Brilliant Tips About Total Capital In Balance Sheet

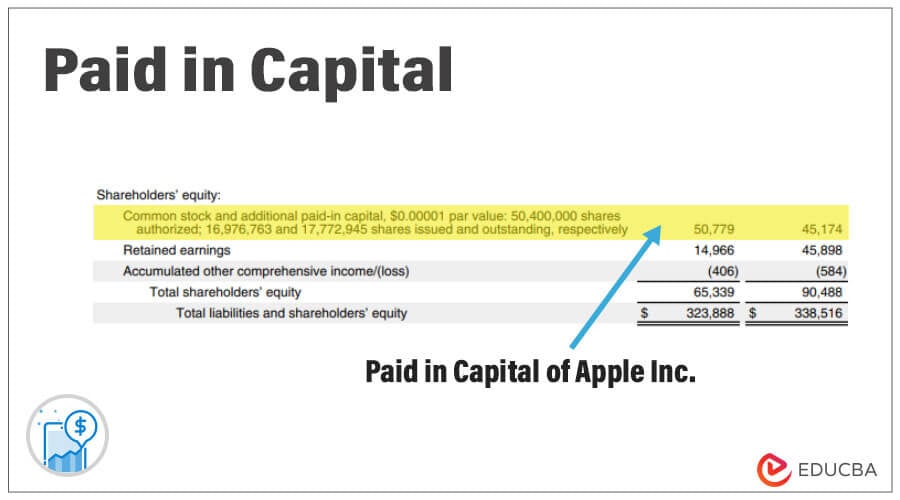

The latter is also known as the ‘book value’, and is the difference.

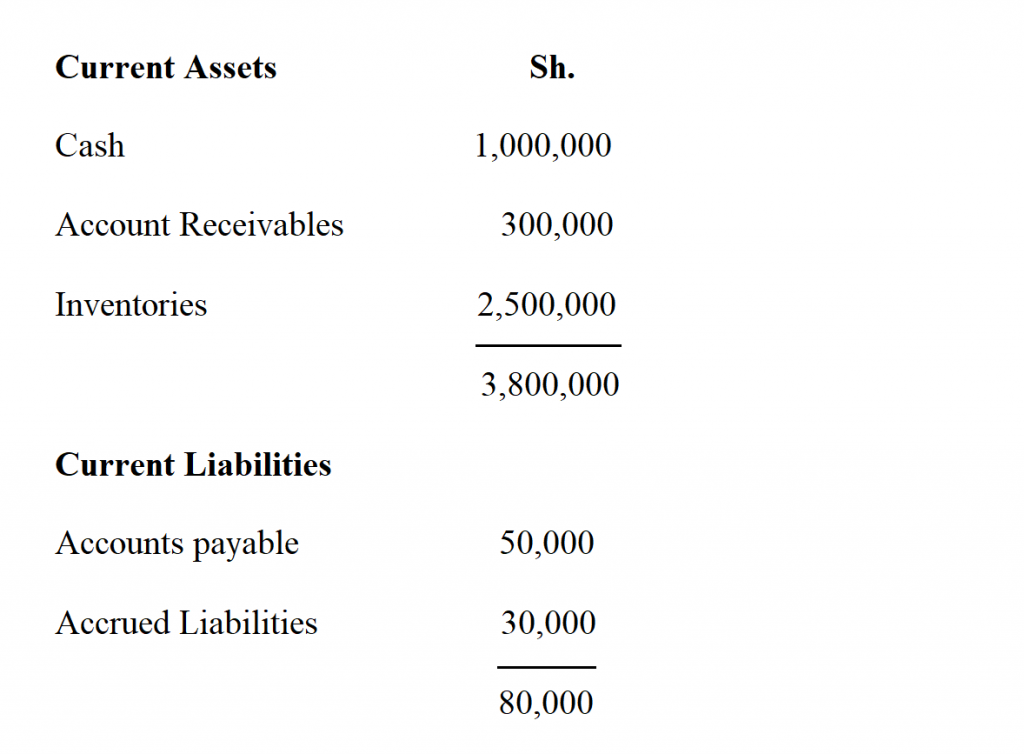

Total capital in balance sheet. Balance sheet equation is assets = liabilities + shareholders’ equity. Capital on a balance sheet refers to any financial assets a company has. As fixed assets age, they begin to lose their value.

