Great Info About Impairment Of Goodwill

Impairment of goodwill. Rising interest rates and the threat of economic recession are exposing businesses to a greater risk of impairment of goodwill. The recoverable amount is, in turn, defined as the higher of the fair value less cost to sell and the value in use; Here is an example of goodwill impairment and its impact on the balance sheet, income statement, and cash flow statement.

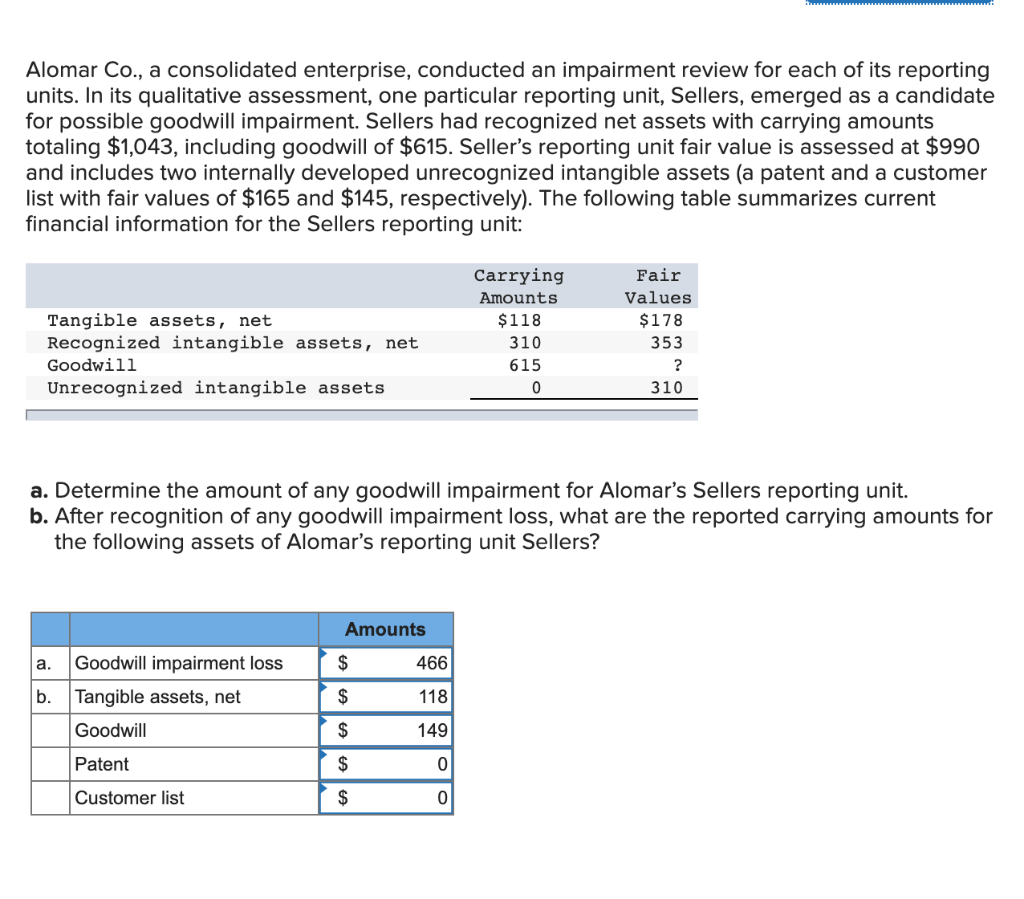

Goodwill impairment is an accounting charge that companies record when goodwill's carrying value on financial statements exceeds its fair value. Additional support is provided to ensure jobsplus language participants feel comfortable with their job duties, and help them practice. Impairment testing of goodwill is a costly process.

A reporting unit is a segment of the business that is autonomous enough to provide discrete financial information. A tiktoker thought she found her dream pair of prada loafers at a goodwill boutique for $300. Company bb acquires the assets of company cc for $15m, valuing its assets at $10m and recognizing goodwill of $5m on its balance sheet.

