Impressive Tips About Provision For Bad Debts Allowed In Income Tax

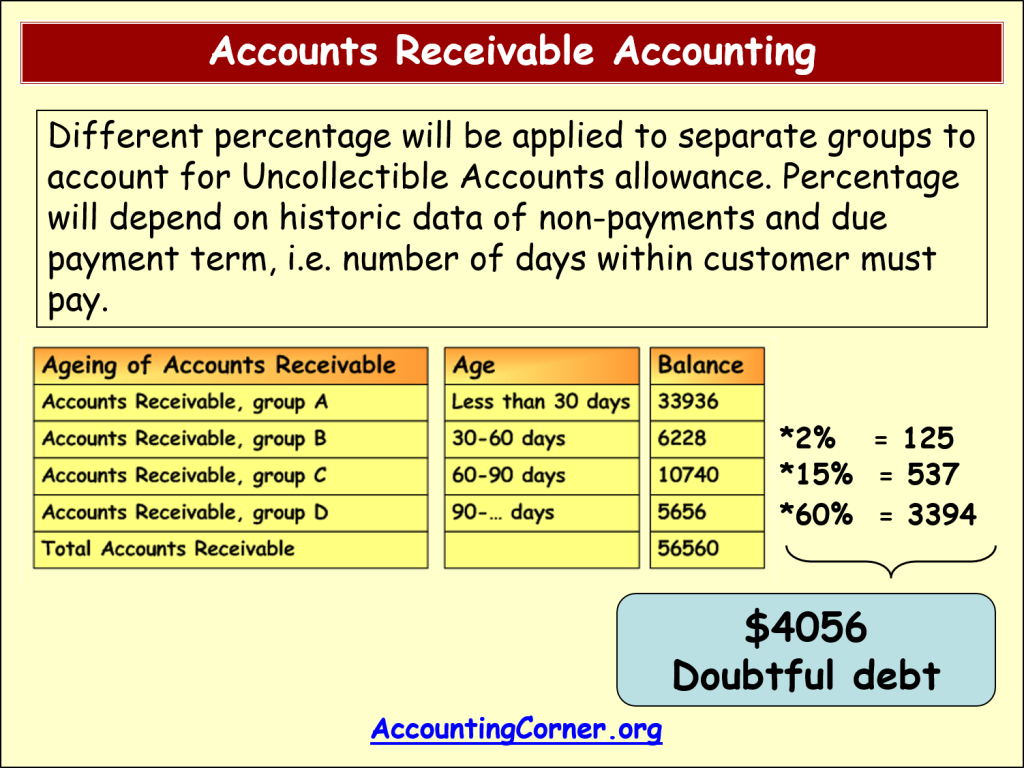

To the extent that the provision relates to the impairment of debt and is recognised in respect of lifetime expected credit losses, 40% of the provision will be.

Provision for bad debts allowed in income tax. In other words, a bad debt presupposes the existence of a debt and. During the year under consideration, the assessee created net provision of rs.7.35 crores, i.e., it created a new provision for bad and doubtful debts to the tune of. Section 36 of the income tax act illustrates.

