First Class Tips About Balance Sheet Valuation Method

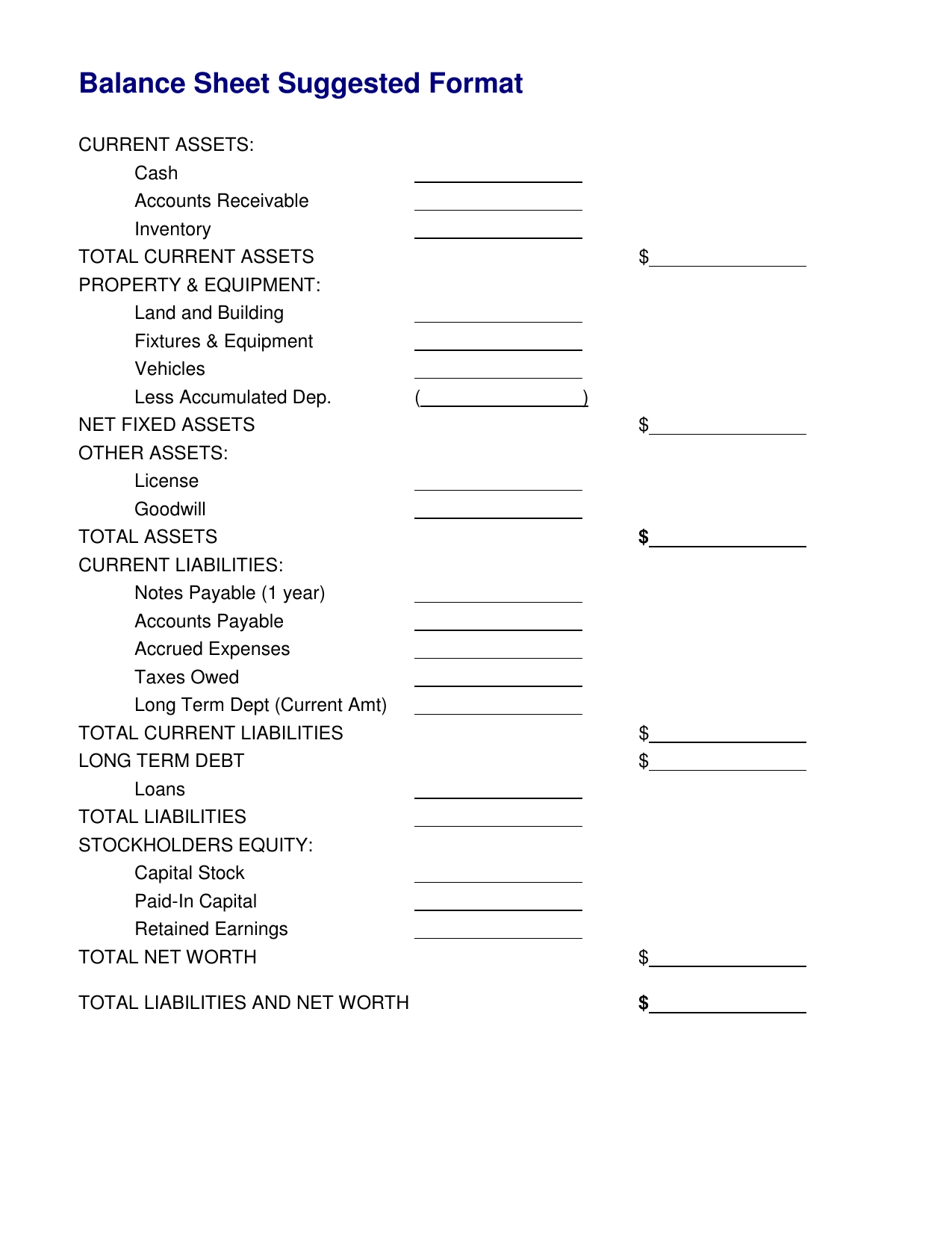

This will tell you your business’s “book value,” or your business’s worth.

Balance sheet valuation method. The enterprise value (ev) is basically the value of the business operations based on the ability to generate cash flows in the future. There are certain elements of. Below are the ending inventory valuations:

Some business owners determine value by simply looking at their balance sheet’s “total equity” section. No accountant could tell you what a. What are the three common methods of.

Basically, the contents of your balance sheet create the foundation for the value of your business. In other words, under the. One of the more popular equity valuation approaches is the comparables approach.