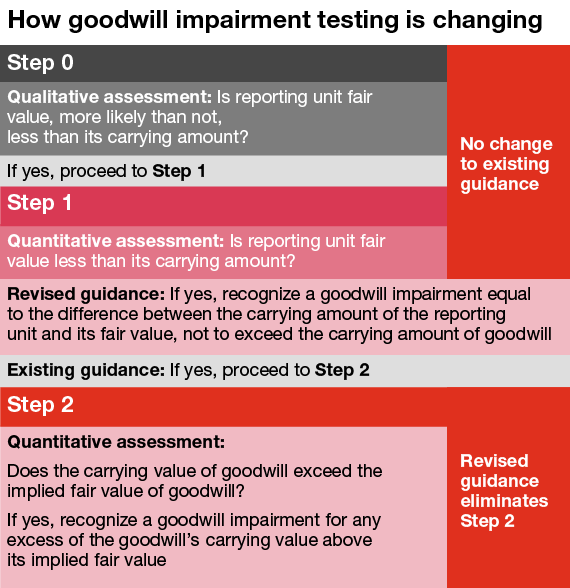

Goodwill and impairment •reasons why an entity has chosen a particular assumption for calculating recoverable amount; A goodwill impairment test progresses in three broad stages: Both ifrs accounting standards and us gaap require annual impairment testing of goodwill1 and prohibit reversing a goodwill impairment loss.

Basic principles of impairment. Goodwill impairment occurs when a company decides to pay more than book value for the acquisition of an asset, and then the value of that asset declines. Goodwill is tested for impairment:

The higher of fair value less costs of disposal and value in use). Goodwill represents the intangible value associated with a business, including its brand reputation, customer relationships, and. Example of a goodwill impairment.

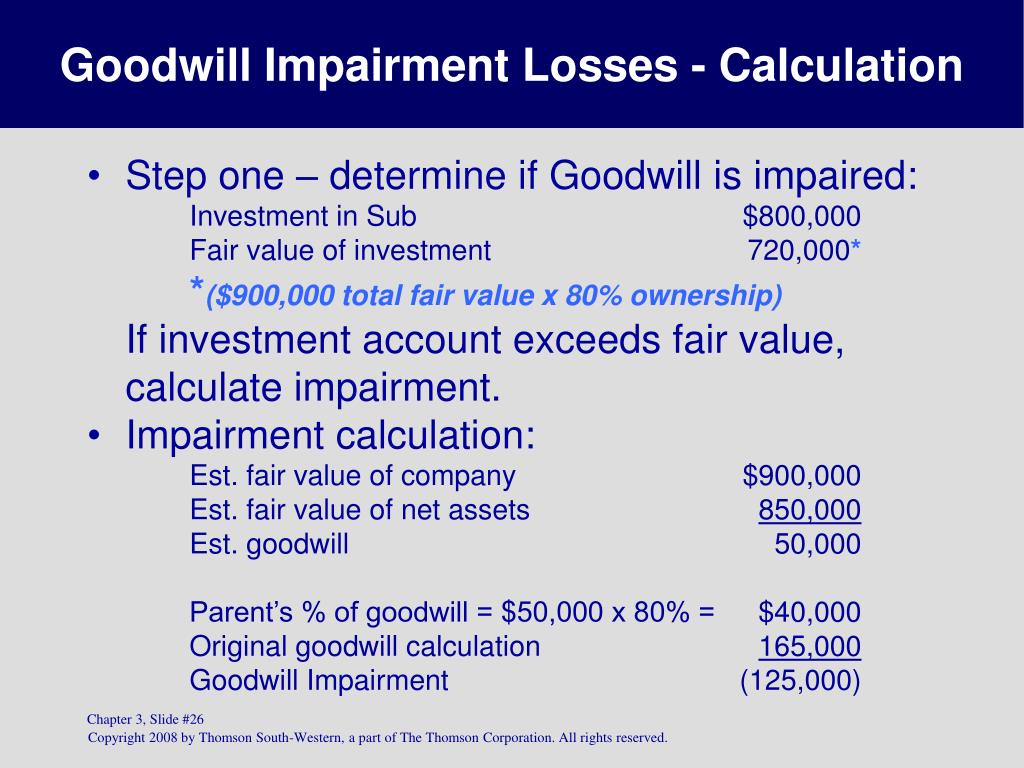

Goodwill impairment may result if and only if the calculated implied fair value of goodwill is lower than its carrying amount. The difference between the amount that. How does goodwill impairment work?

