Matchless Tips About Interest On Balance Sheet

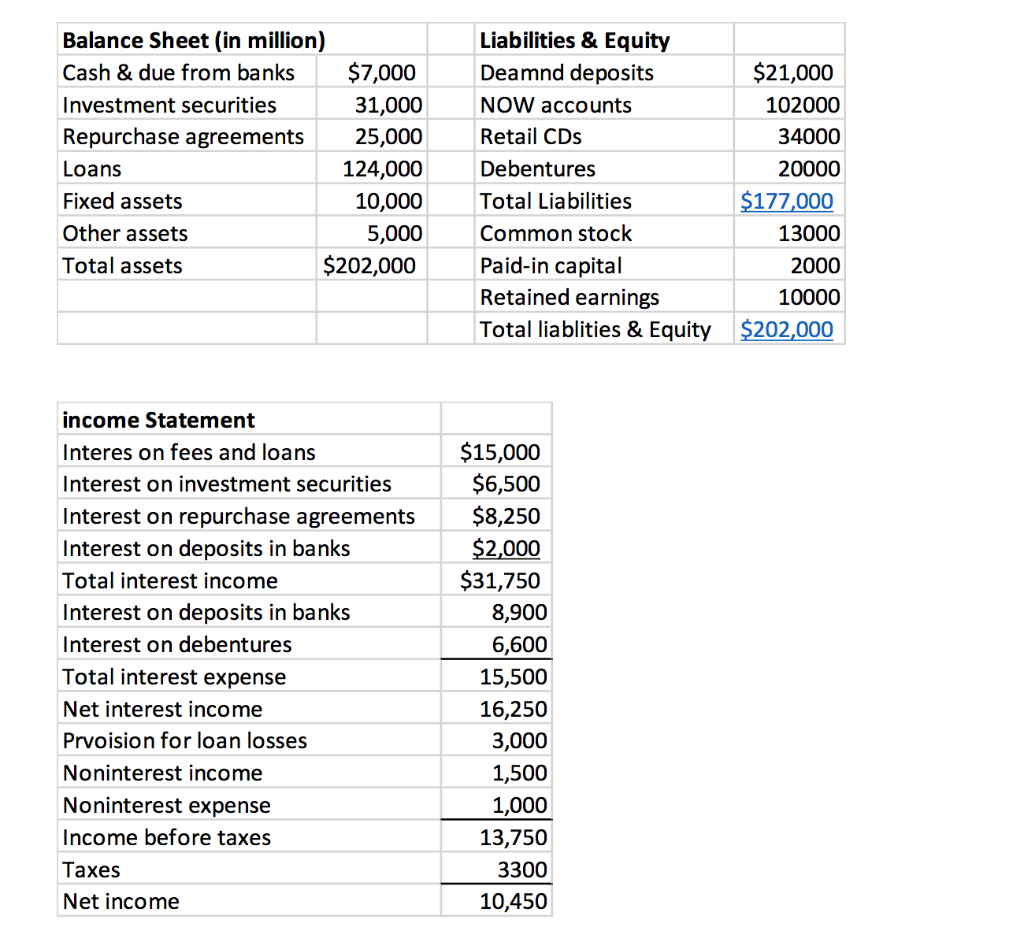

First, interest expense is an expense account, and so is stated on the income statement, while.

