Beautiful Work Tips About Bank Efficiency Ratio Comparison

An efficiency ratio is a calculation that illustrates a bank’s profitability.

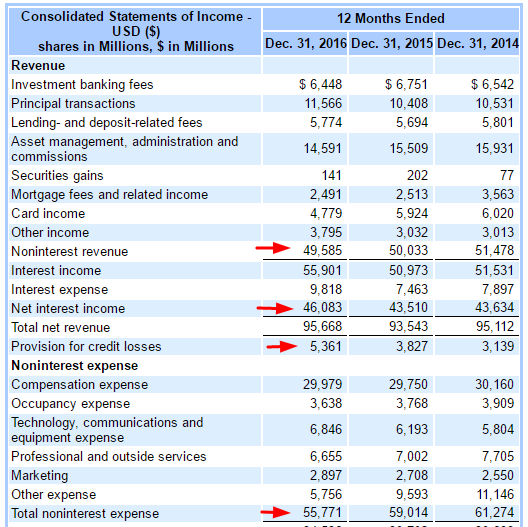

Bank efficiency ratio comparison. The following is a ranking of all banks in the united states in terms of efficiency ratio. The average level of islamic banking efficiency ranges between 89.73% and 94.16%. Bank efficiency ratio = $53,205 / ($51,945 +.

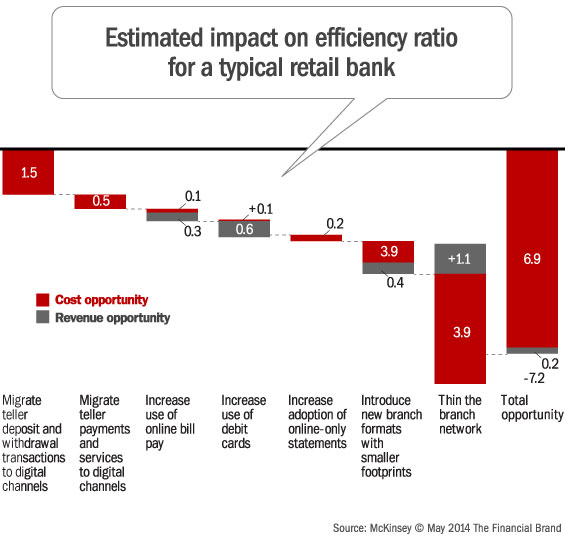

Selected research papers were coded in terms of their key objectives and were segregated into 11 themes—branch, comparison, consolidation and expansion,. Banks with a higher equity will genere'lv report higher operating ratios, such as interest and gross. The metric divides a bank’s operating expenses.

