Underrated Ideas Of Tips About Profit And Loss On Balance Sheet

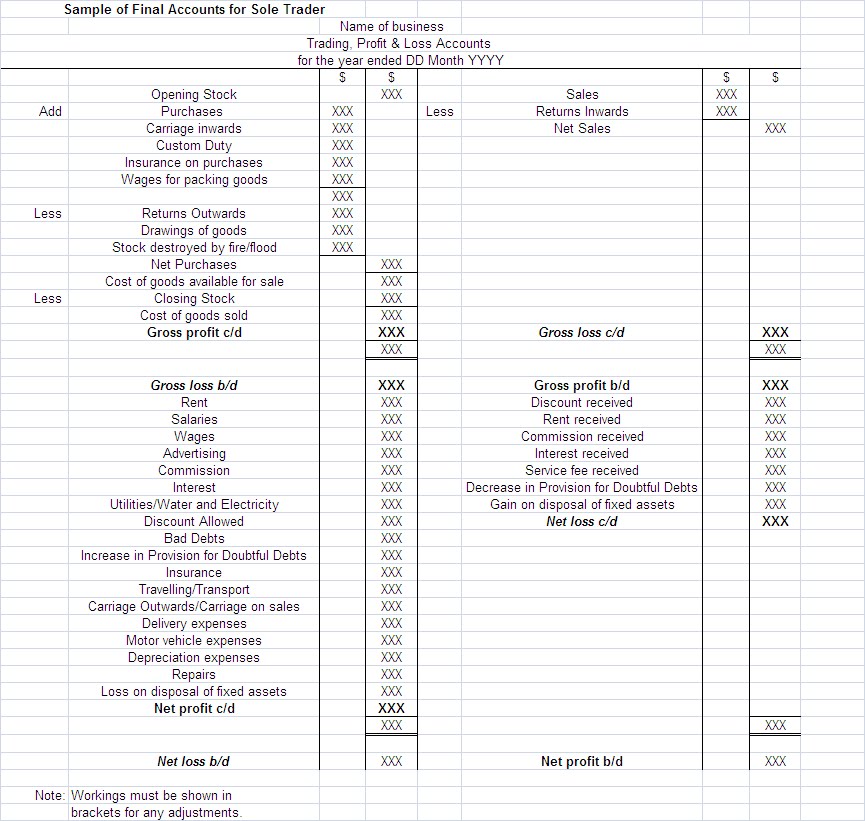

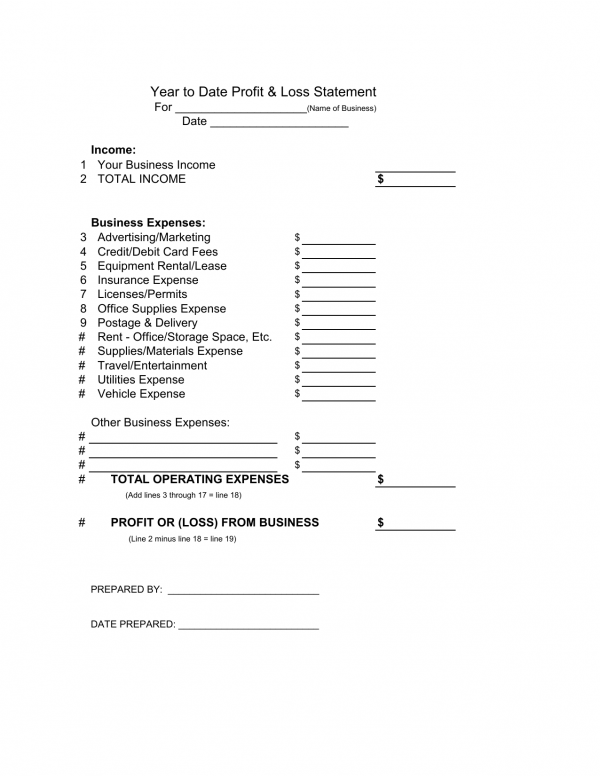

It focuses on analysing the income and expenses incurred during that time to determine whether the company made a profit or.

