Divine Tips About Balance Sheet And Cash Flow Statement Of Any Company

Operating activities investing activities financing activities operating activities detail cash flow that’s generated once the company delivers its regular goods or services, and includes both revenue and expenses.

Balance sheet and cash flow statement of any company. Begin with net income from the income statement. The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year). The statement of cash flows acts as a bridge between the income statement and balance sheet by showing how cash moved in and out of the business.

Determine the starting balance the first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the beginning of the reporting period. But, both can be used to assess the company’s financial health and help with future planning. So practice following the cash.

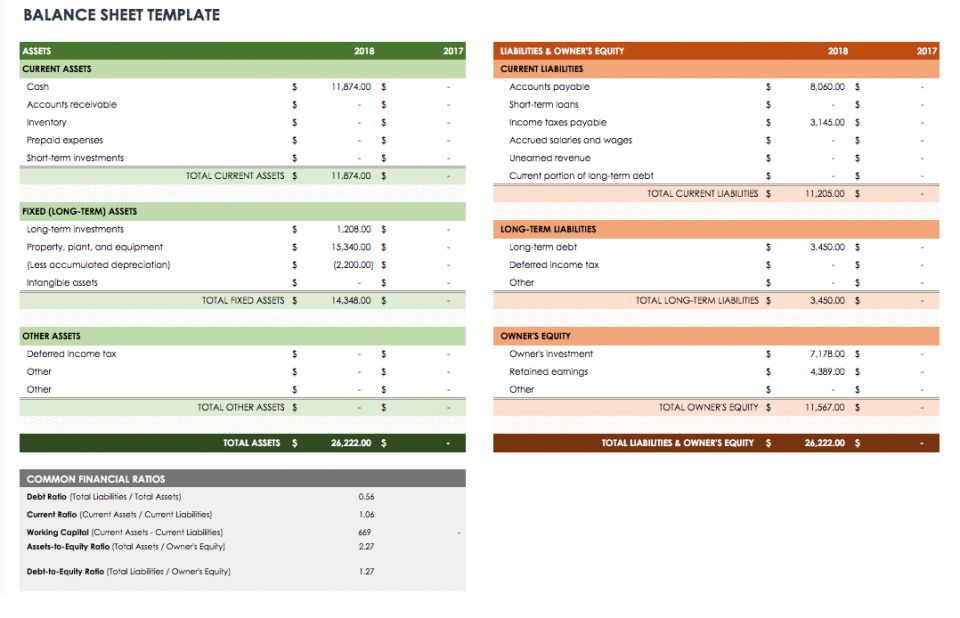

A balance sheet is meant to depict the total assets, liabilities, and shareholders’ equity of a company on a specific date, typically referred to as the reporting date. As one of the three main financial statements, the cfs complements the balance sheet and the income statement. It can be looked at on its own and in conjunction with other statements like the income statement and cash flow statement to get a full picture of a company’s health.

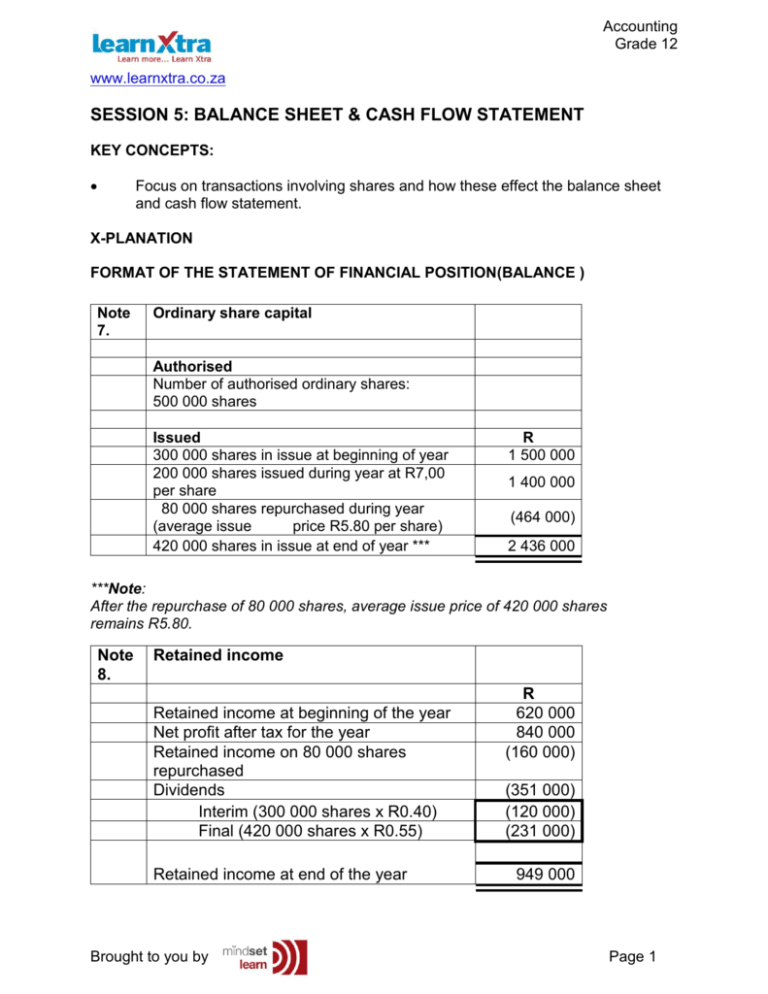

Each of the financial statements provides important financial information for both internal and external stakeholders of a company. The three financial statements are: Four important financial performance metrics include:

Net cash of €14 million as at december 31, 2022), as a result of a strong free cash flow generation, and including the dividend payment (of which €564 million to shareholders of the parent company on 2022 fiscal year. A cash flow statement tells you how much cash is entering and leaving your business in a given period. The statement of cash flows is prepared by following these steps:

A balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity. On the balance sheet, a company will typically look at two areas: It allows you to see what resources it has available and how they were financed as of a specific date.

The balance sheet involves a company’s assets and liabilities from one period to the next while the income statement covers expenses and income over time. This value can be found on the income statement of the same accounting period. This article will provide a quick overview of the.

Compare the cash flow statement with the company's income statement and balance sheet to get a complete picture of its financial health. The balance sheet is one of the three core financial statements that are. The balance sheet is a very important financial statement for many reasons.

(1) the income statement, (2) the balance sheet, and (3) the cash flow statement. Does the balance sheet always balance? Net debt and financing as of december 31, 2023, safran’s balance sheet exhibits a €374 million net cash position (vs.

Often, the reporting date will be the final day of the accounting period. In accounting and finance, the cash flow statement (cfs), or “statement of cash flows,” matters because the financial statement reconciles the shortcomings of the reporting standards established. The income statement, balance sheet, and statement of cash flows are required financial statements.

:max_bytes(150000):strip_icc()/AppleCFSInvesto2-6a84aed790a5476abbc3ef04b1718106.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)