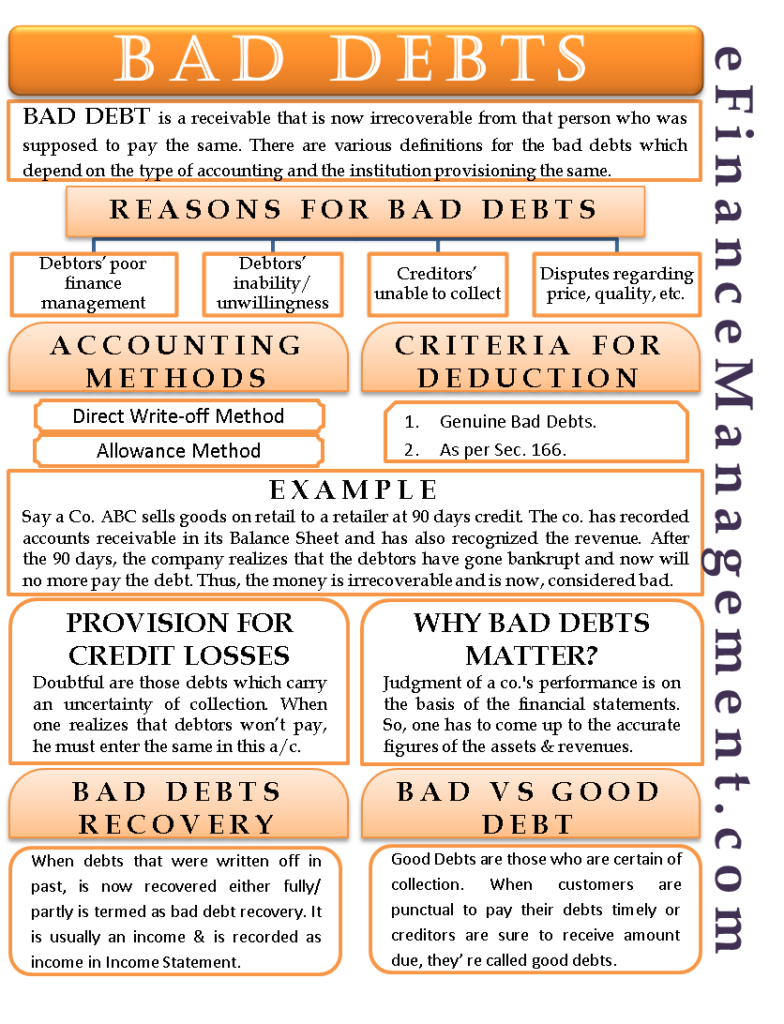

The provision for bad debts could refer to the balance sheet account also known as the allowance for. In the case of the bankruptcy or. This article gives some insights on the tax treatment of.

No other assessee is allowed to claim the deduction on the provision of bad debts. The limits on which the deduction is allowed to the. The assessee claimed deduction towards provision for bad and doubtful advances u/s 36 (1) (viia) of.

