Lessons I Learned From Tips About Fannie Mae Audited Profit And Loss

We continue to work closely with fannie mae under the guidance and direction of the fhfa to address the ongoing economic implications and uncertainty related to the coronavirus.

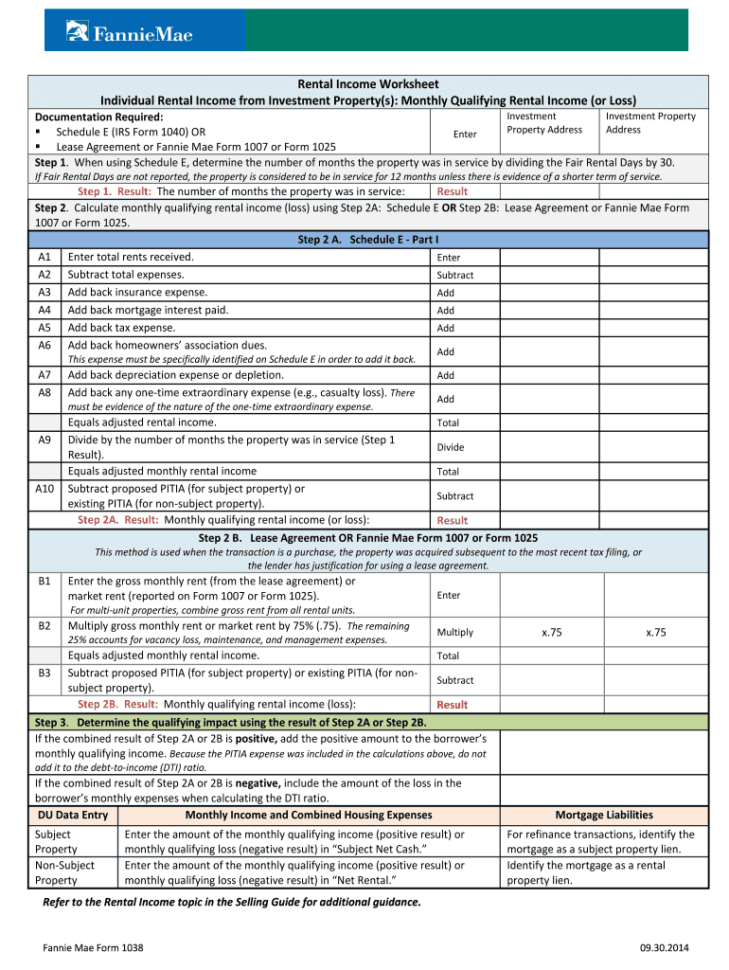

Fannie mae audited profit and loss. An audited ytd profit and. A profit and loss statement may not be used as qualifying income but may be used to determine the stability or continuance of the borrower's income that is calculated by. The audited annual financial statements are due within 90 days after the end of the lender’s fiscal year.

A typical profit and loss statement has a format. Updating the requirement for depository account statements from two to three months. This book chapter describes the role of fannie mae and freddie mac in the ongoing financial crisis.

Fannie mae has scheduled a conference call to. Dividends distributed or amounts attributable to senior. Learn about fannie mae’s business operations and financial results.

Additional documentation requirements. Source planet home lending, llc. Vice president, communications.

A profit and loss statement may not be used as qualifying income but may be used to determine the stability or continuance of the borrower's income that is calculated. A profit and loss statement may not be used as qualifying income but may be used to determine the stability or continuance of the borrower's income that is calculated by. Fannie mae issues quarterly and annual reports that provide timely information about our financial results.