Lessons I Learned From Tips About Financial Statement Cost Of Goods Sold

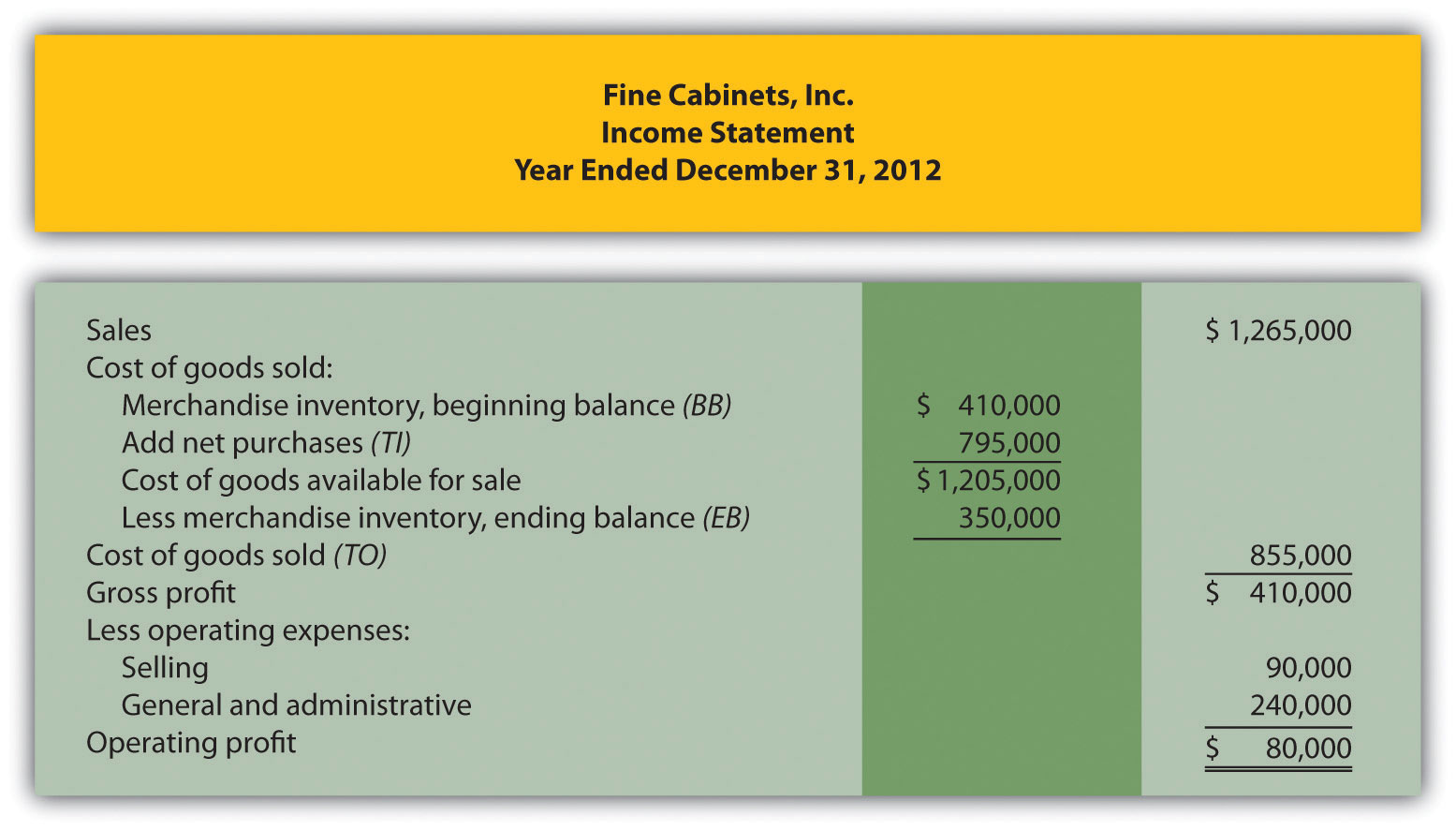

To calculate cogs, business owners need to determine the value of their inventory at the beginning and end of every tax year.

