Glory Tips About Free Cash Flow Statement

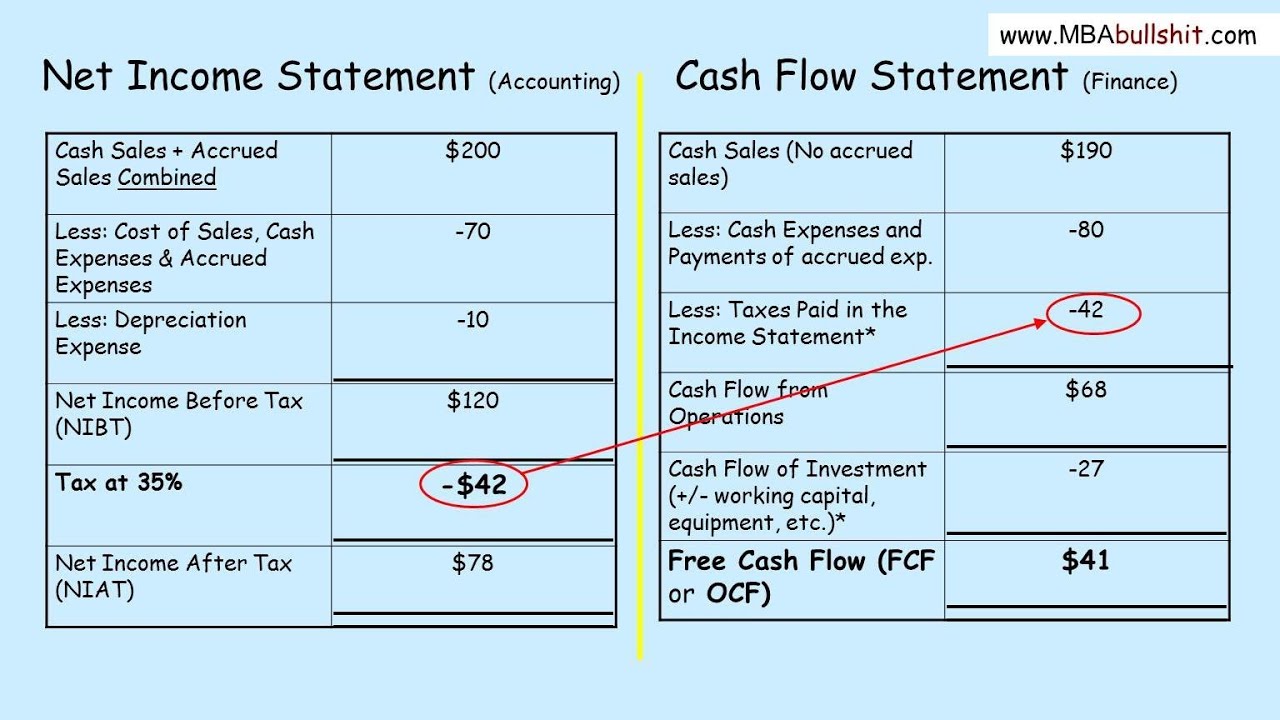

Alternatively, you can use a shorter and easier formula for free cash flow:

