Underrated Ideas Of Tips About Is A Financial Statement The Same As Balance Sheet

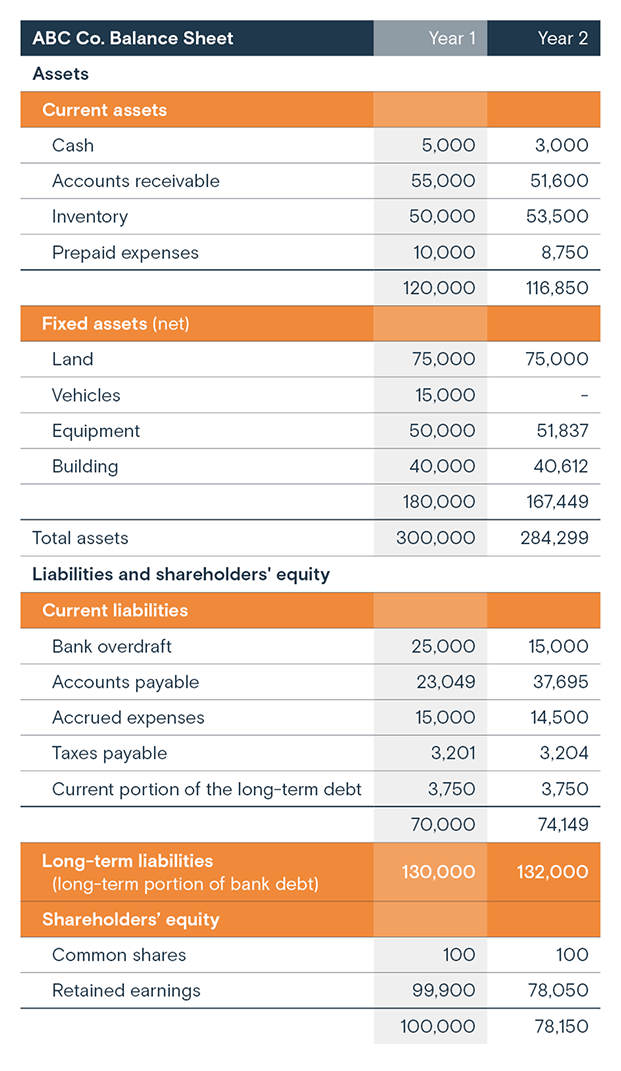

The main difference is that the balance sheet yields information regarding a company’s assets, liabilities, and shareholders’ equity, while the profit and loss statement summarizes information about revenues, and expenses.

