Beautiful Work Tips About Governmental Financial Statements

Understanding governmental financial statements presented by:

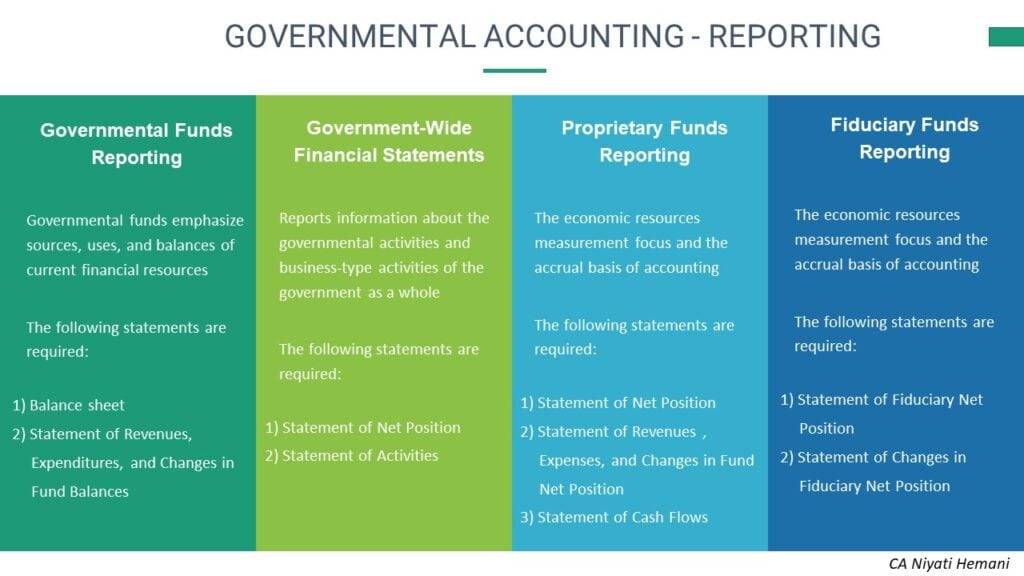

Governmental financial statements. It also described generally accepted accounting principles, or gaap, and their role in. The governmental accounting standards board and the federal accounting standards. Governmental accounting research system (gars) pronouncements.