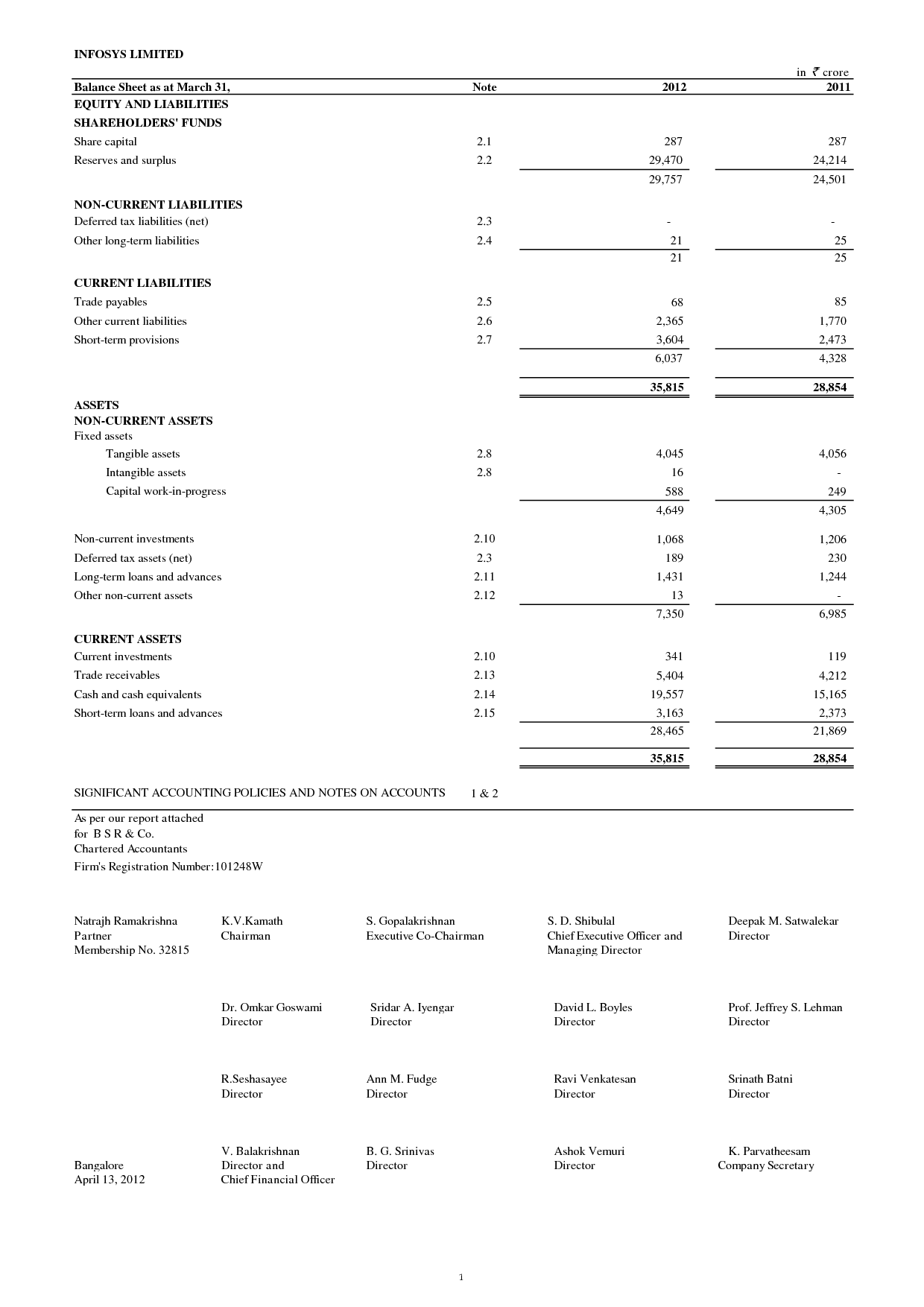

Profit and loss on balance sheet. All income and expenses are added together to gather the net income, which reports as retained earnings. The profit or net income belongs to the owner of a sole proprietorship or to the stockholders of a corporation. The profit and loss statement:

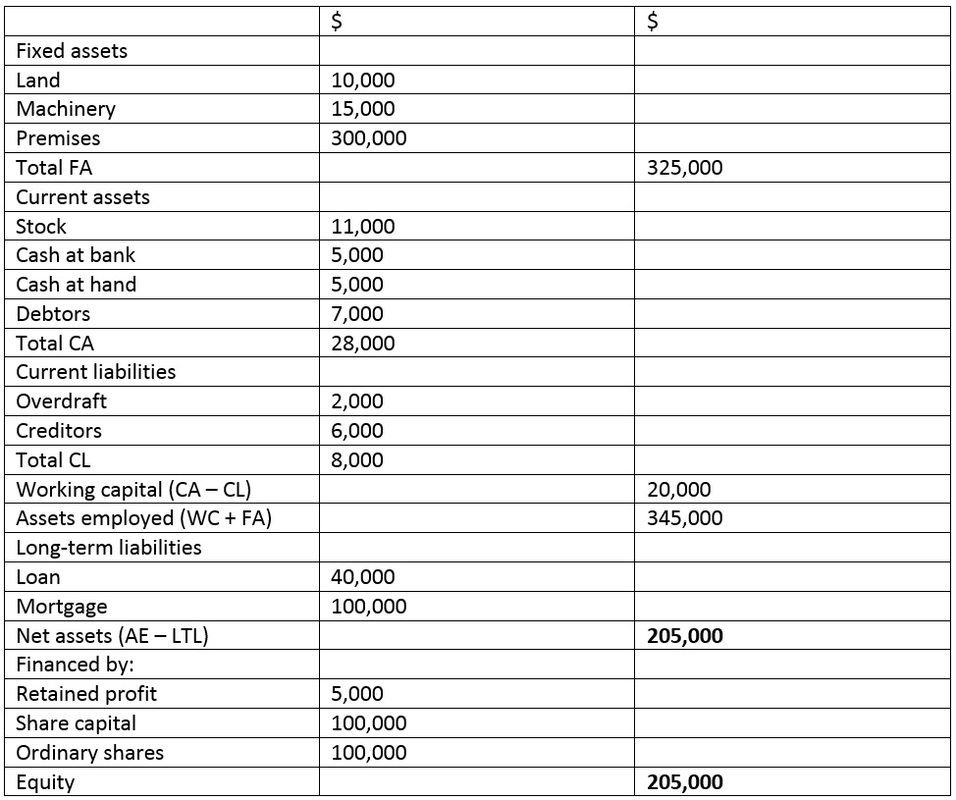

The balance sheet provides a snapshot of what a company owns and owes and the amount shareholders invest. It lists all the ownership, i.e. It measures how the company earns its revenues and incurs its expenses during a period and, importantly, shows the company’s resulting net profit or loss.

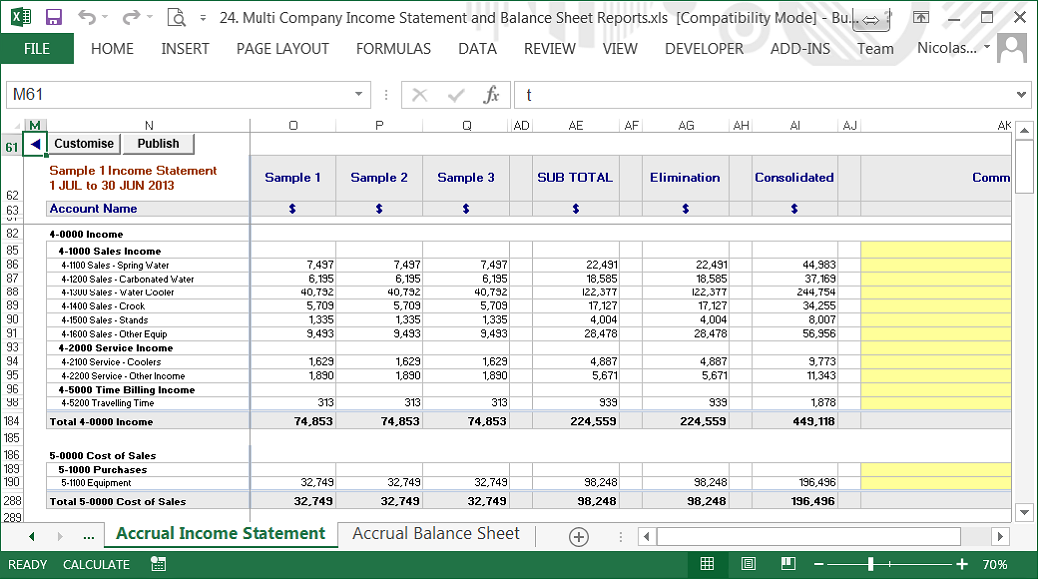

Balance sheets are broadly prepared compared to profit and loss statements. Our correspondent points out bsp’s balance sheet is stronger, its margins are wider, and its dividends are fatter. Balance sheets provide the basis for.

There are several key differences between the p&l and balance sheet, particularly the information presented and what it means. Profit and loss (p&l) statement balance sheet; The balance sheet shows a company’s.

Key difference between a balance sheet and a profit and loss account (p&l) provides a snapshot of the company's financial position at a specific point in time. A profit and loss statement is also called an income statement, or the statement of financial performance. The liabilities and owner's equity (or stockholders' equity) are.

The p&l statement is one of three financial. In contrast, the balance sheet is like a photograph taken at an instant in time giving a picture of what the business owns and what the business owes at that moment in time. Profit and loss account.

It shows your revenue, minus expenses and losses. Because the balance sheet is more detailed then the p&l, you are well advised to seek. A balance sheet (also known as a 'statement of financial position') details a company's assets, liabilities, and shareholder equity at a given time.

That net income becomes a retained earnings line item on the balance sheet, which is used to locate the ending cash balance. The other two are the profit and loss statement and cash flow statement. Balance sheet vs.

The p&l summarizes the company’s performance over a specific period, while the balance sheet reflects the company’s value at a specific. If a company prepares its balance sheet in the account form, it means that the assets are presented on the left side or debit side. The basic formula for the balance sheet is:

The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits. Together, alongside the cash flow statement (cfs) and balance sheet , the p&l statement provides a detailed depiction of the financial state of a company. The balance sheet shows a snapshot of the accounts on any date and used by business owners, investors and banks.

![Balance Sheet vs. Profit and Loss Account [2024]](https://res.cloudinary.com/goforma/image/upload/v1585669485/small business accounting/profit-and-loss-example_simgmu.jpg)