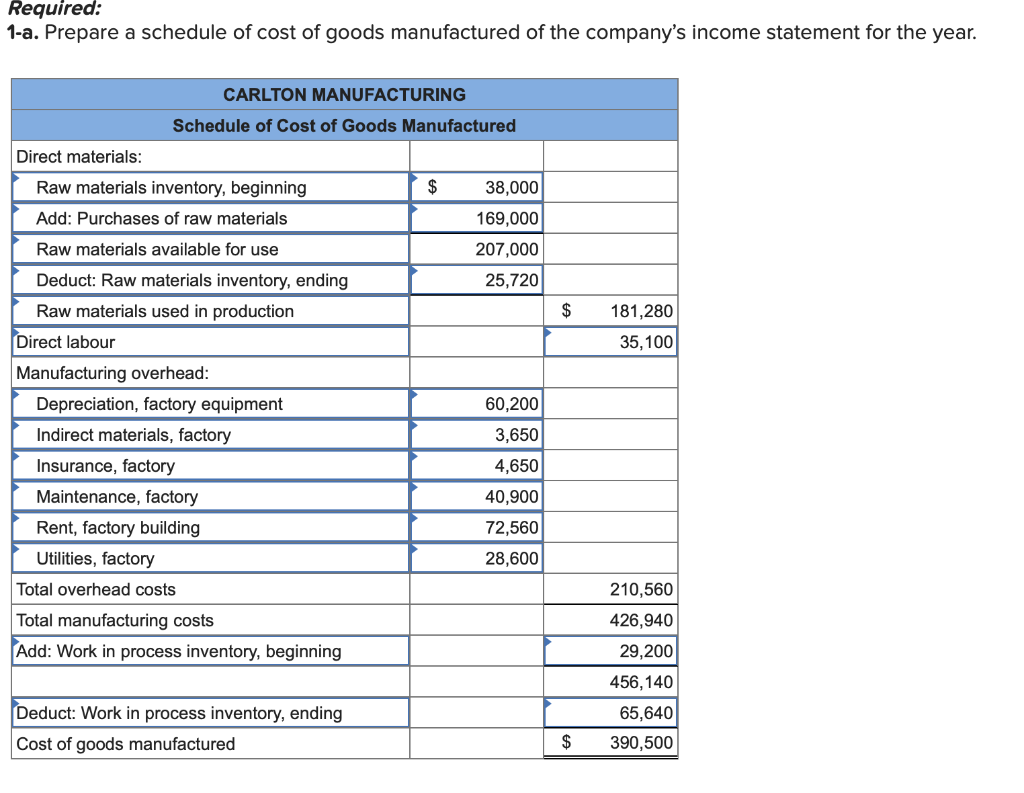

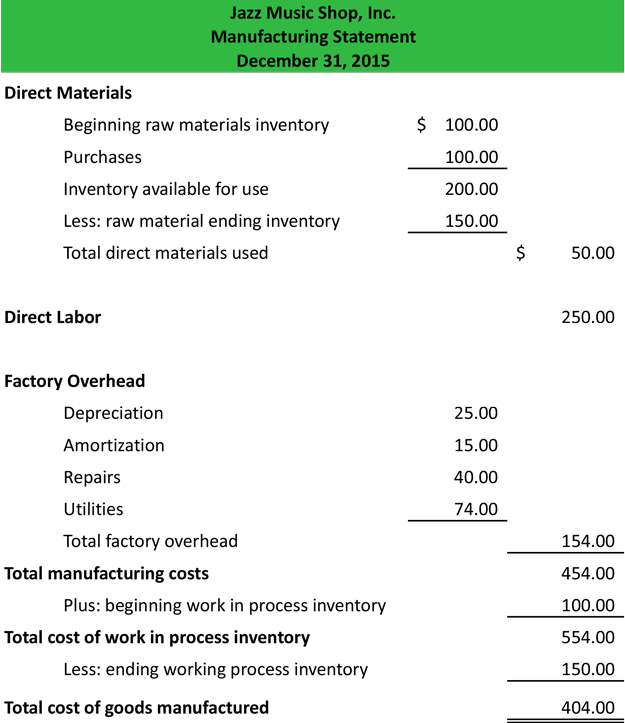

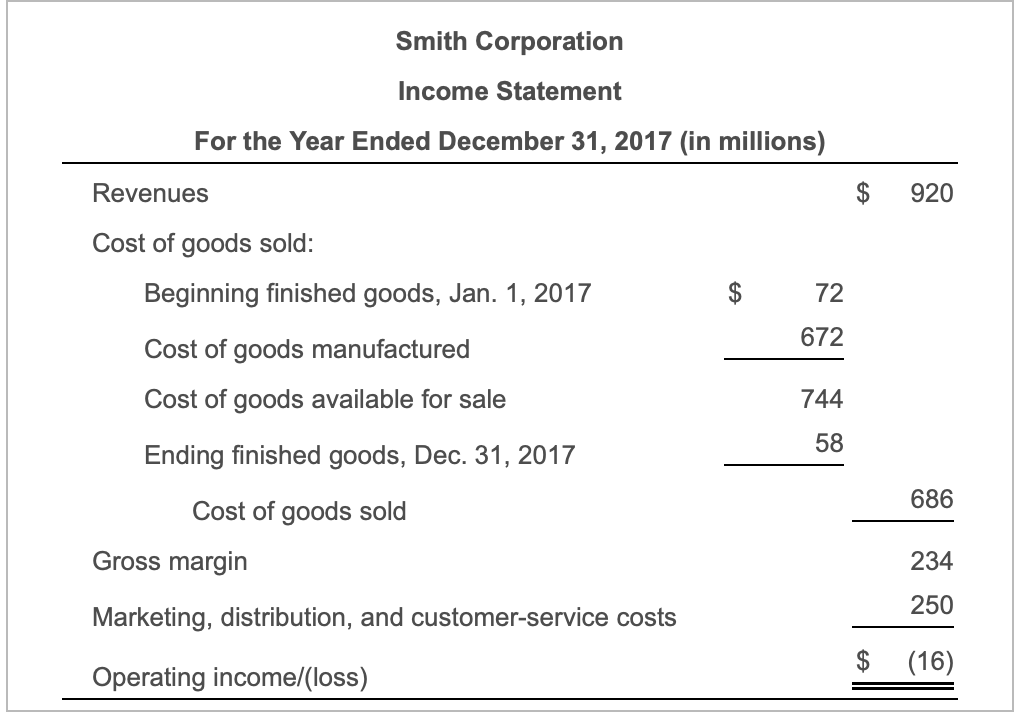

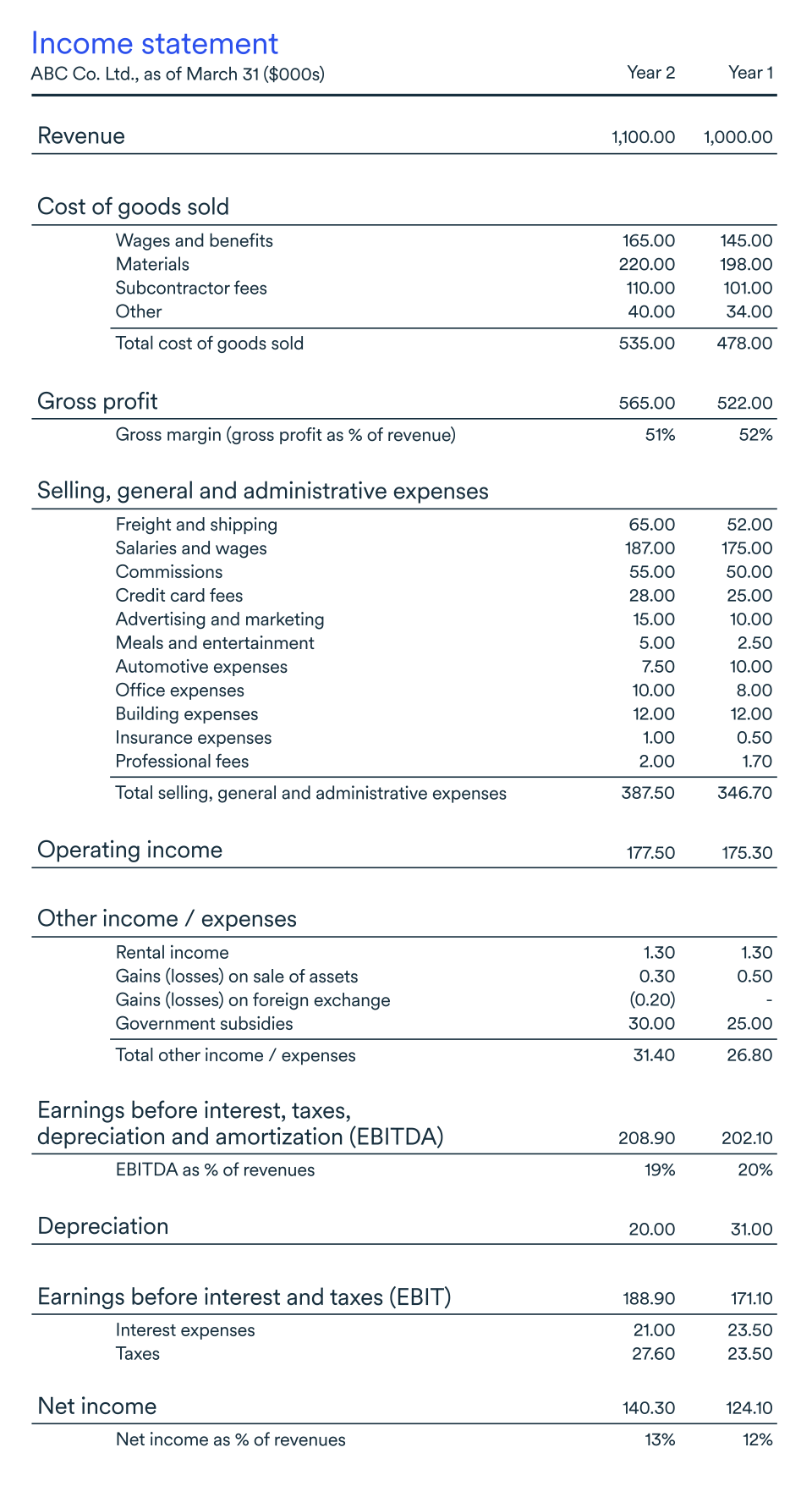

