Painstaking Lessons Of Info About Profit And Loss General Ledger

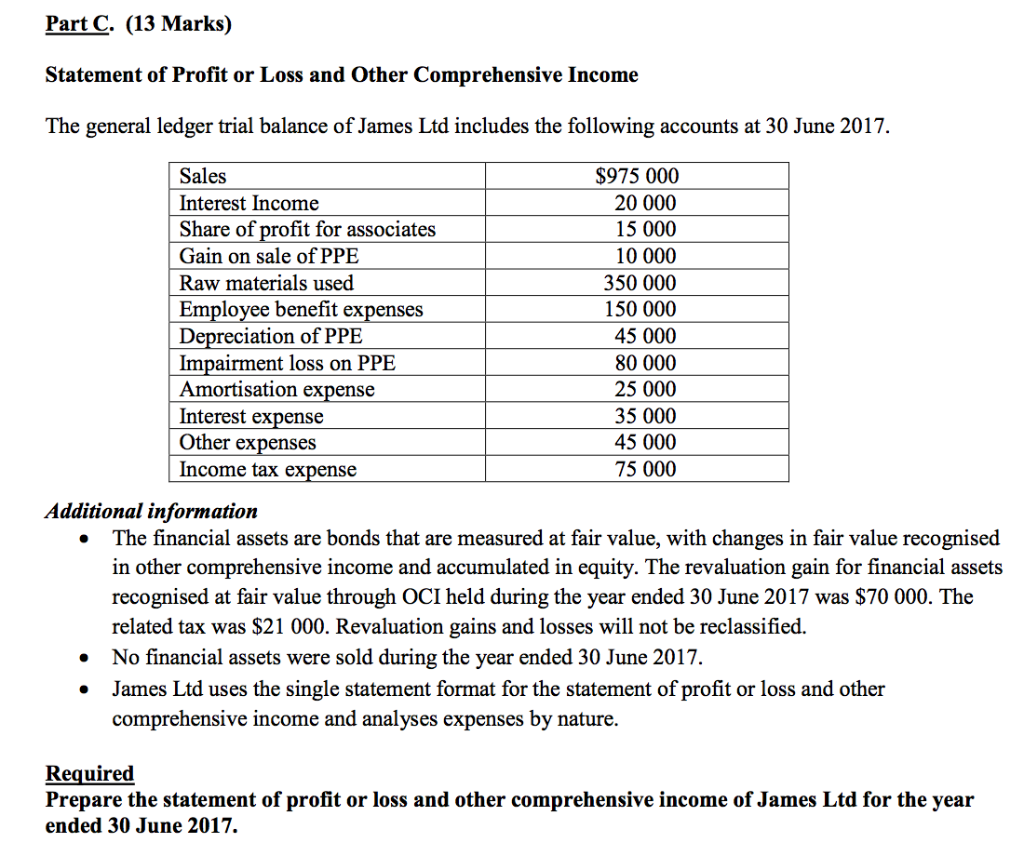

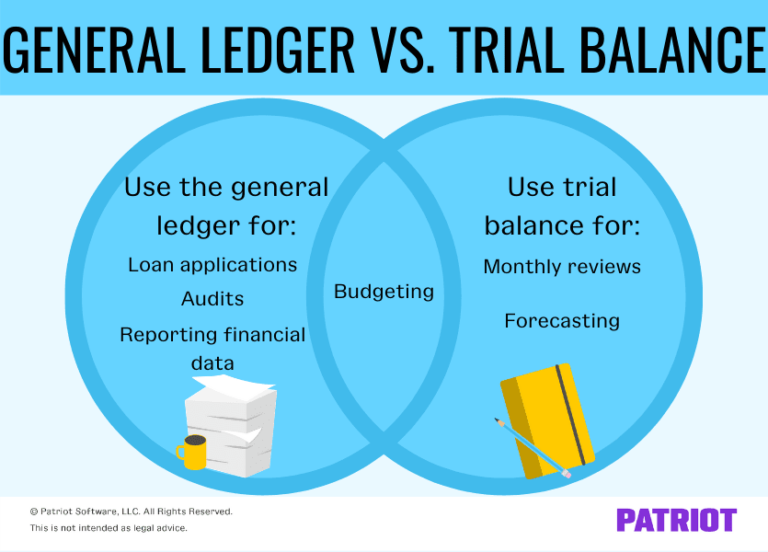

Once you have adjusted journal entries and posted them in the general ledger, construct a final trial balance.