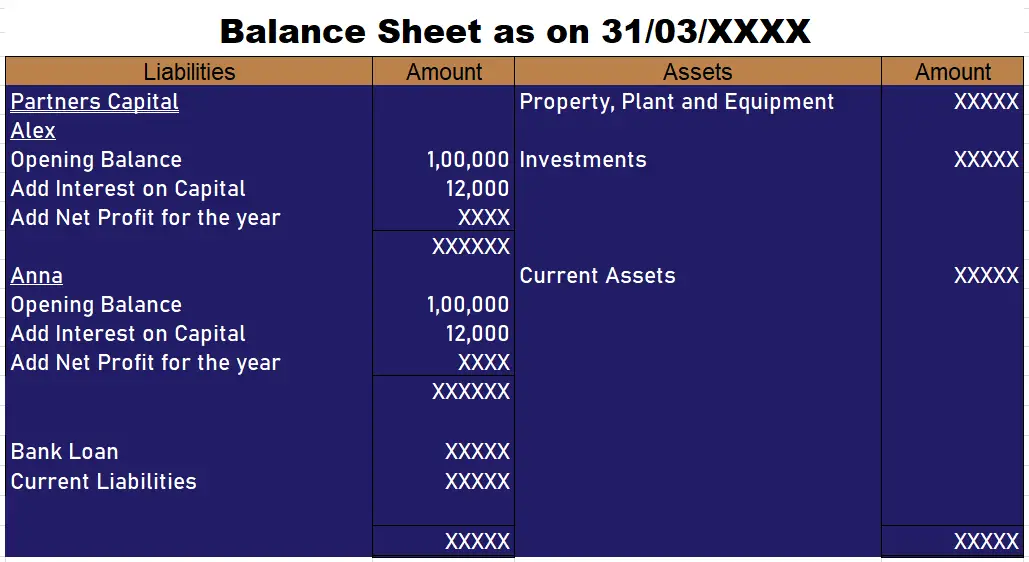

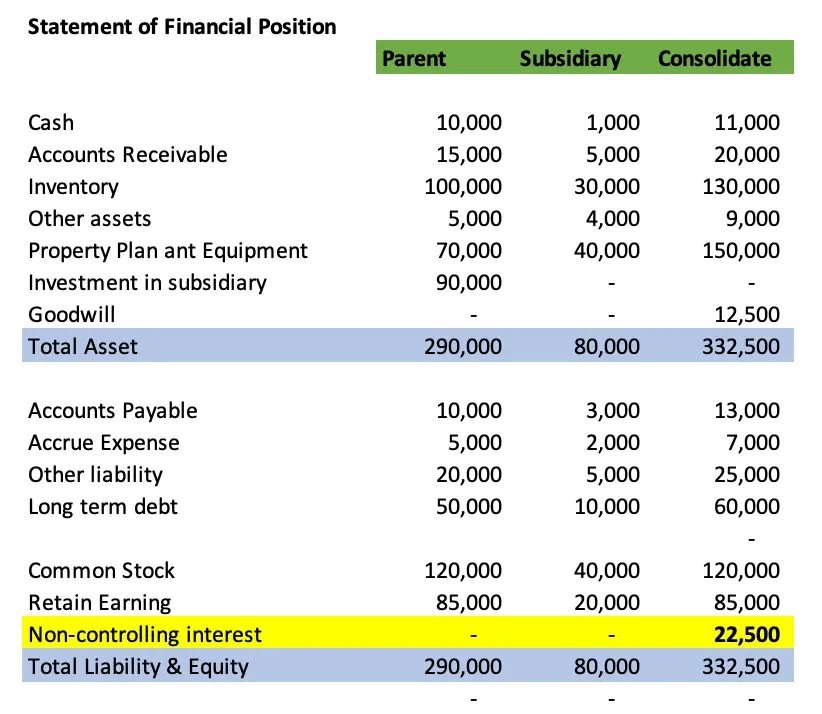

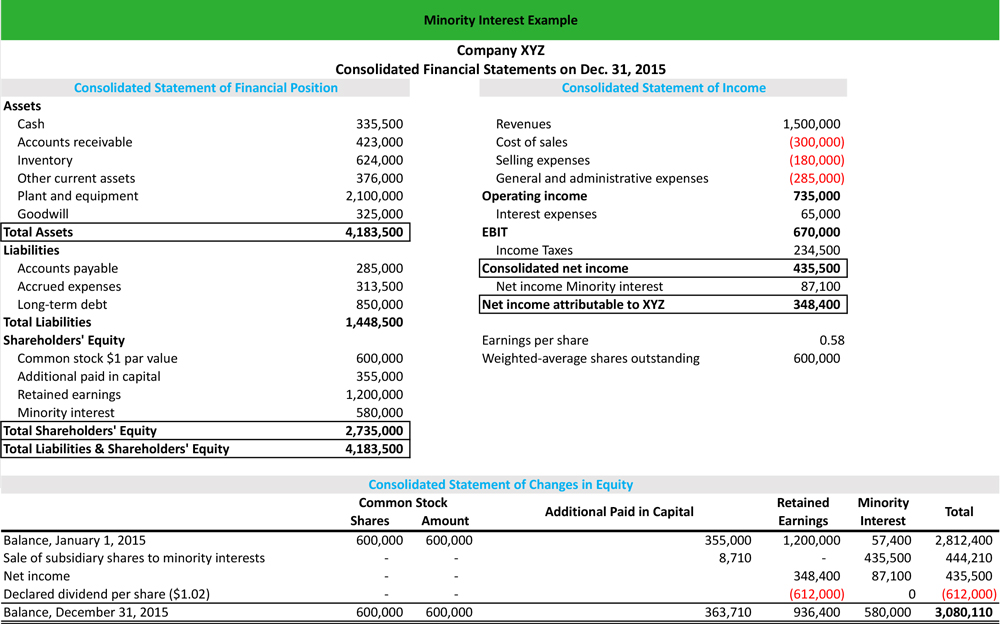

Interest on balance sheet. A balance sheet is one of the primary statements used to determine the net worth of a company and get a quick overview of its financial health. Where is interest expense on the balance sheet? When a parent company (“parent co.”) owns at least 50% of another company (“sub co.”), the noncontrolling interest represents the portion the parent does not own:.