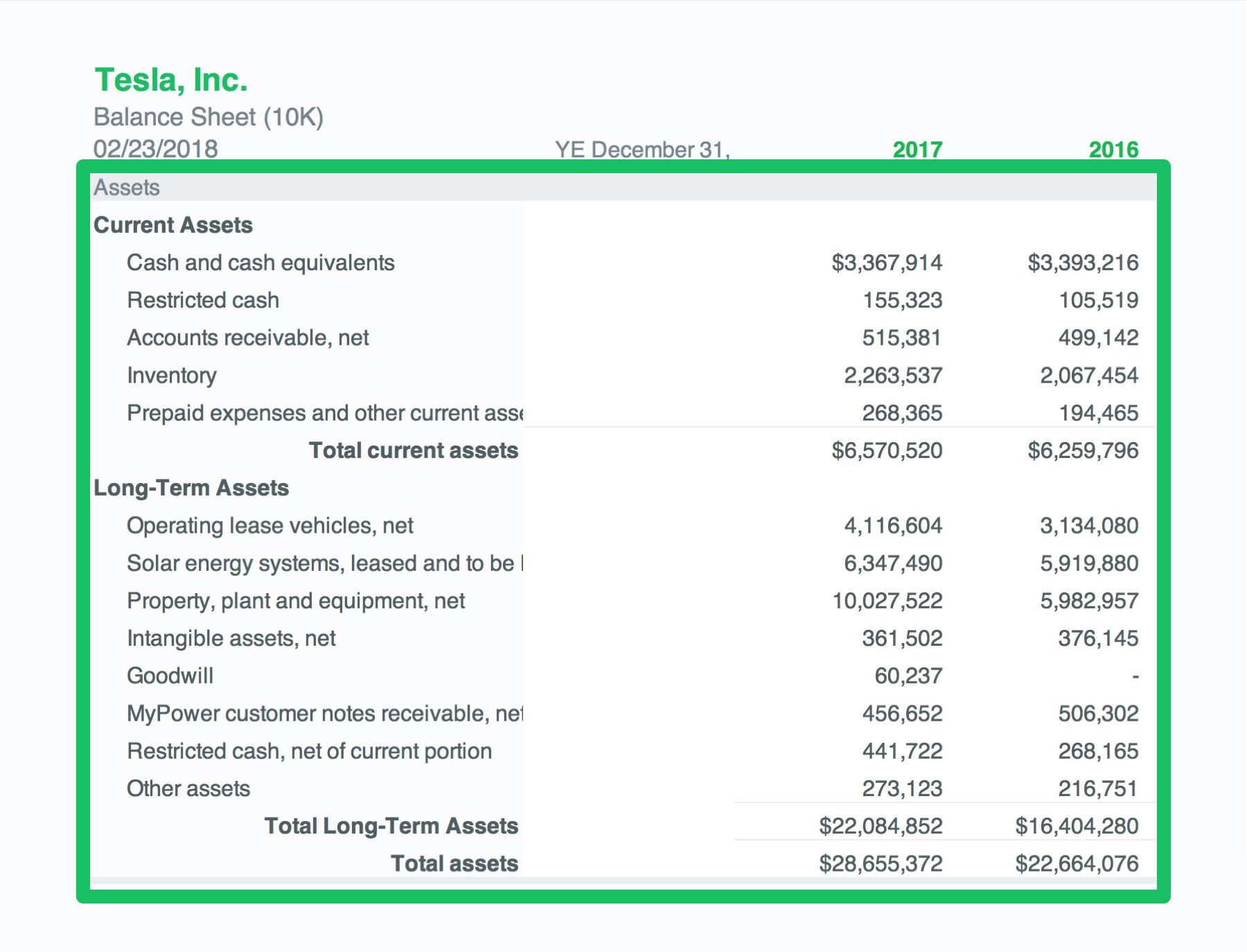

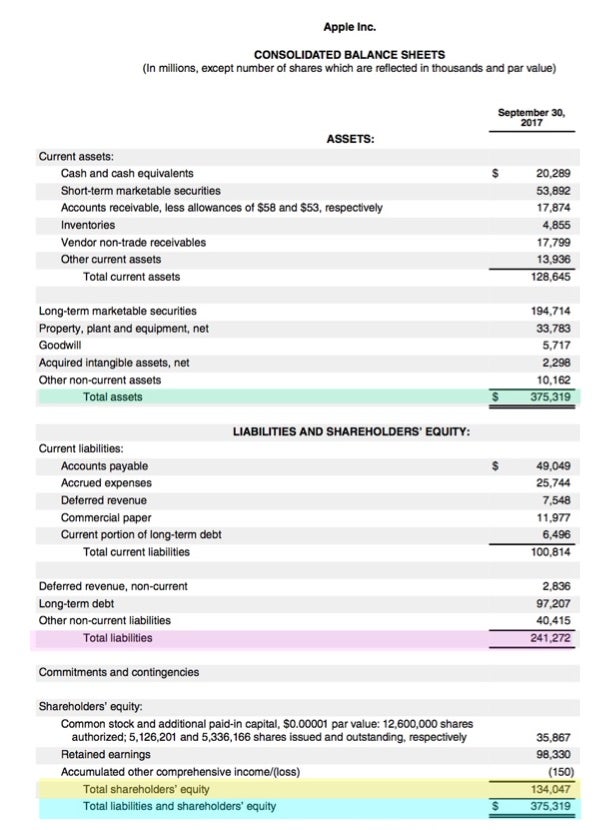

Reading a balance sheet is important in determining the financial health of a company. The balance sheet is a key financial statement that provides a snapshot of a company's finances. A current liability is the.

Beginning fund balance revenue. Assets = liabilities + equity. The balance sheet, also known as the statement of financial position, is one of the three key financial statements.

