Unique Info About Bank Recognition Statement

Bank reconciliation statement is also known as bank passbook.

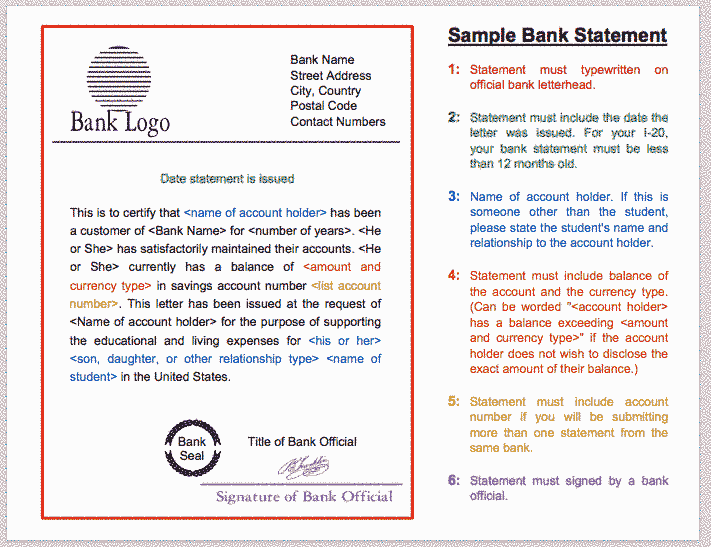

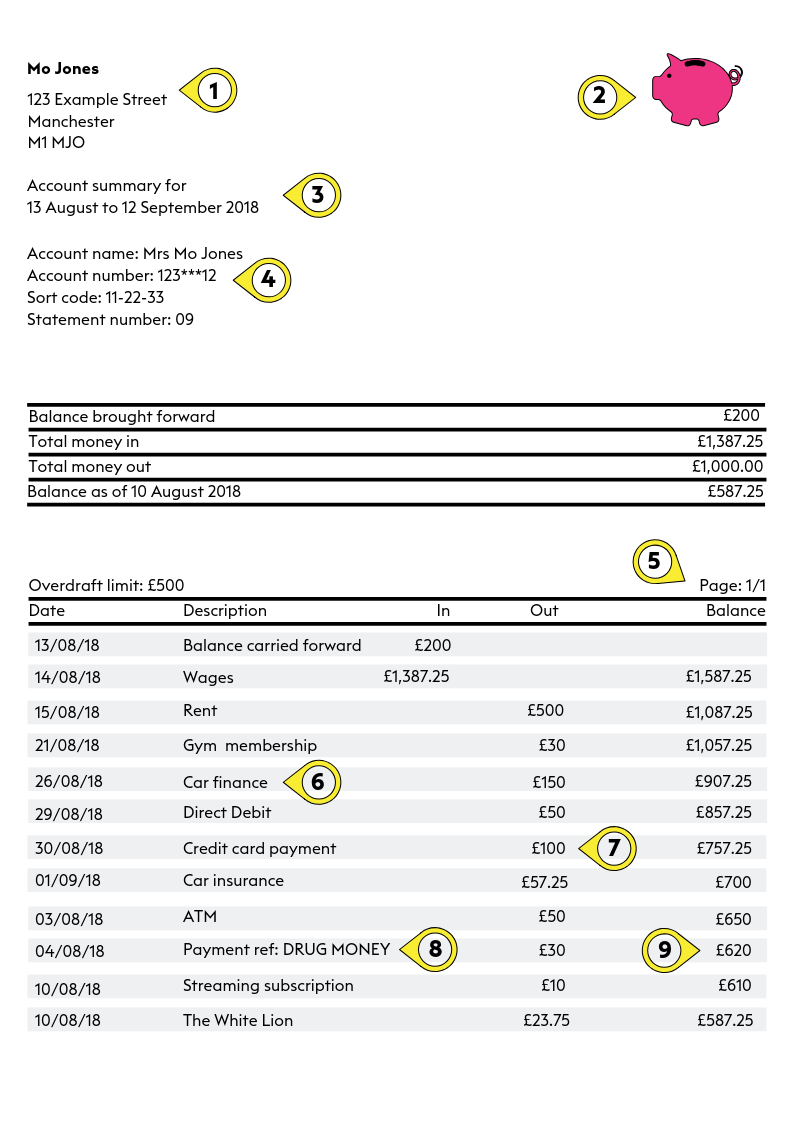