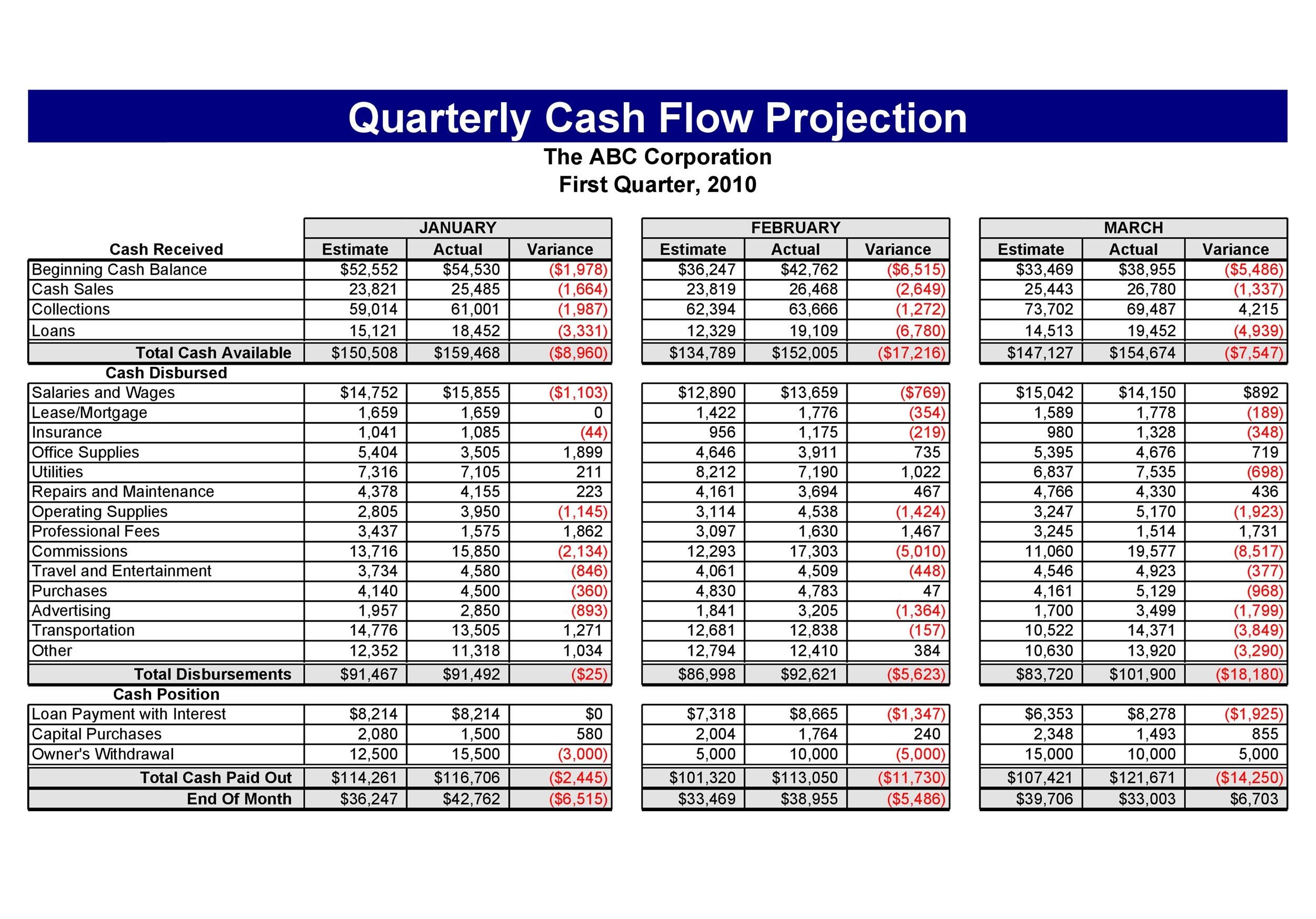

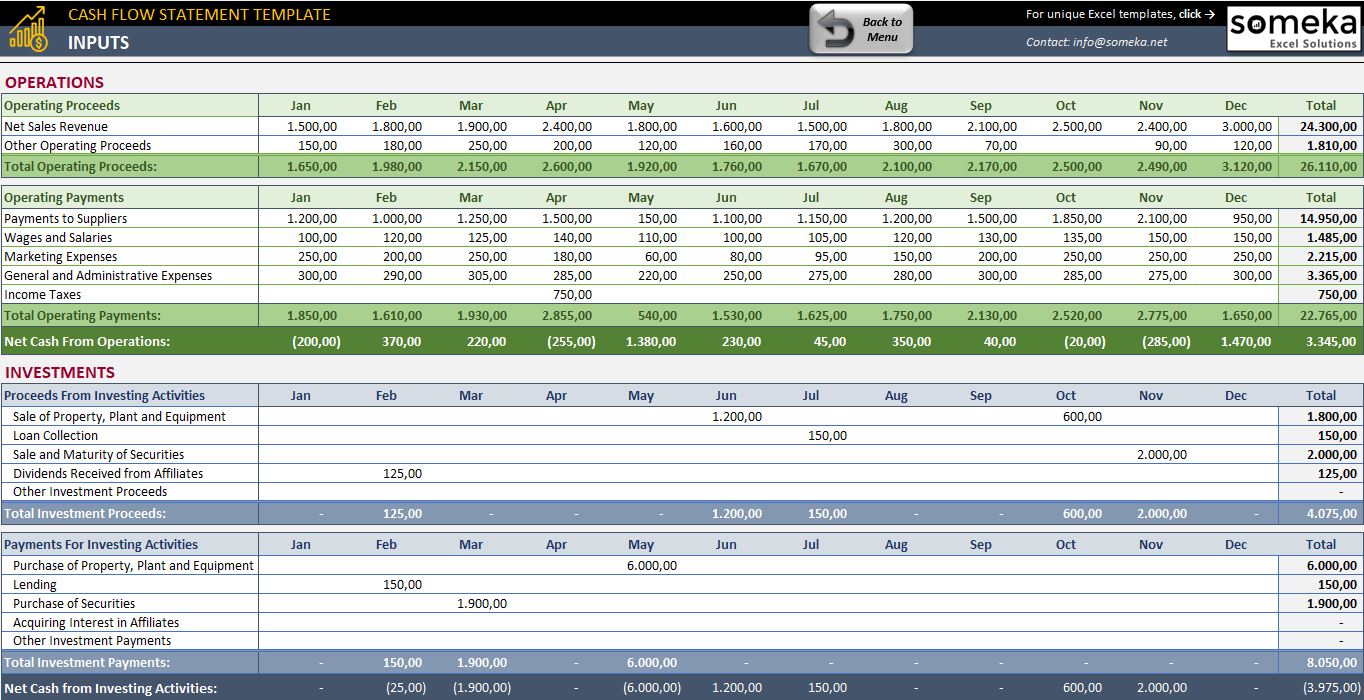

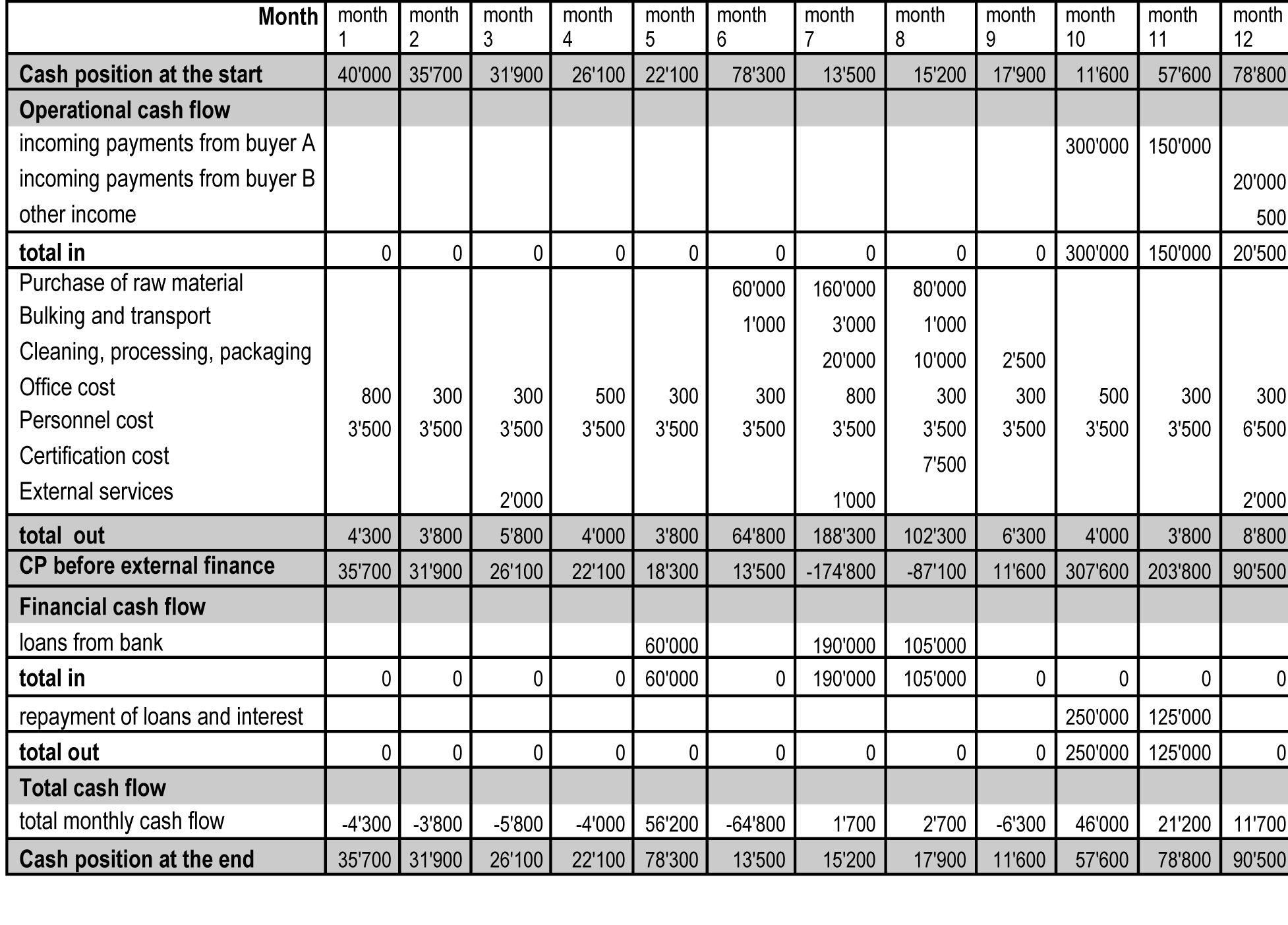

Free cash flow cash flow statement. Free cash flow statement templates accounts payable template. Fcf is the amount of cash a business has after paying for operating expenses and capital expenditures (capex), and fcf reports how much discretionary cash a business has available. To calculate the free cash flow, we subtract capital expenditures from operating cash flow:

Some investors provide more to cash flow statements than other financial statements. By cash we mean both physical currency and money in a checking account. To the general meeting we propose a cash dividend of eur 1.13 per share (2022:

An increase of 2% compared to last. Free cash flow is how much is left over from operating cash flow after capital expenditures. This value can be found on the income statement of the same accounting period.

The cash flow statement just proves that everything balances out. Cash is an important element of business. Ceo statement “in 2023, we delivered another strong and resilient performance.

