Best Of The Best Info About Drawings Debit Or Credit In Trial Balance

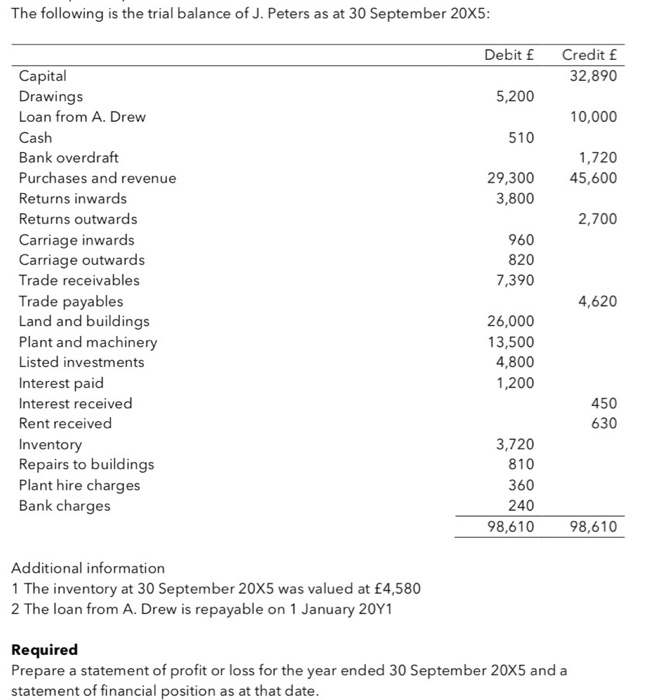