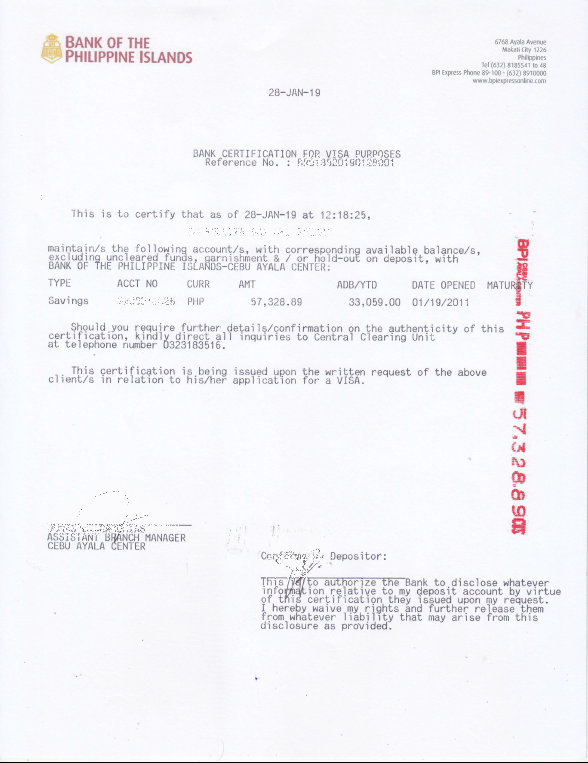

Bank recognition statement. Bank reconciliation statements are effective tools for detecting fraud, theft, and loss. In the case of personal bank accounts,. What is bank statement ocr?

