Beautiful Work Info About Income Statement Revenue Examples

Financial modeling & valuation courses bundle (25+ hours video series)

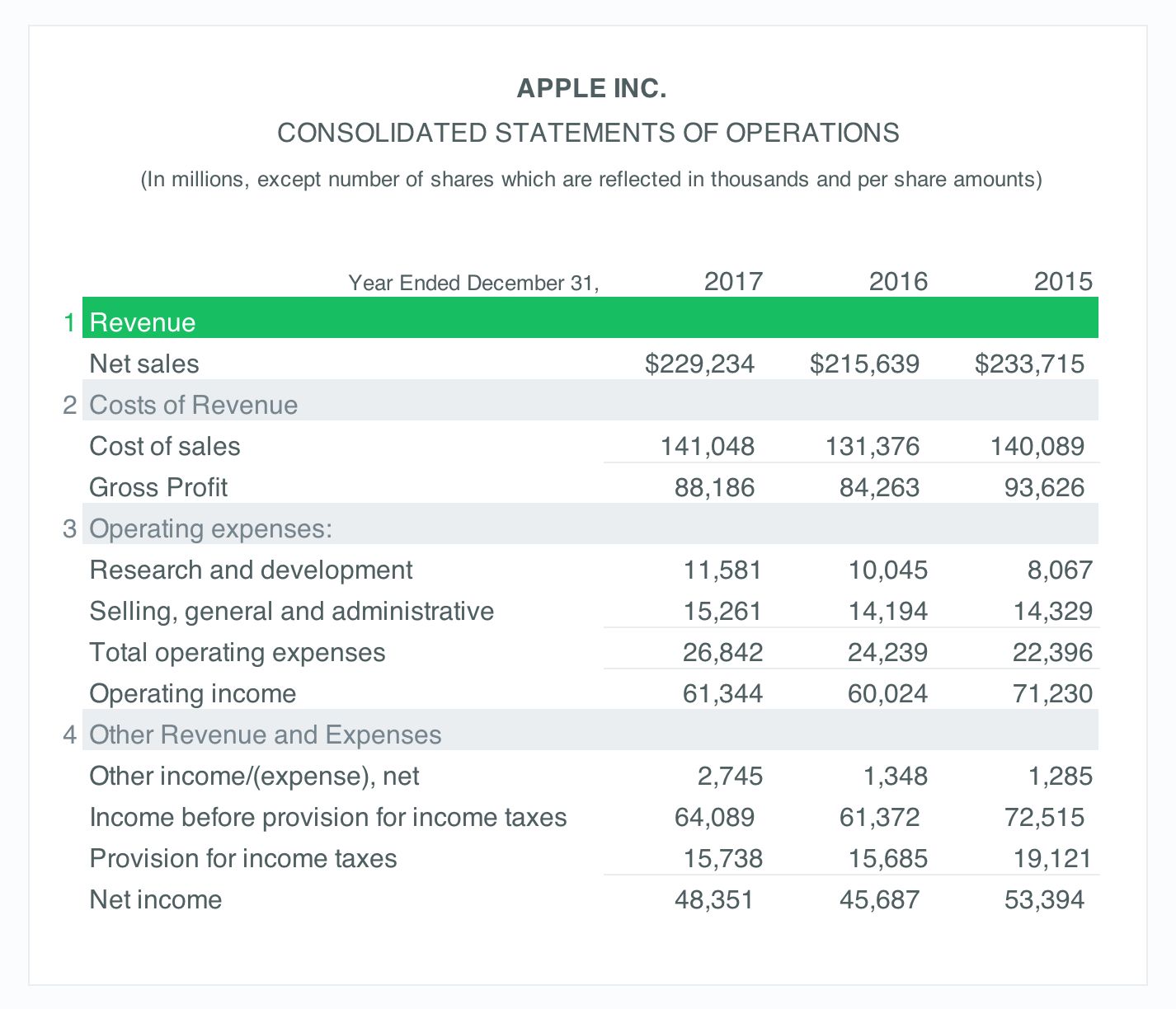

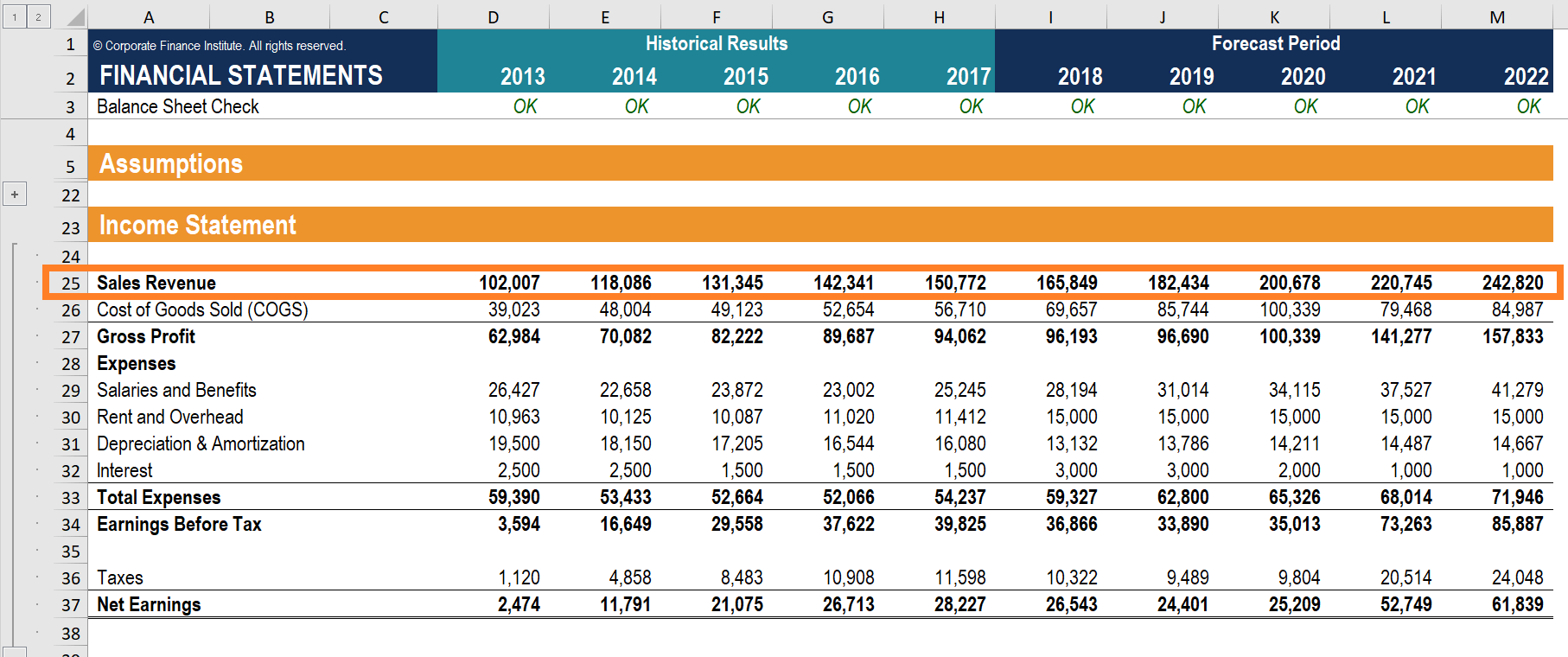

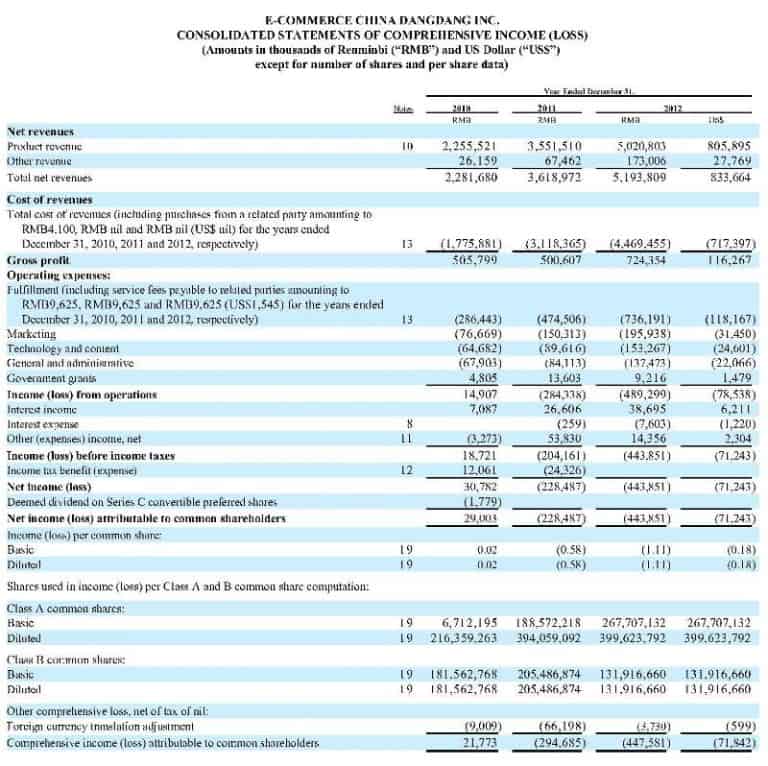

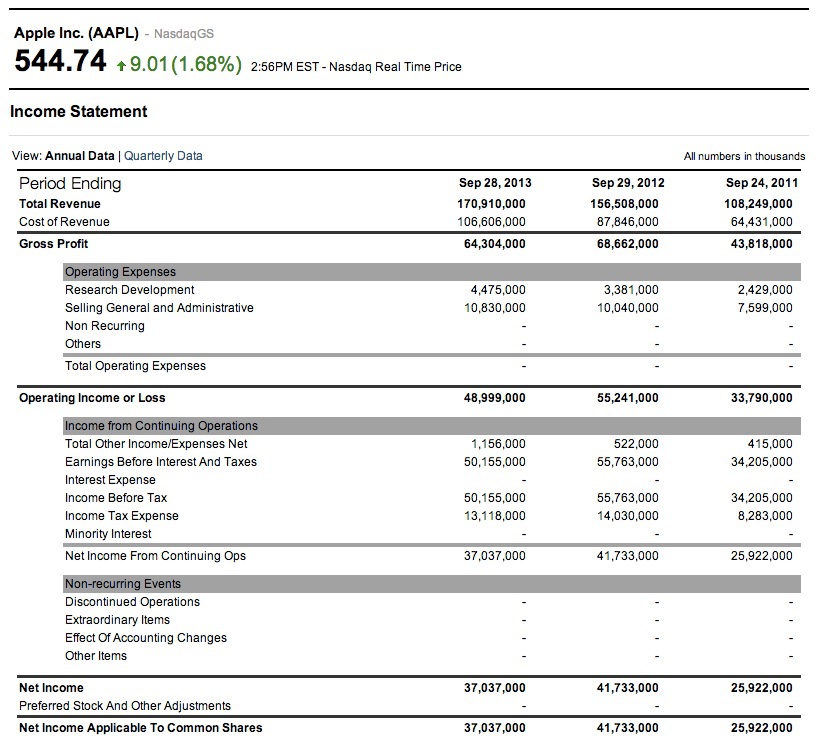

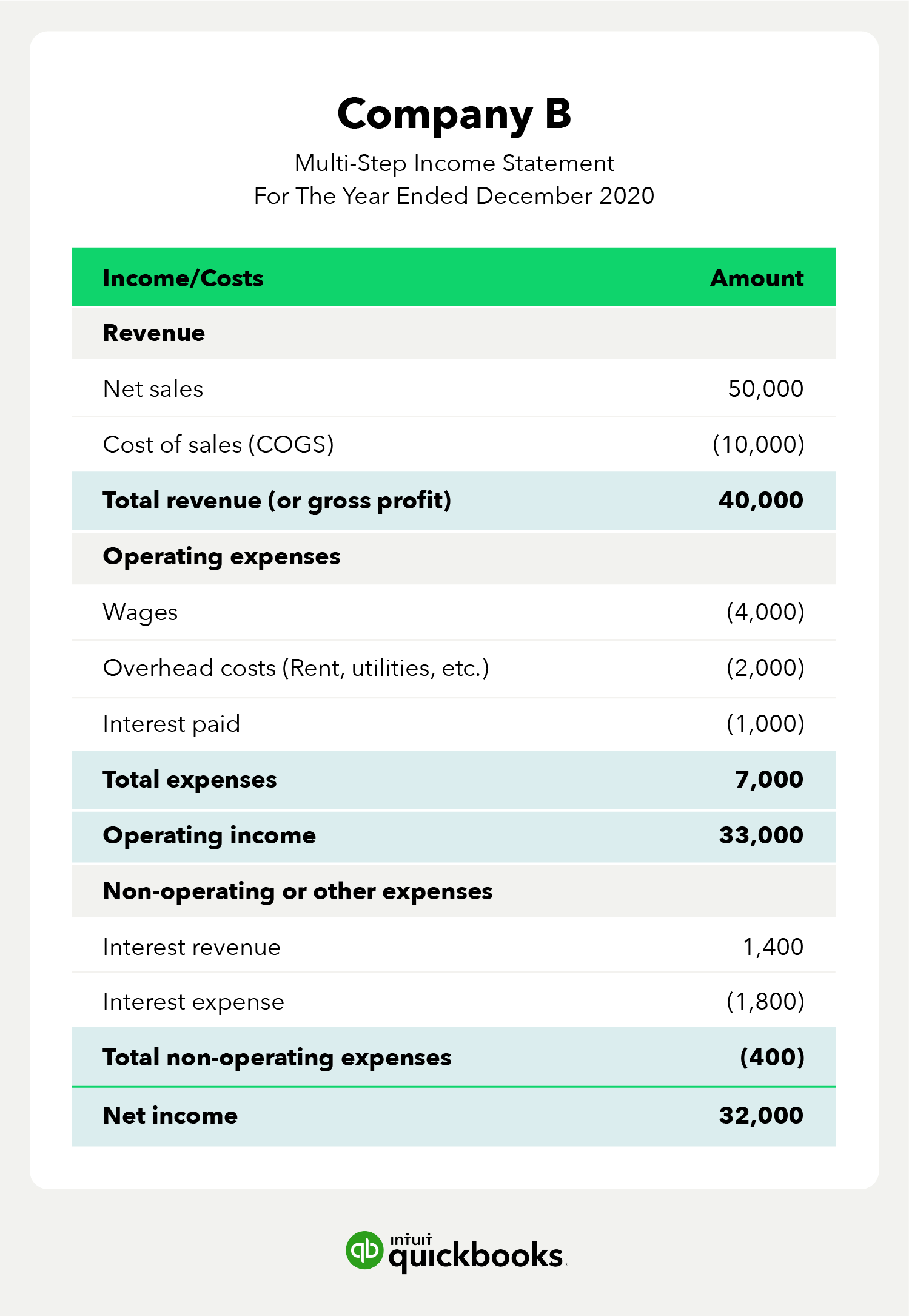

Income statement revenue examples. Within an income statement, you’ll find all revenue and expense accounts for a set period. It’s structured in a way that starts with revenue, from which costs of goods sold (cogs) are deducted to derive gross profit. Revenue, also known as “sales” or “income,” represents the top line of a company’s income statement and is calculated by multiplying the quantity of goods sold or services sold by their respective selling prices.

And other revenues decreased by $460.3 billion (9.3 percent) to about $4.5 trillion for fy 2023due primarily to a decline in individual income and