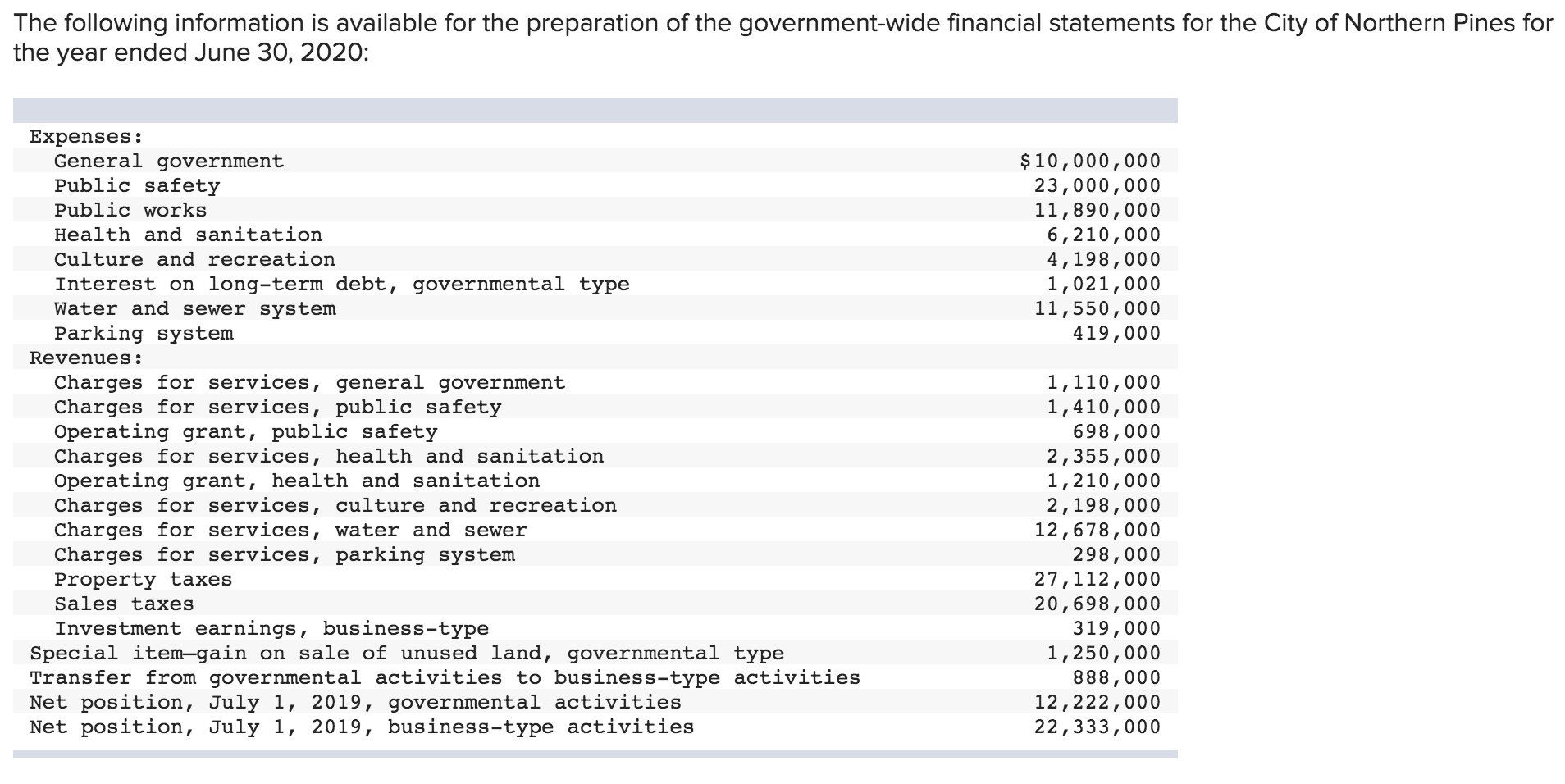

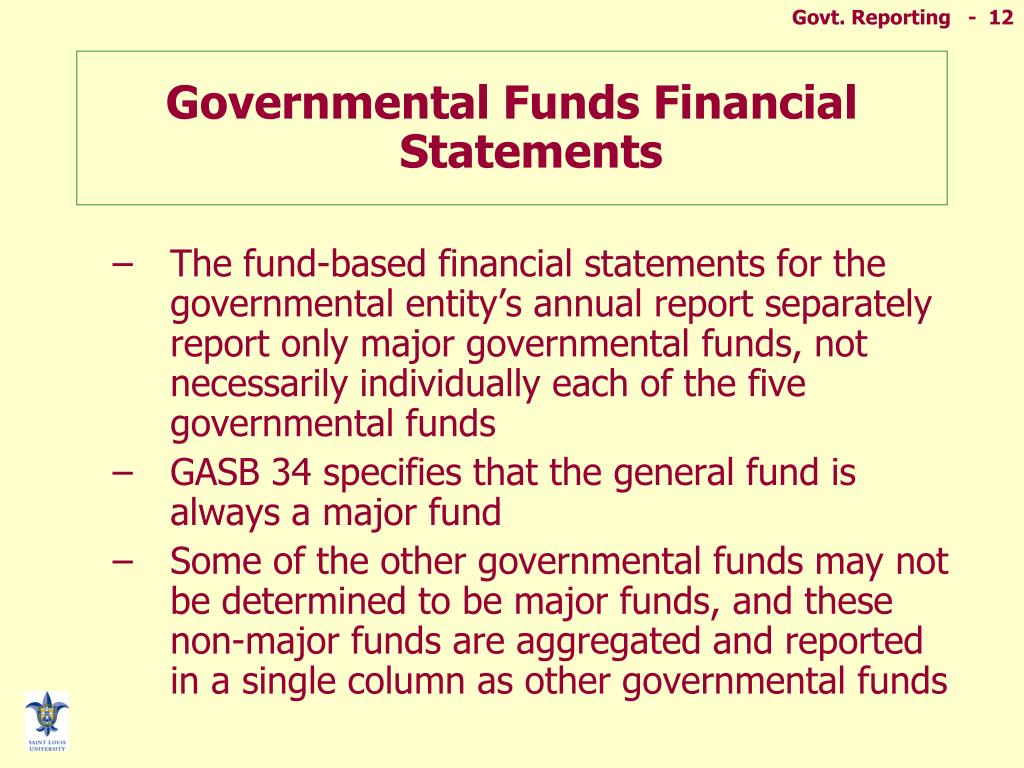

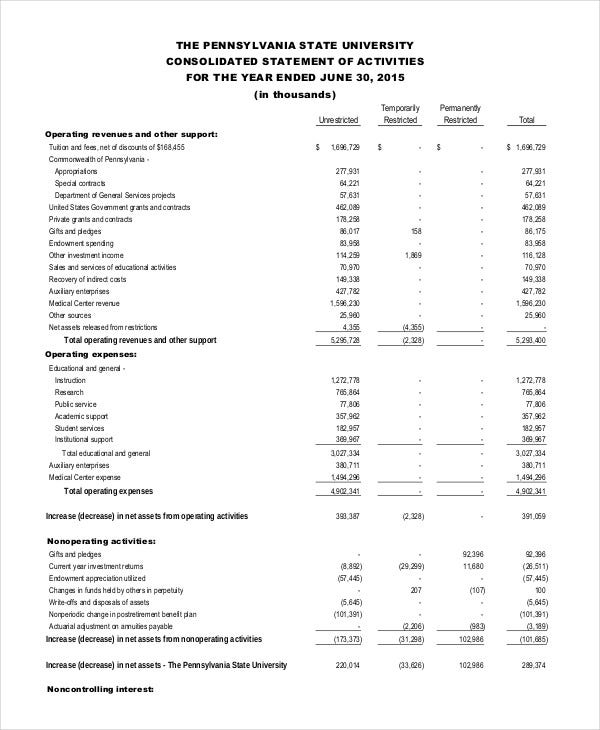

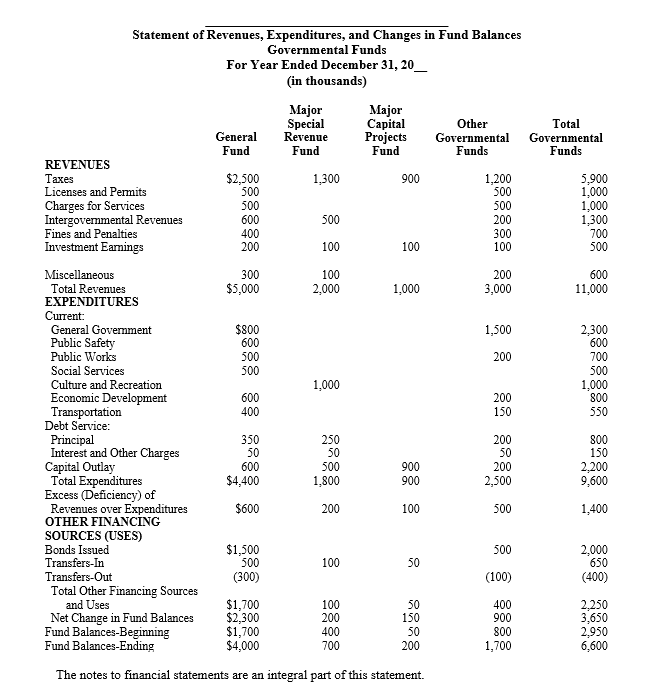

