Recommendation Tips About Negative Cash Flow From Investing Activities

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

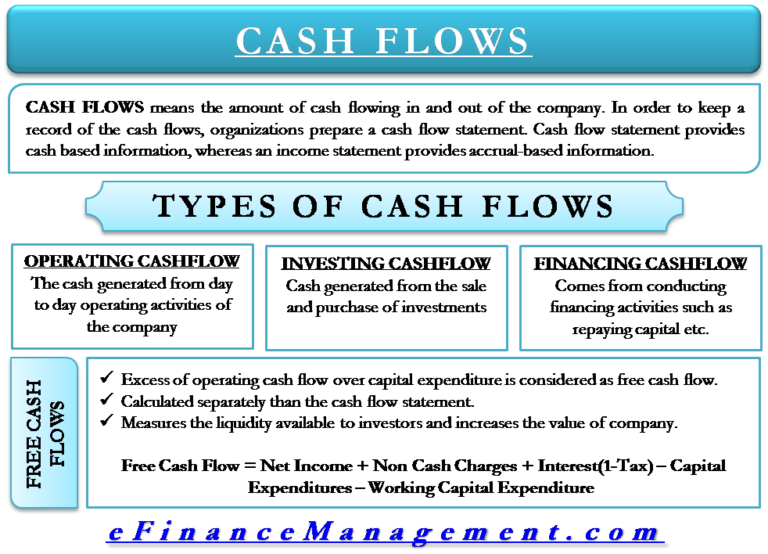

Cash flow from investment activities shows the flow of cash from activity in financial.

Negative cash flow from investing activities. Cash flow from investing activities refers to cash inflow and outflow of cash from investing in assets (including intangibles), purchasing of assets like property, plant and. For example, below is the cash flow statement from exxon mobil (xom). While a negative cash flow in operating activities may be cause for alarm, in most cases negative cash flow in investing activities may temporarily reduce cash.

When a firm reports a negative cash flow from investing activities, it signifies that the company has made substantial investments during the specified. If the company make purchase some fixed assets then the cash flow from investing activities may go negative. Cash flows from operating activities, cash flows from investing activities, and cash.

Here are some important points to consider: So, potential investors or business partners look to cash flow from. Cash flow from investing activities is the section of a company’s cash flow statement that displays.

If a company is a net spender of cash for a time because it is building a second manufacturing plant, for example, the company's might show negative cash. When analyzing the investing section, a negative cash flow is not necessarily a bad thing — you would need to look into the individual items of the investing section. The most effective way to.

The cash flows from investing activities line item is one of the more important items on the statement of cash flows, for it can be a substantial source or use. So, while cash flow is negative, your company is actively investing in growth, which is hardly a bad thing. Cash flow from investing activities (cfi) is one of the three sections presented on your company’s cash flow statement, alongside cash flow from.

The two primary drivers for the negative investing activities number were the. The cash flow statement shows the sources and uses of a company's cash. The statement of cash flows presents sources and uses of cash in three distinct categories:

It's important to analyze the entire cash flow statement and all its components to determine if the negative cash flow is a positive or negative sign. Cash flow from financing activities (cff) is a section of a company’s cash flow statement, which shows the net flows of cash that are used to fund the company.

:max_bytes(150000):strip_icc()/dotdash_Final_Corporate_Cash_Flow_Understanding_the_Essentials_Oct_2020-01-3c5fb3c82fb240c0bad19e14f04ce874.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

:max_bytes(150000):strip_icc()/cashflowfinvestingactivities-recirc-8787bbde413f4036b2f8cfad5c4c6a99.png)