement, also referred to as income statement, is a statement that summarizes your business revenues, costs and expenses incurred. An income statement or a profit and loss statement outline a company's earnings and expenses to determine its net income over a specific time.

A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. This is a very informative article. A profit and loss statement contains three basic elements:

If you use estimated costs, you need to label them clearly. Income statement and profit and loss mean the same thing and can be used interchangeably. All companies require an accounting profit and loss statement (p&l) or income statement for their accounts.

The most common intervals are monthly, quarterly and annually. You also need to clearly state on your profit and loss statement whether your figures are gst inclusive or exclusive. The profit and loss statement (p&l) is a financial statement that starts with revenue and deducts costs and expenses to arrive at net income, the profitability of a company, in a specified period.

The rising costs overshadowed a decent holiday quarter. An income statement, also known interchangeably as a profit and loss account, provides a summary of a company’s revenues, expenses, and profits over a specific period. You can learn about the health of a business—up and down, and across time—by looking at its income statement.

Sales on credit) or cash. It shows both turnover and profitability for the company over that length of time. A profit and loss statement is a snapshot of a company's sales and expenses over a period of time, such as one year.

The income statement, also called the profit and loss statement, is a report that shows the income, expenses, and resulting profits or losses of a company during a specific time period.the income statement is the first financial statement typically prepared during the accounting cycle because the net income or. Also known as profit and loss (p&l) statements, income statements summarize all income and expenses over a given period, including the cumulative impact of revenue, gain, expense, and loss transactions. For each year, you need to fill in actual or forecasted figures against each of the below items.

Income from operations of $652 million; Complete your profit and loss statement. An income statement compares revenue to expenses to determine profit or loss.

You might also hear this document called: The income statement shows a company or individual’s money. How to read a profit and loss statement

A p&l statement compares company revenue against expenses to determine the net income of the business. A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period. Then, it subtracts the costs of making those goods or providing those services, like.