Fantastic Info About Fcff From Cash Flow Statement

Free cash flow is an important measure, as it depicts the cash.

Fcff from cash flow statement. There are two types of free cash flows: Start with a free account to explore. It is one of the.

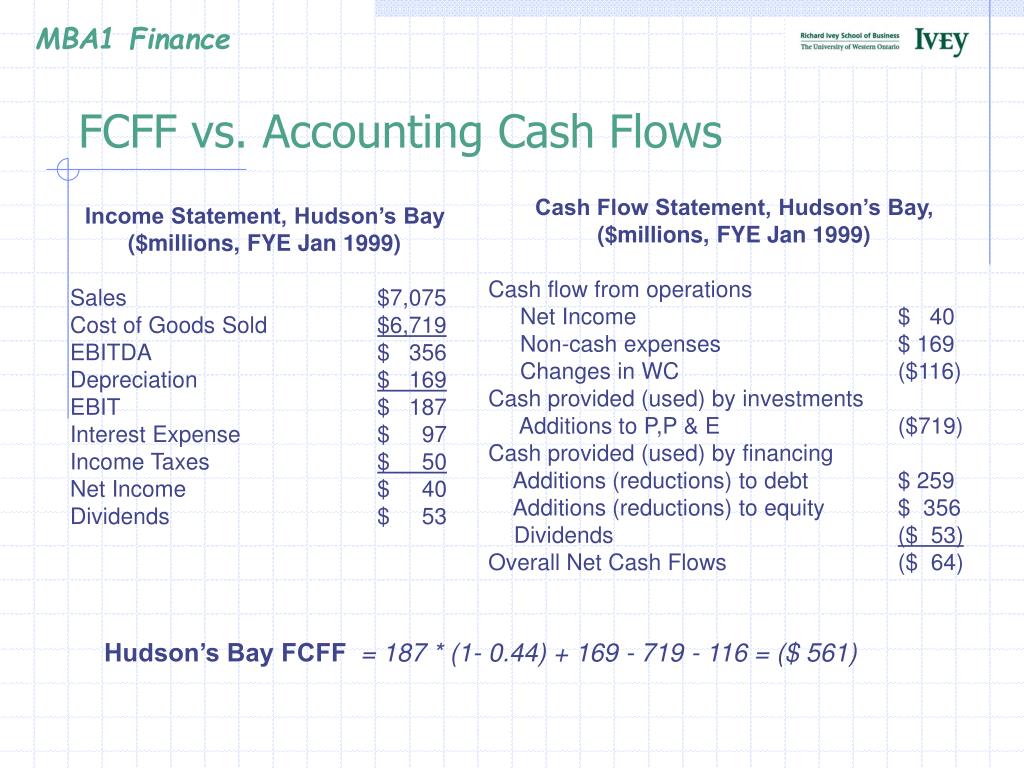

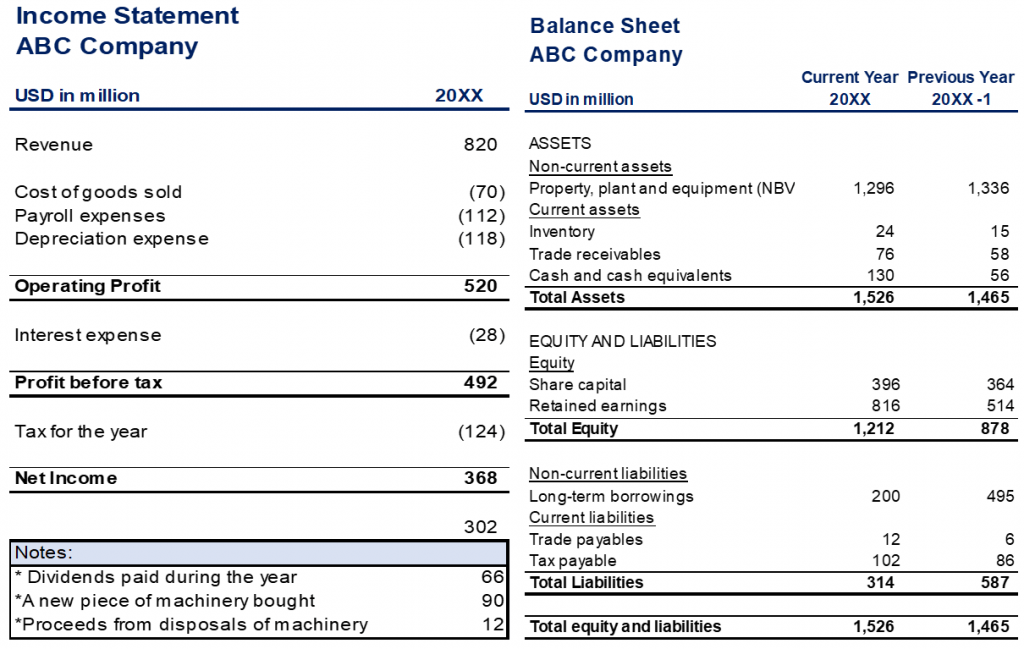

What is free cash flow to the firm (fcff)? Fcff is the financial metric which big companies with high leverage usually represent as the net free. Free cash flow to the firm (fcff) is the cash flow that is available to a company’s suppliers of debt and equity capital after the company has paid all its.

Free cash flow to the firm (fcff) represents the amount of cash flow from operations available for distribution after depreciation expenses, taxes, working capital,. Free cash flow to firm (fcff) is a company's cash flow left for distribution to all funding providers, usually debt and equity holders, after taking into account all the. Fcff, or free cash flow to firm, is the cash flow available to all funding providers (debt holders, preferred stockholders, common stockholders, convertible bond investors, etc.).

Free cash flow to the firm (fcff): Free cash flow to the firm (fcff) is the cash flow available to a company’s suppliers of debt and equity capital after the company has paid all its operating expenses. Guide to reconciling fcff to fcfe over 1.8 million professionals use cfi to learn accounting, financial analysis, modeling and more.

Free cash flow to firm (fcff) (also referred to as unlevered free cash flow) and free cash flow to equity (fcfe), commonly. You start by looking for all the figures. Analysts like to use free cash flow as the return (either fcff or fcfe) whenever one or more of the following conditions is present:

Free cash flow to firm (fcff) is one of the most widely used tools which is used to analyze the free cash available in the company by taking into account the free. Free cash flow (fcf) is calculated by taking operating cash flows less capital expenditures. Fcff is a measurement of a company's profitability after all expenses and reinvestments.

Fcff (free cash flow to the firm) represents the cash flow available to all sources of funding, excluding the impact of interest expense and net debt. Free cash flow to the firm (fcff) is the cash available to pay investors after a company pays its costs of doing. The company does not pay dividends.

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_to_the_Firm_FCFF_Sep_2020-01-f5a6d0cd933447618490bce0f60b57d1.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-3c51e1263e6f488daa2d923e2a43a33d.jpg)

:max_bytes(150000):strip_icc()/Freecashflowfirm_final-687ff00a77b04ae6b47c4de5529e5ff2.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)