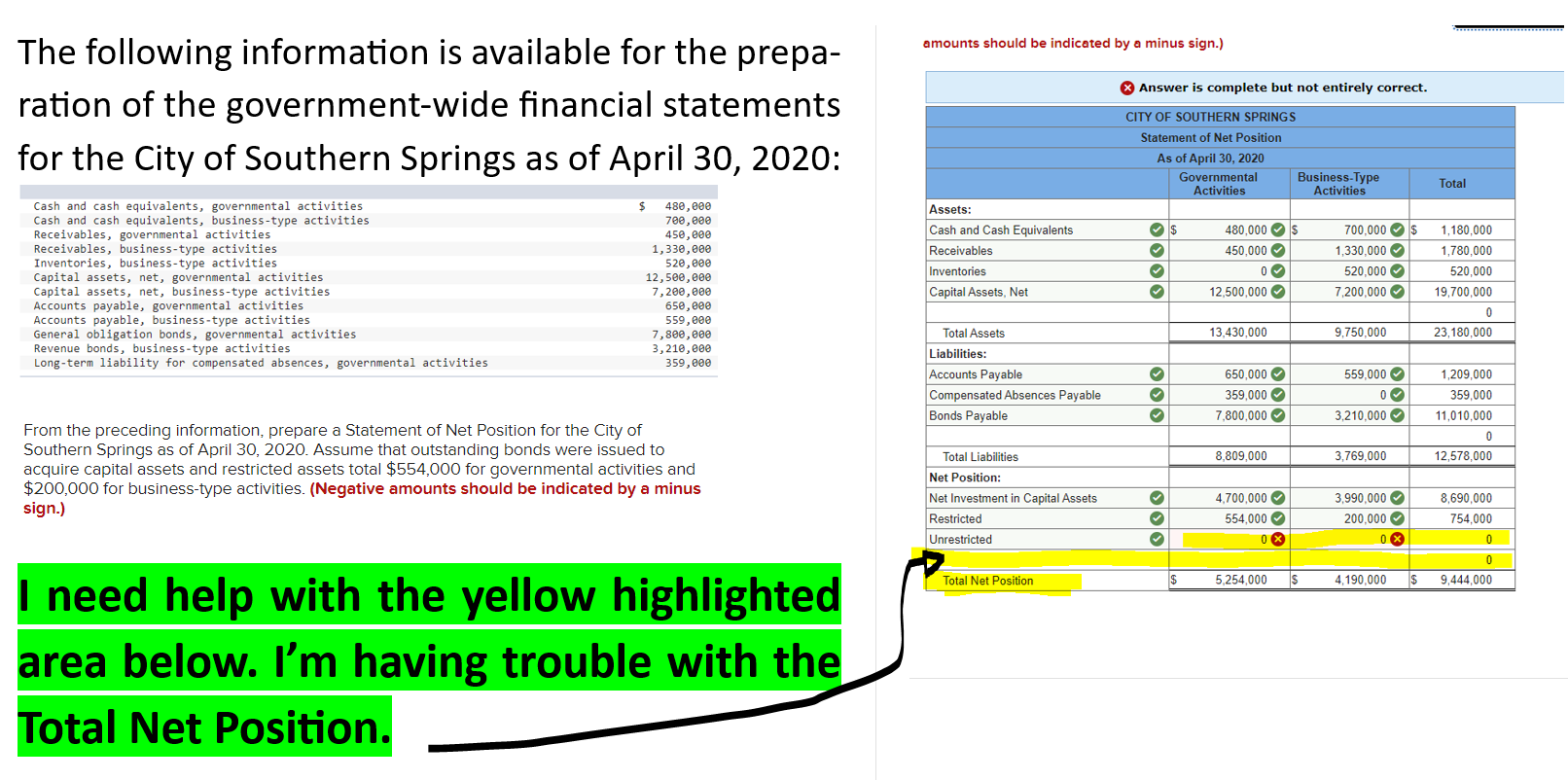

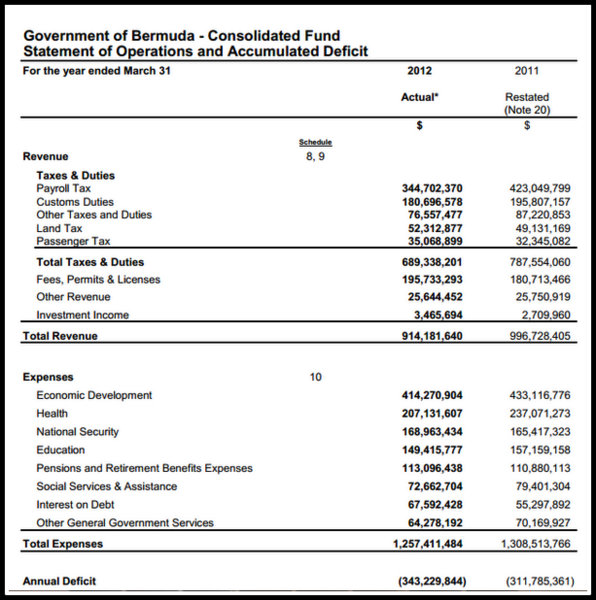

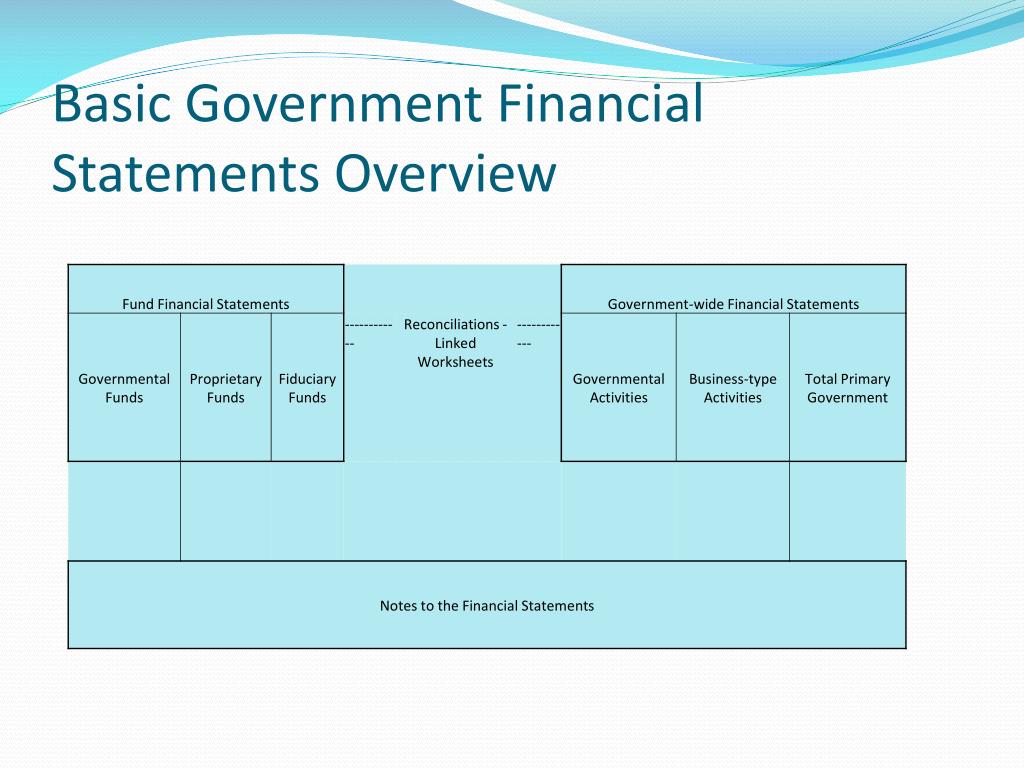

In the broadest terms, there are three major classifications of funds in a government. The government financial statements usually include a statement of activities (similar to an income statement in the private sector), a balance sheet and often some type of reconciliation. Government’s consolidated financial statements for fiscal years.