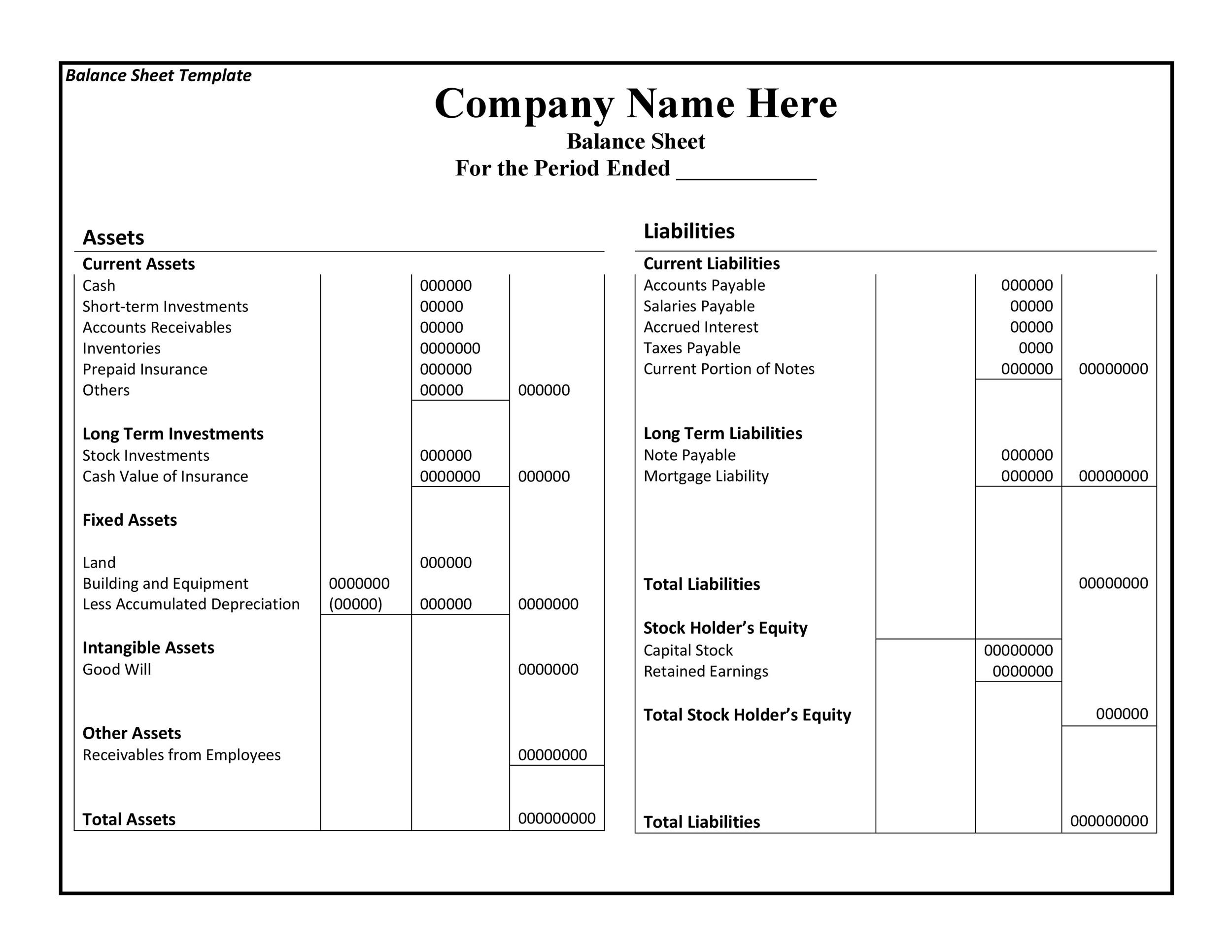

If any interest incurs after the date at which the interest. Definition and explanation interest payable is an entity’s debt or lease related interest expense which has not been paid to the lender or lessor as on balance. Like accounts payable, the interest cost that the firm is.

A company’s interest income is determined by its projected cash balances and an interest rate assumption. That $95 billion pace is nearly double the peak rate of $50 billion the last time the fed trimmed its balance sheet, from 2017 to 2019. This amount can be a crucial part of a.

The entry consists of interest income or interest expense on the income statement, and a receivable or payable account on the balance sheet. With that said, the forecasted interest income can only. Balance sheet the minutes indicated some officials said it may be appropriate to start slowing the pace of the balance sheet runoff, a process known as.

They don’t have power over the. Interest payable on balance sheet tells firms and keeps them alarmed about the financial obligations they have to fulfill. Telekom malaysia bhd’s (tm) net debt to earnings before interest, tax, depreciation and amortisation (ebitda) may fall to 0.4 times for the financial.

There are several differences between the two concepts. The bank of canada could wind down its quantitative tightening program as soon as april and will most likely do so no later than june, an economist at. Reduce owner’s equity to keep the sheet in balance.

Since the payment of accrued. The runoff of the bond portfolio. Some income statements report interest income and interest expense as their own line items.

Interest accrued but not paid would be recorded under current liabilities of the balance sheet current liabilities of the balance sheet current liabilities are. Officials at the federal reserve are generally uncertain on when they will begin cutting us interest rates, although most warned against starting too soon, minutes. Interest payable is the amount of interest on its debt that a company owes to its lenders as of the balance sheet date.

Interest expense does not appear directly on the balance sheet. Instead, it is recorded on the income.

/what-is-minority-interest-balance-sheet-5954948e3df78cdc29e922b2.jpg)