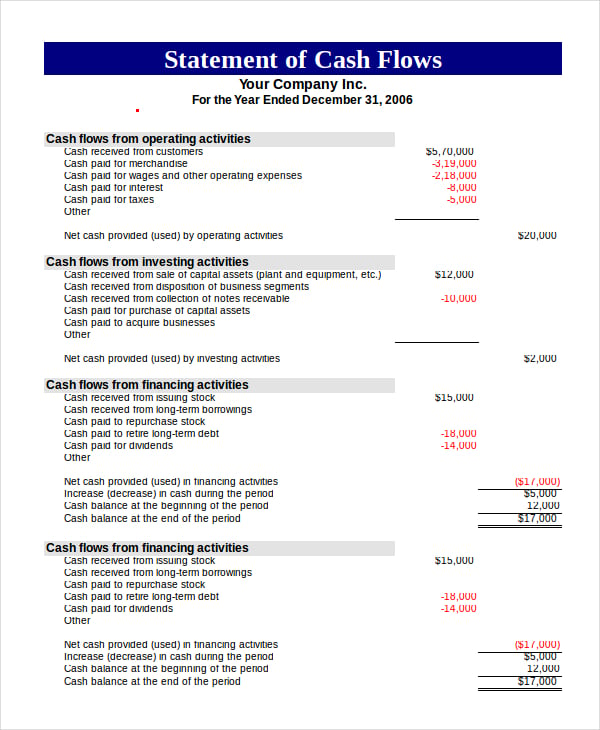

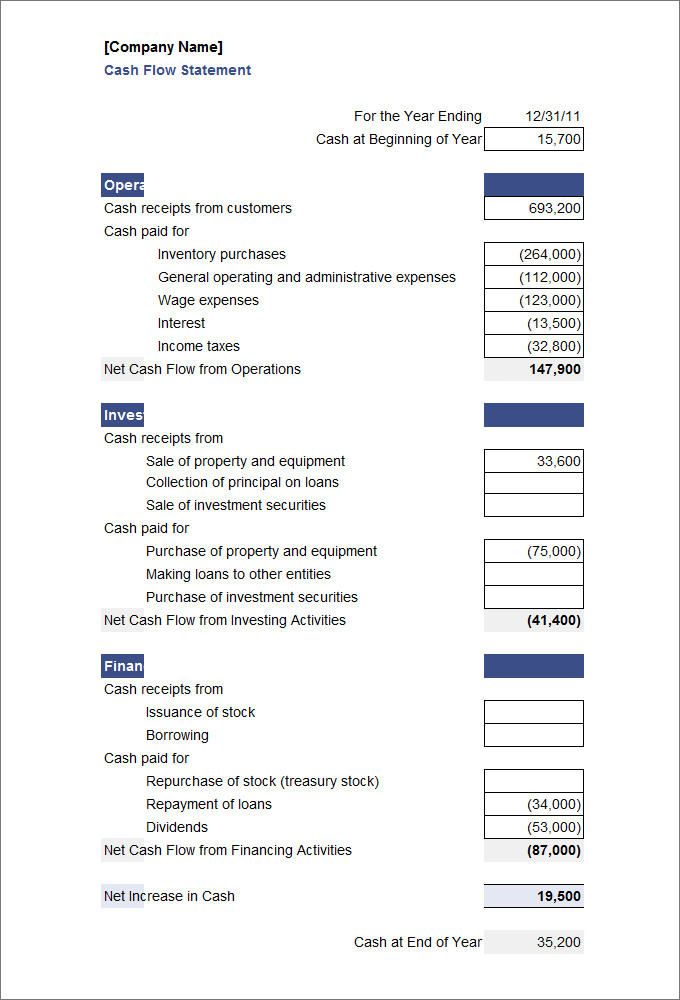

The purpose of a cash flow statement is to provide a detailed picture of what happened to a business’s cash during a specified period, known as the accounting period. This accounts payable template tracks suppliers, order numbers, and amounts due to help you. Streamline your financial management with our free cash flow statement template.

Free cash flow (fcf) =. Free cash flow can be defined as cash in hand of a company after paying all the expenses. Free cash flow is a measure of cash a company generates after paying all expenses and loans.

Management and investors use free cash flow as a measure of a company's. Free cash flow is the remaining cash a company has after accounting for operating expenses and capital. Free cash flow eur 423 million;

Ttm = trailing 12 months. Utrecht, 22 february 2024 highlights revenue eur 3,324 million; Organic revenue growth 4.5%ebita eur 521 million;

The ratio is calculated by dividing the fcf per share by the share price. The cash flow statement, or statement of cash flows, summarizes a company's inflow and outflow of cash, meaning where a business's money came from (cash receipts) and where it went (cash paid). Determine the starting balance the first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the beginning of the reporting period.

Docs free cash flow data by ycharts; The free cash flow yield is an overall return evaluation ratio of a stock, determining the fcf per share a company is expected to earn against its market price per share. Whether the company could face legal liability is unclear, experts.

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-3c51e1263e6f488daa2d923e2a43a33d.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)