Then other assets are reduced pro rata. The amount of the impairment is the difference between the two figures. For example, let's assume that company xyz purchases company abc.

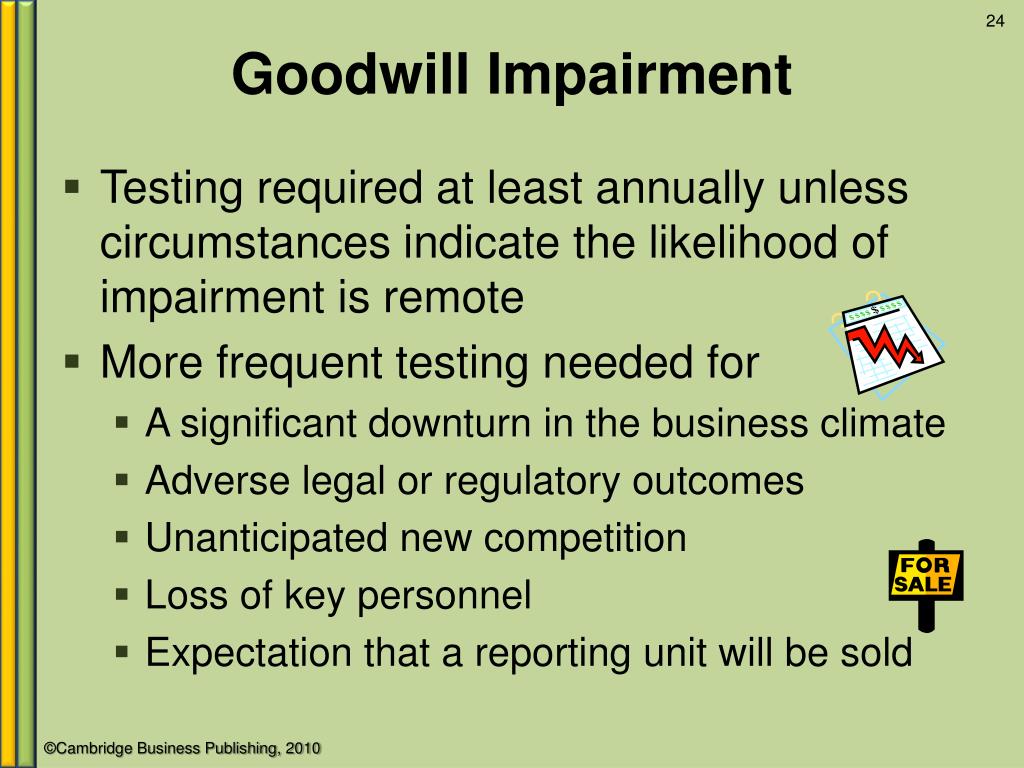

Impairment tests for goodwill must be conducted annually or triggered by major incidents such as changes in the economy, competitive environment, legal issues, key personnel changes, diminishing cash flows, or declining market values of assets. For example, consider a firm called vet corporation that purchases veterinary practices in the hopes of increasing each practice's profits due to centralized. Goodwill impairment occurs when the recorded value of goodwill on a company’s balance sheet exceeds its fair market value.

Feb 21, 2024, 2:33 pm pst. Goodwill is an asset, but it does not amortize or depreciate like other assets.instead, gaap rules require companies to 'test' goodwill every year for impairments.

.jpg?width=1194&name=GoodwillImpairmentTestingTables-03 (1).jpg)