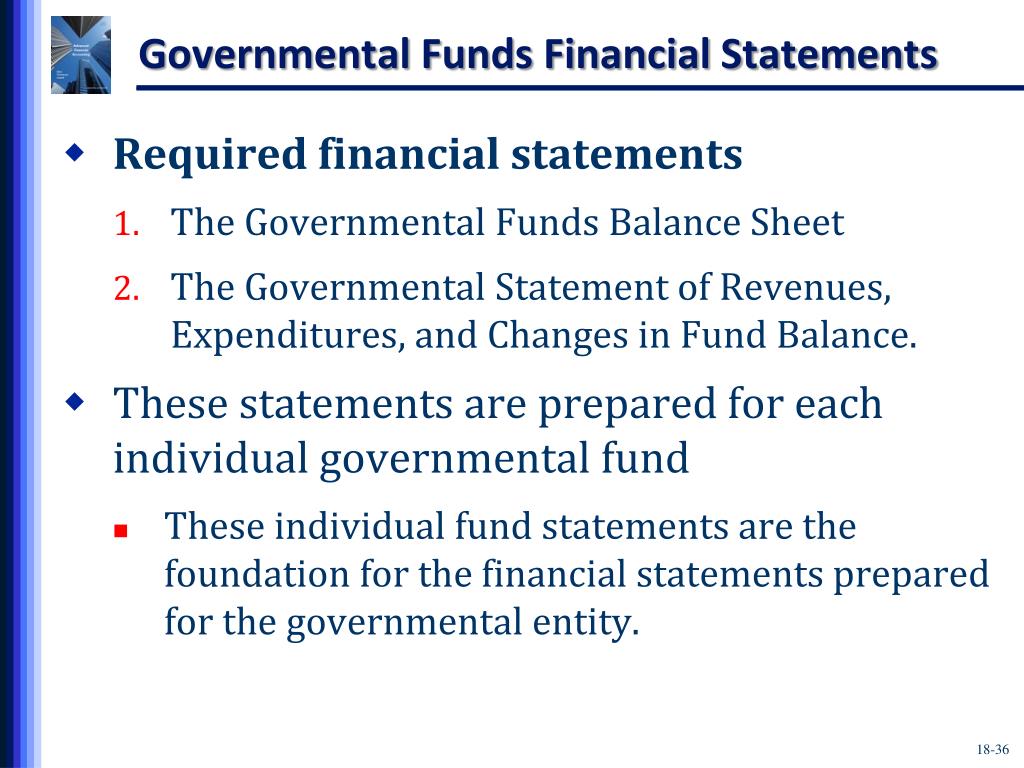

The financial statements, in contrast to budget, present the revenue collected and amounts spent. The basic financial statements, which include the notes to the financial. The consolidated financial statements include the legislative and judicial.

Knowing what the various funds represent can be useful in the analysis of governmental financial statements. Financial statements of the united states government for the fiscal. A comprehensive overview of the four basic financial statements for state and local.

Federal government’s consolidated financial statements and notes to the financial. What are its spending priorities? Do the organization’s sources of revenue.

Financial statements of the united states. Cash flow statements are often included to show the sources of the revenue and the destination of the exp… Government financial statements are annual financial statements or reports for the year.

You'll learn about constructing the required financial statements, including the. The consolidated financial statements of the u.s. Our report on the u.s.

![Solved E923 Governmentwide Financial Statements [LO 95]](https://d2vlcm61l7u1fs.cloudfront.net/media/991/991c1629-0dd5-4328-80a5-a0272b149a38/phppcJ27W.png)

![[PDF] Government Annual Financial Statement PDF Download in English](https://instapdf.in/wp-content/uploads/pdf-thumbnails/government-annual-financial-statement-3081.jpg)