Formidable Info About Flow Of Investment

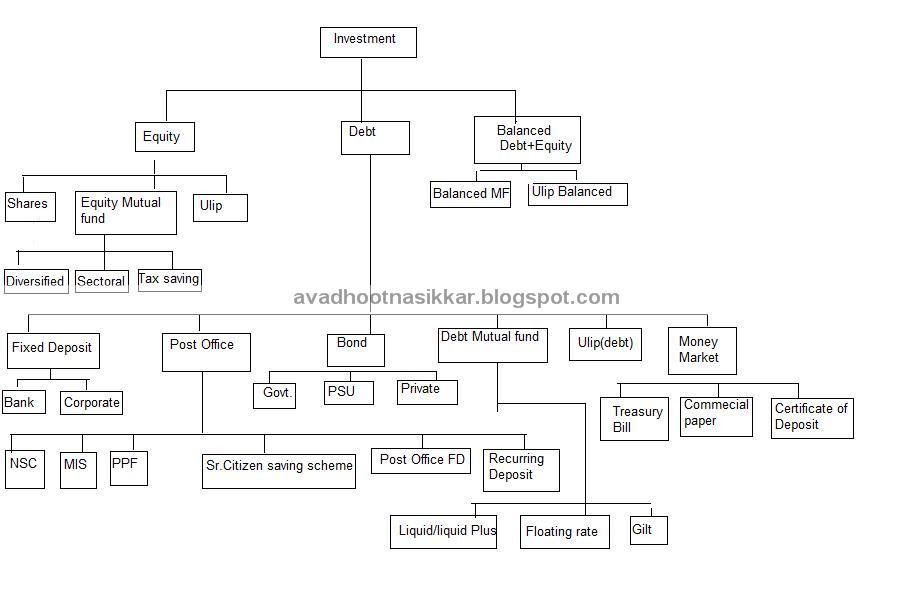

An investment can refer to any mechanism used for generating future income.

Flow of investment. Flow of goods and services (lines one and three) show up in the current account, while we find flow of funds (lines two and four) in the financial account. Inside of a firm, these include the flow of. Flow of investment definition:

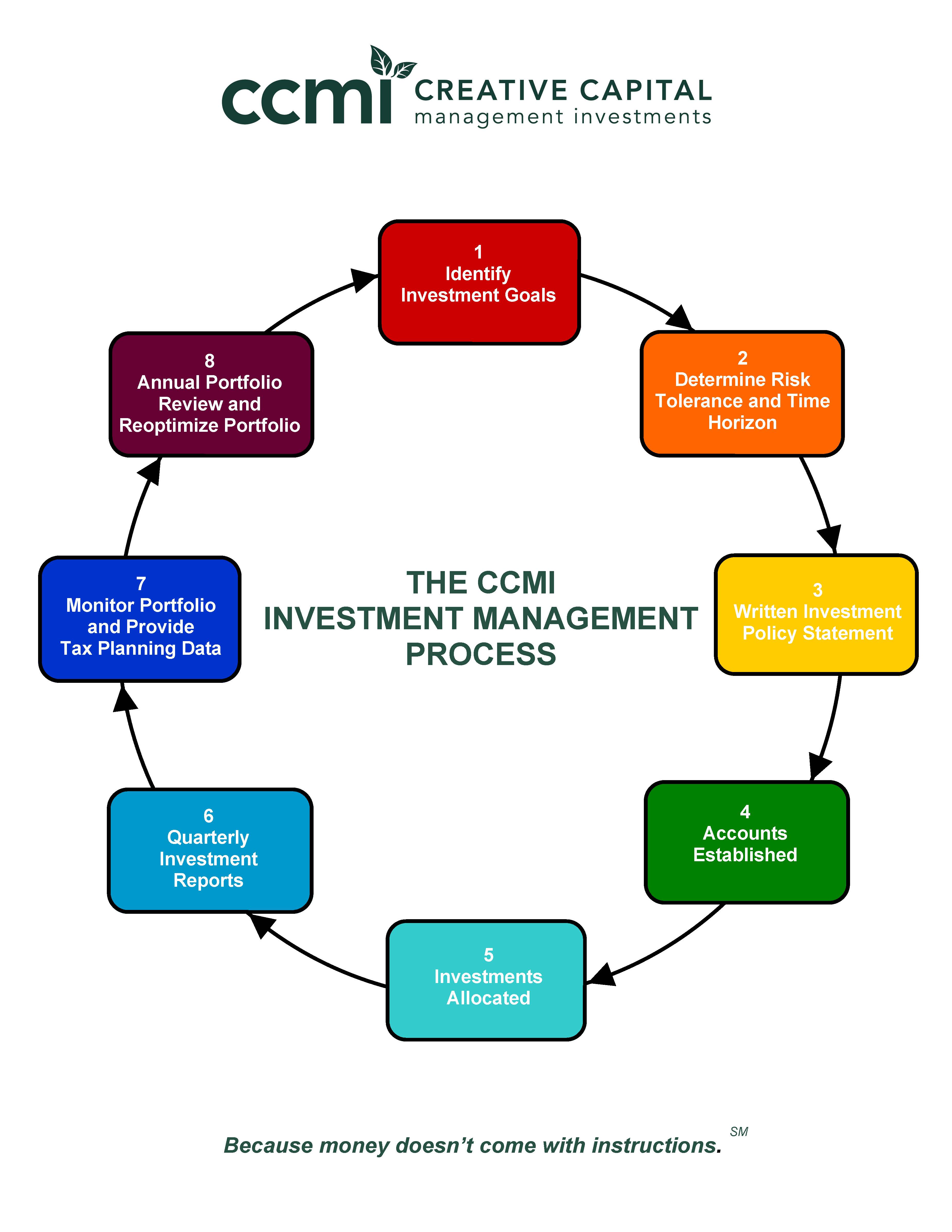

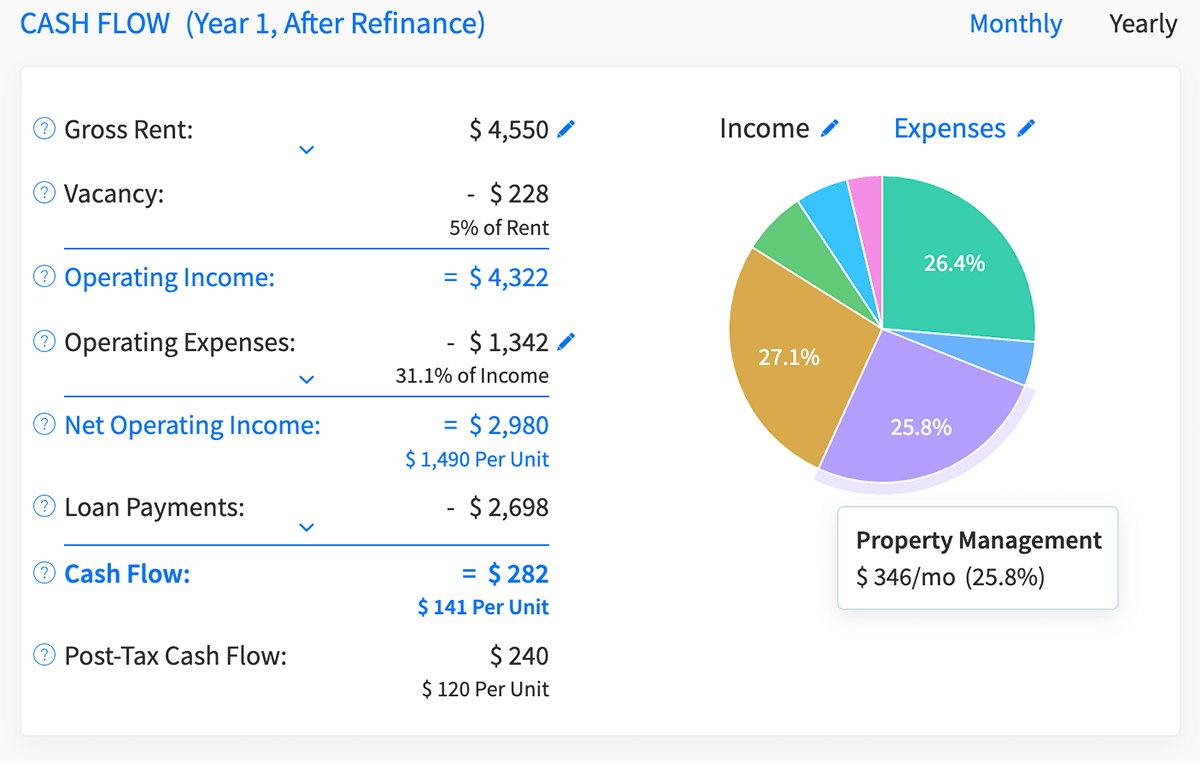

Cash flow from investing activities is the section of a company’s cash flow statement that displays how much money has been. The bottom four lines in. Assessing risk tolerance c) step 3:

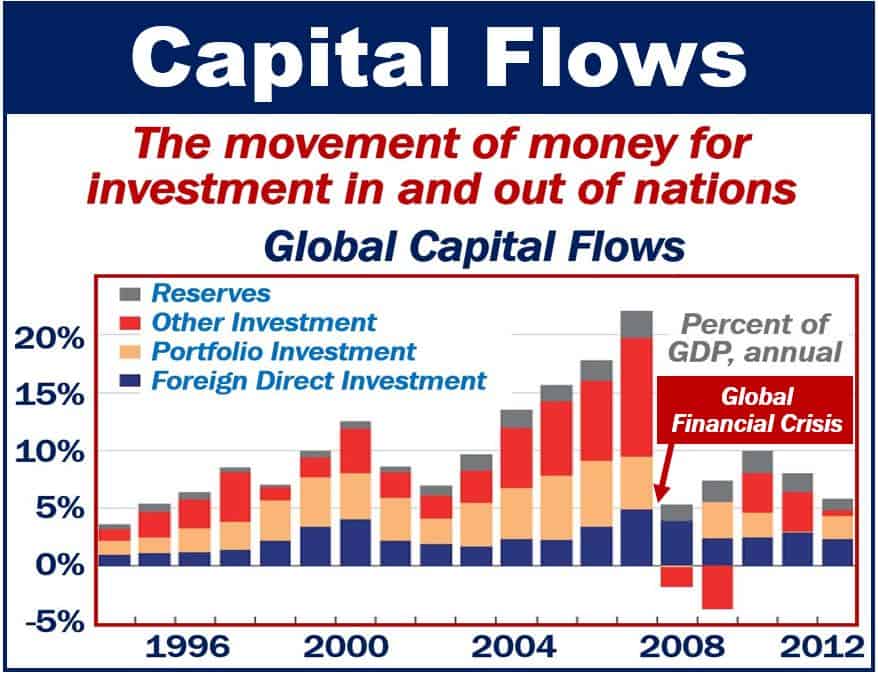

These vital resources are expected to. Capital flows refer to the movement of money for the purpose of investment, trade, or business operations. According to people briefed about the matter, it has to date returned investors 2.5 times gross multiple of capital and 33 per cent gross internal rate of return.

This includes the purchase of bonds, stocks, or real estate property, among. Payment for order flow. | meaning, pronunciation, translations and examples