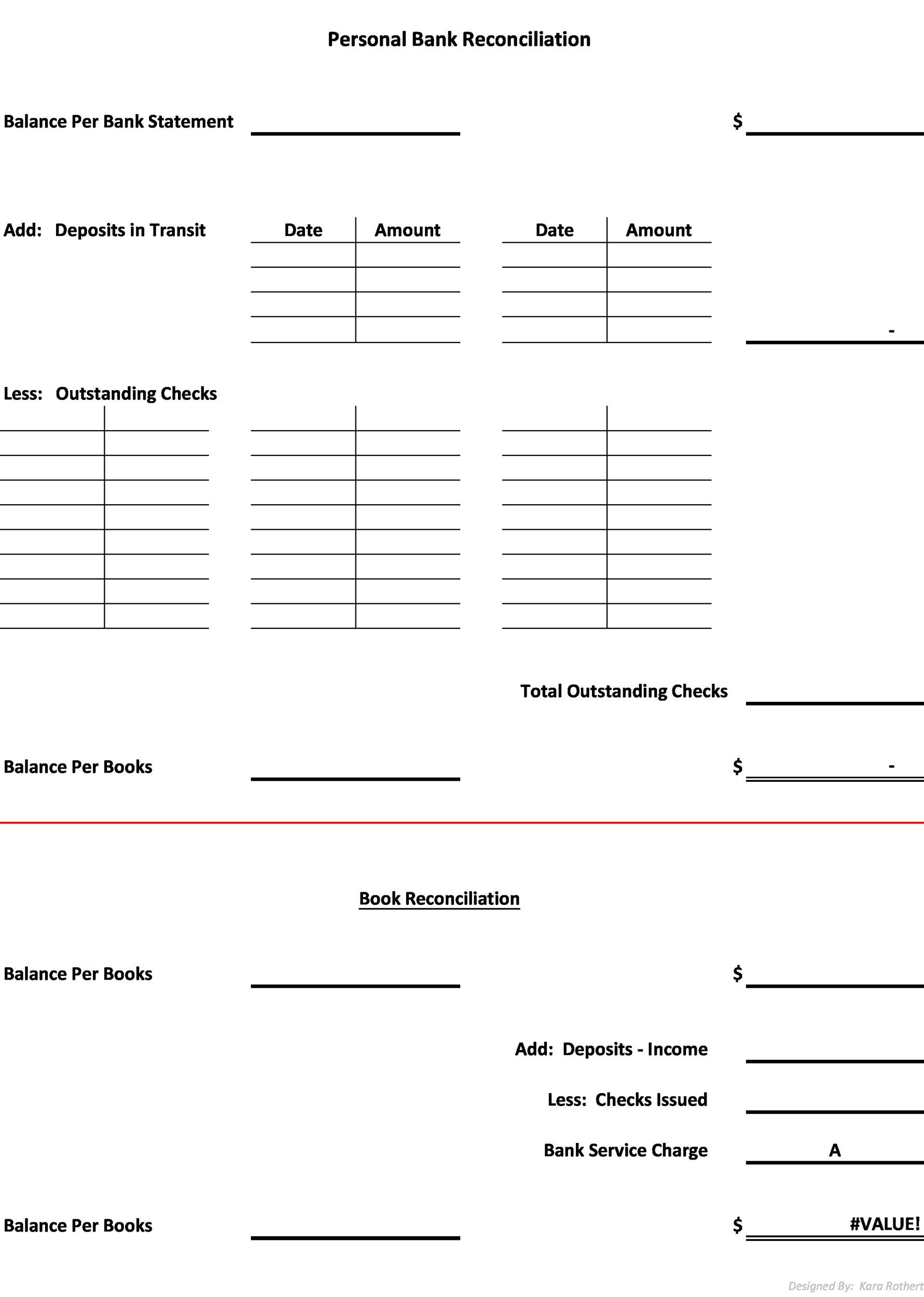

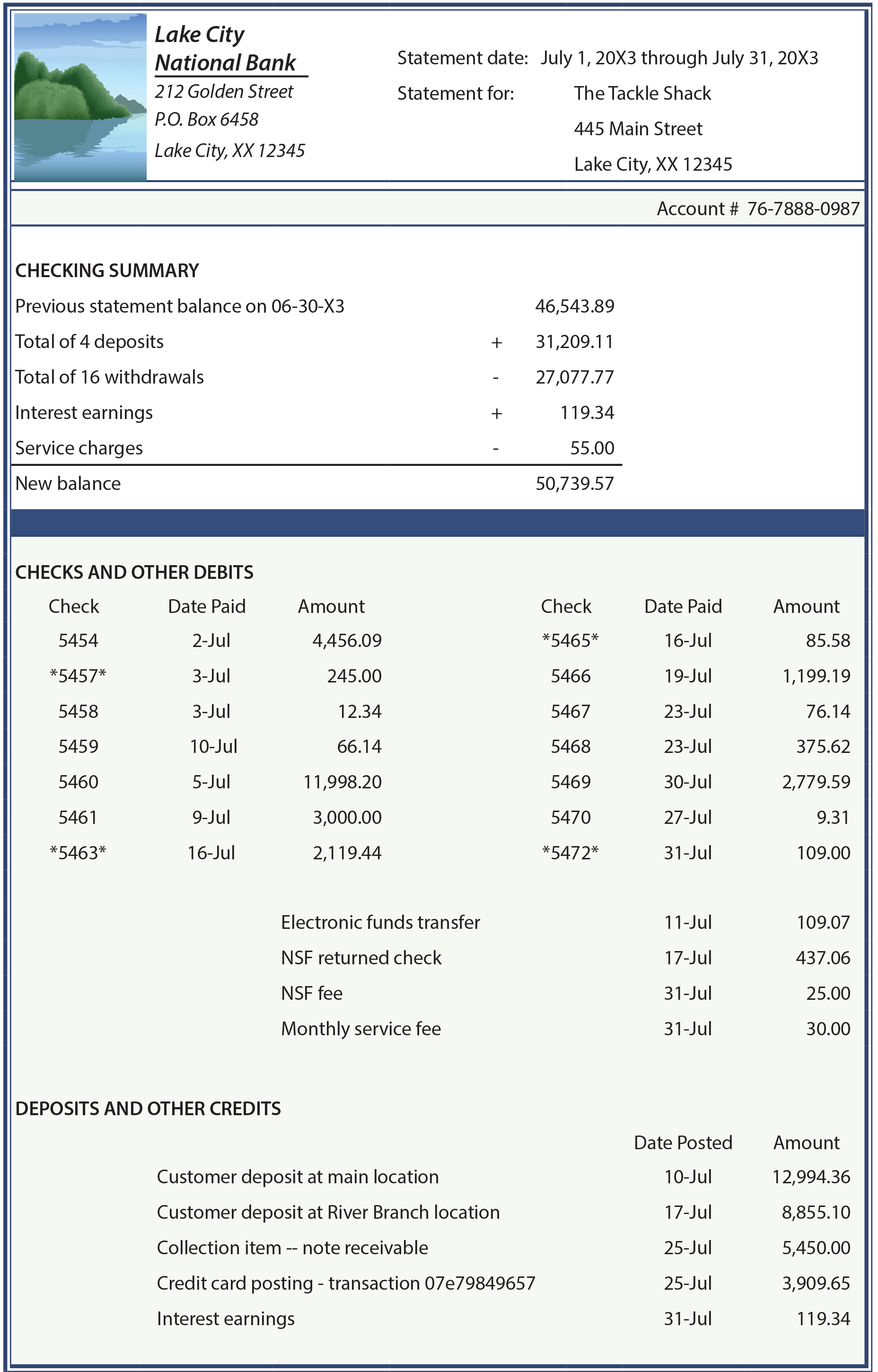

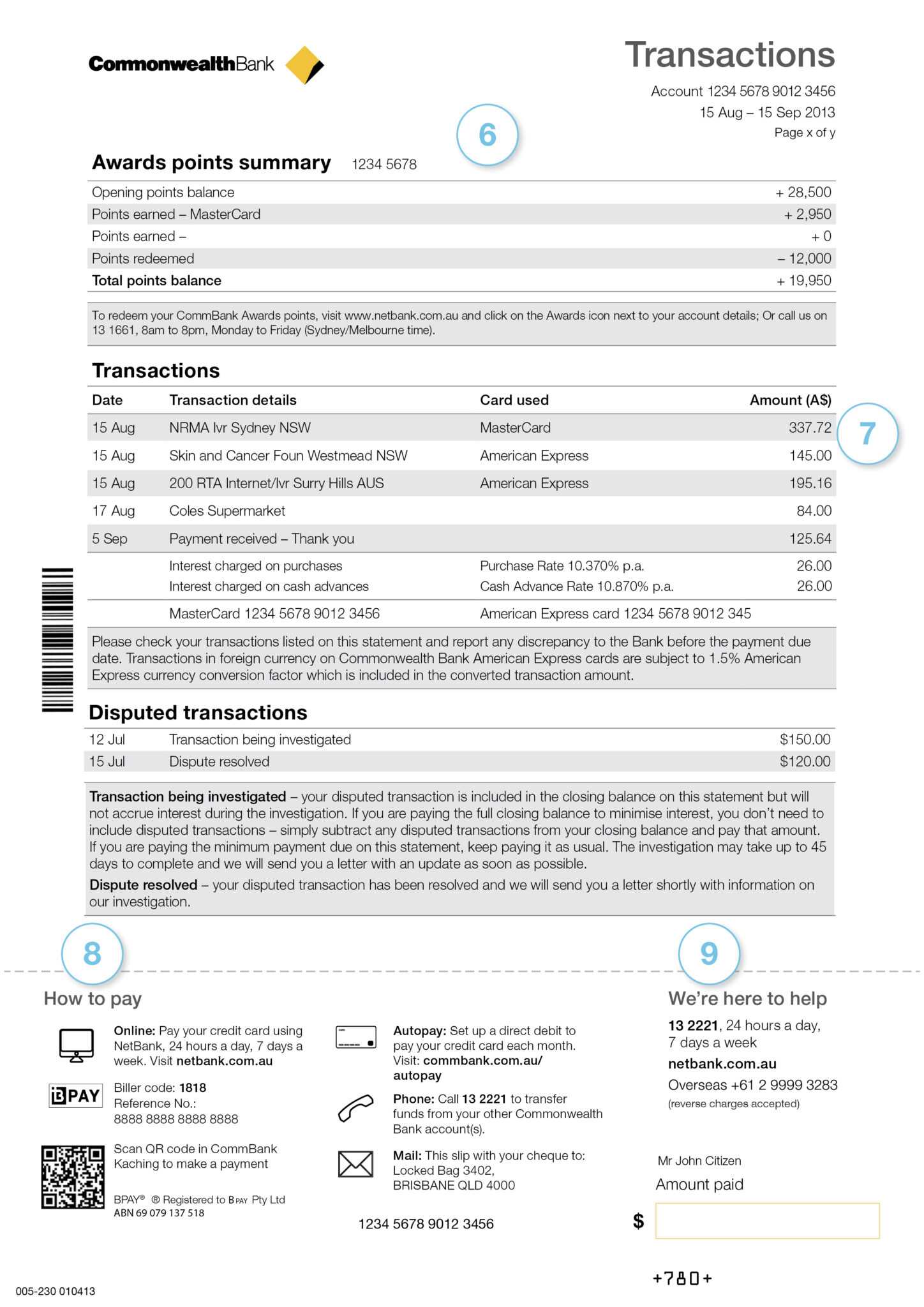

A bank reconciliation statement is a document that compares the cash balance on a company’s balance sheet to the corresponding amount on its bank statement. For example, if a check is altered, the payment made for that check will be larger than you anticipate. Bank reconciliation statement is prepared to compare the balances of the cash book and passbook and correct the mistakes recorded in them.

Differences may be attributed to three sources: In april 2021, the european commission proposed the first eu regulatory framework for ai. In bookkeeping, a bank reconciliation or bank reconciliation statement (brs) is the process by which the bank account balance in an entity’s books of account is reconciled to the balance reported by the financial institution in the most recent bank statement.

Enter your name and email in the form below and download the free template now! We explain what the bank reconciliation is, why we do it, the reasons for the differences between the bank statement and the bank account in the business' books, and what to do with. Determine the adjusted and unadjusted balance as per the cash book this can be done by comparing the credits and deposits on the company’s passbook against the credits and debits in the bank account.

For one which is not matched, suitable adjustments or correction will be done in the book to match it. Hey everyone:) welcome to the ca foundation classes ️class # 25 of paper 1:bank reconciliation statementin this video, we have discussed about the concepts. Then, drag and drop your bank statements into the platform.

A bank reconciliation is a process performed by a company to ensure that its records (check register, general ledger account, balance sheet, etc.) are correct. Make necessary adjustments in the balance according to the cash book First, log into docuclipper and choose the “bank & credit card statements” option.