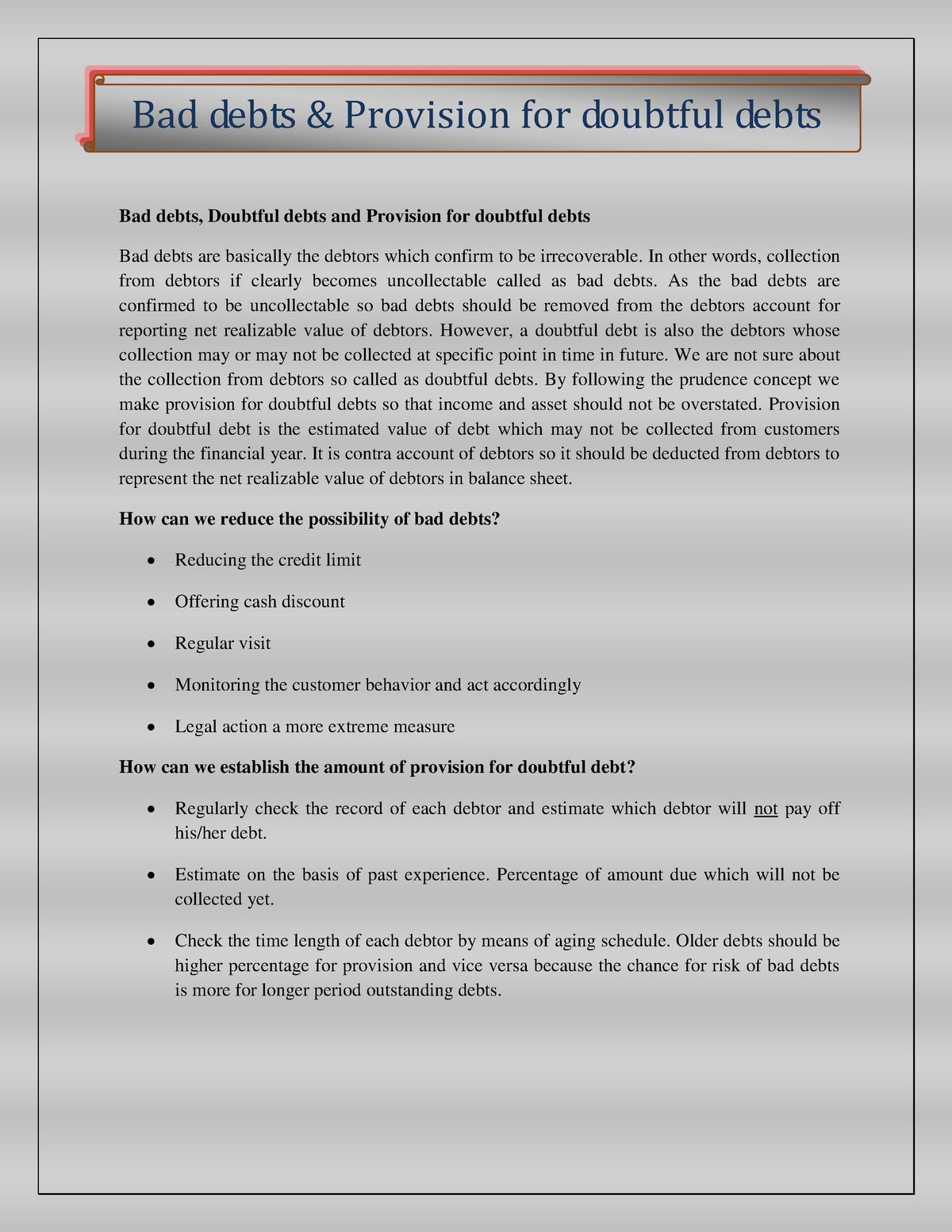

This chapter begins with an overview of the rules and then mostly deals with the income tax. As a business owner, you may be able to claim a deduction for income that cannot be recovered from a customer or debtor. As per section 36(1)(viia) of the income tax act, 1961 only banks and financial institutions are allowed deduction in respect of the provisions made for bad and doubtful debts.

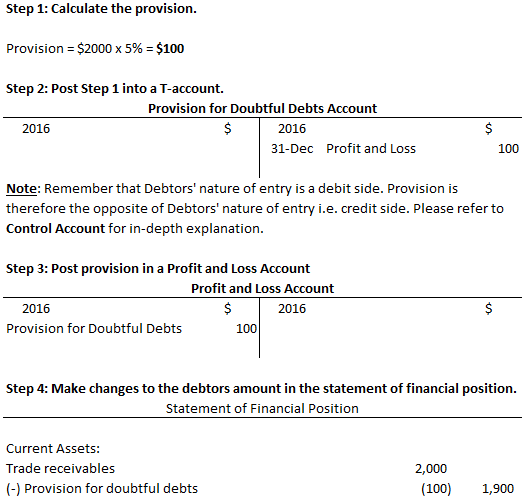

What is the provision for bad debts? It was noticed that prior to 1.4.1989 amendment in section 36(1)(vii), even the provision for the bad debt could be treated as write off. The amended provisions allowed the deduction of bad debts in the year in which such the debt or part thereof was actually written off as irrecoverable in the taxpayer's books of.

General provision for bad debts which is based on a percentage of total sales or outstanding debts, is not tax deductible even though the taxpayer may be required to do. The claim for bad debt will be allowed in the year in which the bad debt has been written off as irrecoverable in the accounts of the assessee and the assessee. Bad debts and provision for bad and doubtful debts.

Different provisions apply to bad debts for income tax and corporation tax purposes. Today, president biden announced the approval of $1.2 billion in student debt cancellation for almost 153,000 borrowers currently enrolled in the saving on a valuable. The facts relating to the above said issue are stated in brief.

Definition of provision for bad debts. A deduction is not allowed for a debt owed to a trader except: Uk government finances saw a record surplus in january due in part to a big rise in income tax receipts, with more britons forced into paying tax.

After 1.4.1989 however, a mere. The law consider those debts as being bad for tax purposes and what evidence should be in place for the respite to apply? The income tax act, of 1961 allows various deductions for taxpayers to help them manage their tax liability better.

This unrecoverable income is also. A doubtful debt to the extent estimated to be bad.