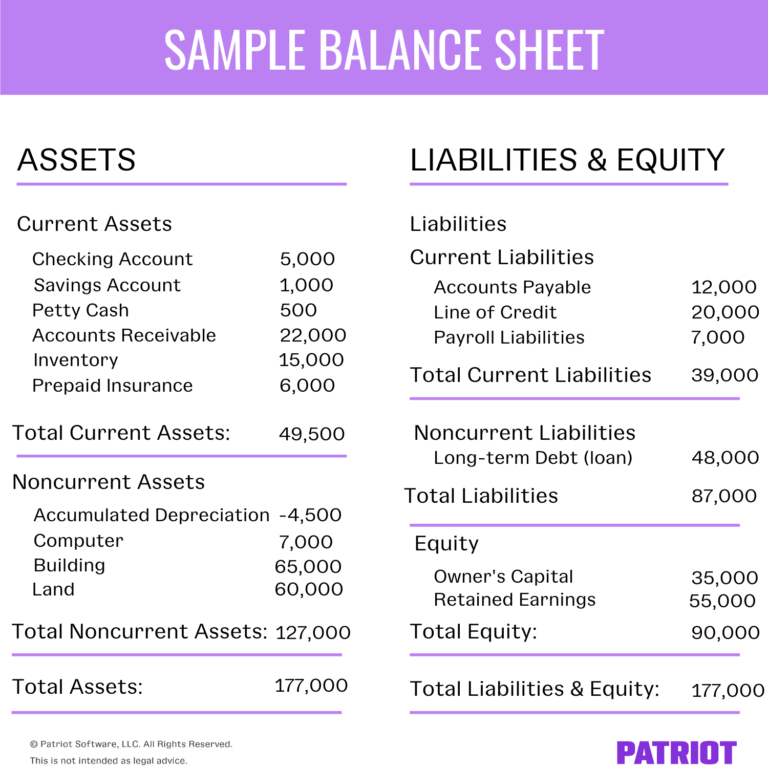

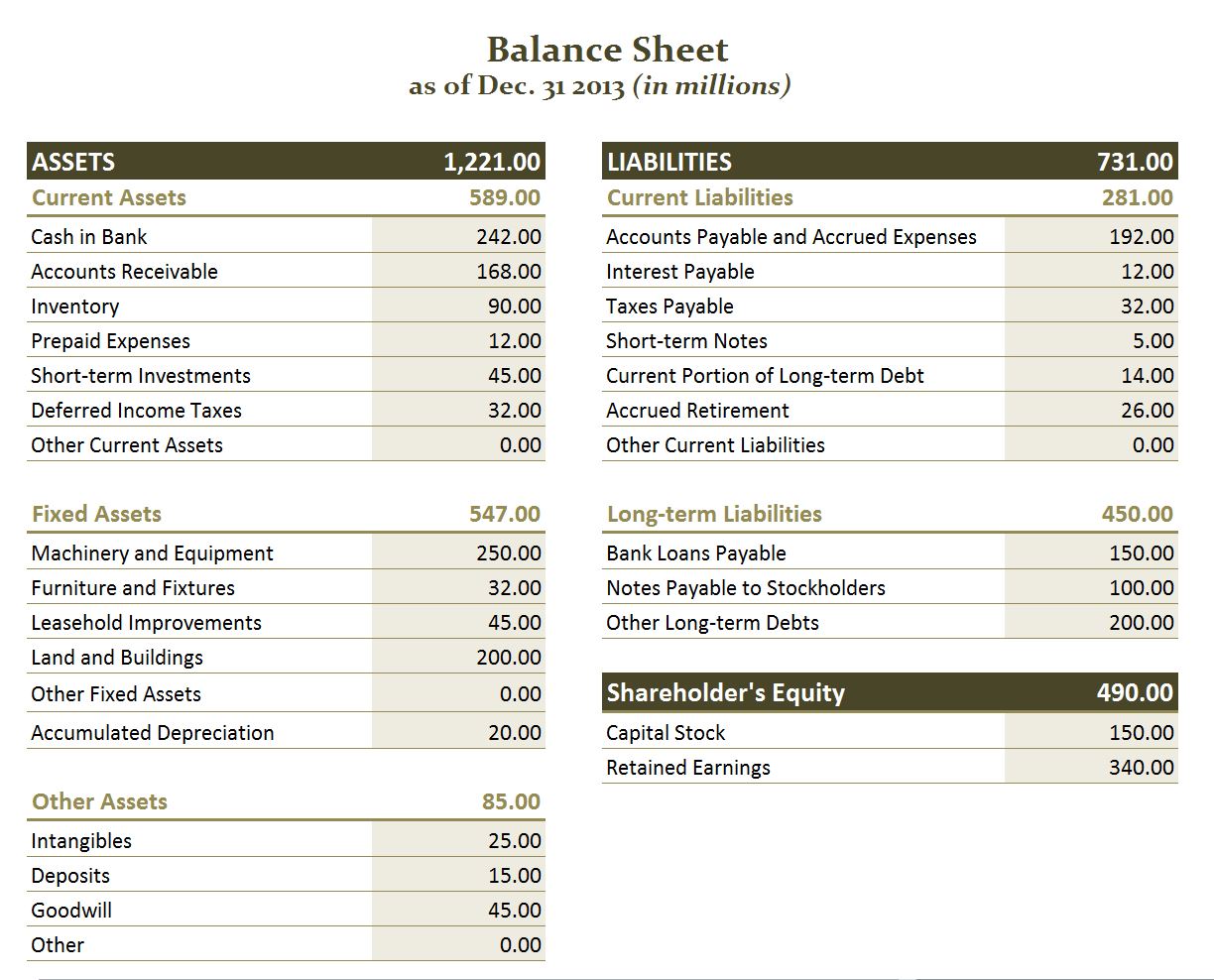

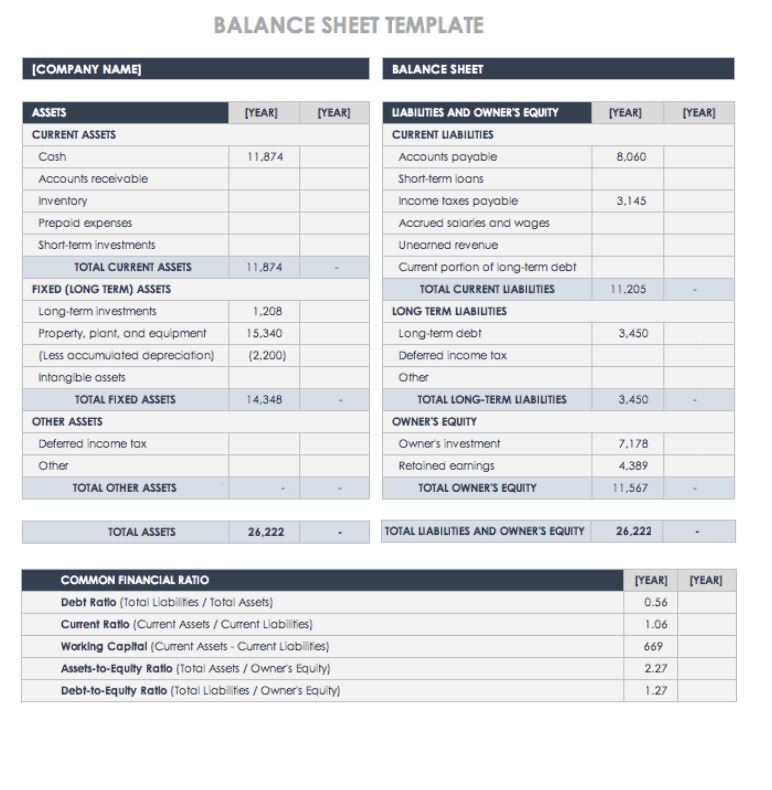

Is a financial statement the same as a balance sheet. But, both can be used to assess the company’s financial health and help with future planning. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset. A balance sheet represents the financial condition of any entity at a particular date.