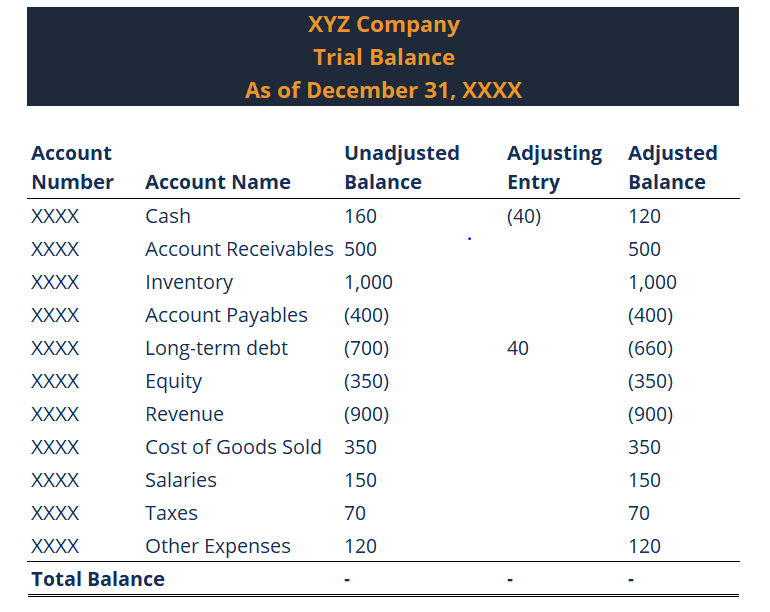

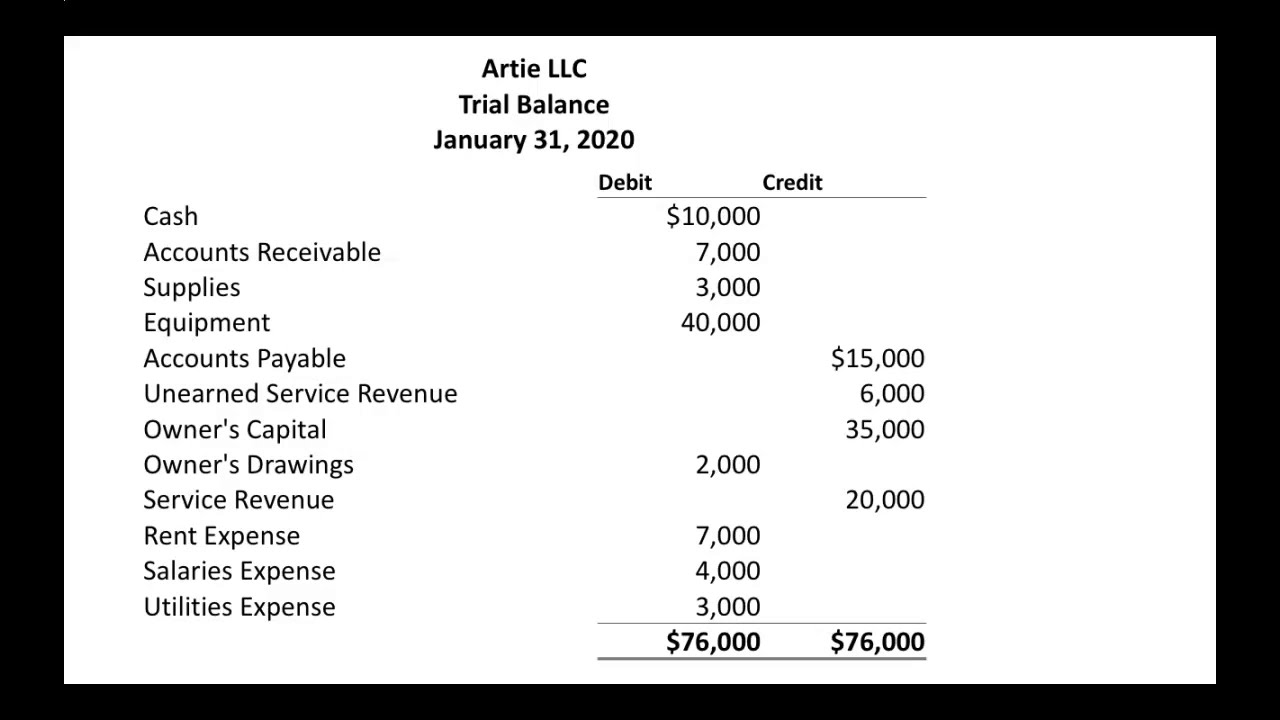

In this case, the trial balance indicates a balanced equation:

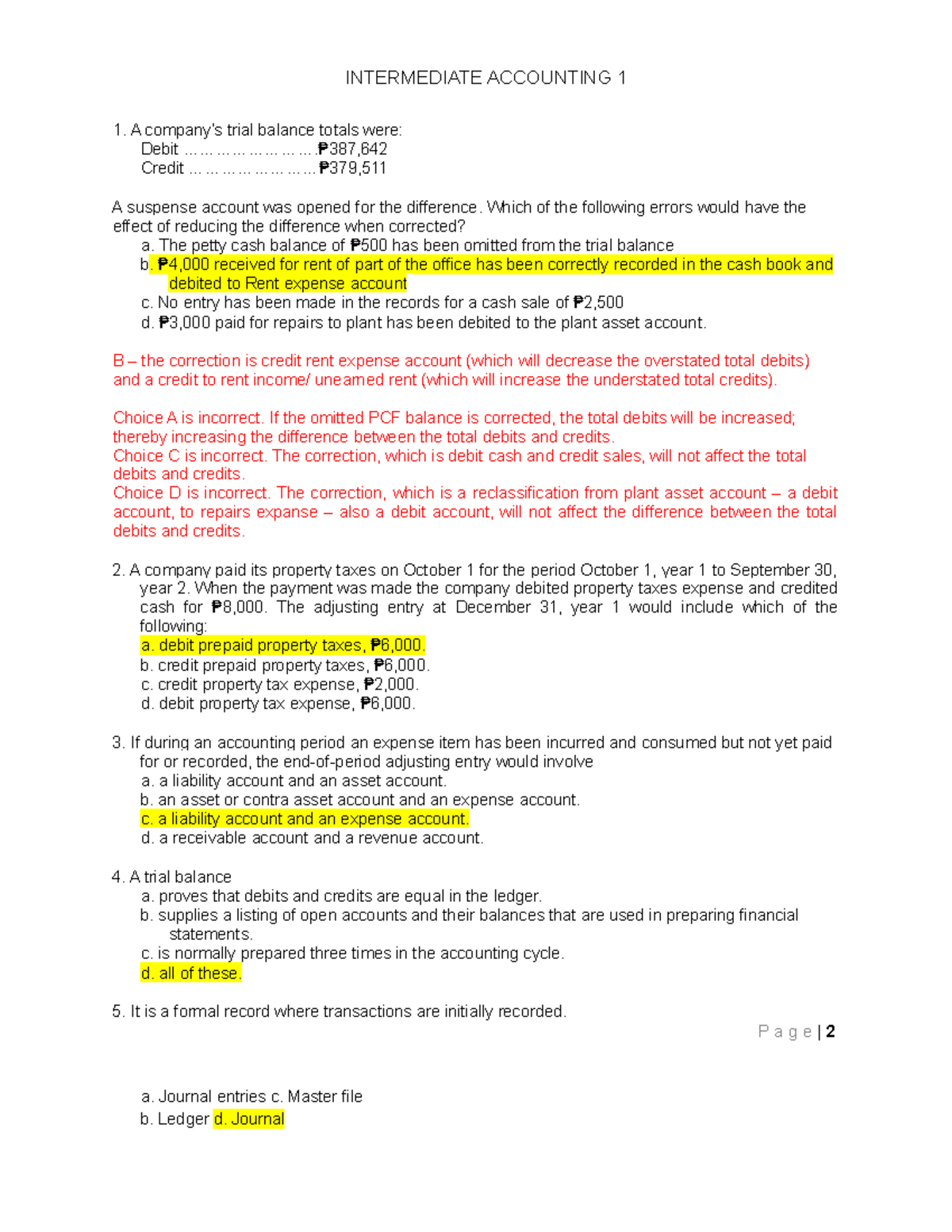

Drawings debit or credit in trial balance. An organisation prepares a trial balance at the end of the accounting year to ensure all entries in the bookkeeping system are accurate. The final total in the debit column must be the same dollar. If totals are not equal, it means that an error was made in the recording and/or posting process and should be investigated.

The learner needs to understand that a trial balance is prepared for twofold reasons. Drawings accounting bookkeeping entries explained. The debits and credits include all.

