Great Info About A Personal Balance Sheet Reports

Here are other equations you may encounter:

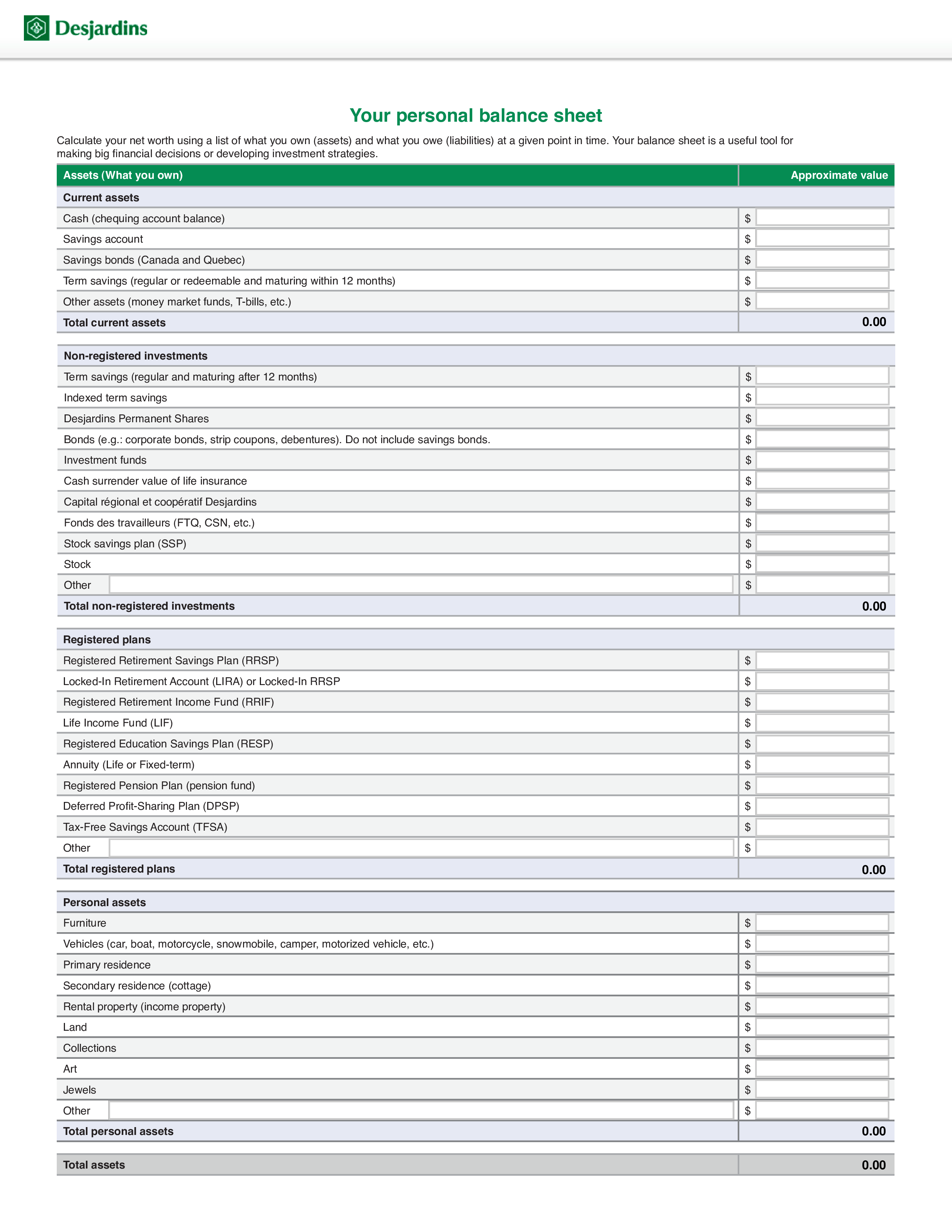

A personal balance sheet reports. Special dividend of € 1.00 per share. The personal financial statement is a document featuring an individual financial state at a specific time. A personal balance sheet reports select one:

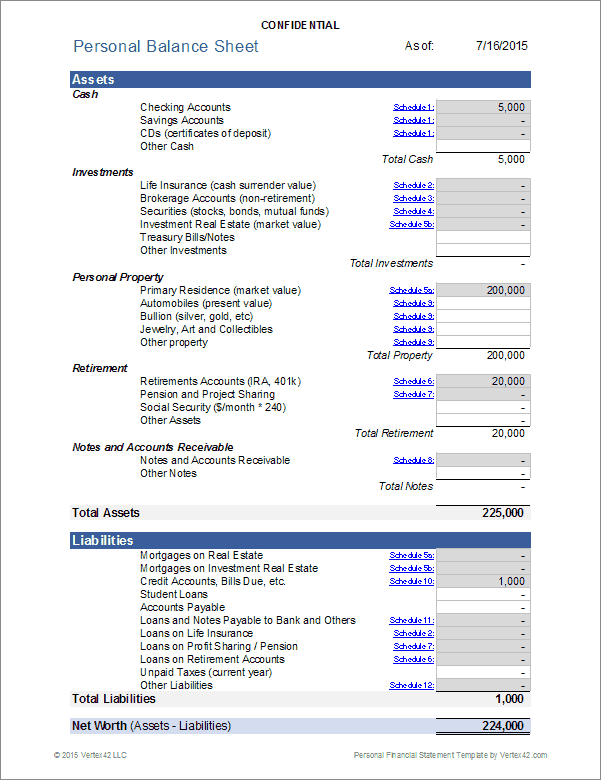

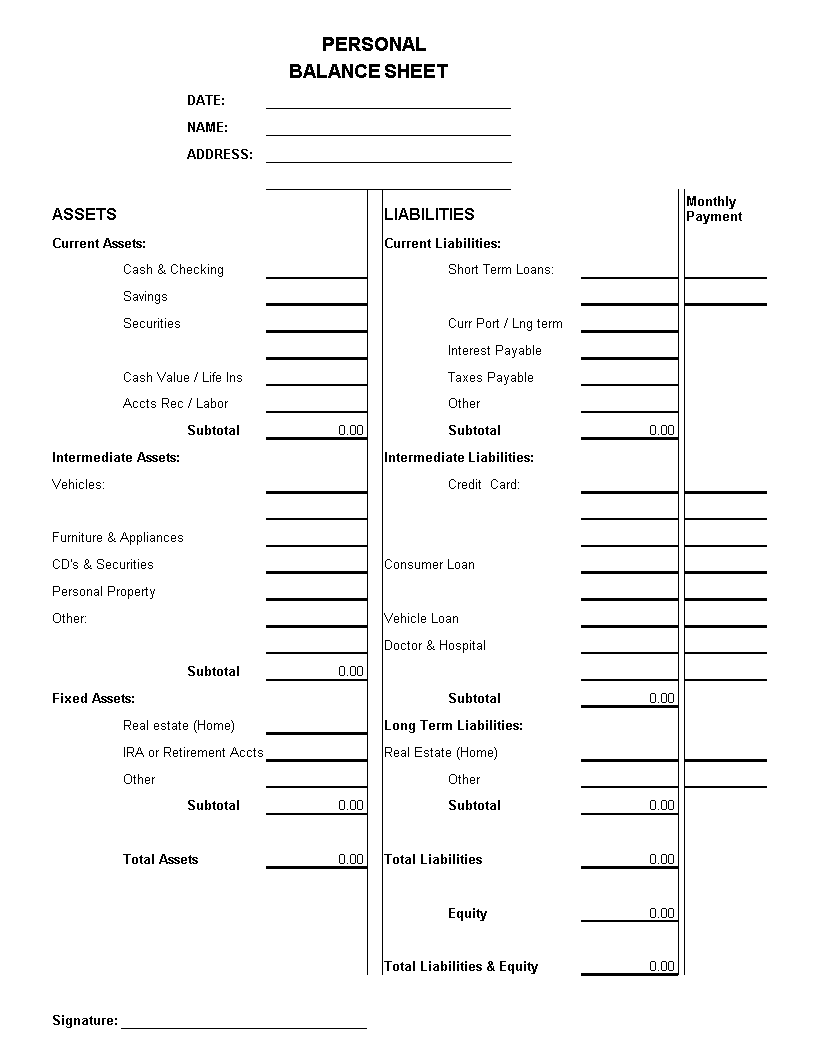

It lists all of an individual's assets and liabilities, with the difference between the two representing their net worth. The total balances of any debt you owe Note that the balance sheet does not include cash flow but does include the total amounts due or the total value of each account.