tax withhodings and l corporate income taxes as well as decreased deposits of earnings from the federal reserve due to increased interest rates. Net income is the remaining revenue after expenses. For the quarter, gaap earnings per diluted share was $4.93, up 33% from the previous quarter.

Income statement for year ended dec. Employee wages, utility bills, repair costs, advertising expenses, legal fees, and office supplies are all examples of revenue expenditures that companies must handle. Some investors and analysts use income statements to make investing decisions.

It does not include any deductions for costs or expenses associated with producing or delivering the goods or services. Nvda) today reported revenue for the fourth quarter ended january 28, 2024, of $22.1 billion, up 22% from the previous quarter and up 265% from a year ago. Amazon refers to its revenue as “sales,” which is equally as common as a term.

Costs incurred by a company like the cost of goods sold , and operating expenses come under this. Now that you have the idea of what an income statement is, let’s look at a real example. Businesses need to watch their revenue expenditure s closely because they affect cash flow and profits.

Fact checked by yarilet perez what is revenue? The income statement is one of three statements used in both corporate finance (including financial modeling) and accounting. It reports sales in two categories, products and services, which then combine to form total net.

O together, individual income tax Add up all your gains then deduct your losses. Also known as the profit and loss (p&l) statement or the statement of revenue and expense, an income statement provides valuable insights into a company’s operations, the efficiency of its.

The net income figure is the last line on the income statement. This is why deferred revenue is also called unearned revenue. Add or remove line items as necessary.

Smart management of these costs helps maintain financial health. Income statements depict a company’s financial performance over a reporting period. An income statement is a financial document that details the revenue and expenses of a company.

To illustrate how revenue is calculated, let’s use a simple example of an ecommerce site that sells a single product: Subsequent deductions for operating expenses result in operating profit. Revenue or fees earned from selling a product or service.

![Statement Name] Revenue Statement](https://imgv2-1-f.scribdassets.com/img/document/358561326/original/5562a25d6c/1613745448?v=1)

:max_bytes(150000):strip_icc()/ScreenShot2022-03-05at10.15.17AM-b1c05918ed68413fbbaa818d057eda34.png)

![Complete Guide to Statements [+ examples and templates]](https://www.deskera.com/blog/content/images/2020/06/Screenshot-2020-06-28-at-9.46.05-PM.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)