Profit and loss general ledger. After the closing journal entry has been posted the profit and loss account would take the format shown in the example. Brent crude, the international standard, lost 27 cents, to $81.33 per barrel. This statement begins with how much money a company made (or lost) during a given period and subtracts expenses incurred during the same timeframe.

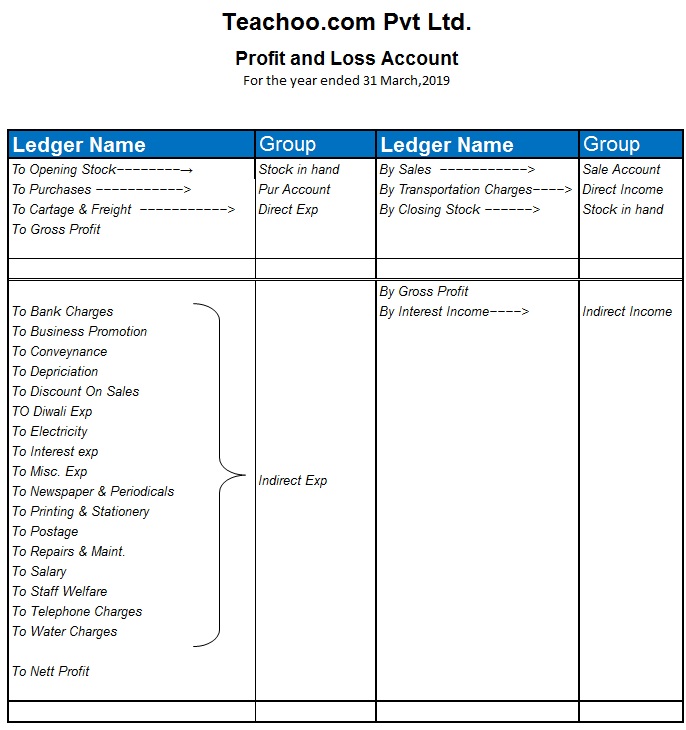

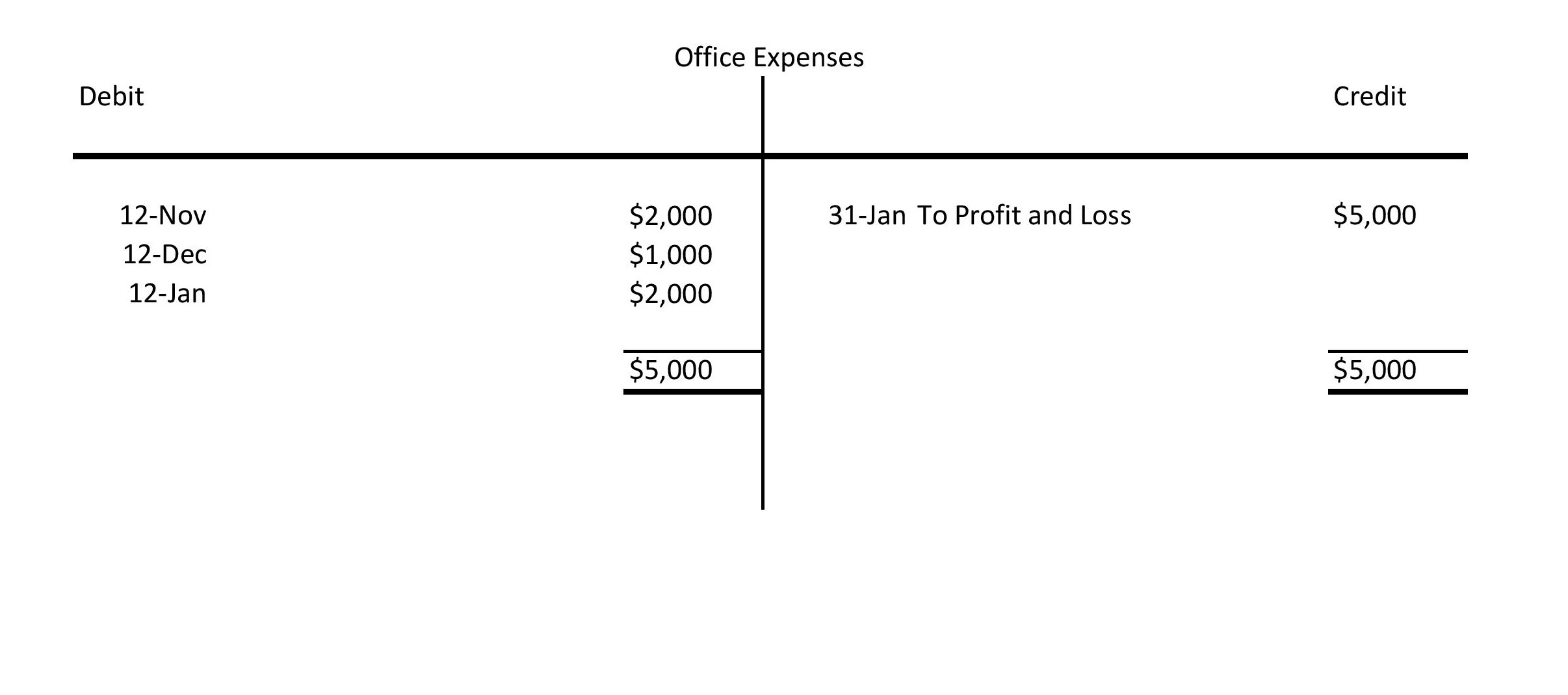

The credit entry to the profit and loss account of 12,000 represents the net profit for the period. On july 16, 2019, usa company sold goods to customers for cash $55,000. Explanation a profit and loss account is prepared to determine the net income (performance result) of an enterprise for the year/period.