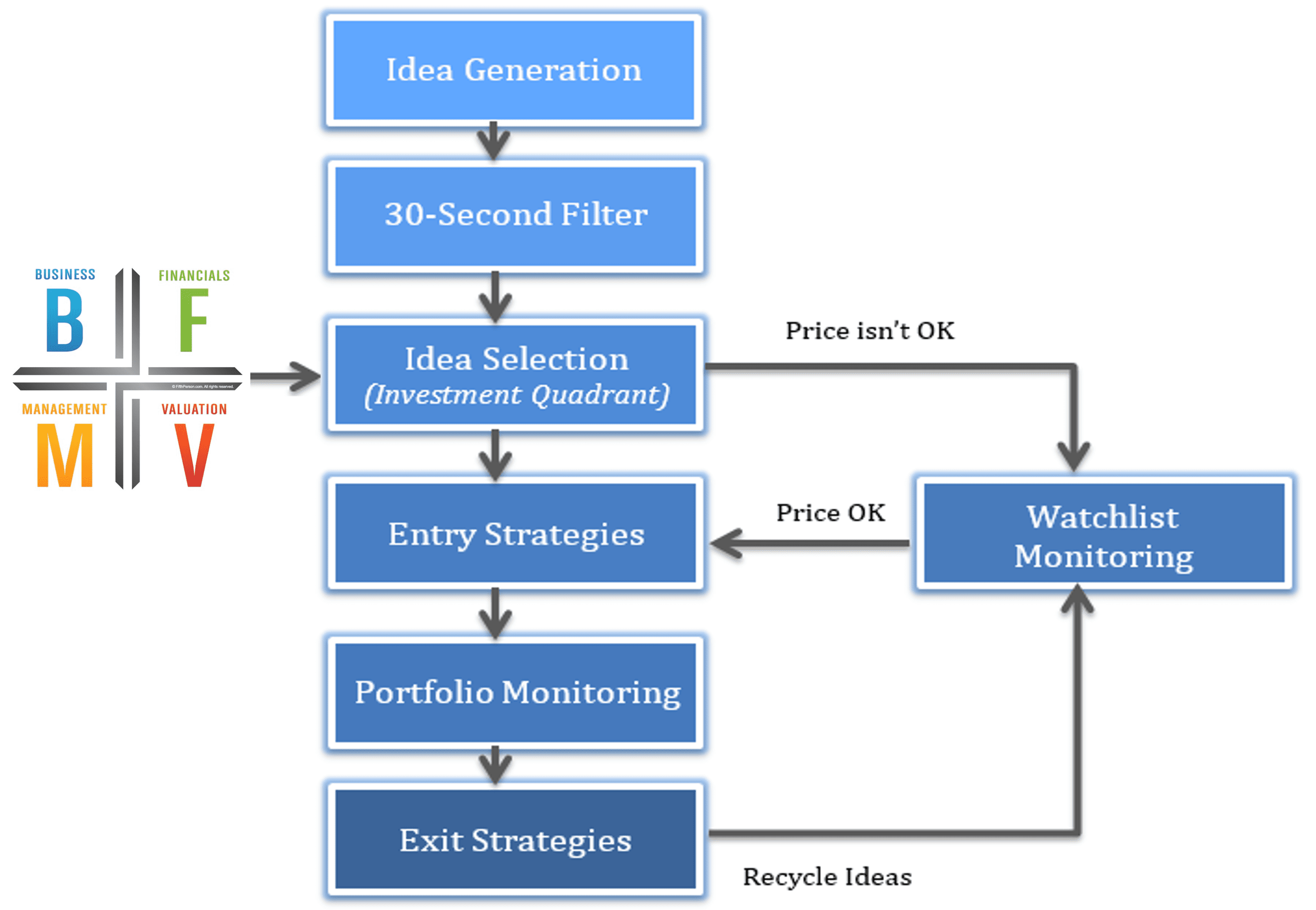

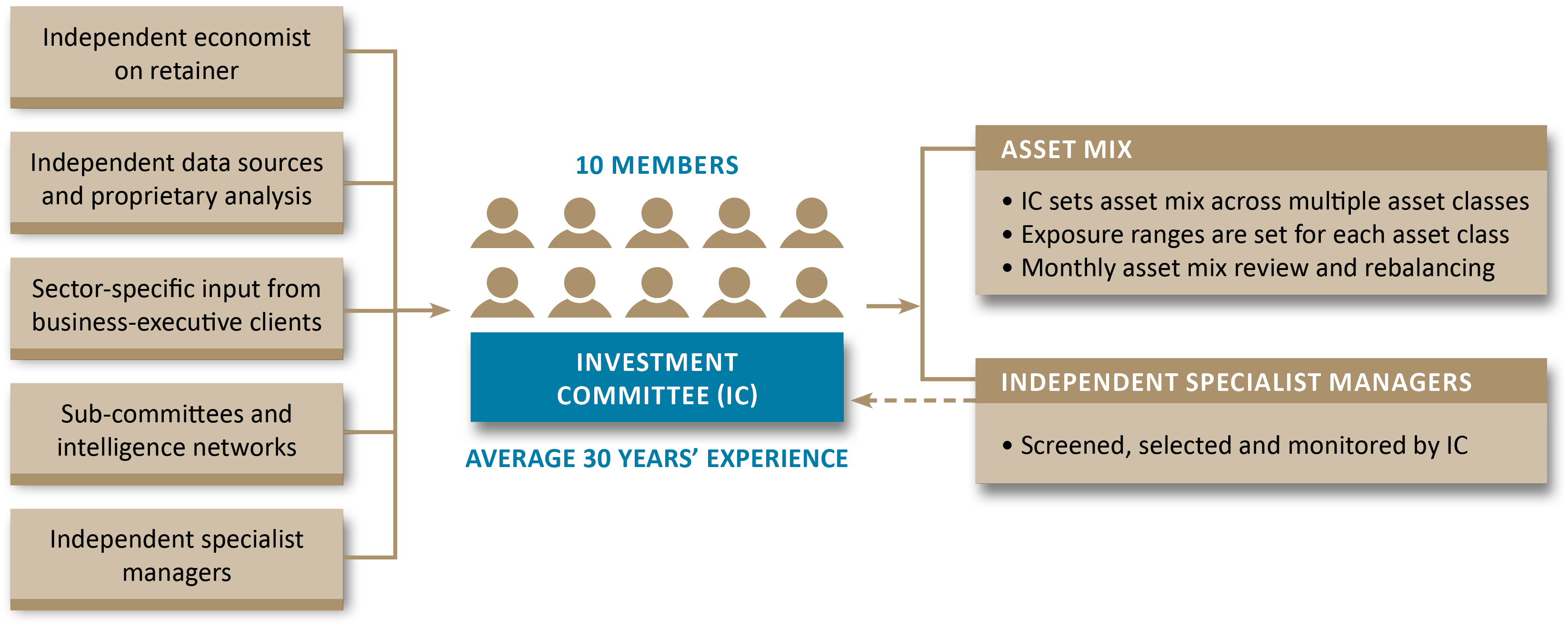

Some activities involve setting investing goals, conducting research and. Using a large data set on investments and accounting information for private firms, we put the balance sheet theory to test. Investors in west african countries are enjoying the best returns on the continent, and are shifting money flows to a region that’s performed well despite coups,.

The new rules also impose a general ban on ‘payment for order flow’ (pfof), a practice through which brokers receive payments for forwarding. Creating a budget and emergency fund d) step 4: If passive income is attractive to you, here are some different kinds of cash flow investments you can make, including their pros and cons.

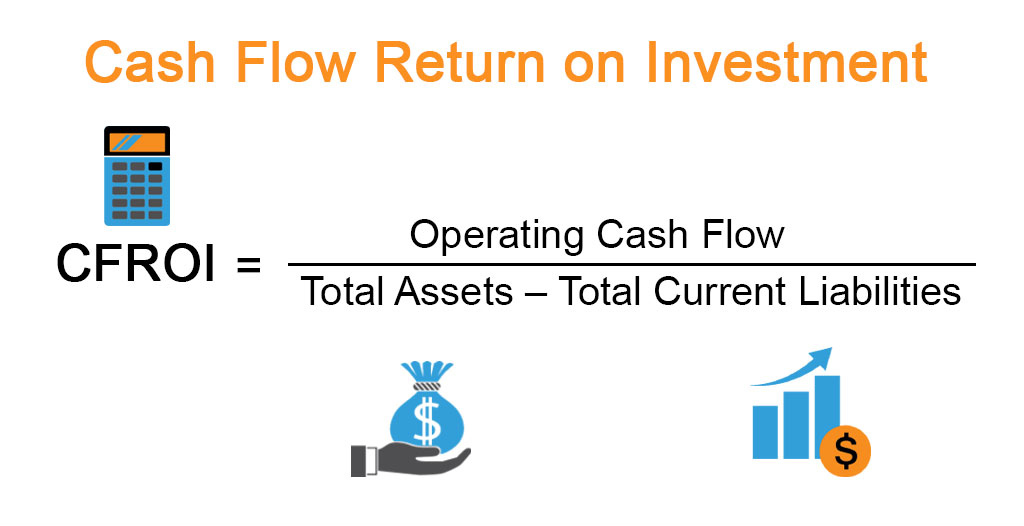

The world investment report focuses on trends in foreign direct investment (fdi) worldwide, at the regional and country levels and emerging measures to improve. Theoretically, a firm might invest more when cash flow is high for three reasons: What is cash flow from investing activities?

A) step 1: With these etfs, cash flow is king. The formula for calculating the cash from investing section is as follows.

Future cash flow and return of the investment cannot be predicted accurately as they are influenced by the market conditions, economic, social, political, and. F ree cash flow (fcf) is defined as what a company has left over accounting for maintenance and operational expenses and it’s a. The cash flow statement reports the amount.

Setting financial goals b) step 2: If a liquid, gas , or electrical current flows somewhere , it moves there steadily and. The investment process is a systematic approach to finding, evaluating, and selecting investments.