Recommendation Info About View 26as Income Tax

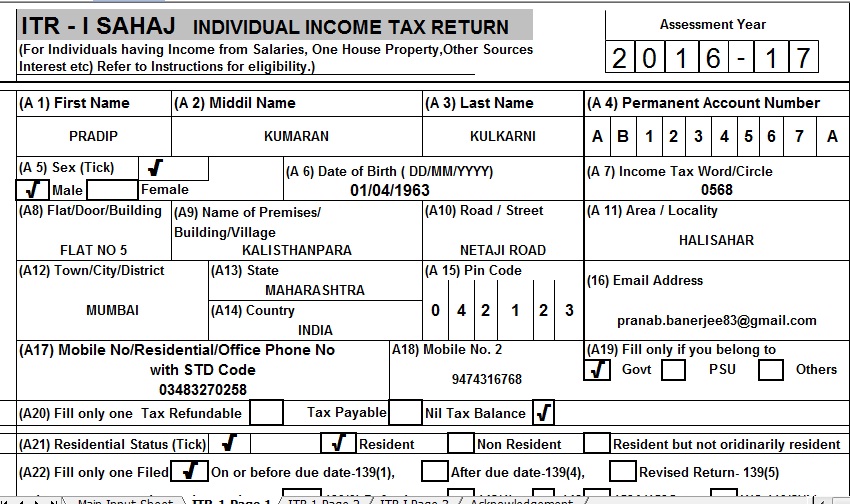

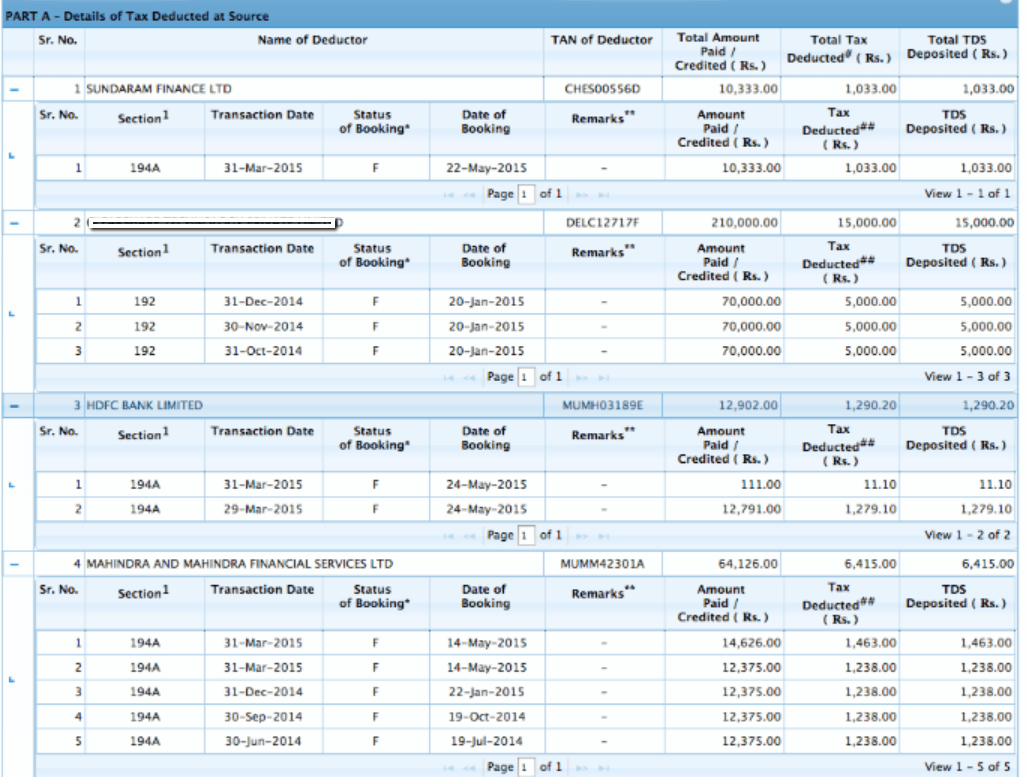

Form26as is an important tax document in india, that every tax payer need to refer at the time of income tax filing, broadly contains the taxes that are paid on your.

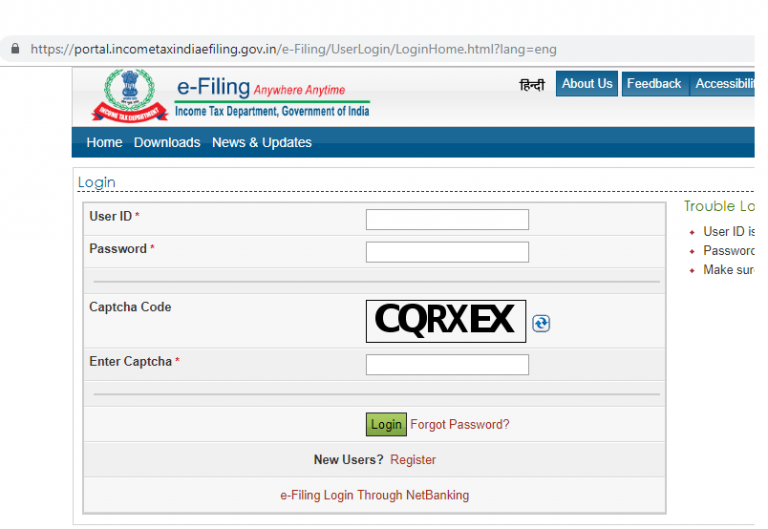

View 26as income tax. Users having pan number registered with their home branch can avail the facility of online. If you are not registered with traces, please refer to our e. Gov.in and login using your e filing user id and password.