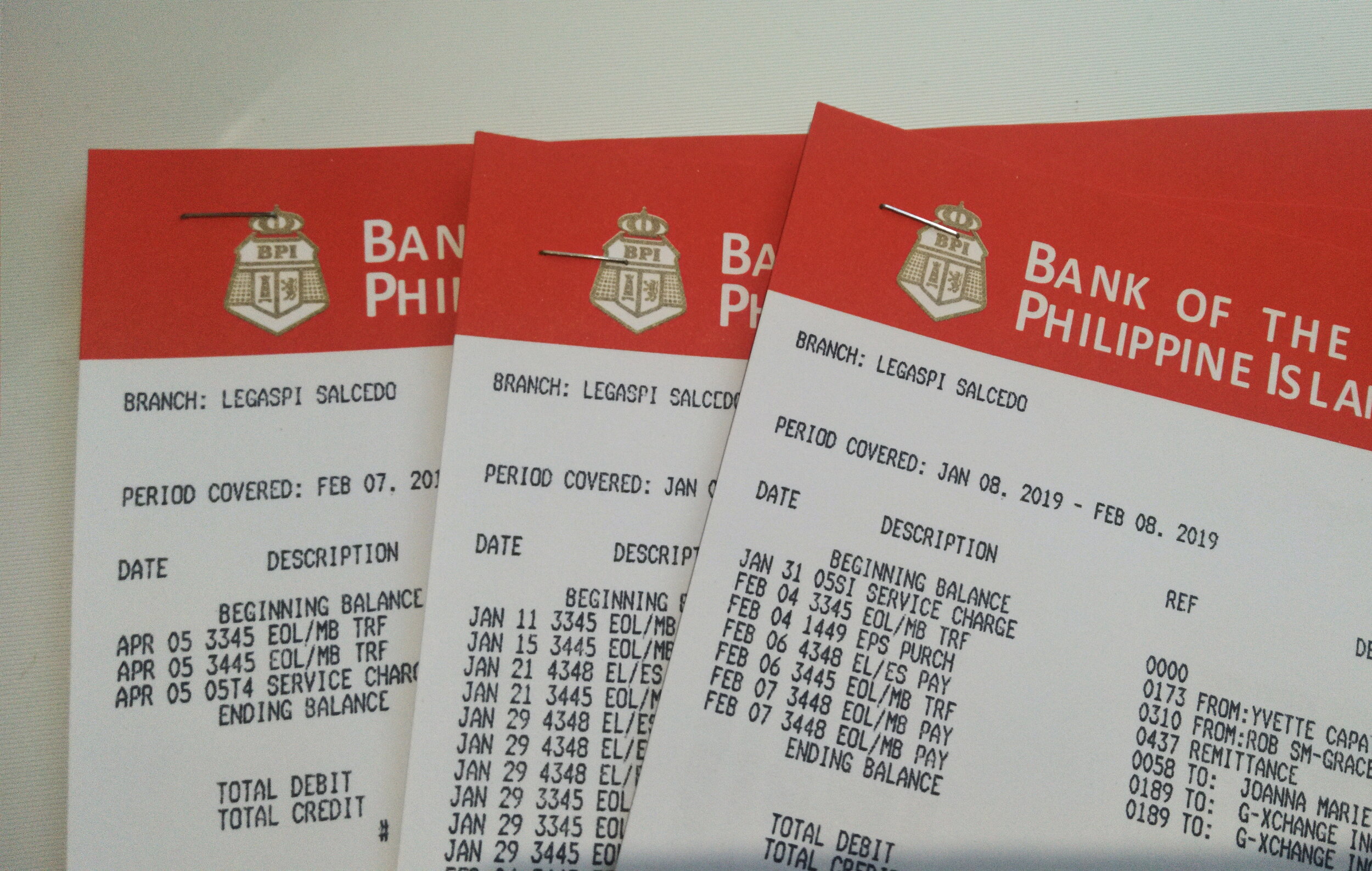

This statement helps the account holders to check and keep track of their funds and update the transaction record that they have made. Items in transit errors service charges We owe it to the palestinians, whose aspirations have been trampled on.

Bank reconciliation statement (brs) involves the process of identifying the transactions individually and match it with the bank statement such that the closing balance of bank in books matches with the bank statement. However, this is not true for your cashbook and your passbook. Brsdownload rkg app at playstore.

A bank reconciliation statement is a summary of business activity that reconciles financial details. The recognition of a palestinian state is not a taboo for france, macron said alongside jordan's king abdullah ii in paris. An ocr bank statement is a digital version of a paper bank statement created using optical character recognition (ocr) technology.

Bank statement verification is the process of confirming the accuracy and authenticity of an entity’s bank statements. Compare the amount of each deposit recorded in the debit side of the bank column of the cashbook with credit side of the bank statement and credit side of the. Any differences must be justified.

:max_bytes(150000):strip_icc()/bank-statement_final-bd27a49a155b44c8b1810bb7705bd34b.jpg)

![35 Editable Bank Statement Templates [FREE] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2021/03/Commonweath-Bank-Statement-TemplateLab.com_.jpg)

![3 Bank Check Recognition Example [65] Download Scientific Diagram](https://www.researchgate.net/profile/Venu_Govindaraju/publication/226698116/figure/fig4/AS:650154373812250@1532020290990/Bank-Check-Recognition-Example-65.png)