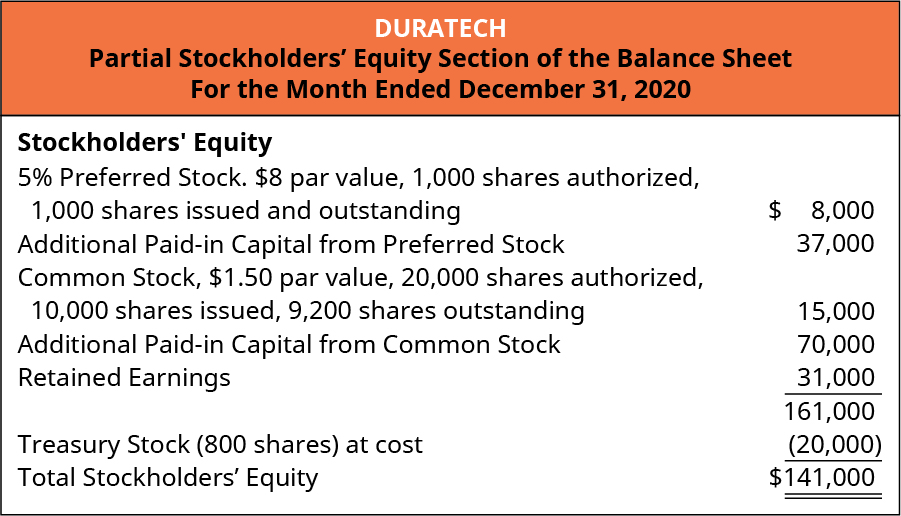

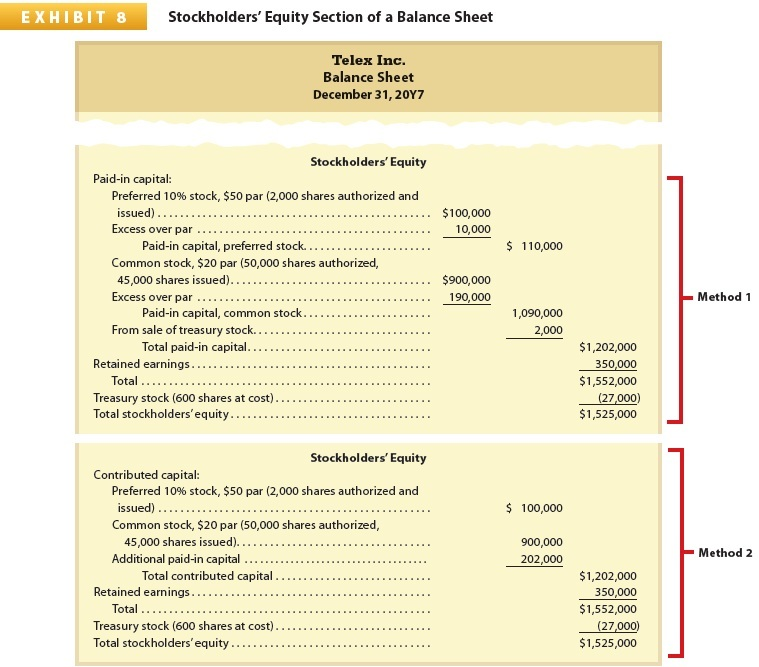

The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. In your balance sheet, capital will fall under the equity category and have the surplus and reserve classification. There are four main types of capital:

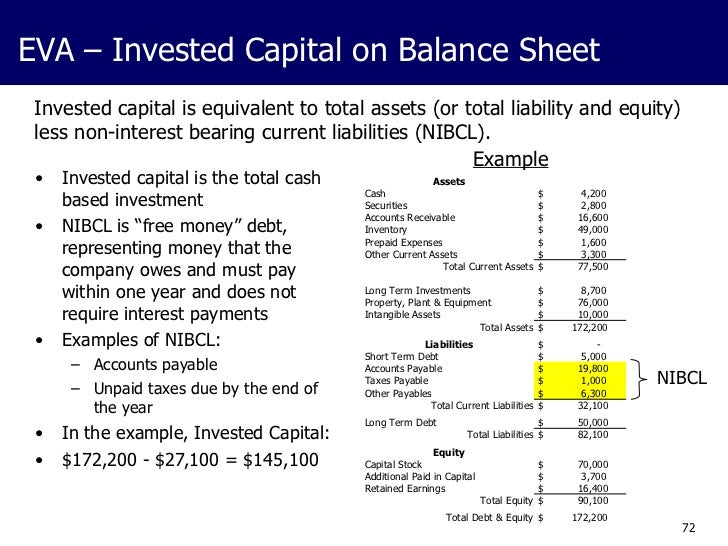

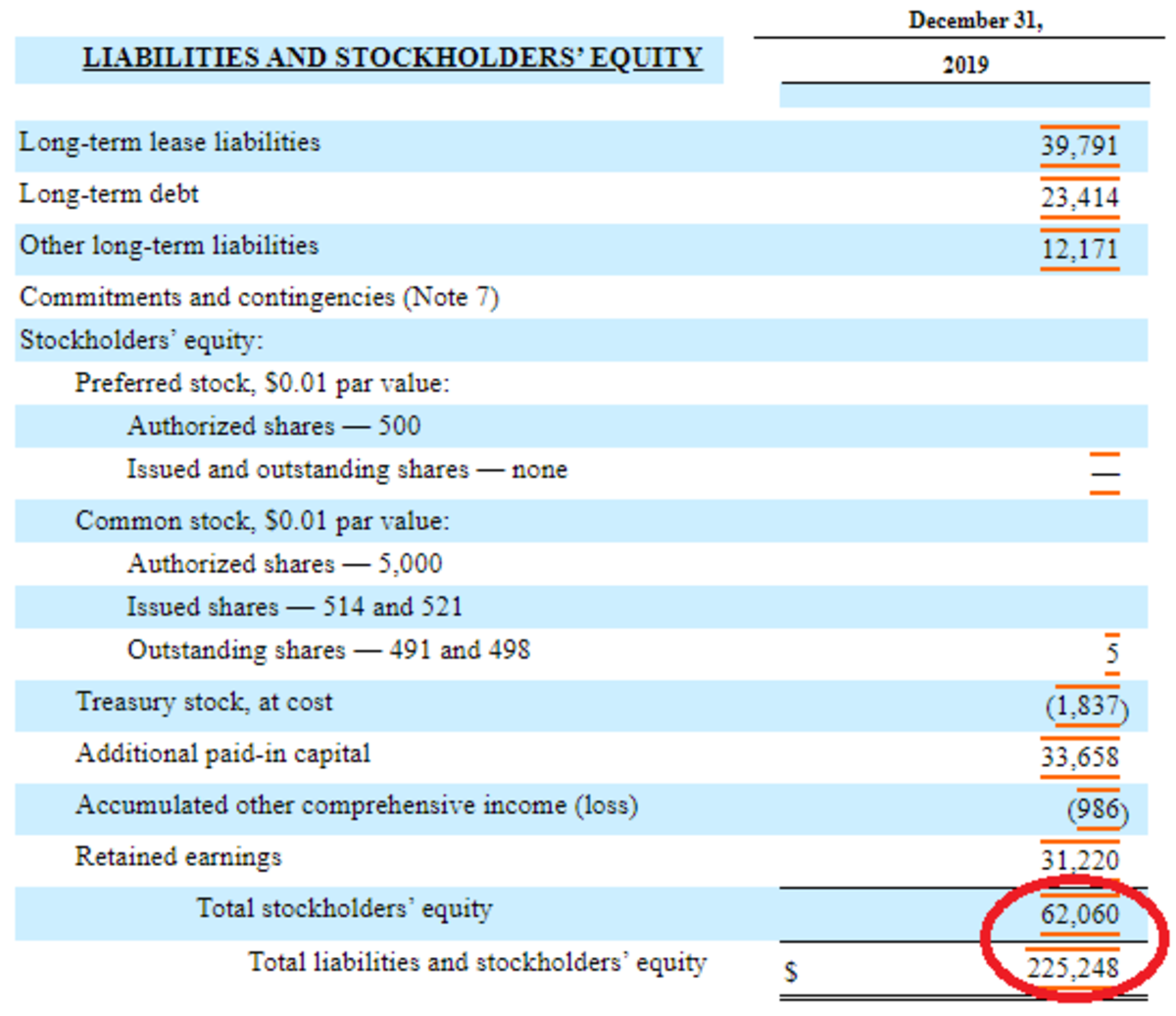

What is a balance sheet? The red boxes highlight the important information we need to calculate rotc, namely ebit and the capital structure. Assets refer to properties owned and controlled by the company.

A balance sheet provides a snapshot of a company’s financial performance at a given point in time. Also referred to as capital structure, total capitalization is what companies across industries depend on to fund expansions, projects and product development. How to read a balance sheet?

Using the formula provided above, we arrive at the following figures: Total assets = liabilities + owner’s equity where, liabilities = it is a claim on the asset of the company by other firms, banks, or people. To get the correct result, you need the average value of assets during the period, not the total value at the end of the period.

The “total capitalization” input is the sum of the company. Liabilities are obligations or debts of a business from past transactions, and share capital is the number of shares * face value. So it can boast us$194.8m more liquid assets than.

It can also be referred to as a statement of net worth or a statement of financial position. The balance between assets, liability , and equity makes sense when applied. According to the last reported balance sheet, fastenal had liabilities of us$661.3m due within 12 months, and liabilities of us$452.8m due beyond 12 months.

Debt to capital ratio = total debt ÷ total capitalization. Capital can also include a company's facilities and equipment. The balance sheet is based on the fundamental equation:

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)

:max_bytes(150000):strip_icc()/ScreenShot2021-05-03at11.03.30AM-985f846f70e347c69f0f288359e7beed.png)