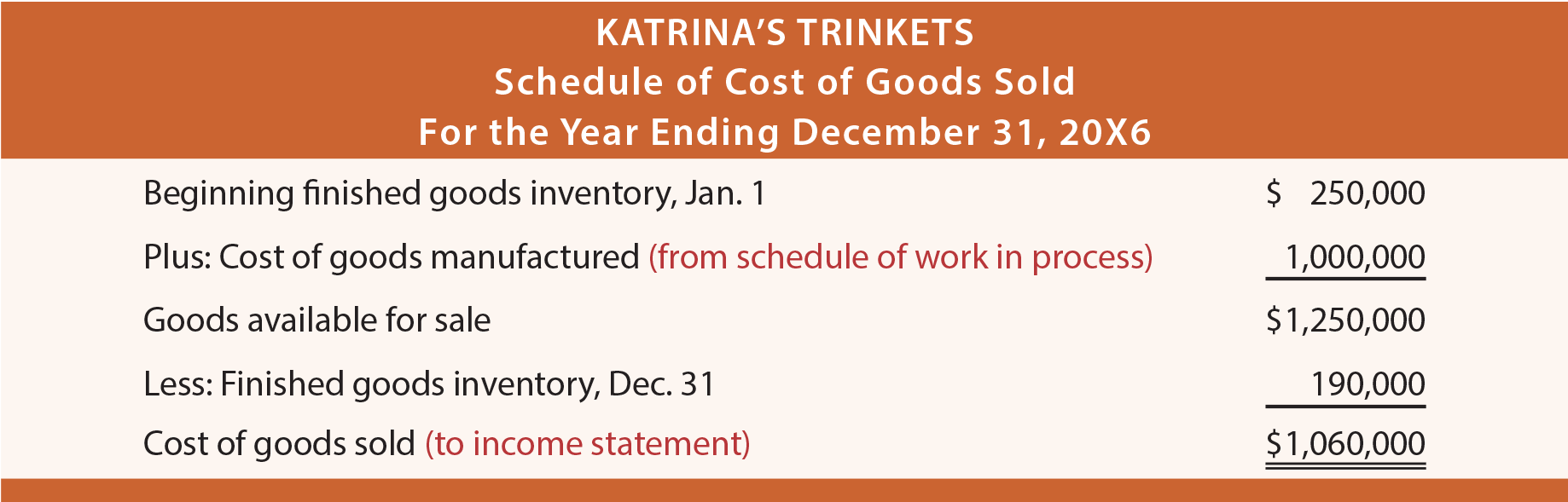

Financial statement cost of goods sold. Explore 6 key elements in. For the year ending on december 31st, 2018, is $14,000. A cost of goods sold statement compiles the cost of goods sold for an accounting period in greater detail than is found on a typical income statement.