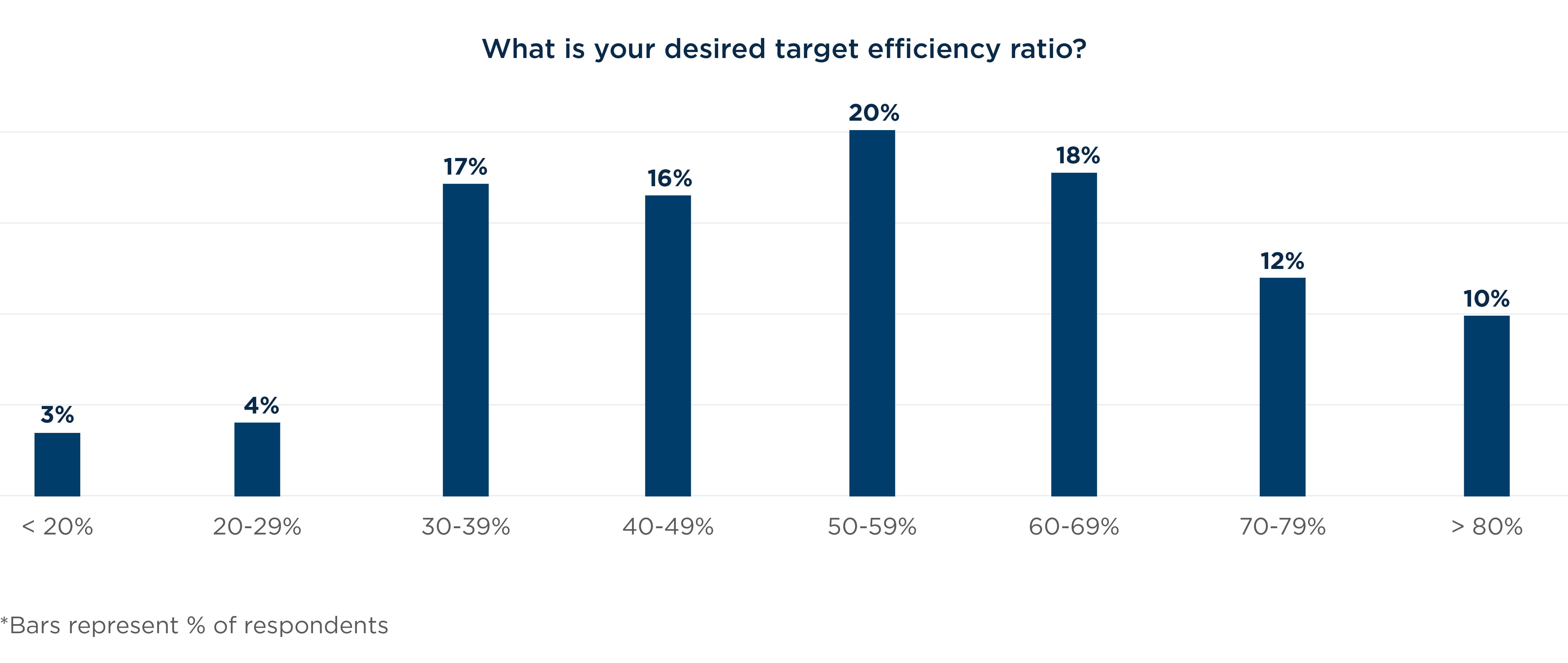

How to calculate efficiency ratio? Bbva has an efficiency ratio of 48.7 % as of september 30, 2019 (last public data at this date), and leads the way in the comparison with european banks,. Efficiency ratio for 2016 = 61.75%.