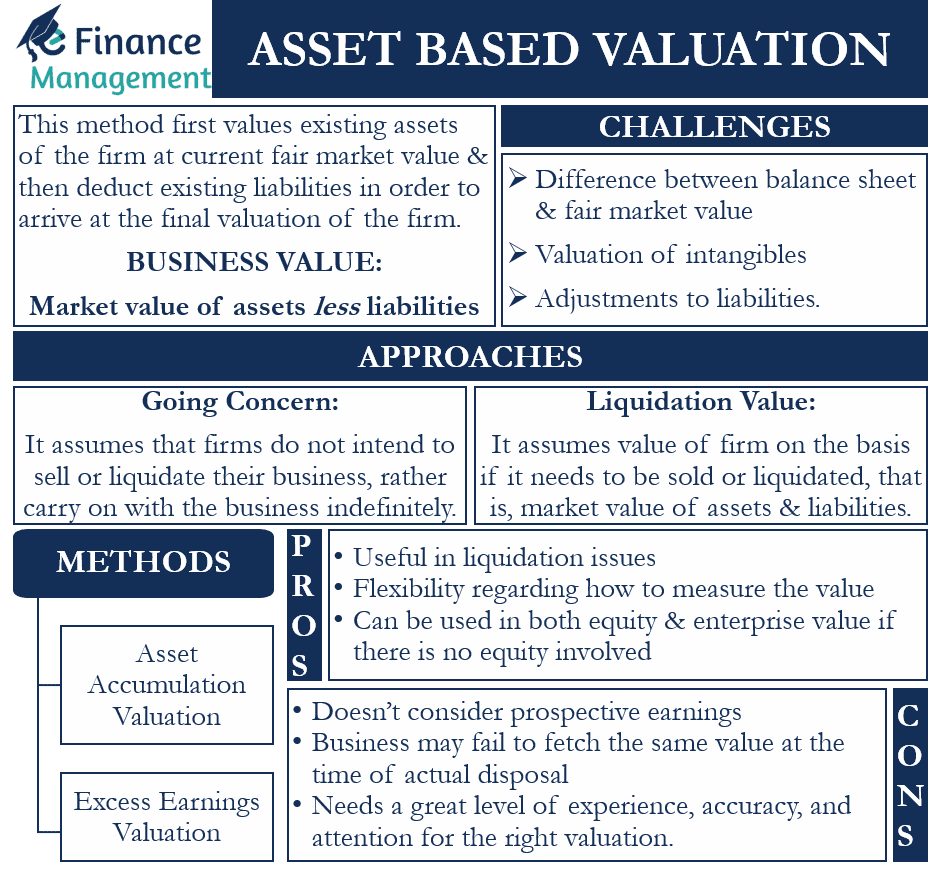

Lastly, relative valuation methods are a price to earnings ratios, price to book value ratios, price to sales ratios etc. The asset based approach, earning approach, and market value approach. 4.4 valuation approaches, techniques, and methods.

Sap s/4hana cloud, public cloud offers tools and features that allow organizations to perform inventory balance sheet valuation efficiently. Discounted cash flow methods include dividend discount models and free cash flow models. This strategy evaluates similar companies and compares relevant valuation.

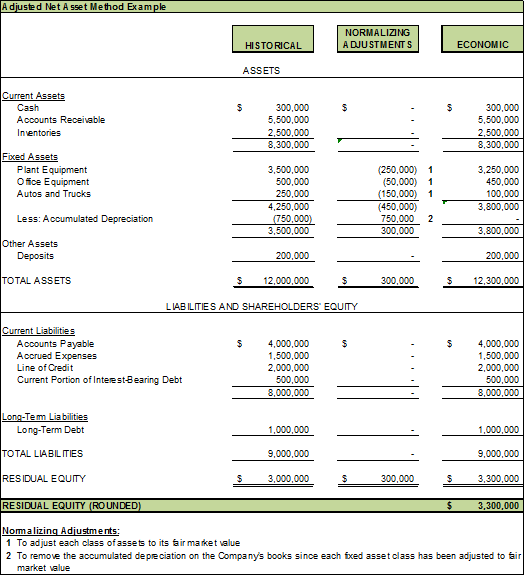

The average cost method resulted in a valuation of $11,250 or (($8,000 + $10,000 + $12,000 + $15,000) / 4). Balance sheet methods comprise of book value, liquidation value, and replacement value methods. The business’s balance sheet — among other reports and factors — can help determine the valuation of a business.

Cost method the cost method is the easiest way of asset valuation.