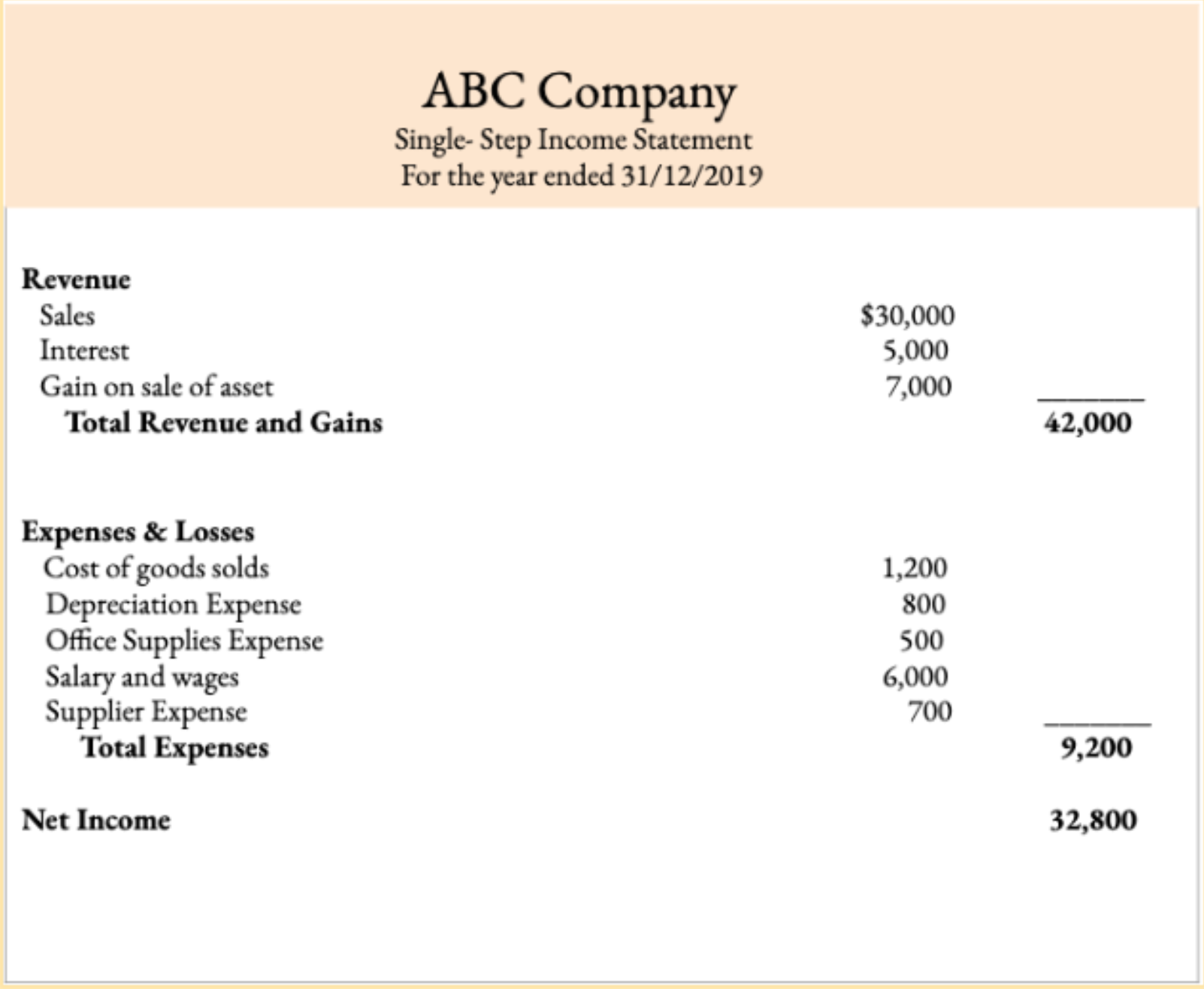

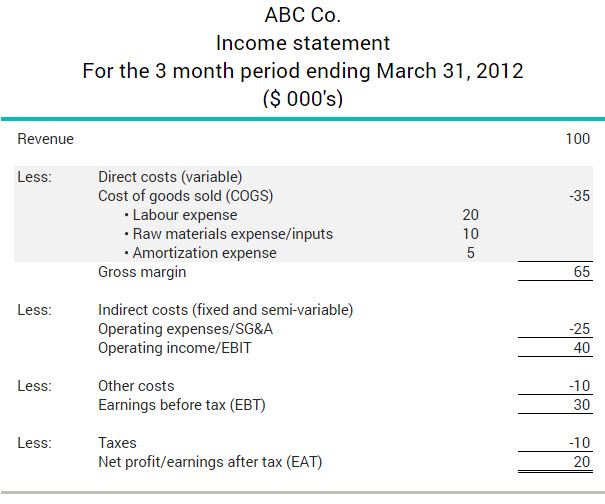

Cost of goods sold (cogs) definition. The cost of goods sold (cogs) is the sum of all direct costs associated with making a product. Cogs is subtracted from a company’s revenue to calculate gross profit.

Cost of goods sold is the direct cost incurred in the production of any goods or services. To calculate cogs, take the cost of initial inventory and add additional direct costs during the period you are measuring. Cost of goods sold (cogs) measures the “direct cost” incurred in the production of any goods or services.

Let us say that you are selling bath soaps. Both manufacturers and retailers list cost of good sold on the income statement as an expense directly after the total revenues for the period. The cost of goods sold (cogs) is the cumulative total of direct costs incurred for the goods or services sold, including direct expenses like raw material, direct labour cost and other direct costs.

Cogs is a critical component in determining a company’s gross profit and,. Key takeaways understanding and managing cogs helps leaders run their companies more efficiently and more profitably. Analysis thus in the present case, the cost of goods sold by company abc ltd.

Introduction to cost of goods sold. Cogs, sometimes called “cost of sales,” is reported on a company’s income statement, right beneath the revenue line. The beginning inventory recorded for the fiscal year ended in 2020 is $3,000.

Financial and income statements usually list cogs according to the. How to calculate cost of goods sold (cogs)? It represents the amount that the business must recover when selling an item.

The cost of goods sold (cogs) is an accounting term used to describe the direct expenses incurred by a company while attempting to generate revenue. What goes into cost of goods sold This statement is not considered to be one of the main elements of the financial statements , and so is rarely found in practice.

The cost of goods sold (cogs) is an important metric in accounting that measures the direct costs of producing the goods or services sold by a company. On the income statement, the cost of goods sold (cogs) line item is the first expense following revenue (i.e. The cost here refers to costs or expenses attributable directly to the goods or products that the entity sold, including the cost of direct labor, direct materials, and direct overheads.

How to calculate cost of goods sold for financial statements written by masterclass last updated: Costs such as sales and marketing, salaries, and transportation are not included in cogs. Cogs are the direct costs attributable to the production of goods sold by a company.

:max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)