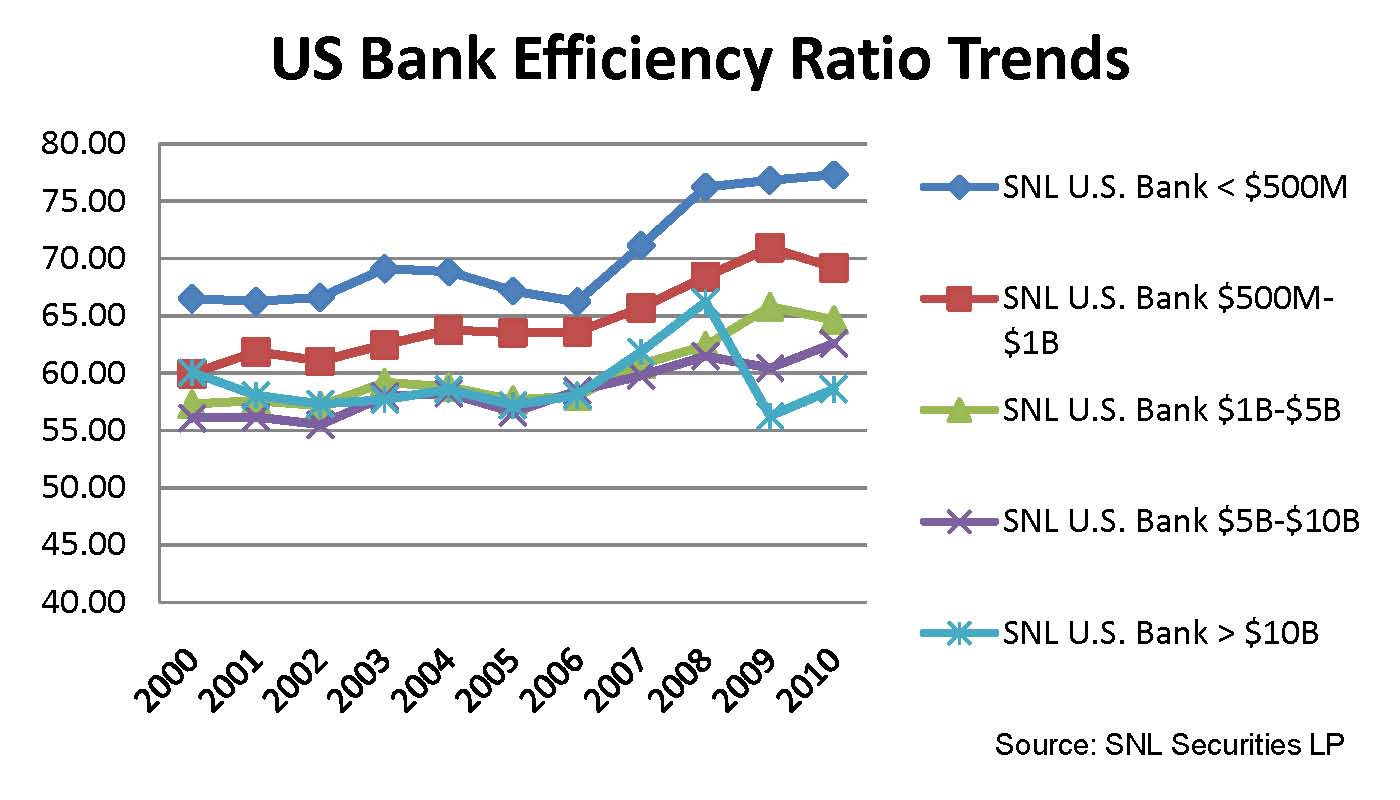

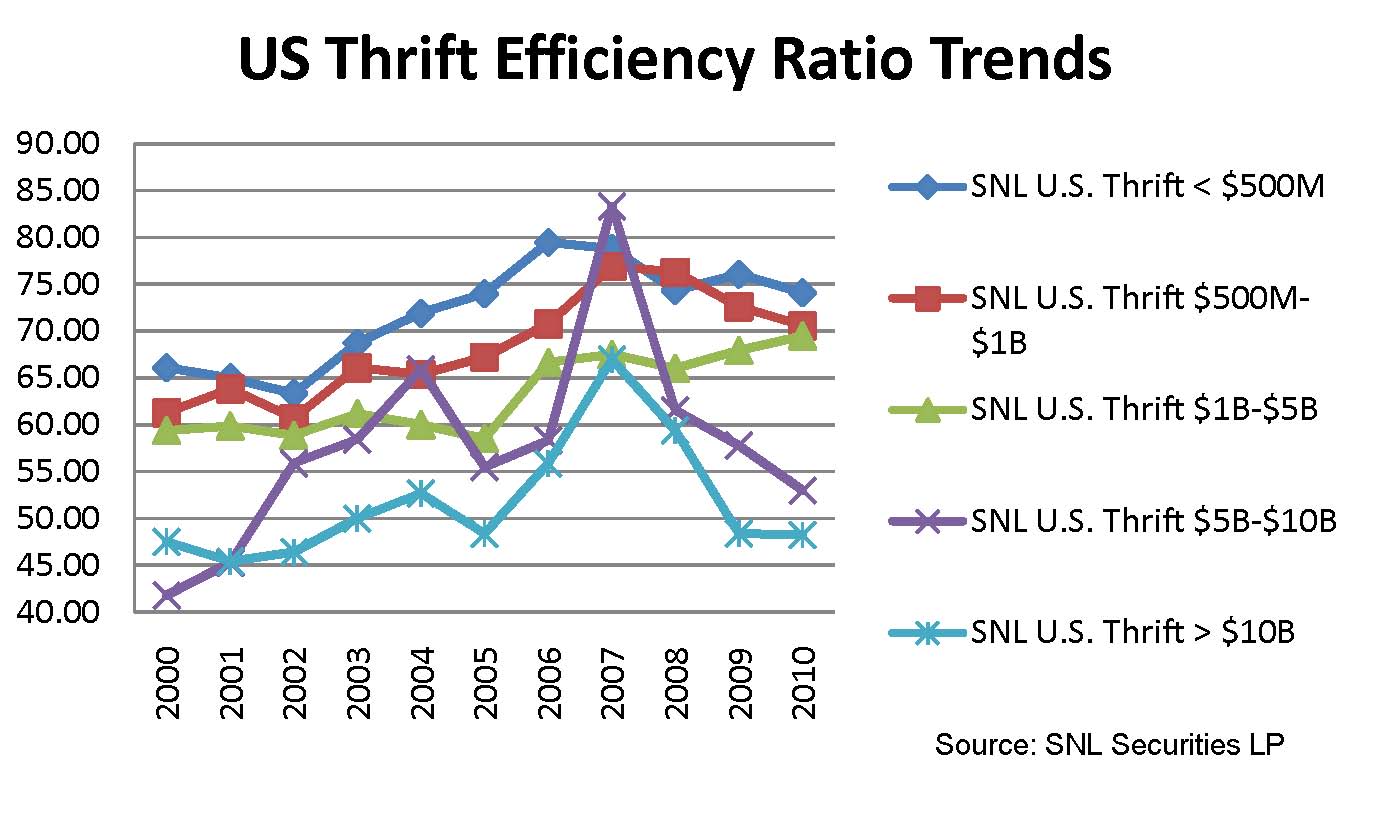

Since a bank's operating expenses are in the numerator and its revenue is in the denominator, a lower efficiency ratio means that a bank is operating better. Bank size is determined in accordance with the european central bank methodology (ecb, consolidated banking data 2018), where bank is defined as a) large. The aggregate efficiency ratio for u.s.