It lists all personal assets, anything owned that has. Earnings on savings and investments. Anything of value you own, including accounts and physical items liabilities:

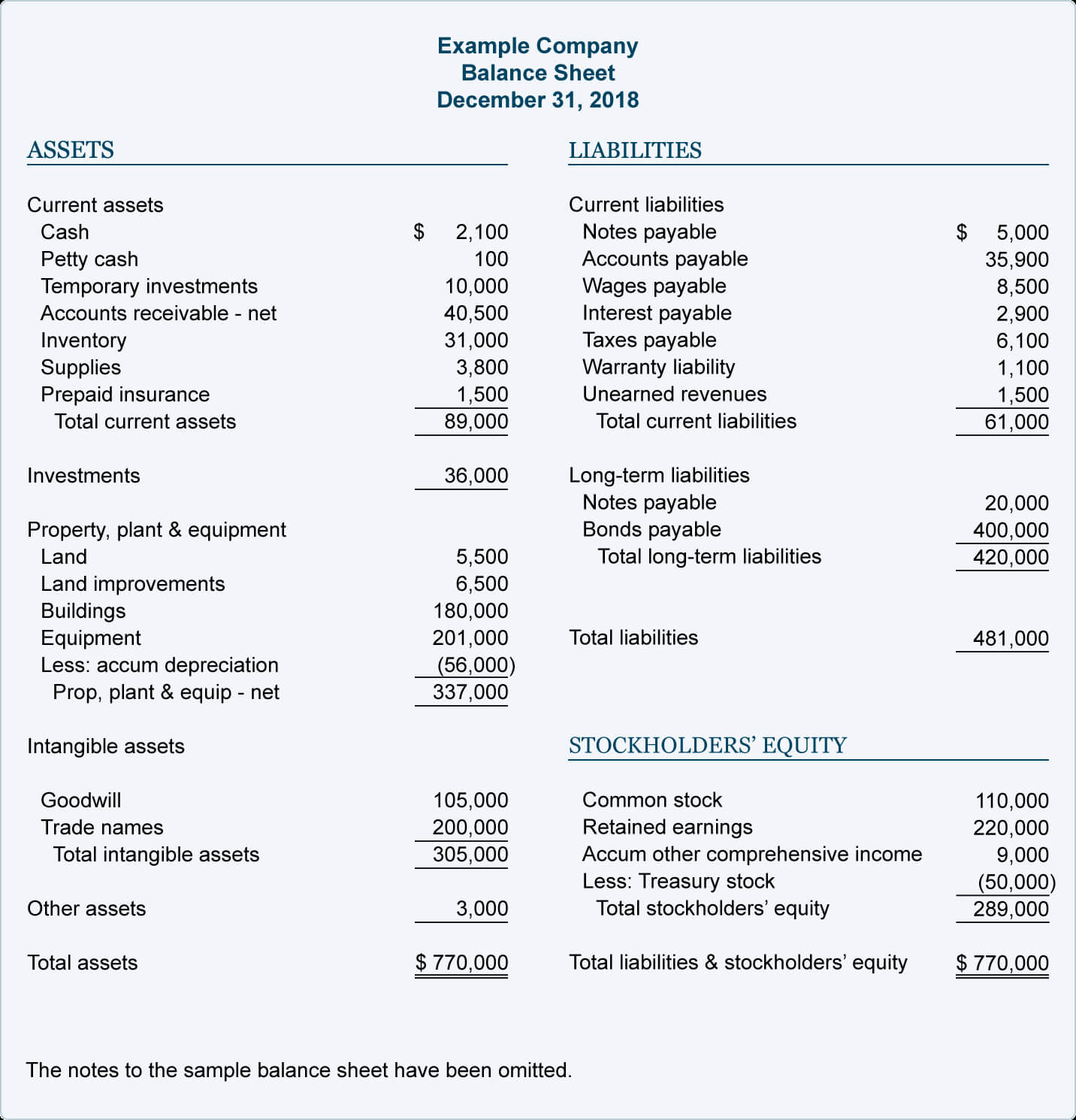

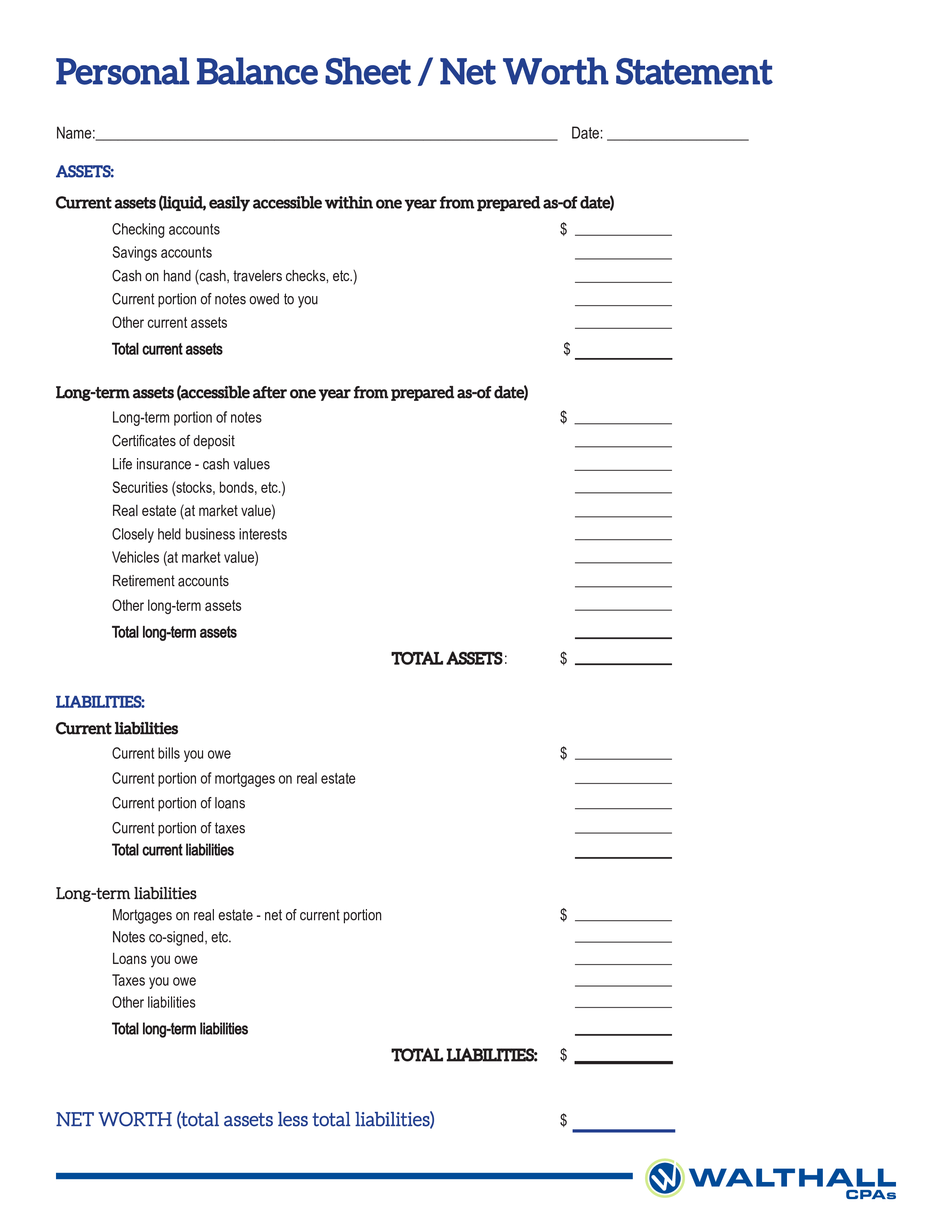

Below we will go through the different assets and liabilities on your personal balance sheet and provide a personal balance sheet example. It lists your assets (what you own), your liabilities (what you owe), and your net worth. The term personal financial statement refers to a document or spreadsheet that outlines an individual's financial position at a given point in time.

A personal balance sheet is a financial document that provides a snapshot of an individual's financial position at a specific point in time. Items owned and amounts owed. A balance sheet includes a summary of a business’s assets, liabilities, and capital.

Earnings on savings and investments. Balance sheets provide the basis for. By listing your assets, liabilities, and calculating your net worth, you gain valuable insights into your financial health and can make informed decisions about your personal finances.

Simply put, a personal balance sheet is a place to track your finances and all the key metrics needed to understand your situation. A balance sheet report gives you a financial snapshot of your company as of a specific date. A personal financial statement is a snapshot of your personal financial position at a specific point in time.

First quantum signs $500m copper deal with shareholder, says asset and stake sales progressing. A personal balance sheet reports select one: How to create a personal finance balance sheet.

The hdfc bank ceo suggested it was understandable why the. You can create a personal balance sheet by completing the following steps, including getting all relevant documents, listing your assets and liabilities, and calculating your net worth. Free cash flow before m&a and customer financing € 4.4 billion;

While this equation is the most common formula for balance sheets, it isn’t the only way of organizing the information. A personal balance sheet is a powerful tool that provides a comprehensive overview of your financial position. In this article, we go over what a personal balance sheet is, how to create one and how to use it as an effective tool in your financial planning.