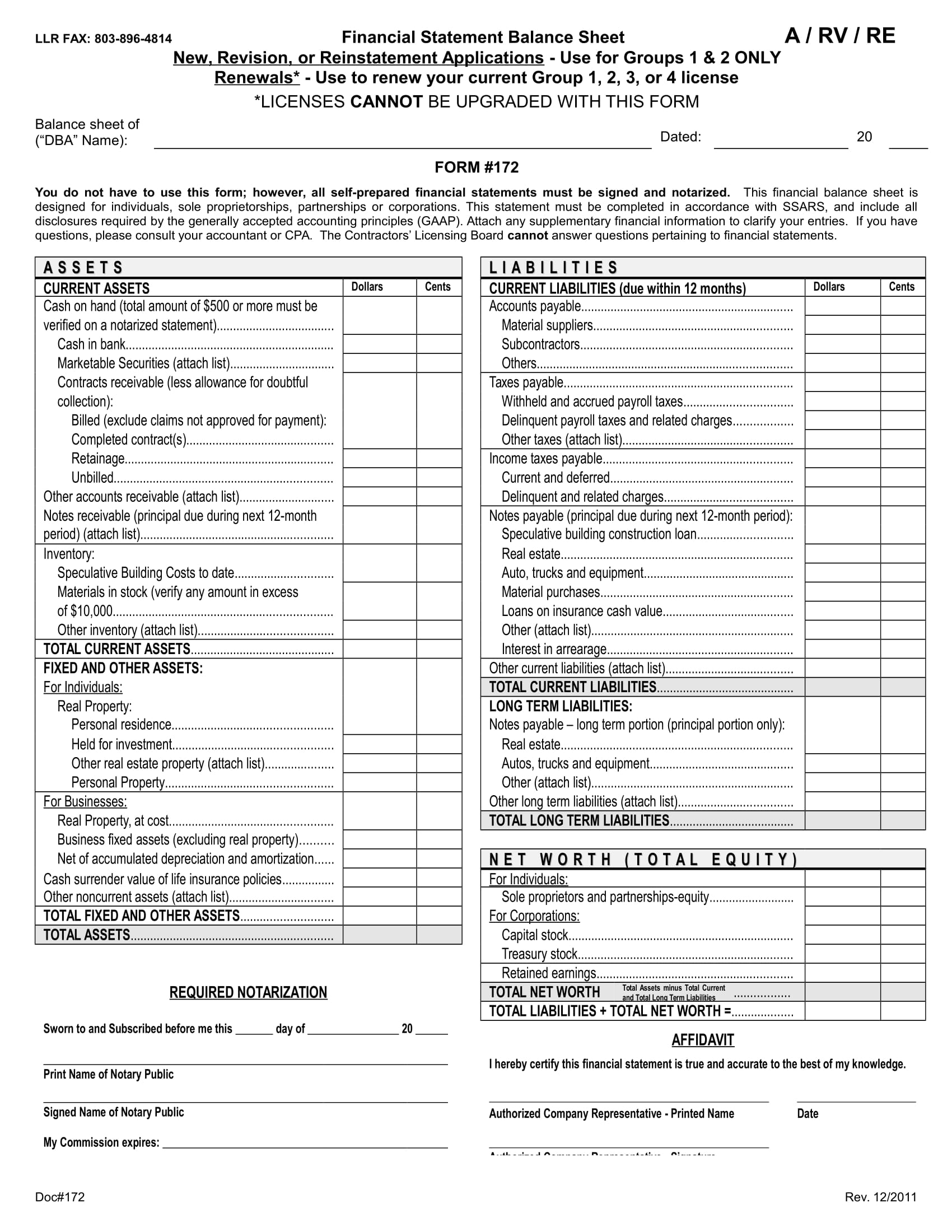

A balance sheet is a precise representation of the assets, liabilities, and equity of the entity, whereas, a financial statement is a representation of a formal record of the financial activities of an entity. The three major financial statement reports are the balance sheet, income statement, and statement of cash flows. Income and expenditure account.

The balance sheet and cash flow statement are two of the three financial statements that companies issue to report their financial performance. A balance sheet can be defined as a financial statement that includes the assets, liabilities, and equity of the company. As fixed assets age, they begin to lose their value.

The balance sheet and p&l statement hold similar financial information; This financial statement details your assets, liabilities and equity, as of a particular date. Measuring a company’s net worth, a balance sheet shows what a company owns and how these assets are financed, either through debt or equity.

In financial accounting, the balance sheet and income statement are the two most important types of financial statements (others being cash flow statement, and the statement of retained earnings). Your balance sheet (sometimes called a statement of financial position) provides a snapshot of your practice's financial status at a particular point in time. It’s evident that the cash flow statement and balance sheet offer two very different purposes as it relates to financial reporting.

While a balance sheet helps businesses evaluate their assets, details from the entire financial statement are necessary to give this information context. The income statement provides an overview of the financial performance of the company over a given period. As of a certain date.

The balance sheet may also be called the statement of financial position or statement of financial condition because it presents assets, liabilities, and shareholders’ equity as a snapshot in time, on a date at the end of the accounting period. A balance sheet covers a company’s assets as defined by. Stay tuned to byju's to learn more.

The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. They both provide a snapshot of a company's financial position at a specific point in time. A balance sheet is a snapshot of your business finances as it currently stands.

A balance sheet is a comprehensive financial statement that gives a snapshot of a company’s financial standing at a particular moment. A balance sheet is a part of financial. Such statements provide an ongoing record of a company's.

A balance sheet provides a snapshot of a company’s financial performance at a given point in time. It can also be referred to as a statement of net worth or a statement of financial position. A balance sheet has a narrower scope, as it is only one part of a financial statement.

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)