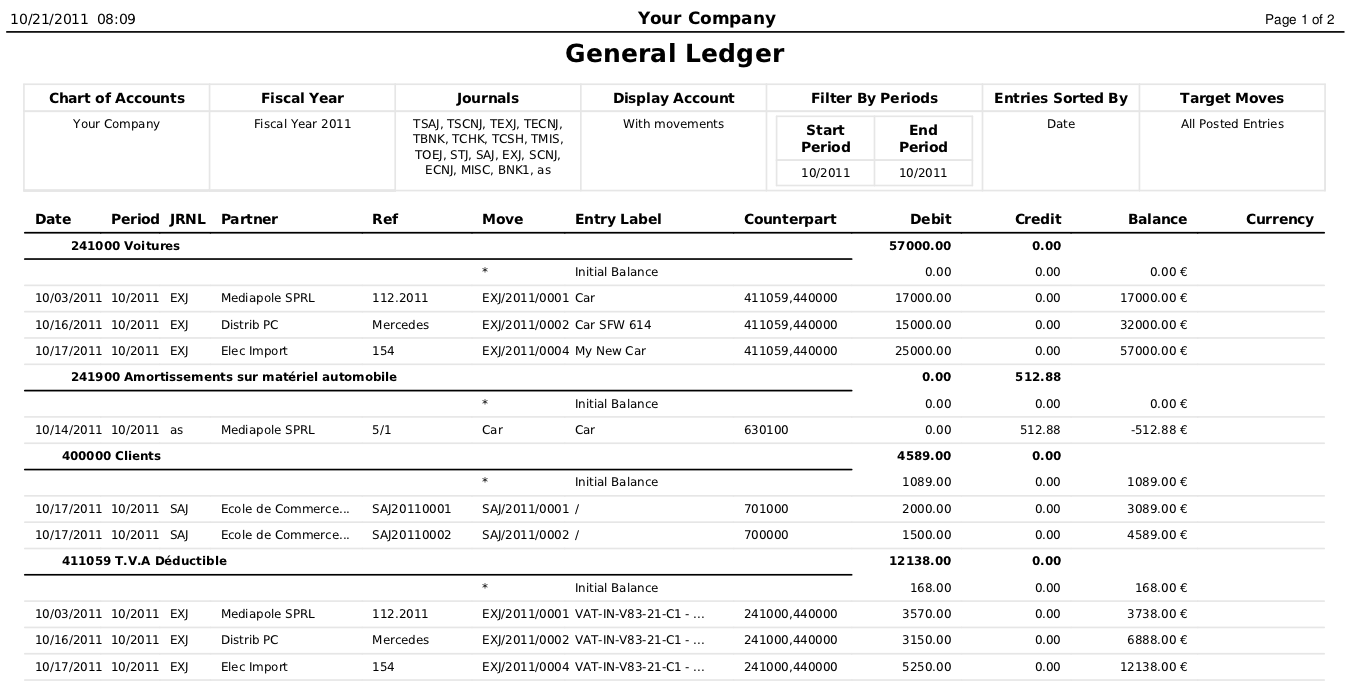

You can obtain current account balances from your. General ledger accounts will normally be used to represent different categories of income, expenses, assets, liabilities and reserves (share capital and retained profits). Examples of general ledger accounting.

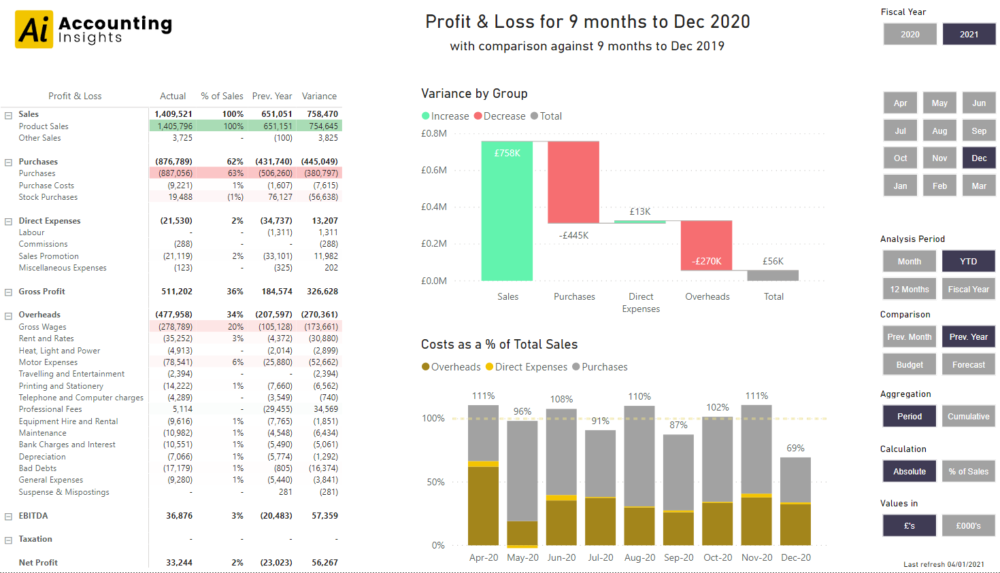

Below is the transaction’s journal entry. An income statement displays a company’s profit and loss over a period of time, or simply, the financial performance. The general ledger acts as a collection of all accounts and is used to prepare the balance sheet and the profit and loss statement.

A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. A ledger, also called a general ledger, is a record of a business’s financial transactions. Profit and loss (p&l) accounting is the process of creating a profit and loss statement to help companies have a clear view of the revenues and expenses over a period.

In the financials menu, click layout on the toolbar and select either profit and loss or. A gl account records all transactions for that account. January 19, 2021 19 min read in this article, you will learn:

For example, sales revenue, cost of goods sold, operating expenses, and other income or expenses are traced back from individual accounts in the general ledger. The transactions are related to various accounting elements, including assets, liabilities, equity, revenues, expenses, gains, and. A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time.

Calculate revenue the first step in creating a profit and loss statement is to calculate all the revenue your business has received. The income statement, also commonly known as the profit and loss statement, is prepared by extracting revenue and expense information directly from the general ledger. Benchmark crude oil fell 30 cents to $76.34 per barrel in electronic trading on the new york mercantile exchange.

A new york judge has ordered former president donald trump and executives at the trump organization to pay over $364 million in a civil fraud case, handing a win to new york attorney general. Within each layout option, create gl groups and add gl accounts to these to manage reporting for the profit and loss, and balance sheet. A general ledger account (gl account) is a primary component of a general ledger.

A general ledger template is a record of the income and expenses that affect your company’s bottom line. General ledger accounts encompass all the transaction data needed to produce the income statement,. A general ledger, more commonly known as a gl,.

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2020/06/Profit-and-Loss-Statement-for-Small-Business-TemplateLab.com_-scaled.jpg)