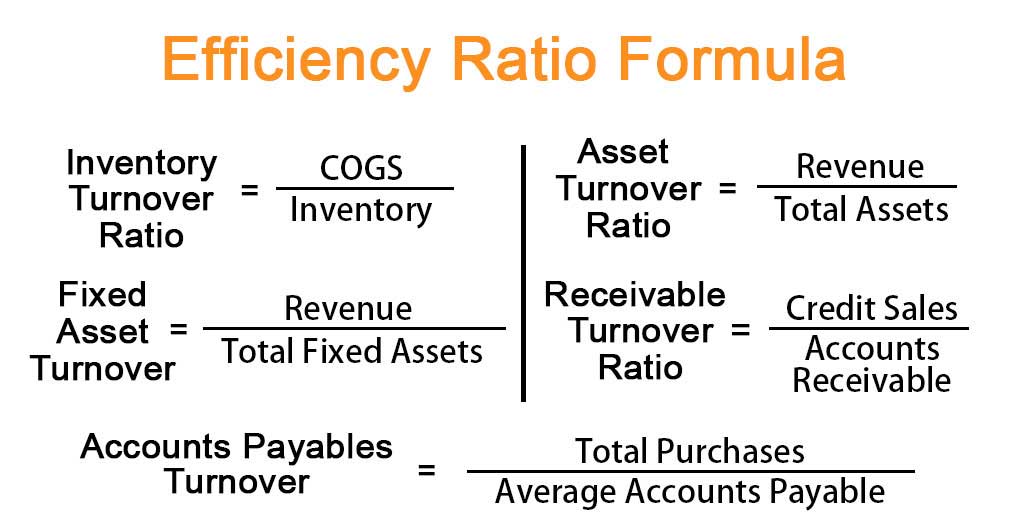

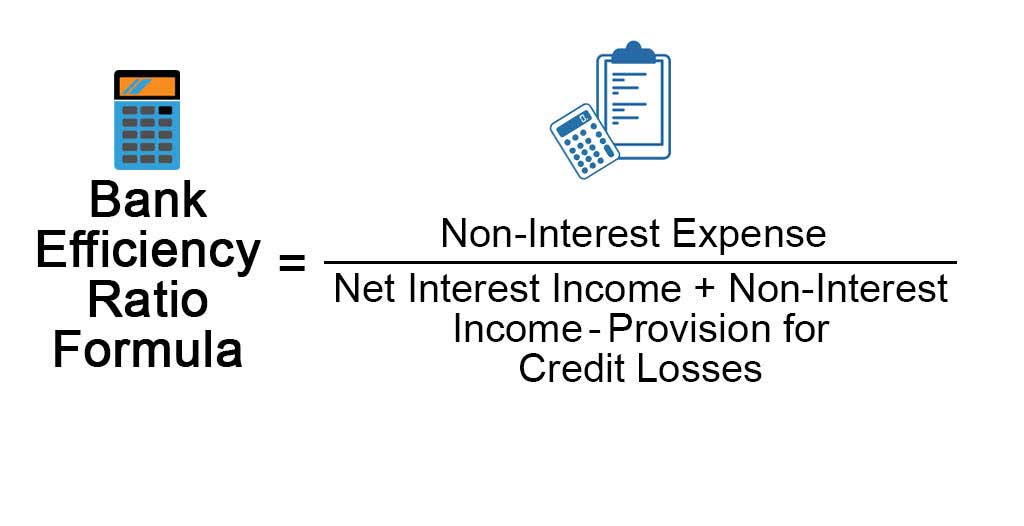

Additionally, the revenue is $150,000 for 2022, and for 2021. The formula for the efficiency ratio is:. The efficiency ratio is a profitability metric that can determine the operating efficiency of a bank.

The study involves a period from 2010 to 2019. For measuring the efficiency level, the data. To calculate the efficiency ratio, divide a bank’s expenses by net revenues.

The value of the net revenue is found by subtracting a bank's loan loss provision from its operating income. A lower efficiency ratio is preferable: The bank efficiency ratio is a key performance metric when assessing a bank’s profitability.

Key learning points. While bank of america's efficiency ratio improved in the first six months this year to 67% from 69% a year ago, the current figure is still 9.5 percentage points. This shows how well the bank's managers control their overhead (or back office).