Fantastic Info About Cash Flow As Per 3

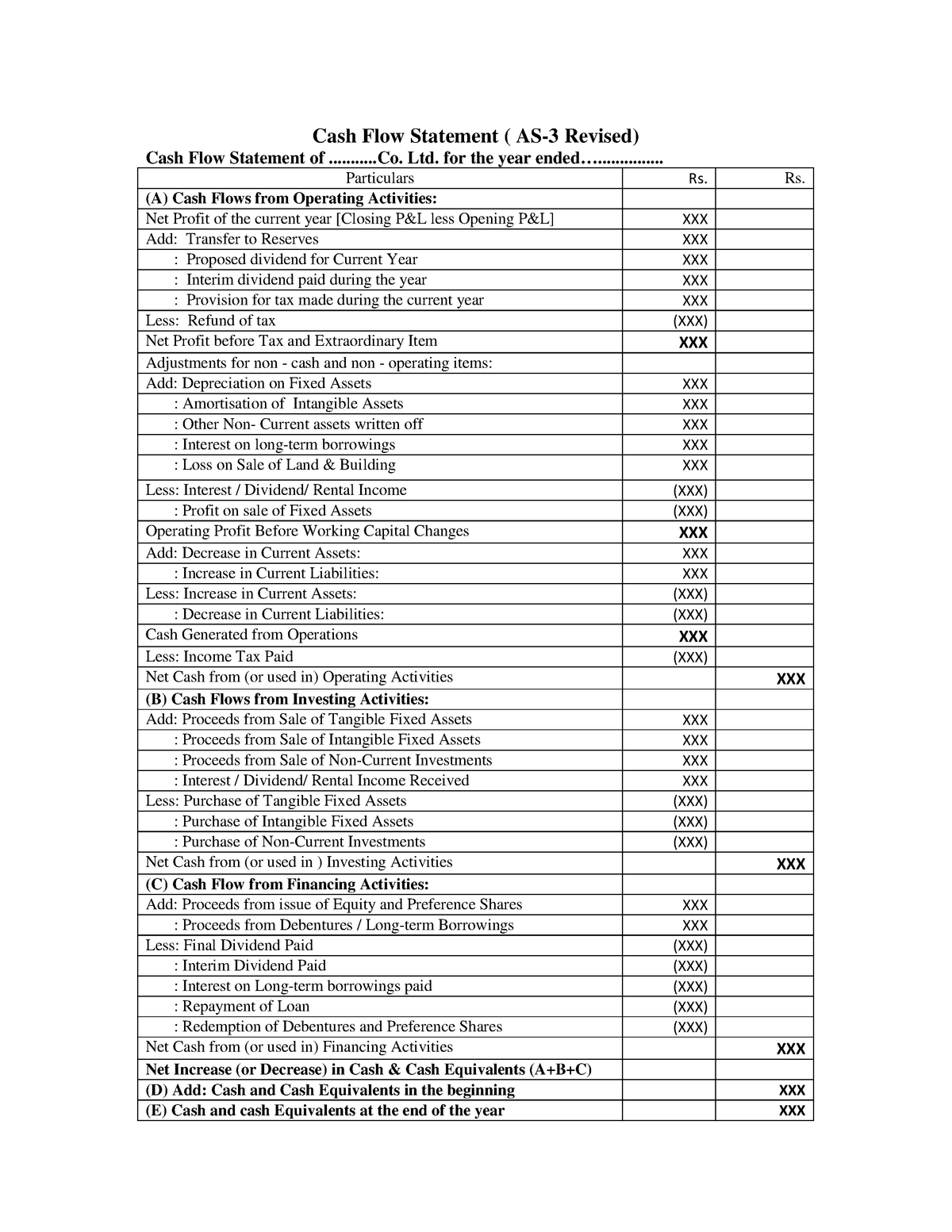

Classifies cash flows during the period from operating, investing and financing activities.

Cash flow as per as 3. Fundamental principle in ias 7 all entities that prepare financial statements in conformity with ifrss are required to present a statement of cash flows. The first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the beginning of the reporting period. Cash position of $1,123.7 million as of december 31,.

Feb 22, 202401:16 pst. Lure of cash poses challenges for asset managers. (b) cash flows from investing activities;

** shares in iss iss drop 9% as the danish services provider q4 print and 2024 free cash flow guidance fall short of market expectations, overshadowing the announcement of a one billion danish crowns billion share buyback. Using the indirect method, operating net cash flow is calculated as follows:. W), one of the world's largest destinations for the home, today reported financial results for its fourth quarter and full year ended december 31, 2023.

Cash flow statements or the accounting standard 3 (as 3) are a common financial report that reveals the amount of cash you have in your account for a particular time. Begin with net income from the income statement. Strong free cash flow of the industrial business up 39% at €11.3 billion (2022:

Such gaap measurements include net loss, net loss per share, net cash provided by operating activities, and other performance measures. While income statements are fantastic for showing you the amount of money you've earned and spent but they're not able to reveal how much cash you've got for a. Operating, investing and financing will be the same.

Determine net cash flows from operating activities. Ganesh contents applicability objective scope benefits of cash flow information definitions cash and cash equivalents presentation of cash flow statements operating activities investing activities financing. An enterprise should prepare a cash flow statement and should present it for each period for which financial statements are presented.

Classification of cash flows as per accounting standard 3. Applicability of as 3 cash flow statements the applicability of cash flow statement has been defined under the companies act, 2013. The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year).

An enterprise should prepare a cash flow statement and should present it for each period for which financial statements are presented. The statement of cash flows is prepared by following these steps:. The statement of cash flows acts as a bridge between the income statement and balance sheet by.

Including cash inflows a business gains from its continuing progress and external financing sources, as well as all cash outflows that pay for trading activities and finances during a delivered time. This accounting standard accounts for information about changes in cash and cash equivalents of an entity during a particular period.such information is disclosed in the cash flow statement indicating cash flows from operating, investing and financing activities during an accounting period. Users of an enterprise’s financial statements are interested in how the enterprise.

Information about the cash flows of an enterprise is useful in providing users of financial statements with a basis to assess the ability of the enterprise to generate cash and cash equivalents and the needs of the enterprise. Presentation of cash flows from operating activities other important points disclosure example of cash flow statement:

.jpg?format=1500w)