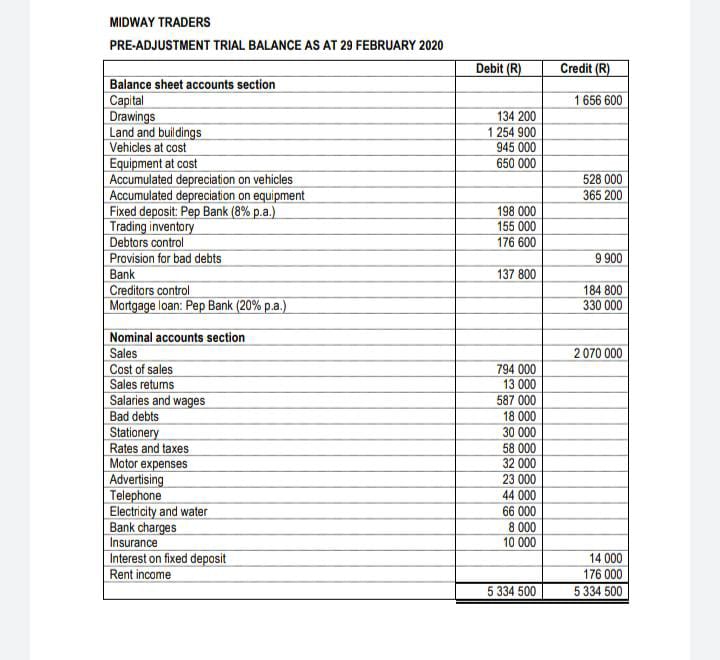

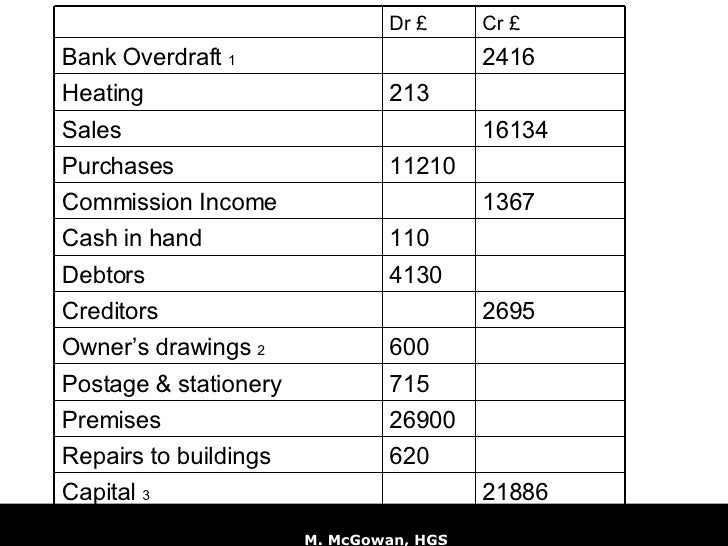

Credit cash is withdrawn from the business and taken by the owner. A trial balance is the accounting equation of our business laid out in detail. As we know, the trial balance is the report of accounting in which ending balances of a different general ledger are presented into the debit/credit column as per their balances where debit amounts are listed on the debit column, and credit amounts.

The trial balance is a summation of or list of credit and debit balances drawn from the many ledger accounts like the bank balance, cash book etc. $10,000 (initial assets) + $3,000 (expenses) + $2,000 (software) = $15,000. A trial balance is a list of the balances of all of a business's general ledger accounts.

One, it is a summary of all ledger account balances at the end of the given period and two, it is used to assess whether there was erroneous accounting entries. Trial balance using account balances. A trial balance is the accounting equation of our business laid out in detail.

It is not an expense of the business. It is a statement prepared at a certain period to check the arithmetic accuracy of the accounts (i.e., whether they are mathematically correct and balanced). Debit the withdrawal of cash by the owner for personal use is recorded on a temporary drawings account and reduces the owners equity.

Drawings a/c debit balance is contrary to the capital a/c credit balance because any withdrawal from the business for personal use will reduce the capital. The most common method of preparing the tb is for each individual account to be balanced off to give a net debit or credit balance on the account, the balance is then entered on the debit or credit side of the trial balance as appropriate. If the total of all debit values equals the total of all credit values, then the accounts are correct—at least as far as the trial balance can tell.

The cardinal rule of the trial balance is that the total of the trial balance debit and credit accounts and ba lances taken from the ledgers should be the same or tallied. Therefore, if the debit and the credit sides of the trial balance are the same, it is assumed that. It does not directly affect the profit and loss account in any way.

This statement comprises two columns: The rule to prepare trial balance is that the total of the debit balances and credit balances extracted from the ledger must tally. At the end of the month, creative designs decides to create a trial balance to ensure the books are balanced:

Once all ledger accounts and their balances are recorded, the debit and credit columns on the trial balance are totaled to see if the figures in each column match each other. We can see everything clearly and make sure it all balances. The accounting treatment of drawings in trial balance is that it is debit as it is a contra equity account or in other words it is the reversal or opposite of capital account which has normal credit balance.