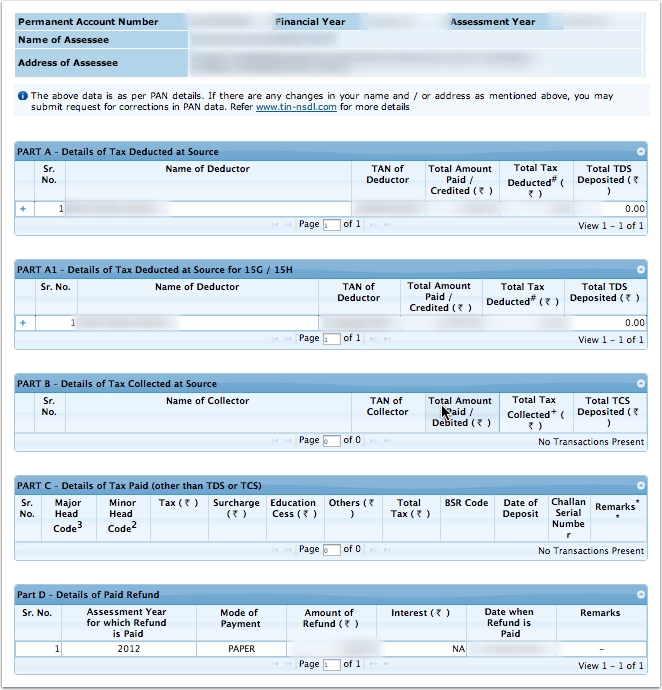

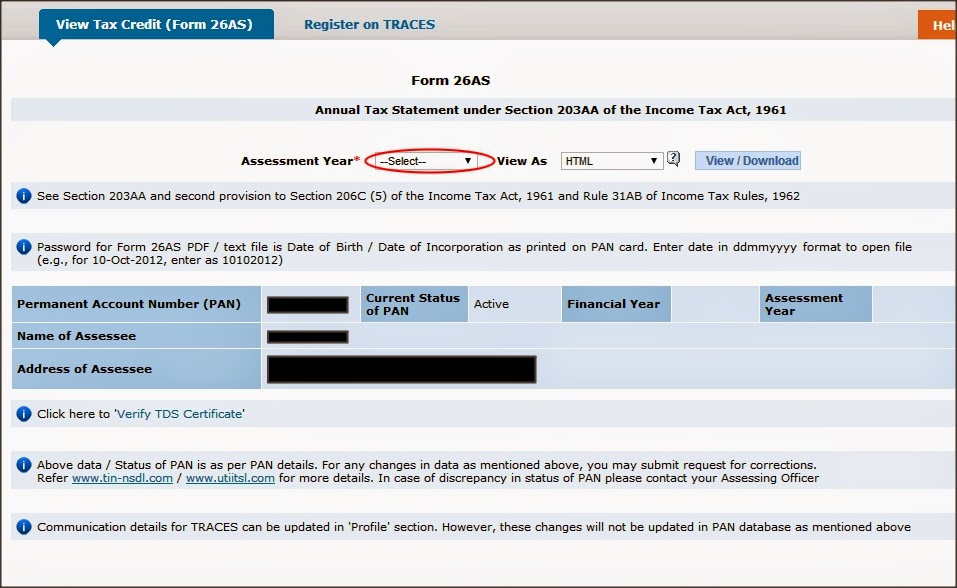

1) visit page www.incometaxindiaefiling.gov.in of income tax and locate the form 26as which is. Upon being redirected, the individual needs to click on the “view tax credit (form 26as)” link. Click ‘proceed’ on the next page followed by selecting ‘view tax credit’.

This article explores the evolving role of form 26as as a comprehensive tax credit statement. Go to 'my account' > 'view form 26as (tax credit)'. Here’s how to see form 26as:

It is available for all taxpayers. Click ‘view form 26as’ and then select ‘confirm’. Form 26as is a consolidated statement from the income tax department that contains details of tax deductions and tax exemptions.

The website provides access to the pan holders to view the details of tax credits in form 26as. Here, the user is required to provide the assessment year and also the format in. Click on ‘login‘ and enter your user id (pan or aadhar number).

Retail.onlinesbi.sbi/personal can view tax credit in form 26as through bank login : Continue to the next step. Input ‘view type’ and ‘assessment year’.

Form 26as is an annual consolidated credit statement that provides the details of the taxes deposited with the government by a taxpayer. If you are not registered then you will be required to register first. The assessee’s submissions were that the services were rendered in a.y.